Implement the Prophit System for Your Brand

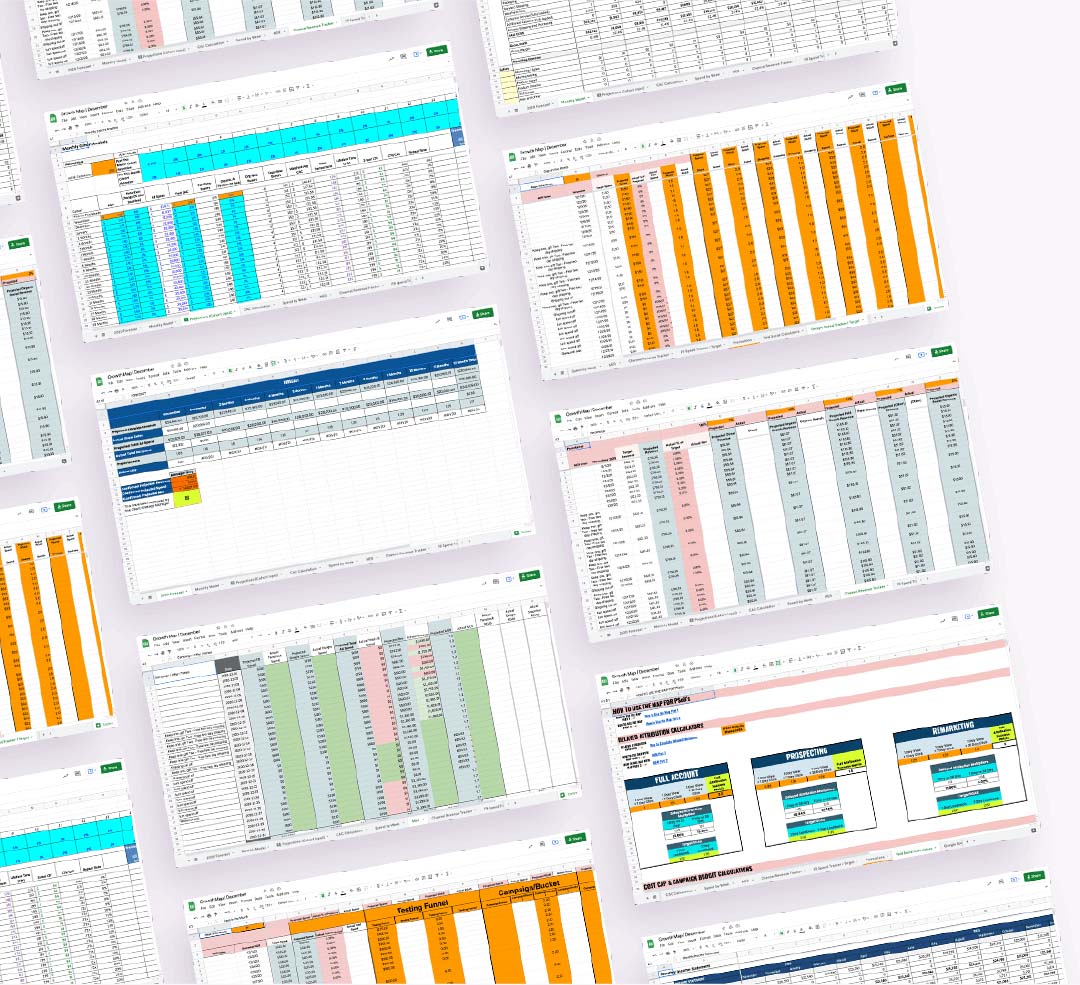

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get Started

Welcome back to another episode of Bridges, where we embark on a journey to bridge the divide between marketing and finance.

Today, we are putting into practice the previous eight episodes of learning to help solve the hardest problem facing ecommerce brands today. If you're a business owner, marketer, or finance professional grappling with any year-over-year revenue decline over the last two years, this one’s for you.

As we journey through this problem, it's crucial to acknowledge the landscape that many ecommerce brands find themselves navigating.

The story of declining revenues is not an isolated one; it's a narrative that echoes across the industry.

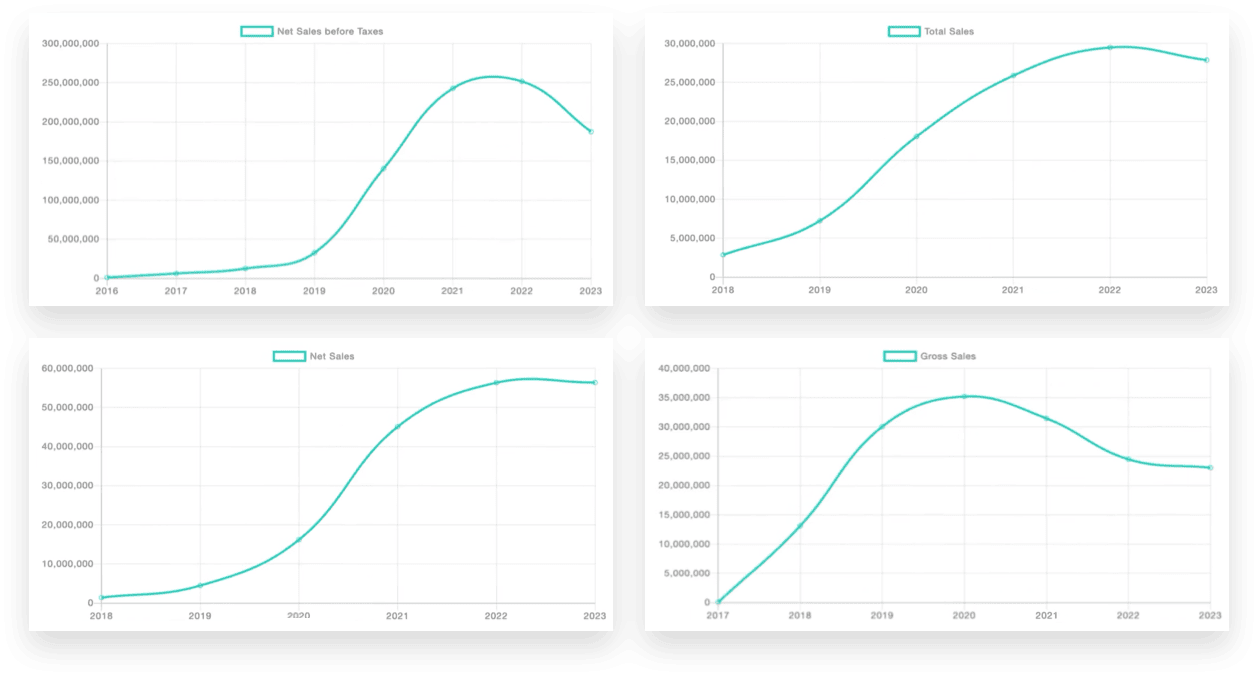

Even renowned brands have felt the sting of stagnating growth, especially in the wake of pivotal events like the iOS 14 update. In 2020 ecommerce brands saw unprecedented growth as a result of the pandemic.

At Common Thread Collective, our experiences mirror this industry-wide trend. We soared amidst the tailwinds of 2020's unprecedented ecommerce boom, only to face headwinds as we approached 2022. The narrative of rapid growth gave way to a sobering reality: declining revenues, strained balance sheets, and the looming specter of negative EBITDA.

Avoid being complicit in the further decline of your business …

Marketing and finance cannot stop this decline without one another. The path to resilience and growth necessitates collaboration between these two departments. In the crucible of declining revenue, siloed decision-making breeds complicity in perpetuating the problem.

It is pivotal that we both financially engineer this process and market and effort our way towards growth. Without insight and collaboration we can’t get there.

Here’s how we can achieve profitability …

This video is a part of our “Bridges” series, which aims to bridge the divide between marketing and finance.

For a deeper dive into the specific strategies mentioned in this article, check out our previous installments in the series.

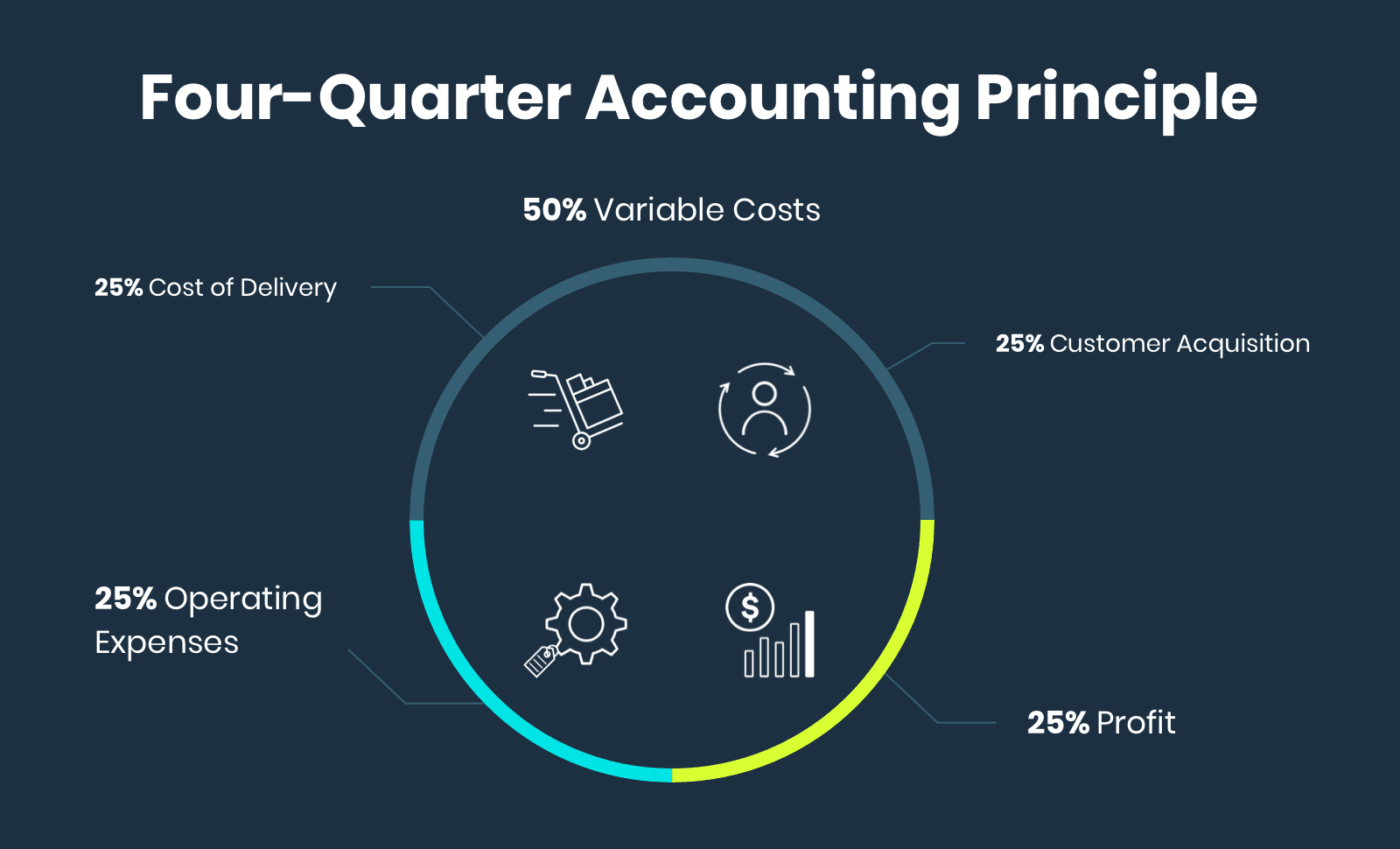

To chart a course out of declining revenue, we must first adopt the lens of Four-Quarter Accounting while examining our profit and loss (P&L) statement.

This holistic framework structures your P&L statement into four core categories:

By dissecting revenue streams and expenses across these categories with a goal of allocating 25% to each category, a clearer path forward emerges.

We break down and detail all core sections of our Four-Quarter Accounting Principle in episode 1 of our Bridges series, A Marketer’s Guide to Mastering the Profit and Loss Statement. If you are just starting this journey toward connecting finance and marketing, we recommend you start there.

Here’s our breakdown of Four-Quarter Accounting at a glance …

CAC is about your ad spend. Cost of delivery are all the variable expenses associated with getting the product to your customer. Your OPEX are all fixed expenses and profit is what's left over after all of that.

Now we call it Four-Quarter Accounting because at a balanced view, you could imagine all of these categories all representing 25 percent of your revenue.

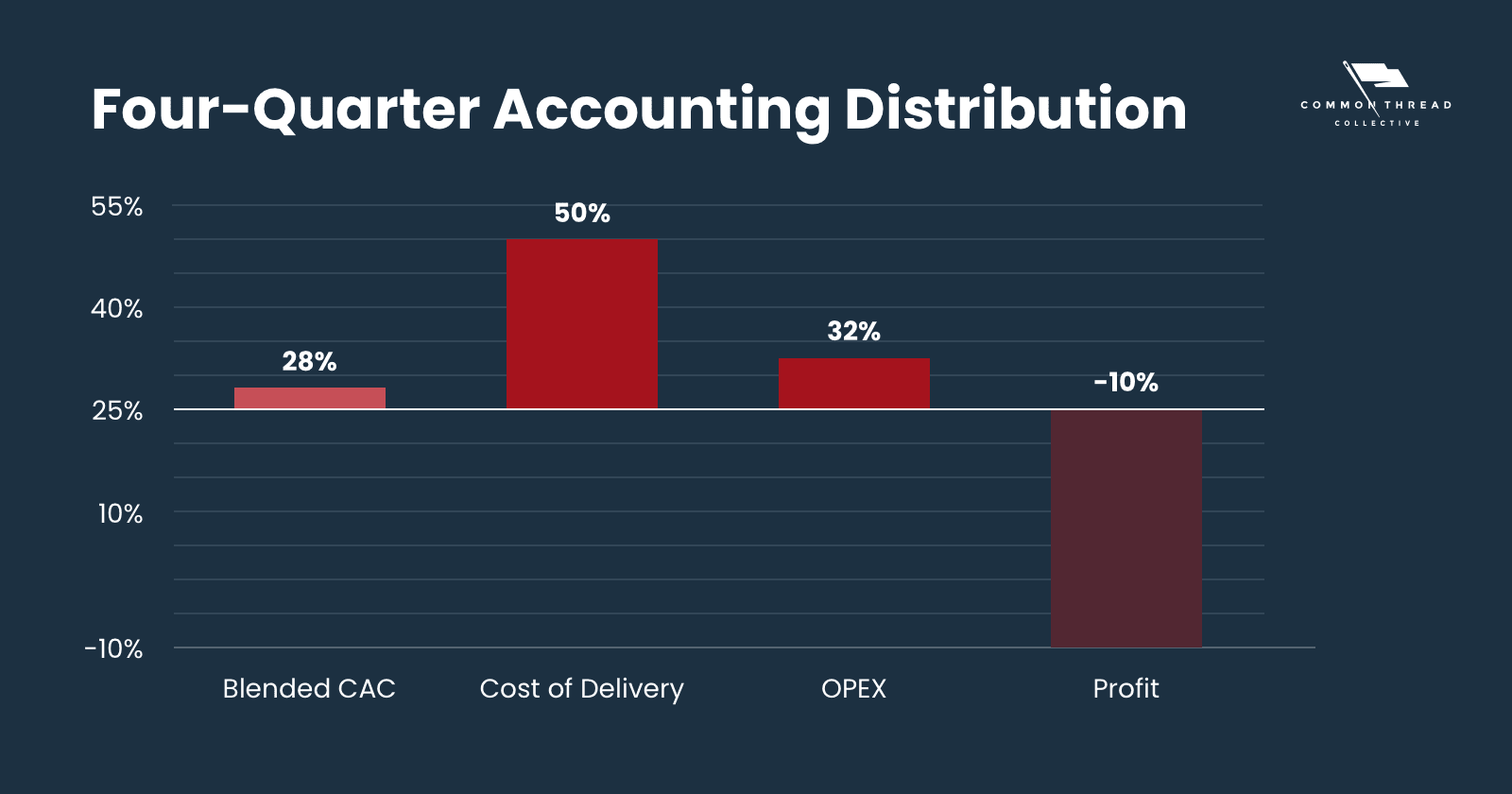

This is rarely the case.

In fact, your P&L composition likely looks something like this …

How did we get here?

It’s often the case that revenue might decline slightly, but costs always continue to increase.

Turning this around often requires a deep understanding of your business’ P&L, but it is possible to go from red to black in as little as 90 days.

The initial phase of our roadmap involves “squeezing the sponge,” a short-term strategy aimed at survival and financial restructuring. This short-term lifeline is necessary to cover your expenses while right-sizing the margin and OPEX on your way back toward profitability.

As the business looks to cut everything, collaboration between marketing and finance is paramount. Among those cuts, it’s very intuitive to cut ad spend as a large line-item in your expenses.

This isn’t wrong in the short-term, but the danger begins when this cut lasts too long.

Squeezing the sponge comes in three key actions …

By synchronizing efforts across marketing and finance, businesses can recalibrate their financial trajectory and lay the groundwork for sustainable growth.

On the marketing side, cut down ad spend to any non-click reported immediate revenue generation that does not achieve immediate first-order profitability. Increase the email send rate to send every day to maximize existing customers.

On the finance side, fixed costs should never exceed the contribution margin you can expect off existing customers. This will ensure you always have the ability to be profitable and thrive. This will allow you to not depend on creating new customer contribution margin in order to survive.

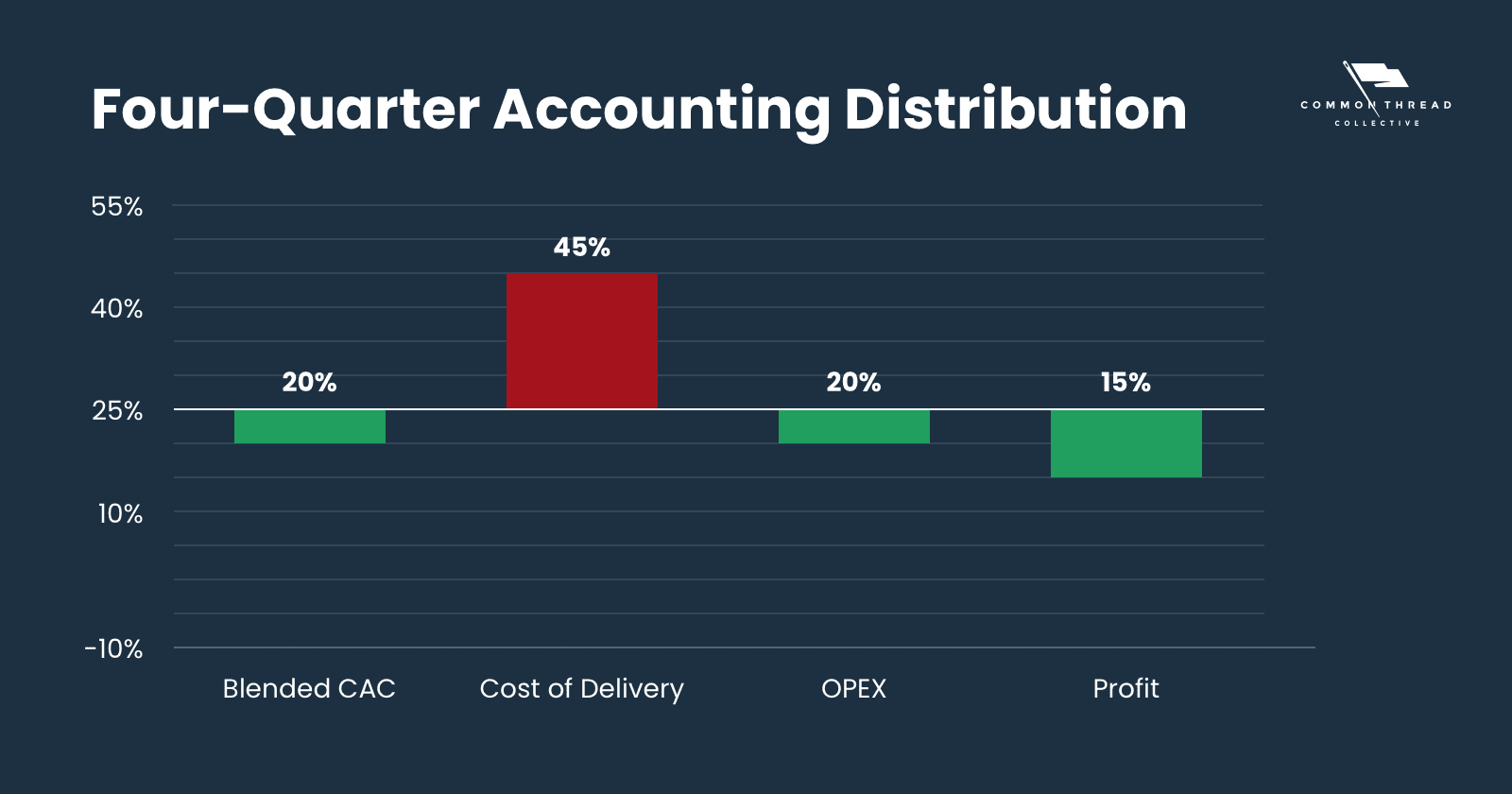

By the end of step one, your Four-Quarter Accounting breakdown should look more like this …

While this strategy will work in the short-term, it’s important not to get stuck here. Without refilling your sponge with more new customers, your business will die squeezing all the revenue out of your existing customer-base.

Transitioning from survival to growth necessitates a strategic shift. Embracing a mindset of calculated risk-taking, businesses must restart the growth engine. Central to this phase is a willingness to increase CAC for new customer acquisition while maintaining lean OPEX.

Margin thresholds supersede Marketing Efficiency Ratio (MER) as the guiding star, ensuring that growth is not hampered by arbitrary constraints. You want to grow as rapidly as you can at a breakeven to regrow your customer-base.

In this step of the process, our new Four-Quarter Accounting breakdown should look more like this …

New customer acquisition is the engine for growth.

Unless you run a legacy giant retailer with millions of active customers, growing your active customer base is vital to solving declining revenue.

Moving forward towards revitalizing growth, a customer-centric approach takes center stage. Understanding your net active customer-base becomes imperative.

Every business will have five key customer sets:

Examining the relationship between churned and new/reactivated customers will indicate the growth or shrinkage of your active customer file. Your active customer file is the best predictor of future customer revenue.

Without replenishing your customer file in excess of the churn, your business will decrease in revenue over time.

But don’t ignore your lapsed customers either …

Tackle the problem from both sides by acquiring more new customers and preventing churned customers through targeted reactivation campaigns and promotions.

Lapsed customers often represent the overlooked third layer of potential customer revenue after the more common cohorts, new and returning customers.

To find this hidden group, you want to look at the distribution of time to second purchase among your overall orders. We often group lapsed, or at-risk customers between the 40%-80% range of purchases. Once a customer crosses that 80% distribution mark (for our brand, Bambu Earth, that’s at 100 days between purchases) they are likely not coming back to purchase.

At the culmination of our journey lies the vision of homeostasis: a state of balanced financial health where CAC, COD, and OPEX converge to ensure sustainable profitability.

By setting clear goals and embracing a collaborative ethos, businesses pave the way for enduring success.

In the face of declining revenue, the road ahead may seem daunting. By embracing collaboration, harnessing data-driven insights, and charting a strategic course forward, ecommerce brands can transcend adversity and emerge stronger than ever before.

Marketing needs to bring finance into their dashboard, and finance needs to bring marketing metrics into their finance dashboards and documents.

As we navigate the complexities of the ecommerce landscape, let us remember that the true measure of success lies not in the absence of challenges, but in our ability to rise above them.

Together, let us embark on this journey of resilience, innovation, and growth. The road to recovery begins with a single step — a step taken hand in hand, bridging the gap between marketing and finance.

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get StartedCommon Thread Collective is the leading source of strategy and insight serving DTC ecommerce businesses. From agency services to educational resources for eccomerce leaders and marketers, CTC is committed to helping you do your job better.

For more content like this, sign up for our newsletter, listen to our podcast, or follow us on YouTube or Twitter.