Implement the Prophit System for Your Brand

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get Started

Welcome back to another episode of Bridges, where we embark on the journey to bridge the divide between marketing and finance.

Today we're discussing a topic that may be the perfect overlap between marketing and finance, and that is pricing. We’re looking at how both sides, marketing and finance, can use pricing as a tool in their tool belt to help deliver better business outcomes.

The easiest and simplest way to improve your gross margin is to simply increase your price.

But there's also another counter-signal within that, one that has an inverse effect on margin. Marketers often use discounting in a way that negatively impacts the gross margin their finance or product development teams had initially planned for.

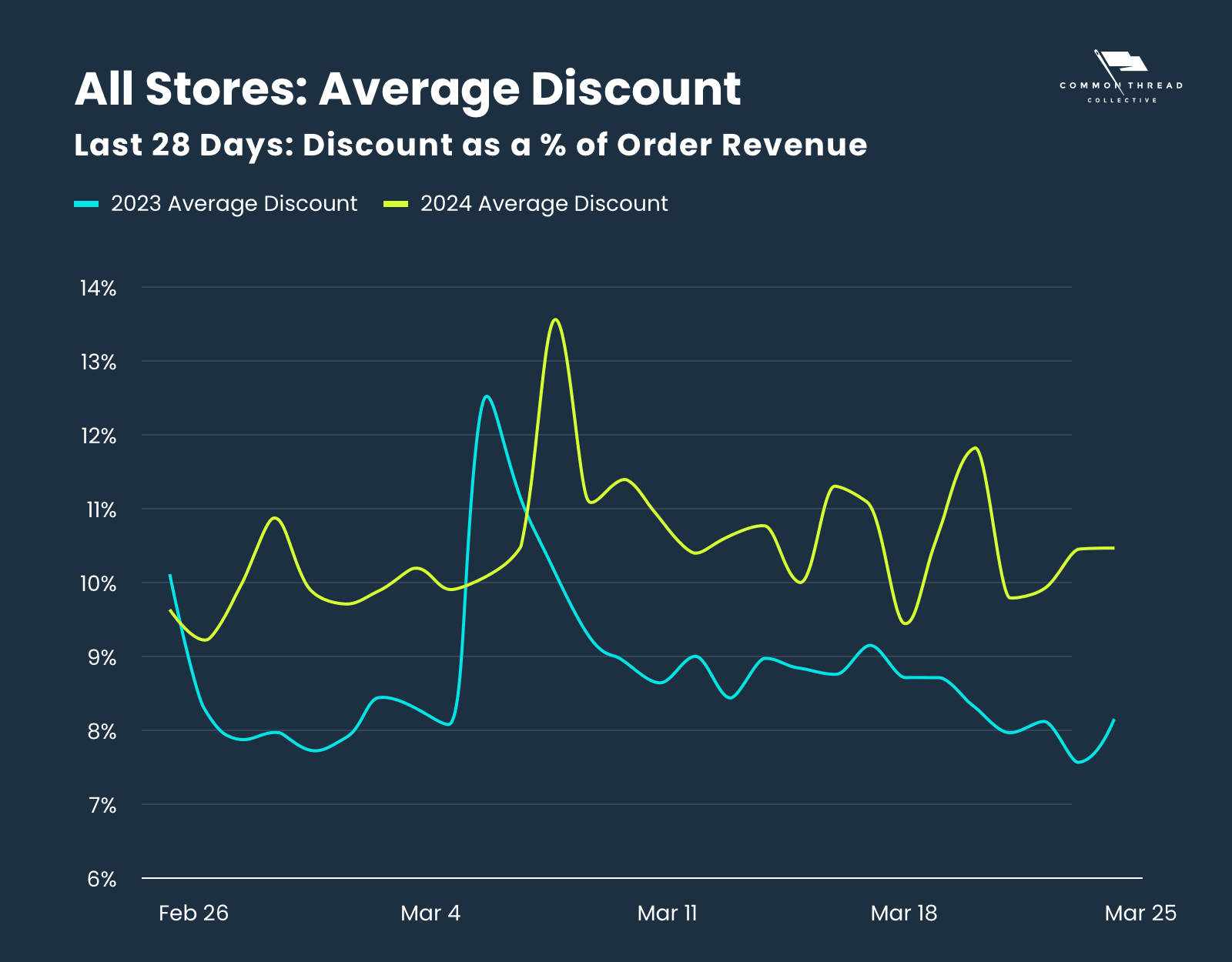

Looking in particular at this moment in ecommerce, you'll see an ongoing trend, where the average discount rate is going up over time.

This trend has a hidden effect on the gross margin of brands. Looking at a “Four Quarter Accounting” table, it may look like the Cost of Delivery is up year-over-year. But in reality, the cost of the product may not have changed at all. What has changed is simply the discount rate.

Price is a lever for customers right now, and in different market environments, the price elasticity of demand changes.

We know there are ongoing narratives around inflation and customers’ desire to have a discount relative to a consistent increase in price over time. It's not surprising that the relationship between price and demand is changing right now.

It is highly unlikely that there would be one price for every variable unit your brand sells over the entire history of your business. Embrace price as a dynamic component of your business in many different directions relative to the surrounding market factors.

And to start, here’s how we’ll get there …

This video is a part of our “Bridges” series, which aims to bridge the gap between marketing and finance. For even more ways to bridge that gap, check out our previous installments in the series.

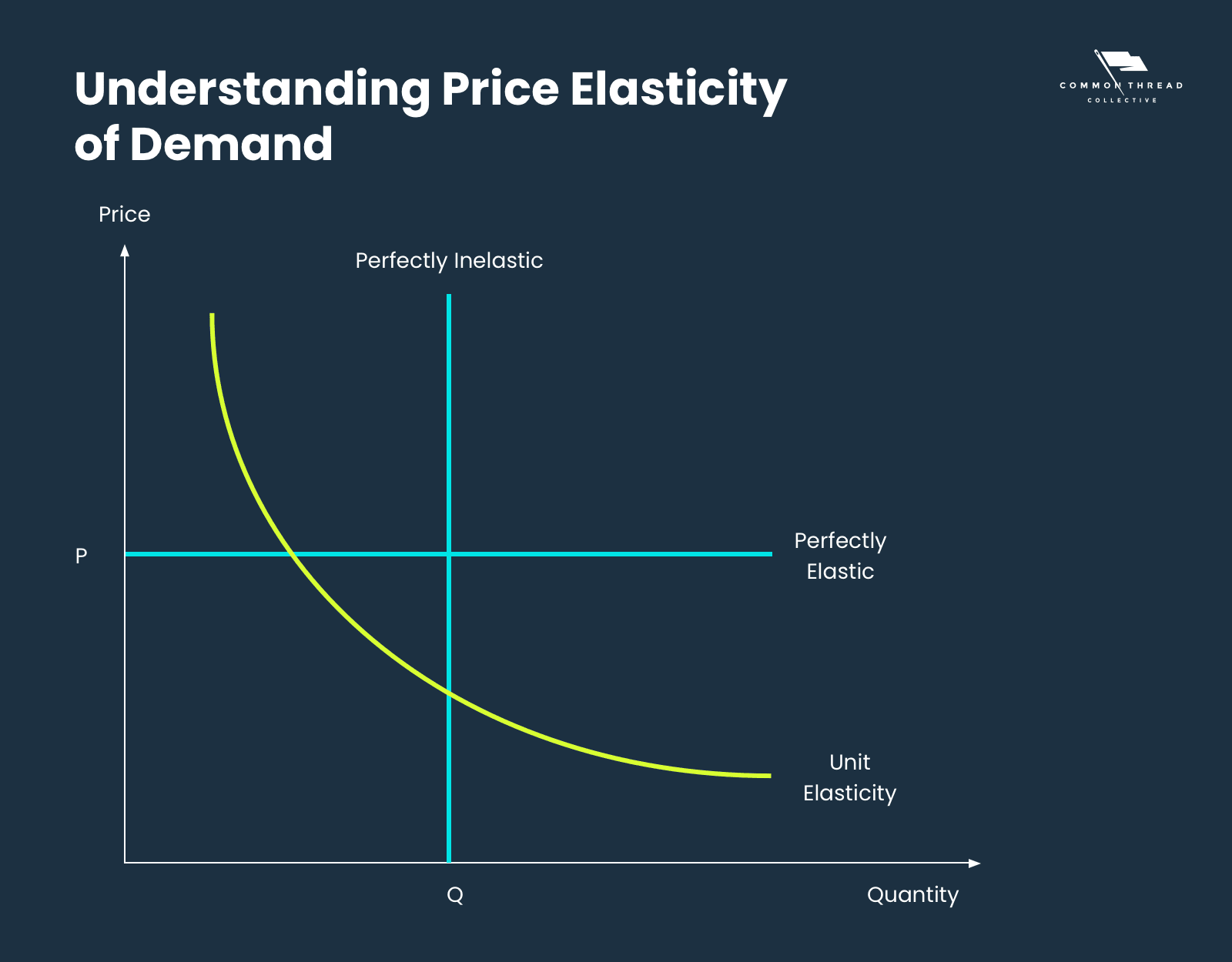

Let’s go back to ‘Economics 101’, and recall the concept of price elasticity of demand. It's a fundamental economic principle that measures the responsiveness of demand for a product to changes in its price.

Think of it as a gauge of how consumers react to price fluctuations.

The idea behind this concept is to measure the relationship between a change in price and a change in demand.

Some products, like gasoline, exhibit perfectly inelastic demand, where price changes have minimal impact on demand. Others, like consumer goods, showcase elastic demand … where price changes can significantly affect demand.

If you were to create a formula to determine price elasticity, you would take the percentage change in quantity demanded, and divide that by the percentage change in price. If your price elasticity is >1, then your goods are elastic (many consumer goods.) If price elasticity is <1, then it is inelastic (gasoline.)

As marketers, our job is to navigate this spectrum and make our products less elastic. We need our products to become less price-sensitive so that we can increase the price without affecting demand by the same amount or offset a discount rate with outsized demand relative to any discount we might run.

By understanding the factors that influence demand elasticity, we can craft strategies to optimize pricing and maximize profitability.

The elasticity of demand is not only determined by the intrinsic qualities of a product. External factors play a pivotal role in shaping consumer behavior.

These factors include:

These external dynamics underscore the complexity of pricing decisions and highlight the need for a nuanced approach to pricing strategy.

Our job as marketers is to maximize the marginal value of every SKU.

Getting the price right is hard.

To get there, you first need to have a solid understanding of the costs your business incurs to get the product.

In ecommerce, pricing becomes even more intricate. Businesses manage diverse portfolios of products, each with its demand profile and elasticity. Understanding the demand curve for each SKU is paramount, yet challenging.

The demand curve is not the same for all SKUs, so the price shouldn’t be either.

Getting pricing right requires a deep understanding of consumer behavior and market dynamics. Each SKU you have is like placing a bet on the potential future demand of that individual SKU. And we do mean every SKU, whether that means an individual product, size, or color variant.

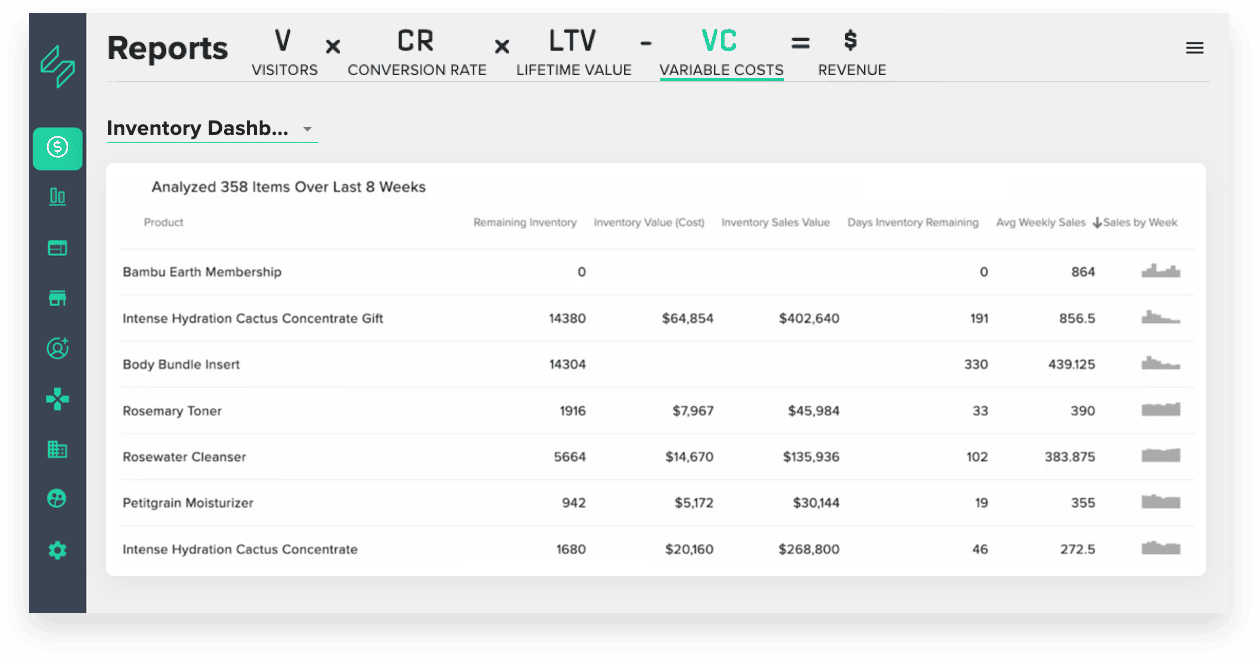

To understand this demand curve, we created an inventory dashboard inside Statlas. Then we assign an inventory grade for each product by dividing the days of inventory remaining by the days of production lead.

Simply knowing the inventory status still isn’t enough for most ecommerce businesses. When inventory sits in your warehouse for an extended period, it’s not enough to simply decide to liquidate it. Marketers also need to consider their business’s goals.

Are you distributing cash? Are you looking for a sale event? Does protecting EBITDA matter? Do you have covenants with the bank to keep or do you need to create cash? How much cash do you have available to you? How important is it to turn aged inventory back into cash?

By leveraging inventory data, marketers can make informed pricing decisions to optimize contribution margin.

The goal is to consistently have “just-in-time inventory.” That’s the ideal state for ecommerce, where you receive your next batch of inventory on the exact day you run out of your current stock … you are never out of stock and never overstocked.

An overabundance of inventory becomes a problem depending on the cash position of your organization … how important is it to turn that inventory back into cash? It can also be a problem depending on if your product expires or the likelihood it goes bad on the shelf.

This means that marketers need to consider the larger market components … how much demand exists at any given product’s current price alongside a consideration for your business’s unique cash and inventory position when thinking about price.

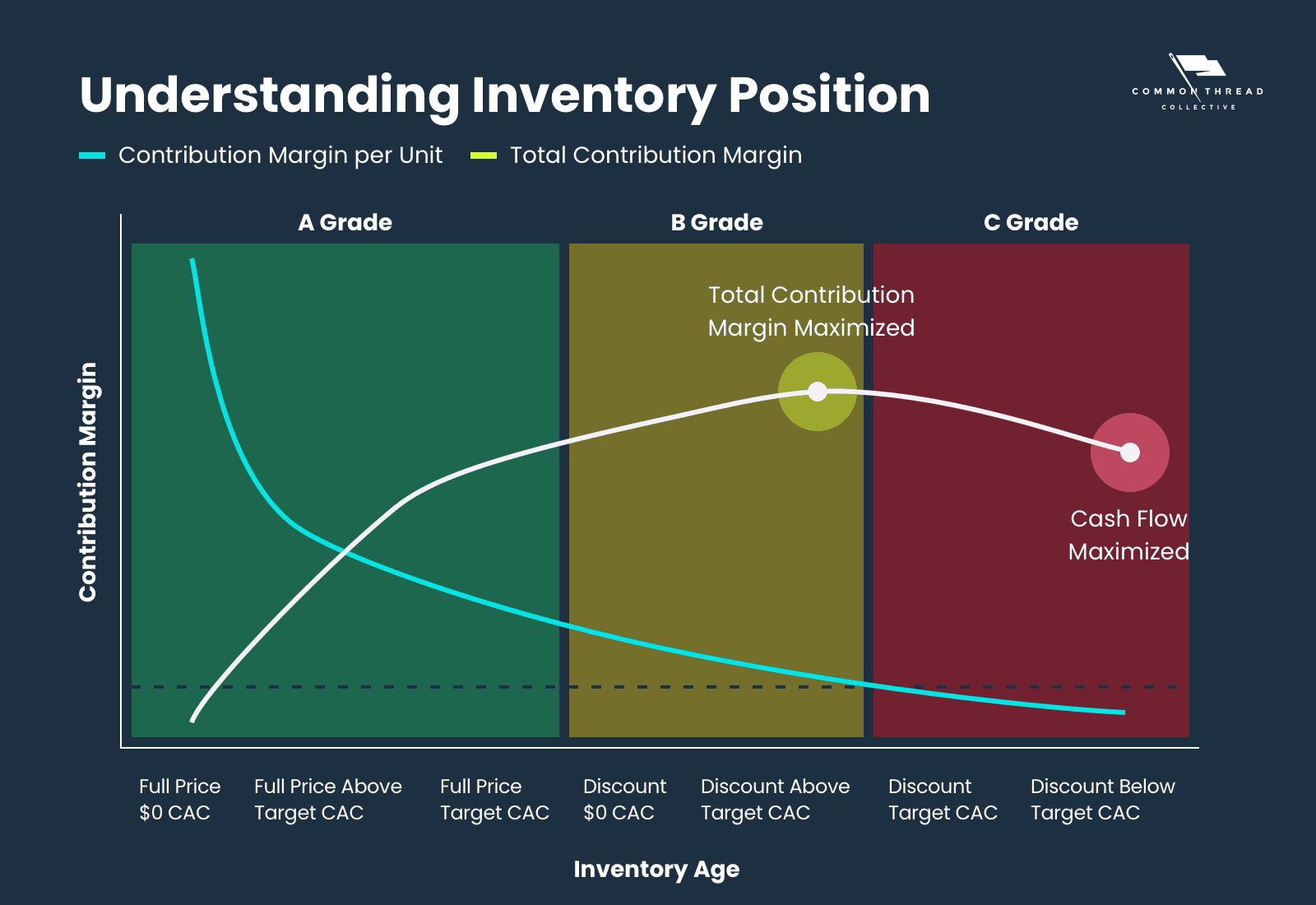

This complexity doesn’t only apply to the actual MSRP or the retail suggested price, it affects how often you discount, whether you're willing to discount, and the CAC or the acquisition cost you're willing to pay relative to that price. All three are different levers available to you when thinking about maximizing the marginal value of SKU.

After understanding the levers available to you at different inventory positions, you need to understand what to do with your inventory at each position. Start by assigning a grading system to different inventory positions …

Start by selling A-grade inventory to existing customers using email and SMS to maximize total contribution.

Next, sell products at full price with an above-target efficiency CAC.

When your inventory begins to age, begin considering discounts. Start those discounts with existing customers to avoid introducing additional customer acquisition costs, before moving into discounting above your target CAC.

By the time your product inventory status makes it to C-grade, you are looking at a liquidation strategy.

If you are in an apparel business you likely have hundreds, if not thousands of SKUs in C-grade inventory status. Your business would be well served to liquidate, even at a slight loss for the sake of being able to turn these SKUs back into better inventory that can produce better margins in the future. The caveat here is if carrying that on the balance sheet is a way to protect the P&L in the short term, because this action deteriorates the profit and loss statement.

We often see marketers running discounts at above-average target CAC on inventory that is about to run out. Do not pay CAC for inventory in low supply.

Cost controls are so important because they give you a lever to tighten the efficiency relative to available supply.

When we know the pace of our revenue and when we can create moments to drive increased demand and can plot that a year ahead, it allows us to make inventory a process that is synced to the marketing calendar.

Ecommerce is a rhythm business. The idea that you should constantly try to hit your maximum spend every moment of every month needs to be corrected.

You need to build an annual plan and execute against that plan with timing, pace, and rhythm.

Your ability to predict your future revenue is the mechanism by which you maximize the marginal value of every unit because you can order supply that keeps you in that green zone.

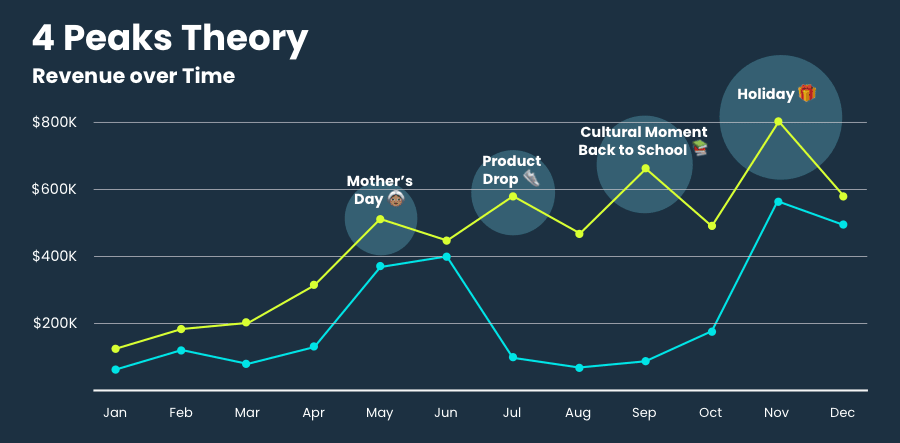

Year-round growth comes from a calendar with at least four peaks.

At Common Thread Collective, we’ve long talked about the ‘Four‑Peaks’ Theory. Most marketing calendars and revenue plots for ecommerce businesses follow two peaks: Father’s or Mother’s Day, and Black Friday/Cyber Monday.

With the Four-Peaks model, you take advantage of the traditional holiday season, major gifting celebrations, and cultural moments (i.e. The Solar Eclipse, First Day of Summer, or International Cat Day) as well as product events.

This calendar drives performance through storytelling and limited purchase opportunities to create a continuous rhythm throughout the year.

There are, of course, different pricing strategies that offer avenues for maximizing marginal value. From limited edition drops to dynamic variant pricing and discounting, each strategy presents opportunities to enhance profitability.

One lever that allows you to expand the margin profile is the idea of limited edition drops, where you leverage scarcity as a mechanism to move prices up and increase demand.

As an example, look at Bruce Bolt. They recently did a product drop with the “King of Juco,” an awesome influencer and content creator.

This product drop is already completely sold out.

Now, part of that you could argue is bad planning relative to the supply and demand available. The other part is to cut costs.

Returning to our ‘Economics 101’ discussion, one way to consistently move prices up is by keeping supply low. Limited Edition drops allow you to build scarcity into the customer's mindset.

Moments are no longer marked by discounts and promotions. They're marked by scarcity and increased demand for an awesome, above-average product featuring something you might love.

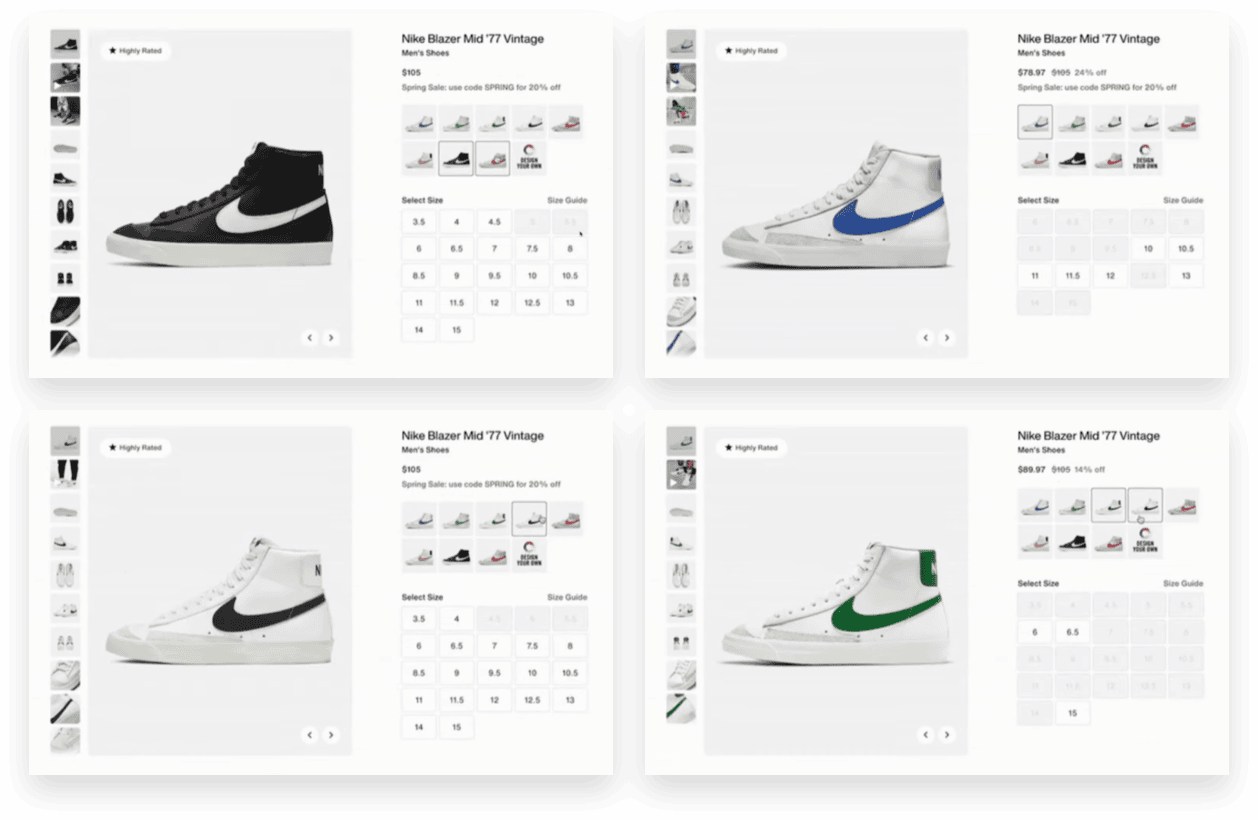

Another lever you can use to maximize marginal value against price is the idea of dynamic variant pricing. Once again, this pricing strategy simply leverages supply and demand to maximize your marginal value.

If you go to Nike's website, you will notice that every color and size has a different price relative to the amount of demand.

Non-core SKUs of different sizes in low supply have lower prices to move that inventory lacking the present demand at that existing price. Even among Nike’s best signature SKUs, less desirable colors or sizes will be discounted to move that inventory, whereas more popular colors and sizes don’t require any discounting to move the product.

Not all demand is equal across every SKU.

This allows the business to reinvest cash back into the primary position of supply. Think about how to introduce a dynamic pricing structure to sell overstocked SKUs and turn that stock back into cash so we can gamble again on a better mix of products to maximize the marginal value of every SKU.

What is the present inventory position across core SKUs? Is there anything that's aging out? Is there an opportunity to liquidate products? Is liquidation a necessary action at this moment?

Are there ads that we should turn off, because we will organically sell out of the remaining inventory and don't need to introduce paid CAC into that margin profile?

This is how you get to maximum contribution margin as a business. And it's where price is your ongoing lever.

You may have thought when we started this, that we were just going to talk about the idea that you should price test. You should price test because you likely haven't found your total price elasticity of demand. But it's so much more than that.

Striking the right balance between maximizing contribution margin and maintaining cash flow is essential. Pricing decisions must align with broader business objectives and market dynamics.

As we reflect on the role of pricing in driving business success, it's clear that pricing is not a static element but a dynamic and strategic tool.

Pricing is more than just assigning a number to a product … it's a strategic endeavor that requires a deep understanding of market dynamics, consumer behavior, and business objectives.

By empowering marketers with insights and strategies, businesses can harness the power of pricing to achieve long-term profitability. Apply these principles to your own business and embrace pricing as a dynamic aspect of your marketing and finance strategies.

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get StartedCommon Thread Collective is the leading source of strategy and insight serving DTC ecommerce businesses. From agency services to educational resources for eccomerce leaders and marketers, CTC is committed to helping you do your job better.

For more content like this, sign up for our newsletter, listen to our podcast, or follow us on YouTube or Twitter.