Implement the Prophit System for Your Brand

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get Started

Effective financial planning serves as the bedrock upon which successful businesses are built.

This notion is underscored by the insightful conversation between Taylor Holiday and Mark Lupton, Founder & Fractional CFO at Greenhouse Business Advisors.

At the heart of this approach lies the recognition that financial planning isn't merely an exercise in number-crunching but a strategic endeavor that guides decision-making across all facets of the organization. To start, we’ll take a closer look at what goes into creating that financial plan.

A financial plan is built upon and informed by …

By meticulously mapping out every aspect of the business's financial landscape, leaders can gain clarity and foresight, enabling them to navigate uncertainties with confidence.

This proactive stance is further bolstered by the adoption of real-time monitoring and reporting mechanisms, which empower businesses to make informed decisions and swiftly adjust course when necessary.

A successful business is built around clear goals and communication …

In this conversation between Taylor and our guest CFO, Mark Lupton, we aim to bridge the gap between marketing and finance by clearly presenting the need for the two departments to work together.

They share their thoughts around planning and forecasting as well as …

This blog post is another in our “Bridges” series, which aims to bridge the gap between marketing and finance.

Opening communication between marketing and finance has never been more important for the growth of your ecommerce business. You can watch all videos in this series on our YouTube channel, or subscribe to our newsletter to get weekly updates straight to your inbox.

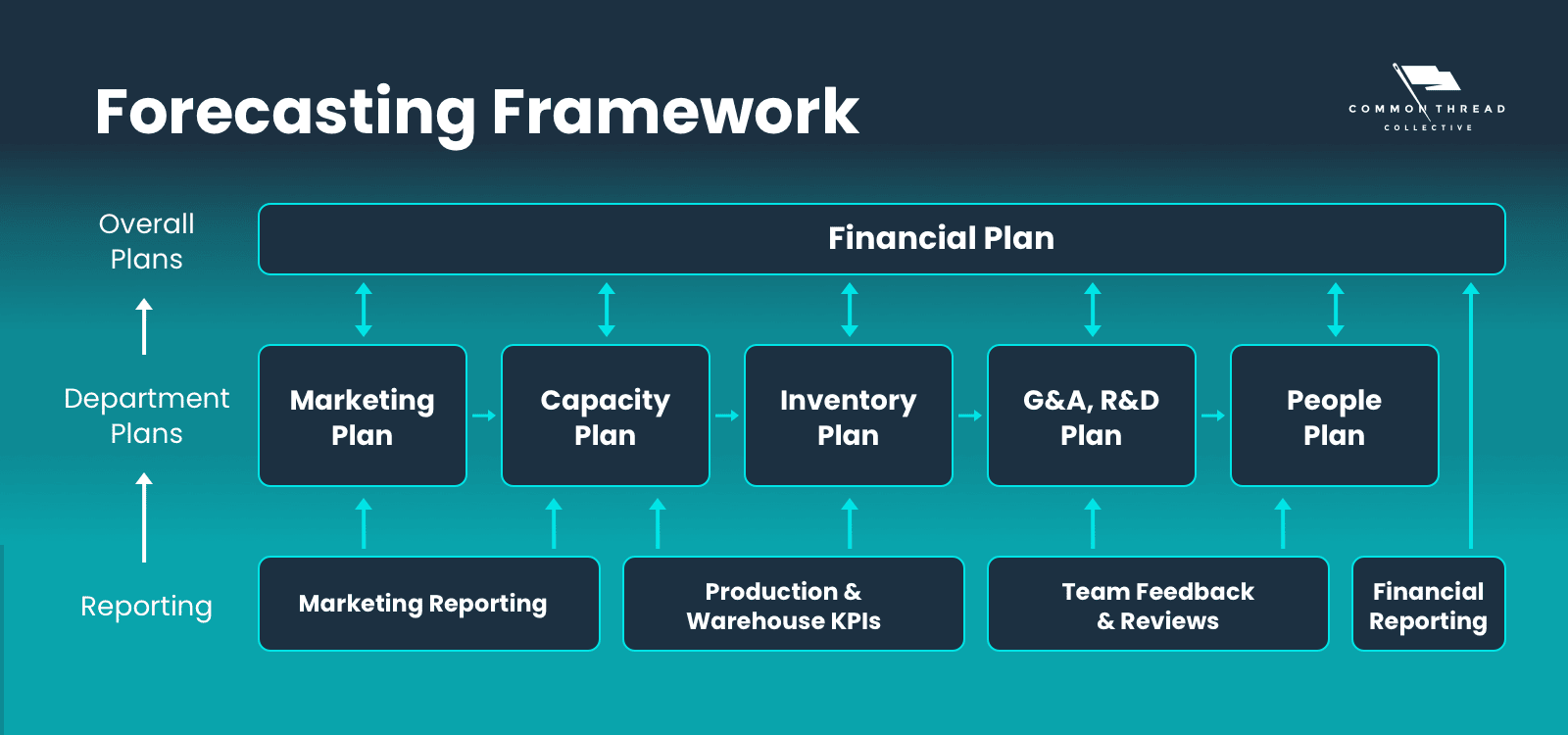

The overall financial plan of a business is informed by reporting, which then gets fed into departmental plans until finally culminating in the overall financial plan.

Looking at our diagram, the financial plan is generally built left-to-right. Marketing and demand will inform our capacity plan. How much we can produce will inform our inventory plan, and so on.

However, there is a consideration for bottlenecks and a situation in which constraints and limitations might push things the other way. A maximum capacity output might define our marketing plan if there is a bottleneck.

A business’ growth is ultimately determined by alleviating the bottlenecks that prevent the next phase of growth.

If you’re looking at a bottleneck-driven way of doing planning, then you focus first on the bottleneck and work everything downward from that position.

Everything in this plan is ultimately a cycle. It all rolls up into the financial plan and then it comes back down.

Is it feasible? Is it tenable, and realistic? Is it what you ultimately want?

Our job as marketers and forecasters is to ultimately tell them what is likely to occur, and the owner’s job is to tell us what they want to occur.

Then, we need to bring those into alignment.

As a business owner, your goals drive the business and overall strategy. Whether you acknowledge it or not, your personal goals and what you want to get from the business drive the strategy. It’s imperative that you align that consciously, and incorporate it into the financial plan.

Who owns the forecast? Who decides this is complete? Is it the CFO, the marketer, or your operations manager?

Ultimately, the owner owns the forecast.

The ultimate authority to set the final version of the forecast is the person responsible. In some cases that might be a single owner, or in others it might be a board of directors. But as a board member, your vote is declaring and owning responsibility for the business outcome.

Marketers cannot be victims of a forecast.

It is your job to educate, inform, and build a case if the forecast is inaccurate. By the time you start down the path of executing against the forecast, you accept it. Everybody is responsible along the way.

This is about assimilation into somebody else's culture.

If you're a marketer, showing reports with ROAS, and CPM and expecting CFOs to use them, you are missing a big opportunity to care about the language of your counterpart and learn to communicate with them in a way that will make the most sense.

It's on you to become fluent in their language. Of course, you're going to be clumsy in some ways and you won't be perfect at it, but the effort is a signal that I value what you value.

The whole purpose of this series is to invite you into the idea that as a marketer, you could impact the boardroom. The way to do that is to understand the finances of your business and to engage in it with fearless curiosity, openness, and confidence.

CEOs, the relationship between your sales executive and marketing executive is yours to cultivate.

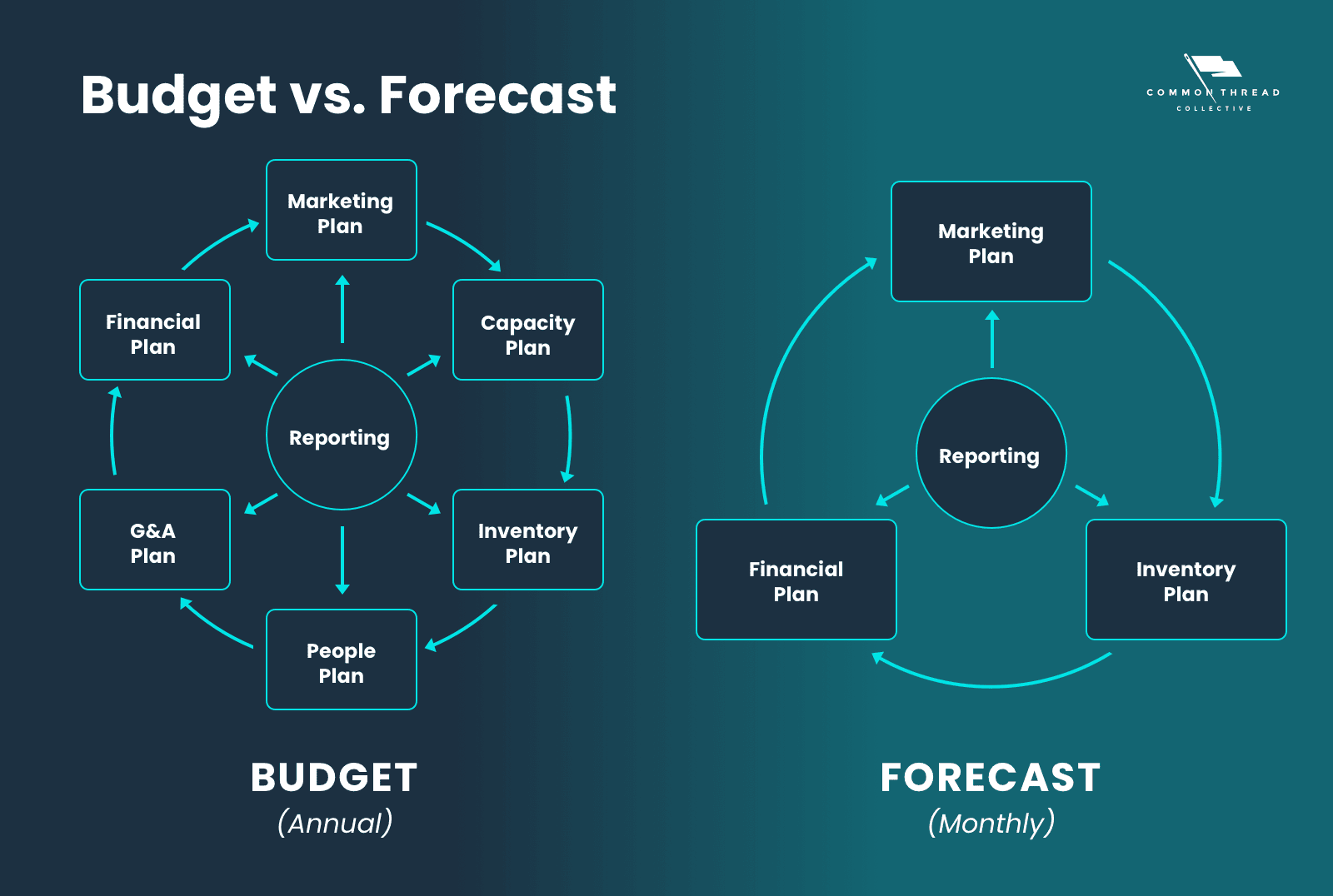

It’s hard to pivot and change capacity, G&A, and people every month.

For most ecommerce businesses, we simplify the monthly forecast plan, narrowing it down to Marketing, Inventory, and Finance.

After you close the books on your business every month, have a review of the previous month before building next month’s forecast. Evaluate where you were importantly wrong and where things went well.

A look at Common Thread Collective's monthly forecasting process …

At CTC, we close the books by the eighth of every month.

That might sound fast, but our business is pretty straightforward. So it's doable.

From there, we have a review meeting where we bring the full marketing calendar for the next month (not the current month because we’re already in that) and the latest expectation of revenue down to contribution margin on a daily level to that monthly forecast meeting.

We review the calendar, ensure everything is scheduled to go out at the right time and check in on inventory against the media plan. Then we take those numbers and lock them in inside Statlas.

That allows us to see performance to daily expectations in a narrow window, and it allows us to see what adjustments we need to make and course correct quicker.

Different versions of this forecasting method work for businesses at all stages of growth. Going through the process of planning is important no matter what stage your business is in.

At a smaller size, your business likely has a simpler plan, fewer static elements, and more fluidity. You're not carrying a lot of staff or have a ton of equipment, but you do have a marketing plan, inventory production, and finance engine.

You need a plan around those things.

As a smaller business, you may not know your growth rate, but this is an exercise in learning and reflection. Do a monthly forecast if not a daily one. You want to eventually get to this place where you have all of this synced together.

Many business owners may feel vulnerable or apprehensive about sharing financial information, but doing so is crucial for fostering a culture of accountability and driving strategic decision-making. By acknowledging and addressing these fears, leaders can create an environment where stakeholders feel empowered to contribute to the company's financial success.

Everyone in the business needs to know, “Are we winning or losing?”

One of the goals here is to move marketers out of attribution tools, and into an understanding of the impact you're making on the financial objective of the business.

People should be focused on what actually drives enterprise value.

The owner's objective is to build something of worth and value that they can extract that value from at some point in time, whether that be on an ongoing basis and you keep it forever to build a legacy business or a business you sell and exit from.

But, if the whole leadership team is looking at different optimization points that aren't aligned with the goals of the owner, then your business is going to end up in different places, rowing in different directions, having tension within the teams, and not delivering the financial results.

When the financial state of the business is clear and visible, the likelihood your business reaches its financial goals improves significantly.

Bring down the silos for the sake of your business.

We won’t send spam. Unsubscribe from Common Thread Collective at any time.

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get StartedCommon Thread Collective is the leading source of strategy and insight serving DTC ecommerce businesses. From agency services to educational resources for eccomerce leaders and marketers, CTC is committed to helping you do your job better.

For more content like this, sign up for our newsletter, listen to our podcast, or follow us on YouTube or Twitter.