Implement the Prophit System for Your Brand

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get Started

Profit is king.

The capacity to generate free cash flow is dominating the expectations of all organizations. The cost of capital continues to remain high, and investment is sitting out on the sidelines.

Businesses need to be able to produce their own operating profit that allows them to sustainably scale without the use of outside capital or with limited access to outside capital.

In today's rapidly evolving landscape, the stakes have never been higher.

Ecommerce marketing is no longer just about creativity and customer engagement; it's increasingly about driving tangible financial outcomes. The pressure to not only craft compelling campaigns but also to contribute significantly to the bottom line.

You get it … the struggle to make your marketing efforts align seamlessly with the financial goals of the business. But here's the kicker: it's not just a minor hiccup; it's a colossal roadblock with far-reaching consequences.

This is where our new "Bridges" series comes into play, offering invaluable insights for marketers navigating these complex waters.

Learn how to connect your marketing and financial teams while we walk through …

The Era of Financial Fluency in Marketing

Imagine a world where marketers are not just creative geniuses but also financial wizards.

In the current ecommerce era, understanding the financial components of a business is no longer optional for marketers; it's essential.

This shift towards financial fluency is not just a trend but a necessity.

When you enter into finance from an accounting or finance background, you’re governed by a set of parameters — gap compliance and other structural thinking that informs a limiting view of how you're going to interact with the world.

Now, it’s limiting in the sense that it’s regulated … and that regulation is important for the sake of how you track and establish the financial documents as an account or finance leader for the organization.

But the beauty of entering finance from a marketing perspective comes from a lack of being governed by these documents, gap compliance, etc. You don’t have the limitations of the finance team.

Instead, marketers can adjust the traditional format of these financial documents to better communicate to other parts of the organization in ways they can understand.

This is about understanding and creating insight and impact.

… and of course, we’ll start here with the Profit and Loss (P&L) statement.

Traditionally, Profit and Loss (P&L) statements have been the domain of accountants and financial analysts. In fact, most P&L statements are the output of whatever accounting software you are using (Quickbooks, Xero, or FinalLoop.)

This output will traditionally look something like this:

While the numbers in the above P&L are made up, it provides a good example of how P&L statements are often distributed to a marketing team in a way that isn’t all that useful.

The challenge lies in the fact that traditional P&L statements are not structured in a way that is intuitive for marketers. That’s why we translated this default generic structure into something much more effective layout for marketing teams … and really, the entirety of the organization.

Often P&L statements are referred to as a chart of accounts. You’ll see income and expenses, with different categorical buckets of costs grouped together like bank charges, payroll, or fun categories like ‘miscellaneous expenses.’

But we’re not as concerned about how you categorize these items, as much as we are about the sequence and design of the P&L in total.

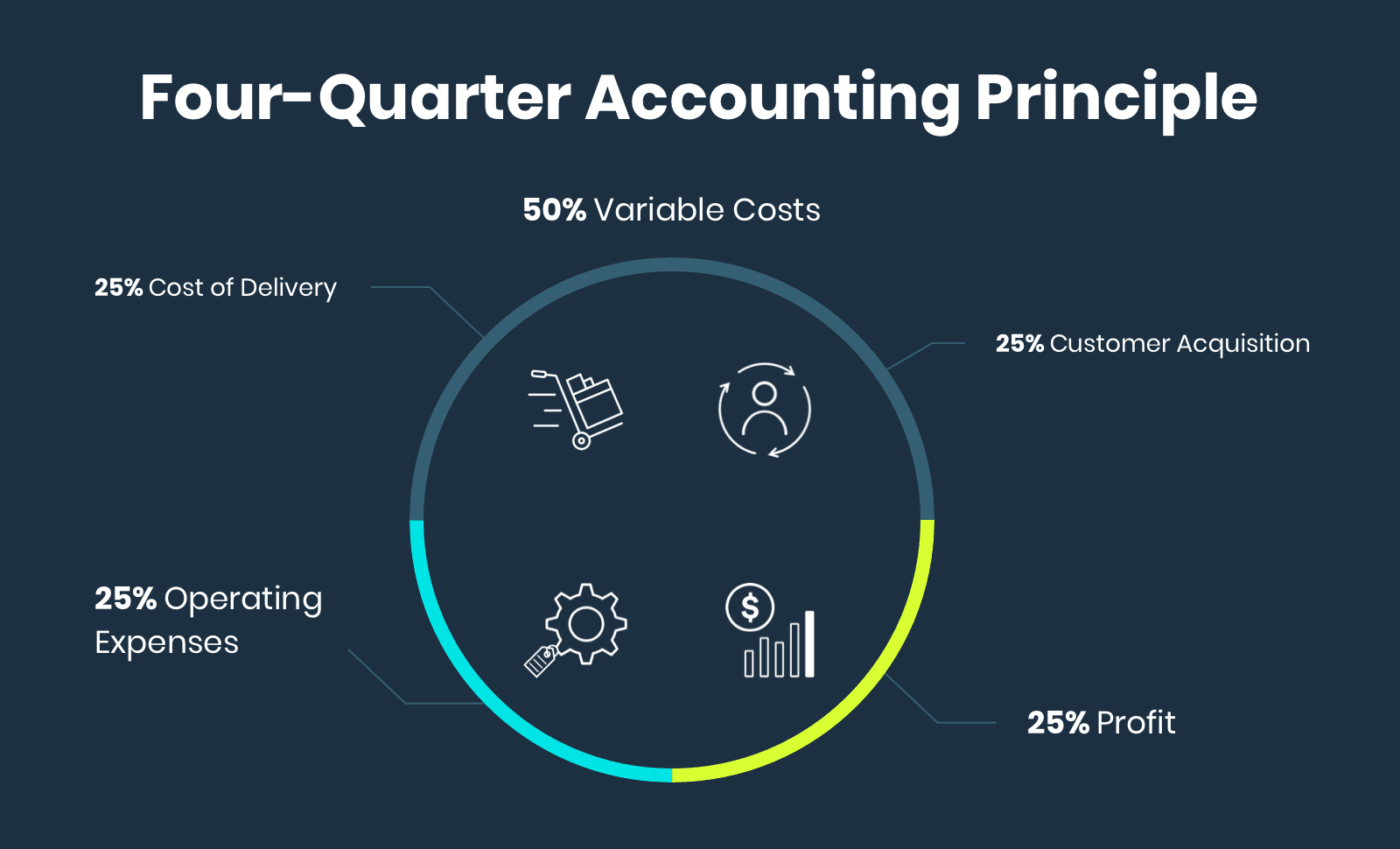

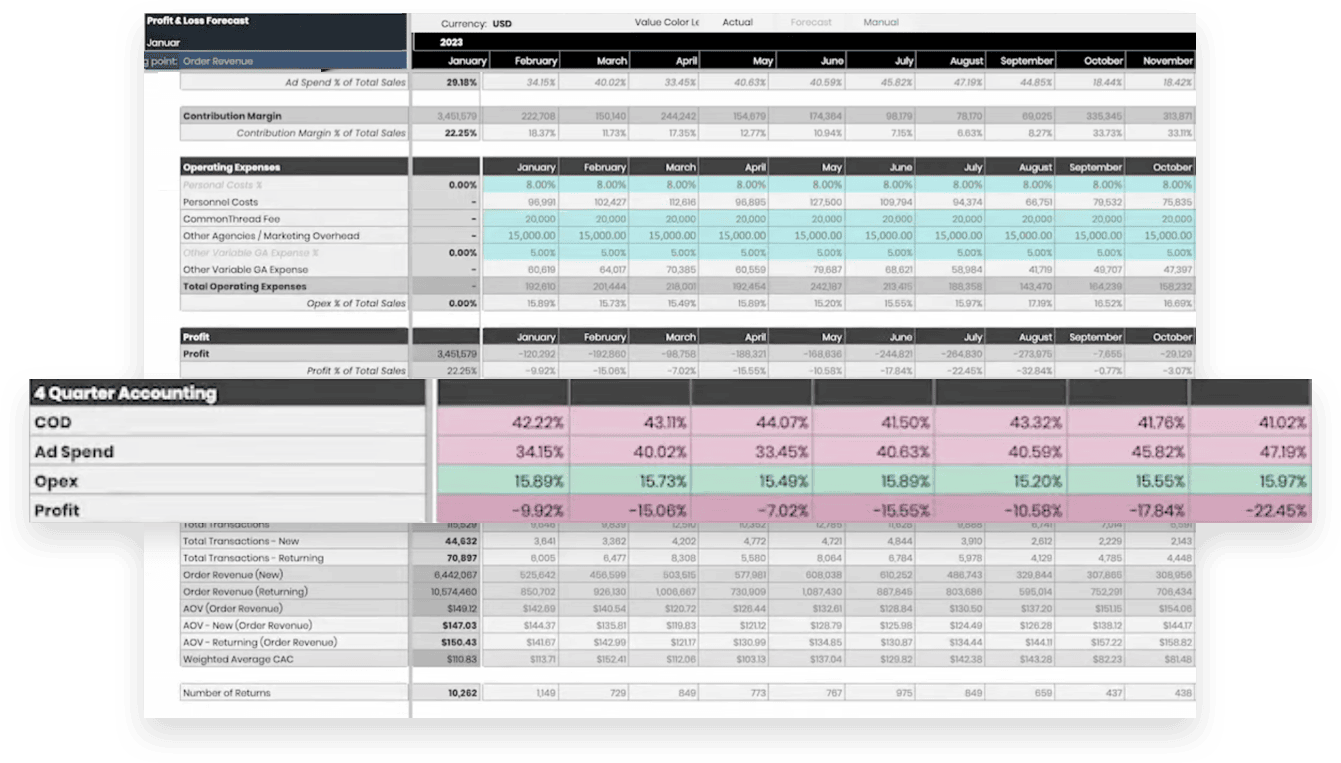

This is where our princple of 'Four-Quarter Accounting' comes into play, offering a new approach to make P&L statements more accessible and useful for marketing professionals.

Four-Quarter Accounting is where we take a potentially large group of categories and group them into four very simple groups inside of your P&L that bring to the surface some of the core metrics that drive systemic growth for ecommerce brands.

Structuring your P&L through the Four-Quarter Accounting Principle will help you to understand where your revenue is going and where your profit is disappearing in any given month.

This principle works by establishing 25% targets for each of four main categories on your profit and loss statement.

Those four categories work like this:

In ecommerce, understanding variable expenses is crucial.

It's not just about the cost of the product; it's about the entire journey it takes to reach the customer.

Oftentimes, businesses will refer to cost of goods, gross margin, or variable expenses with an inconsistent set of categorizations or definitions.

'Cost of Delivery' has become our universal, unifying term for encompassing all of those expenses involved in getting a product from the manufacturer to the customer. This includes:

Most of these numbers are priced on a variable basis.

If you have a warehouse staff and you do your own fulfillment … it's possible some of these costs could become an OPEX or more of a fixed spent because it's a headcount thing.

We're not going to dive into all these edge cases here, but I recognize they do exist.

Cost of delivery is intended to help us think about every time an order goes out, what percentage of that revenue is given away to fulfill the actual product to the customer?

In a traditional P&L you’ll see these costs blended both above and below the line, making it harder to find that number for each order.

Knowing that total cost per order is vital for setting accurate pricing and marketing strategies, CAC targets, ROAS efficiency, and aMER to actually make money every time I sell a product.

Customer Acquisition costs, or ad spend – the literal dollars that are paid for performance advertising – plays a significant role in the ecommerce P&L statement.

It's not just about how much is spent on ads, but understanding the difference between platform ad spend and associated service fees. This specific category is just the dollars spent on the platform. None of the service fees associated with them.

This distinction is crucial for determining the contribution margin, which in turn affects the overall profitability of ecommerce operations.

Every ecommerce P&L should include a section after gross profit, after ad spend, to get to contribution margin.

This is the total dollars generated before fixed expenses. This is ultimately what is going to flow through to cover your your fixed expenses, your OpEx.

This is where you should be setting your targets each month as an organization.

Marketers need to be acutely aware of how their ad spend decisions impact the financial health of their business.

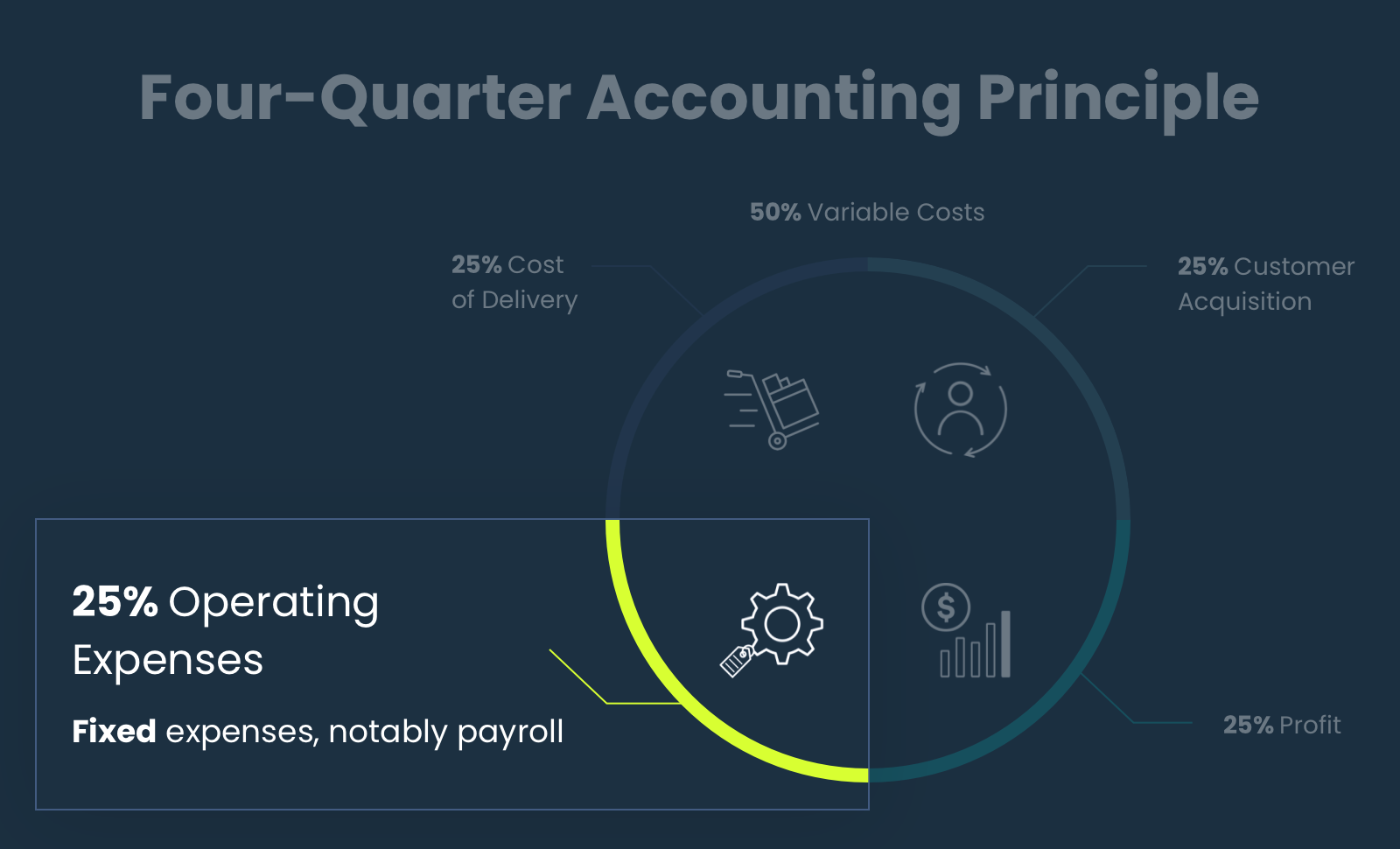

Operating Expenses (OPEX) represents all the other expenses … all the fixed expenses that do not change on a variable basis.

Efficient OPEX strategies are essential for maintaining a lean operational budget, which in turn plays a significant role in the sustainability and growth of the business.

Remember that we are not trying to create a chart of accounts, so we often lump many categories into a much simpler ‘OPEX bucket.’ We will break out personnel, payroll that represents the largest line item, but from there we just want to get to a total OPEX.

Keep in mind that ecommerce expenses are not linear.

To lower your OpEx over the long-term, you might invest in an ERP system or hire an expensive employee. This means your OpEx might peak above our 25% target in a given month.

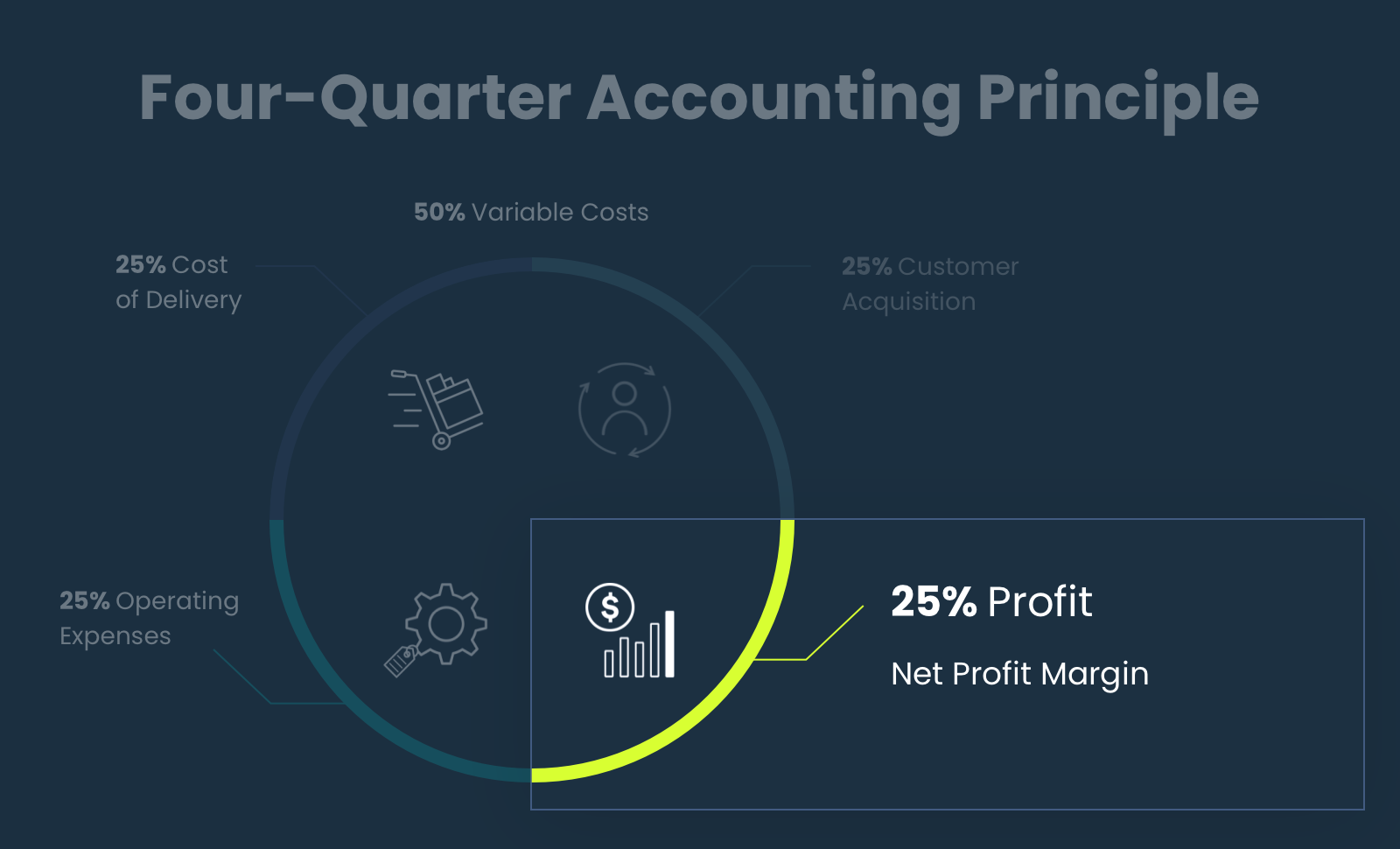

Profit represents the final category in our simple P&L.

We have the cost of delivery, we have ad spend, we have OpEx, and then the remainder is our profit.

At the bottom of every P&L, we construct a table providing a quick, at-a-glance view of these categories, color-coded to indicate whether it aligns with our 25% benchmark.

This benchmark is designed to quickly reveal where profits are being allocated.

Typically, an efficient ecommerce business might aim for a 25% net profit margin, although a more realistic goal might be around 20%. Nevertheless, we use 25% as an aspirational benchmark for each category.

Note: This is not a target but a heuristic to easily assess where profits are being utilized.

Each month, we evaluate these categories against the 25% standard. For instance, if the overall profit margin falls to sub 9%, ad spend is at 34%, cost of delivery is at 42%, and OpEx represents a lean 15% … it becomes clear where adjustments are needed.

In this scenario, targeting cost of delivery and ad spend would be more effective than trying to reduce an already lean OpEx.

Four-Quarter Accounting for your ecommerce business

Our 25-25-25-25 concept is just that … a simple concept to establish a basic expectation.

In reality, the typical breakdown for most ecommerce businesses might be closer to 15% for OpEx, 40% for cost of delivery, and 20% for ad spend, leading to a 25% profit margin.

The Four-Quarter Accounting method serves as a mental model to assign expected percentage values to each category, allowing for tailored conditional formatting based on your business's specific margin profile, operational leanness, and advertising expenditure.

The key idea is to set these expectations and use the 25-25-25 rule as a simple guideline.

This method consolidates various individual line items into a more comprehensible format: revenue followed by the four quarters of expenses — cost of delivery, ad spend, OpEx, and profit.

Once you understand all the metrics that make up our Four-Quarter Accounting principle, you can move to begin improving them. Strategies to improve OPEX, contribution margin, gross profit, and more are available in our Antifragile Ecommerce Guide.

A crucial aspect of analyzing a Profit and Loss statement, especially for marketers, is the representation of income.

Often, income is simply categorized under a single line item labeled 'sales' or 'income'. However, revenue is not just a single number; it's a multi-faceted metric that needs detailed analysis.

It's vital for marketers to understand and distinguish between the various types of revenue, as the term 'revenue' does not have a uniform definition across different contexts. There are numerous forms of revenue, and each has its specific implications.

For instance, Shopify, typically defines 'sales' or 'revenue' as 'total sales'. This is the default figure displayed on the Shopify dashboard, which most entrepreneurs are accustomed to.

Total sales represent order revenue — every dollar collected from the customer minus returns.

However, when we speak of 'revenue', it's essential to have a detailed breakdown. This includes:

Having visibility into all four levels of revenue is crucial.

Brands that only focus on total sales often overlook the significant impact that returns and discounts have on their financial health. In some instances, discounts can be the hidden culprit behind eroding profits, growing unnoticed over time.

That is why it is vital for a detailed P&L statement to display sales across all these four levels. The granularity will allow for a deeper understanding of the financial dynamics and help you make more informed decisions.

Adopting the Four-Quarter Accounting approach can transform how you view and understand your financials.

Simplifying the P&L statement into four key areas - Cost of Delivery, Ad Spend, OPEX, and Profit highlights the areas of the business that are or are not working.

The Four-Quarter Accounting standard of 25-25-25-25 for each category leads to better financial decision-making and provides a clearer picture of where the business stands financially.

When are missed financial targets actually a marketing problem?

With an understanding of Four-Quarter Accounting, marketers become equipped to push back on businesses’ demands that they fix fundamental issues with the company’s finances.

For example: if OpEx substantially exceeds 25% of your revenue, it's a red flag. A well-run ecommerce business should ideally keep payroll within 8 to 12% of revenue, with total expenses not surpassing the 25% threshold.

An overly high OpEx might necessitate reducing headcount, downsizing office space, or cutting back on non-essential expenses like production, photo shoots, or corporate lunches.

The goal is to operate as lean as possible, minimizing fixed expenses to maximize the budget available for marketing.

The benefits of an efficient team …

I recently listened to the Operators podcast, where Sean from Ridge discussed their business model. They maintain a Marketing Efficiency Ratio (MER) of about 2.5 to 1, allocating roughly 40% of their revenue to marketing.

This is achievable due to their excellent profit margins and a lean, efficient team, where revenue per headcount is carefully managed.

As marketers, it's crucial to recognize potential issues within your organization. These could include excessive ad spend as a percentage of revenue, margin problems arising from discounting, returns, or product costs (possibly linked to pricing strategies), or an inflated OpEx.

You should not only focus on the immediate metrics like platform costs or CPM but also develop a deep understanding of the financial realities of the business.

Knowing where the money goes is crucial for your success as a marketer.

It’s not just about the downstream effects; it's about anchoring yourself in the financial aspects and recognizing where adjustments are needed.

The 'Bridges' series is set to explore various aspects of financial planning in marketing and bridge the gaps between marketing and finance.

Upcoming topics include cash flow forecasting, Lifetime Value (LTV) forecasting, and setting cost cap targets.

These insights are crucial for marketers to connect their activities to the financial results of the business, ensuring that marketing strategies are not only creative but also financially sound.

By understanding and applying these principles, marketers can significantly contribute to the financial health and success of their organizations.

The journey towards financial fluency in marketing is not just beneficial; it's essential in today's competitive ecommerce landscape.

Transform your ecommerce business by applying these insights. For further guidance or in-depth learning, consider our consultation services and additional resources.

We won’t send spam. Unsubscribe from Common Thread Collective at any time.

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get Started