Fashion is constantly evolving.

Seasons change. Tastes transform. Fads come and go.

Ruled by subjectivity, risk weaves itself into the fashion industry … blessing one moment. Cursing the next.

And it’s not just a matter of style.

How fashion ecommerce brands operate is constantly evolving too. New technologies, shifting markets (at both geographic and economic levels), plus the shadow of profitability.

Threading the needle calls for a clear understanding of the 10 trends shaping ecommerce fashion.

Table of contents; click any point to jump ahead

- Ecommerce Fashion Industry Grows to $1 Trillion by 2025

- Global Fashion Continues East, But ARPU Rules the West

- Vertical Data: Apparel, Accessories, Shoes, Luxury & Eyewear

- Divides Deepen Between Fast Fashion and Designer Brands

- Profitability & Sustainability in Apparel Ecommerce for 2023

- Personalization ‘Coutures’ the Online Store Experience

- Multi-Channel Demands Immersion through Social Media

- Retail Fashion Remains, Beckoning Omni-Channel Operations

- Fashionable Predictions: Social, Loyalty & Intimacy + Returns

- The More Fashion Changes, the More Fashion Stays the Same

This article serves as a compendium on the latest research for online fashion.

It includes apparel industry data, practical examples, and a tactical guide on fashion marketing. If you’d like to download the full article to save for later or share with your team, you can grab it here:

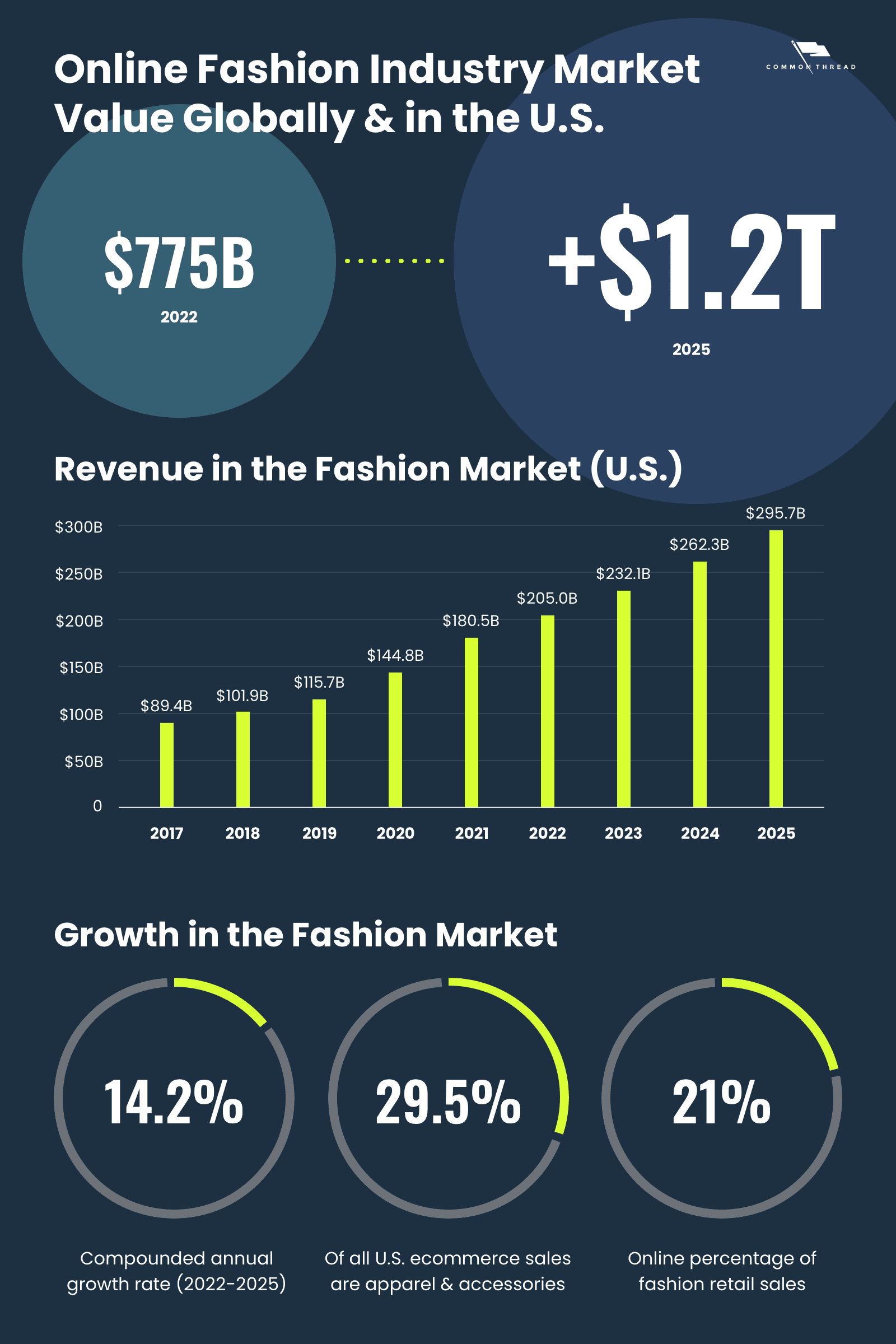

1. Ecommerce Fashion Industry Grows to $1.2 Trillion by 2025

The business of fashion is more than big; it’s the biggest of the big.

With a global market value of $775 billion, apparel, accessories, and footwear are the number one ecommerce sector in the world.

By 2025, that number is expected to reach just over $1.2 trillion.

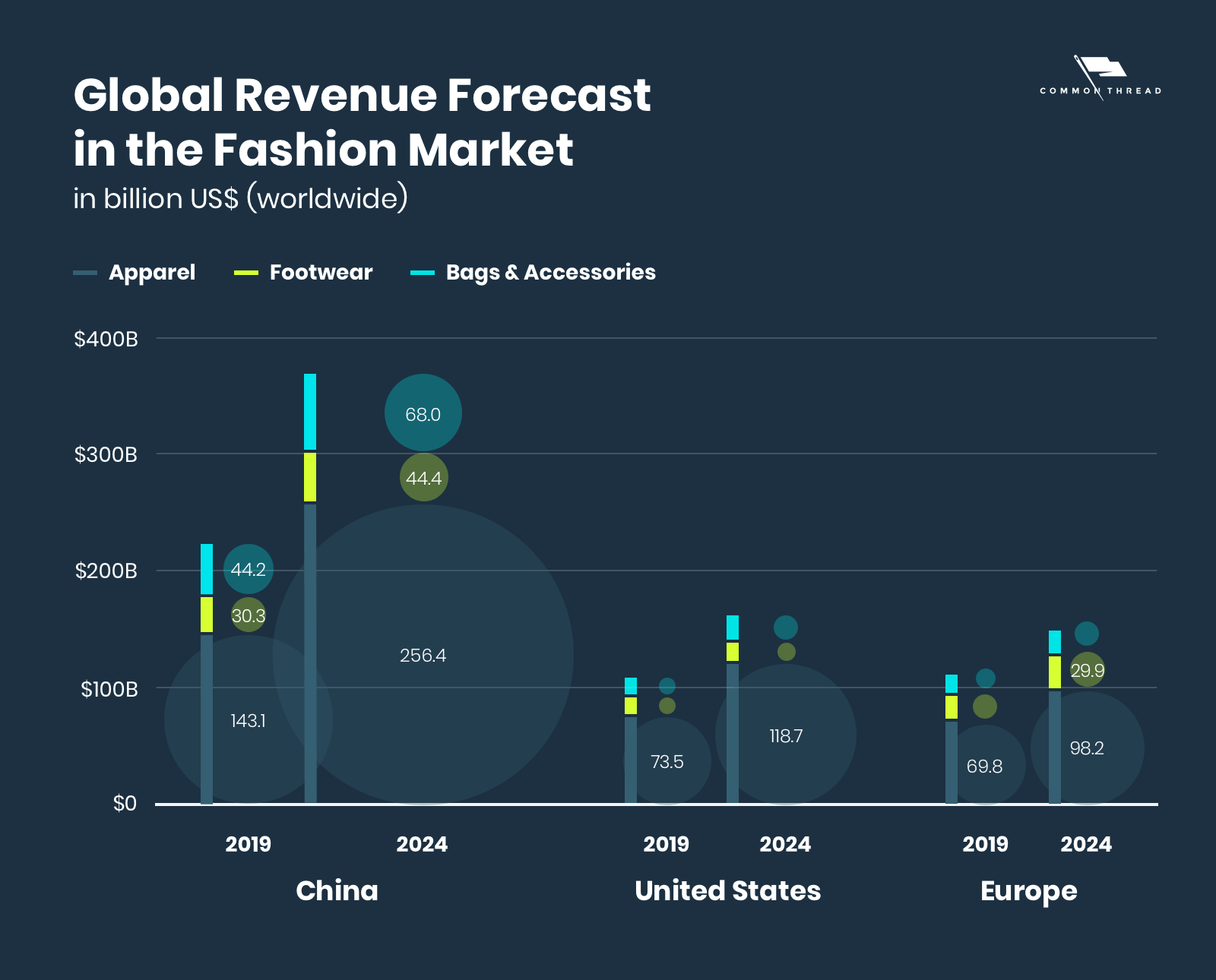

2. Global Fashion Continues East, But ARPU Rules the West

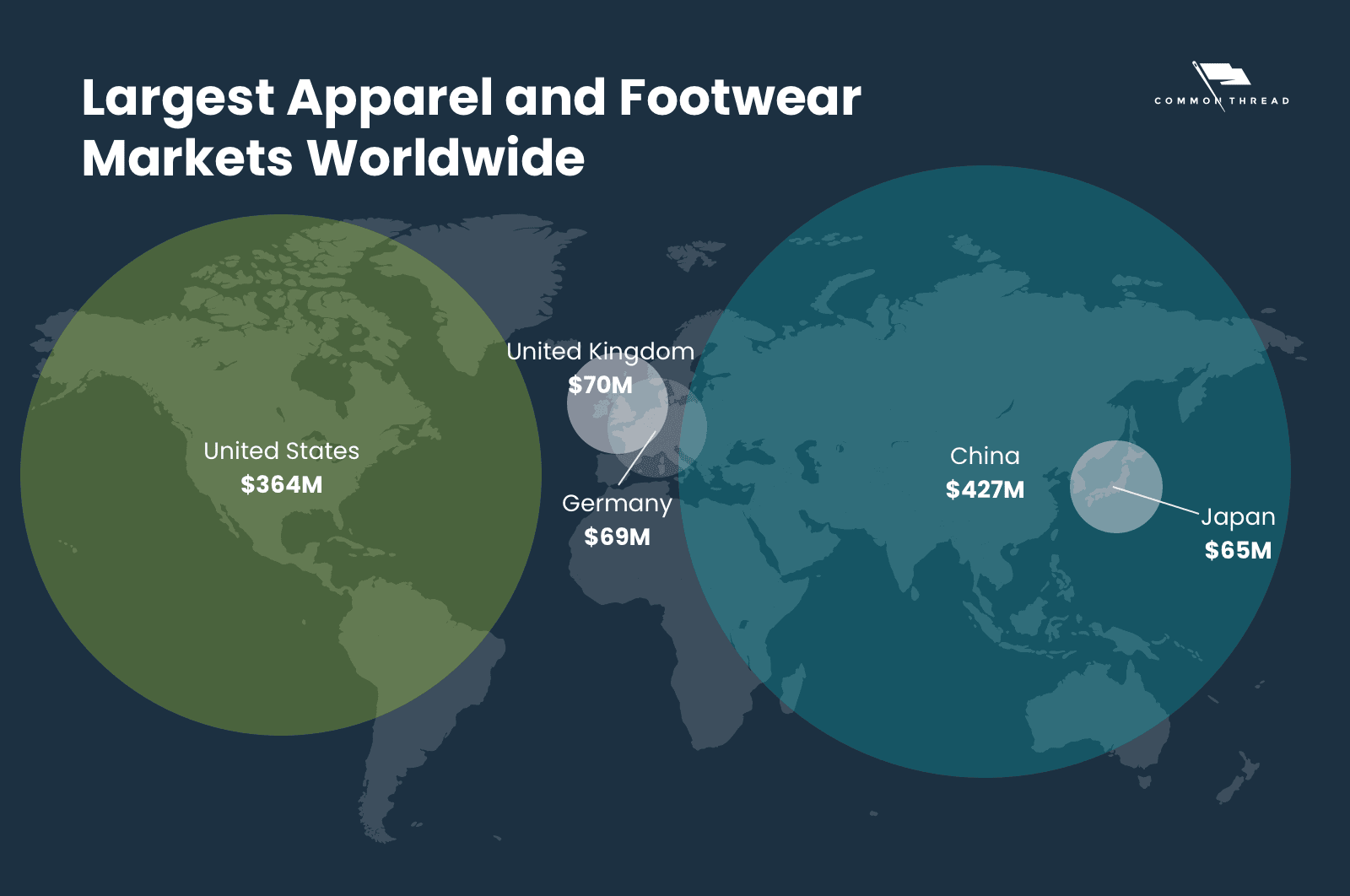

Geographically, market size tilts heavily toward China; USA is close behind, with a big leap to get to the other top countries from there:

- China: $427M

- United States: $364M

- United Kingdom: $70M

- Germany: $69M

- Japan: $65M

Moving forward, China’s dominance will only intensify …

International data should not be used to downplay North America and Europe’s role in shaping worldwide preferences. Nor the opportunities still emerging domestically.

Globally, coronavirus hit online apparel and accessories hard. Conversely, eMarketer reports 9% YoY growth in the US and a step-change in its percentage of total retail sales from 26% to 37%.

In addition, individual US consumers already out spend their Chinese and European counterparts as evidenced by average revenue per user (ARPU).

That gap is expected to widen substantially:

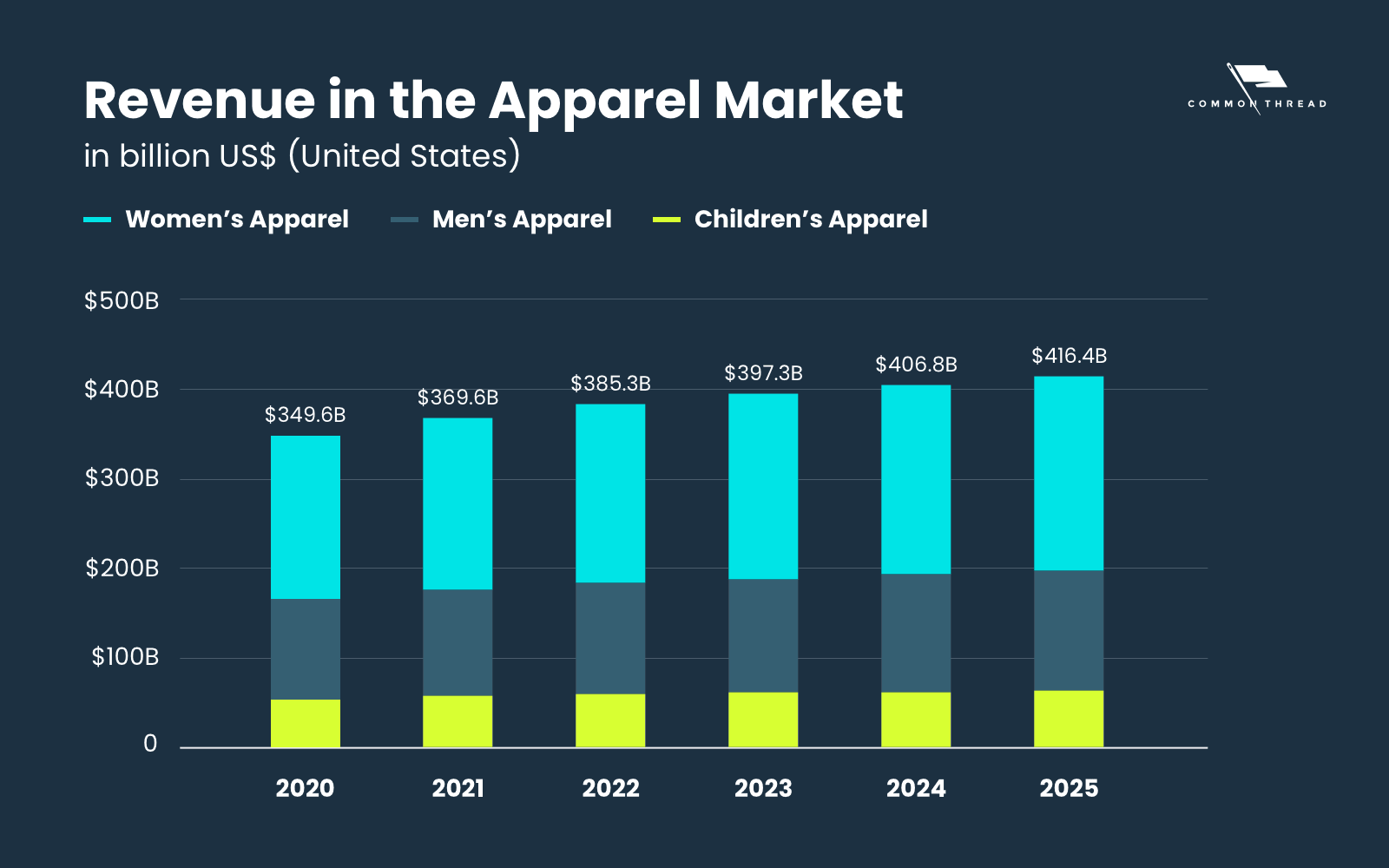

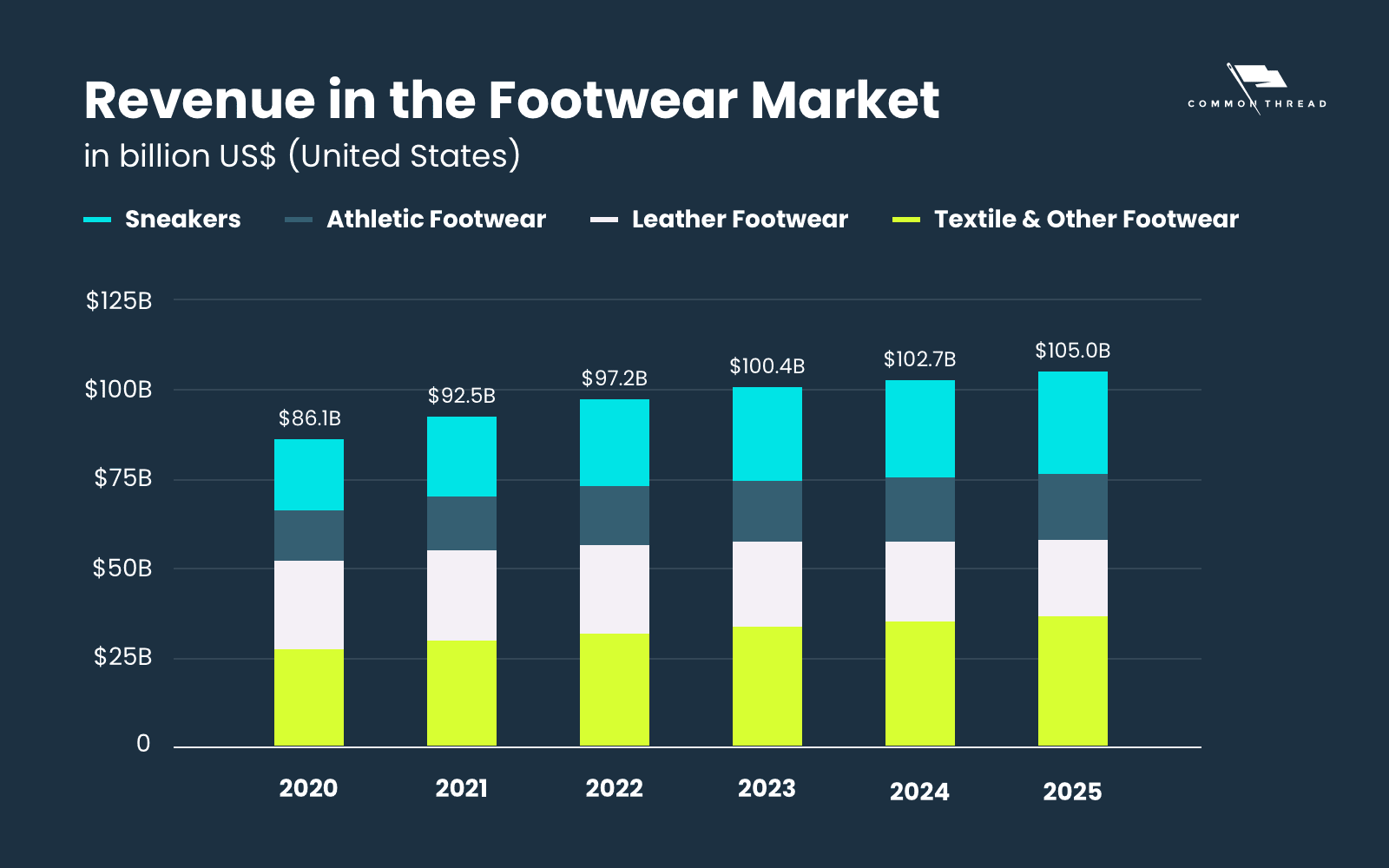

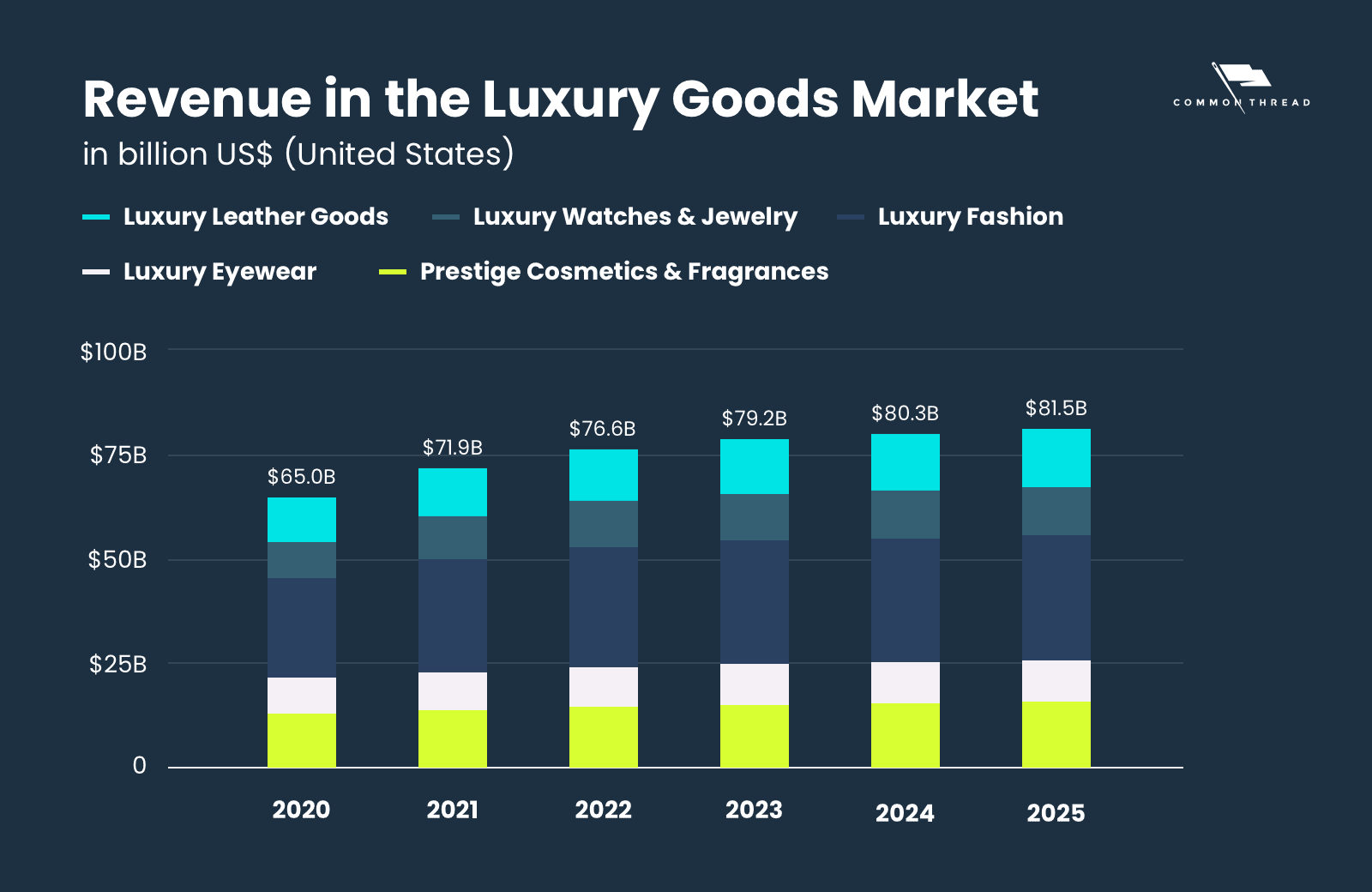

3. Vertical Growth: Apparel, Shoes & Luxury Goods

The good news is that compounded annual growth rates are up and to the right for fashion at large as well as every subcategory.

In other words, no matter what source you turn to, the prognosis is the same: 2023 will be fashion’s biggest year yet.

With projections to benchmark your own growth, one final piece of foundational data must be attended to before looking at examples of these ecommerce trends in action.

Want weekly Fashion data updates delivered to your inbox?

From store CAC to Facebook ROAS, the DTC Index contains charts tracking year-over-year data points from all parts of the funnel.

4. Divides Deepen Between Fast Fashion and Designer Brands

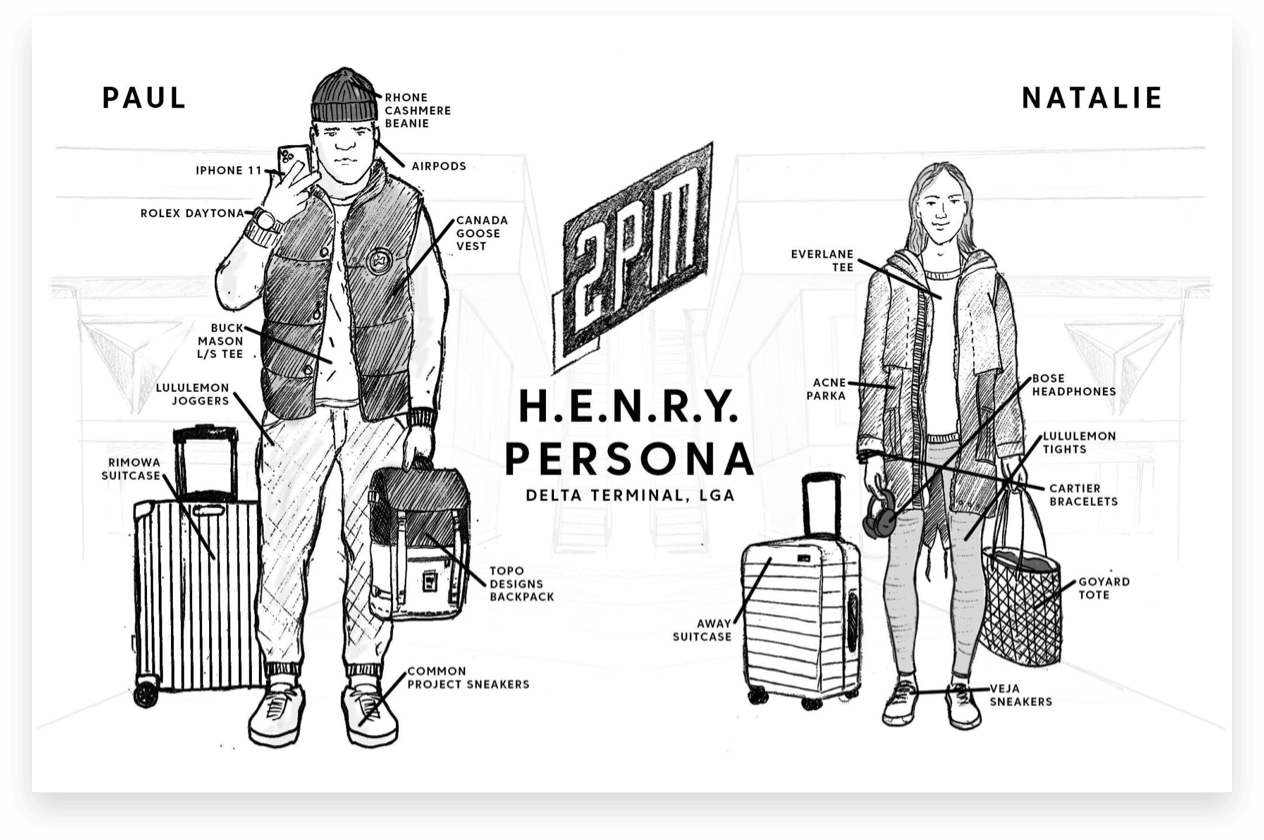

Call it H.E.N.R.Y. (high earners not rich yet) versus C.A.R.L.Y. (can’t afford real life yet), “Generation C” versus “Generation N,” new-luxury versus dollar-shoppers … or simply brands versus commodities.

Regardless of the name, the divide between haves and have nots has never been more stark. Or, rather, between those willing to pay for appearances (H.E.N.R.Y.) and those who don’t have the luxury (C.A.R.L.Y.).

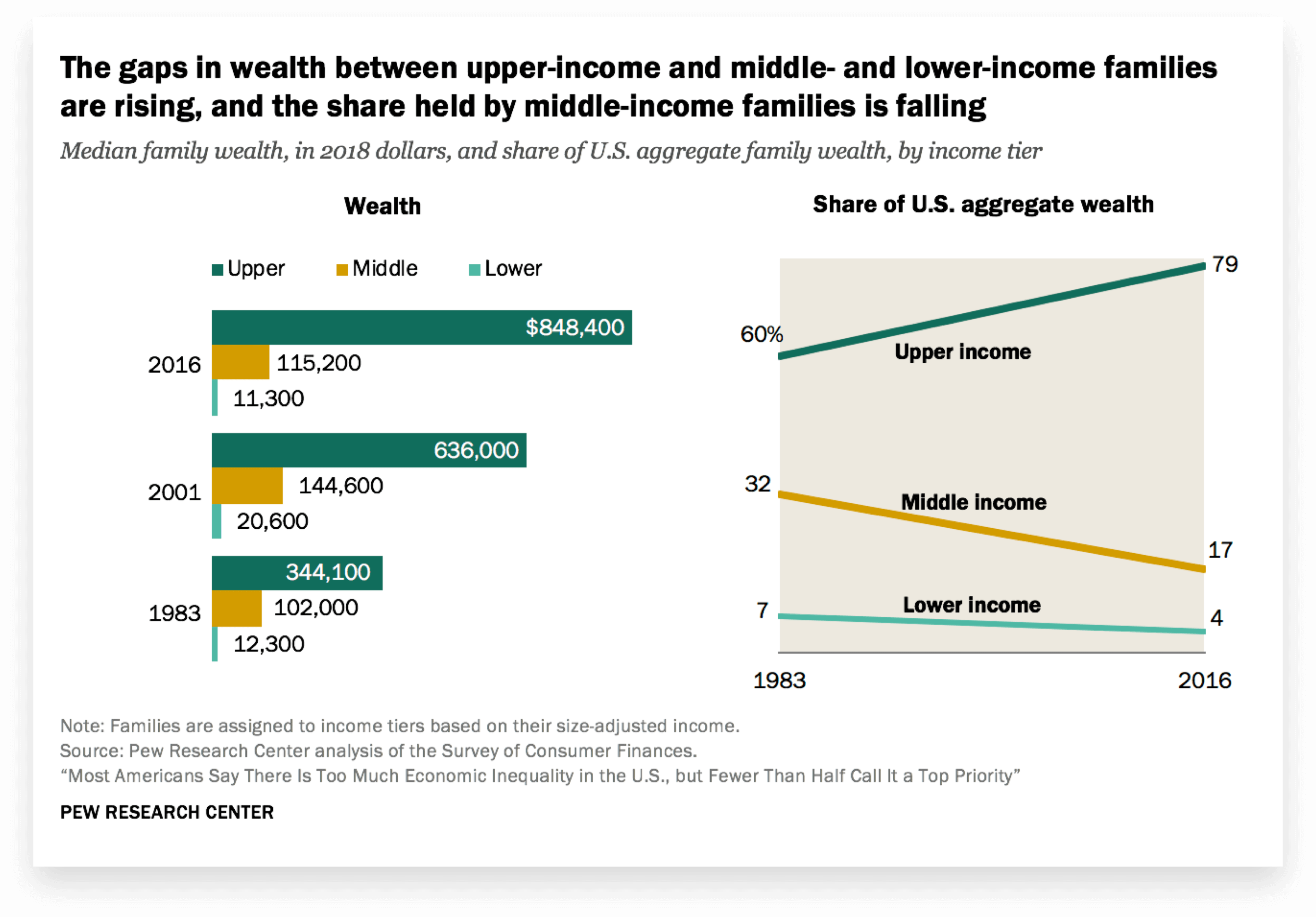

Economic gaps are likewise bifurcating commerce. Recent history is littered with mid-market mishaps — both online and off. In the US, income and wealth gaps have both deepened over the last decades. It’s only gotten wider since the pandemic.

Shopping habits reflect these divides; particularly retail behemoths aimed at cost-conscious consumers as well as their fast-fashion equivalents.

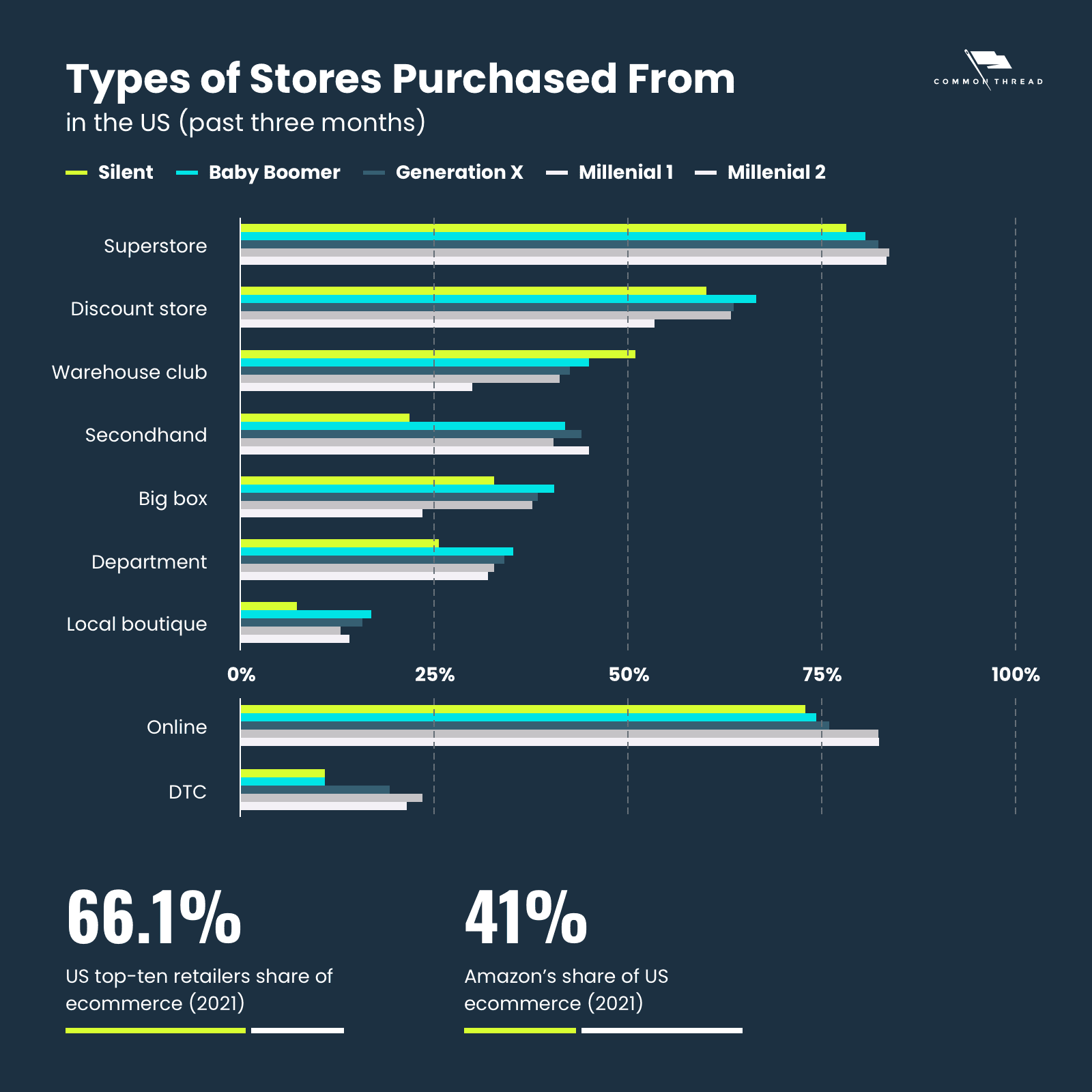

Regardless of the generation, superstores, discount stores, and warehouse clubs have become de facto choices. Department stores and local boutiques, in last place.

The same is true online; most notably, Amazon and enterprise online business’ own the lion share of the market.

No industry bears this mark more clearly than fashion.

And no sub-category should be more alert to its effects than DTC.

As middle-class consumers either disappear, seek experiences (over things), or reach upward beyond their means … brands must likewise make a choice.

Up-market. Down-market. Or languish in-between.

From brand to merchandising, advertising to advocacy, even pricing to loyalty, the implications of this choice affect every other trend.

5. Profitability & Sustainability in Apparel Ecommerce for 2023

Profitable growth comes down to four metrics: visitors, conversion rate, LTV (your cash multiplier), and variable costs.

Without hyperbole, that single equation is the future of ecommerce; fashion or otherwise.

As an agency, it’s fundamentally shifted how we structure client relationships. It’s also come to life in two resources. One, a guide on the ecommerce business strategies derived from the equation.

And two, this tutorial detailing its development and implementation:

As brands move from market share to dollars in their pockets, knowing your variables and taking hold of those with the highest likelihood of impact will define success.

Let’s dive into each part of the equation.

Visitors: Social Media, Influencer Marketing & Search Engines

They’re watching, but you gotta get the right people to look.

Eye-catching. Ostentatious. The audacity!

Fashion comes alive through what can be seen. As an ecommerce business, however, visibility isn’t just about boldness. It’s about catching the right eyes for both short- and long-term growth.

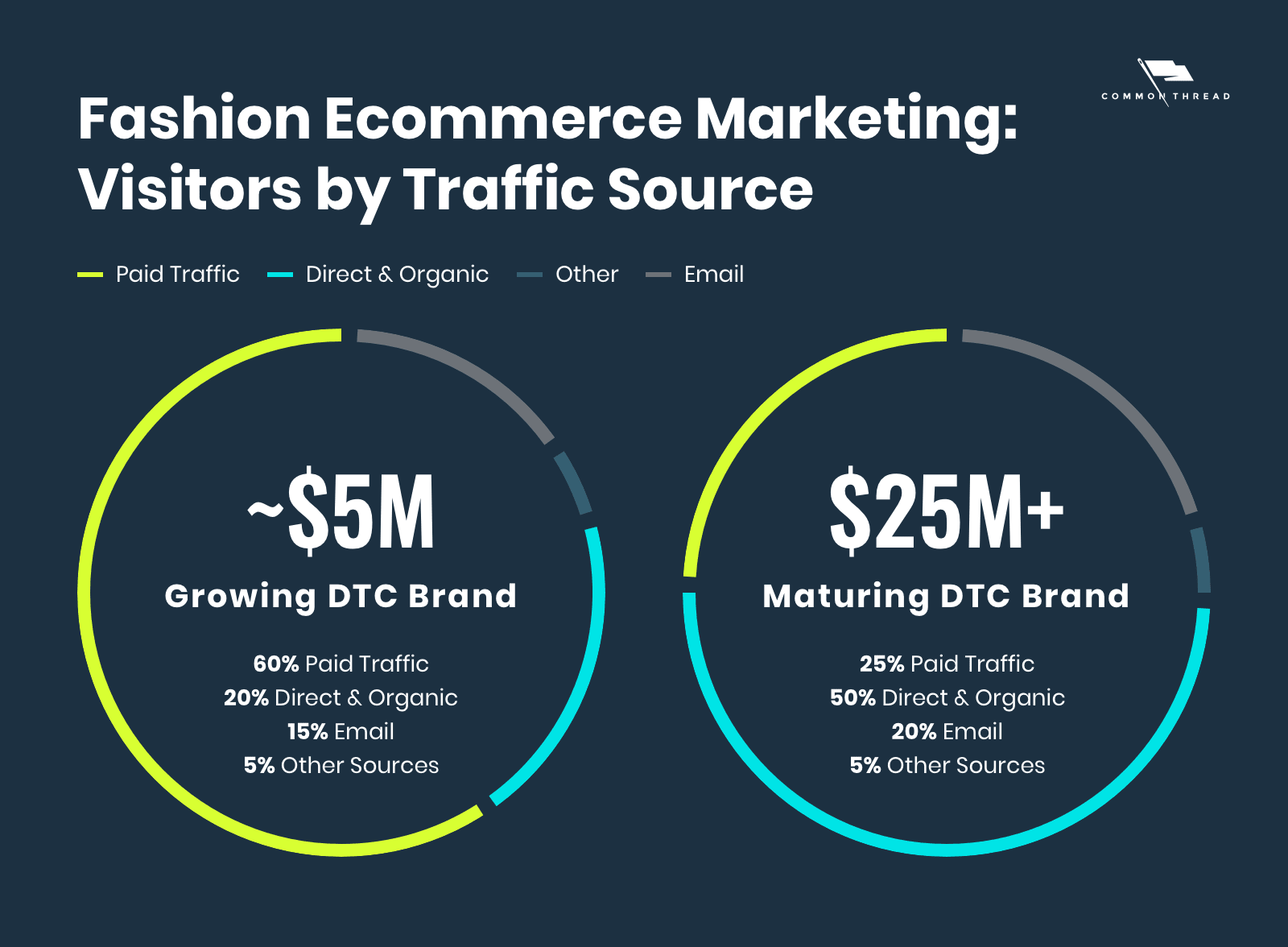

Why that dual focus? Because if you don’t have the right traffic mix, you can forget about scaling.

For early stage brands, scale means investing in paid sources. A channel breakdown would look something like …

- Paid Social and Search: 60%

- Organic & Direct: 20%

- Email: 10%-15%

- Other: 5%

As you mature, your traffic mix should evolve as well.

🚀 Propel Your Brand with Paid Social

When you have an objective to increase traffic to your ecommerce store, paid social media marketing helps you slice through the noise and boost your visibility.

Ecommerce trends show us that there’s a five-step process to connect your business to the customers who crave what you have.

Let’s take a brief look at each step in the Facebook ads campaign workflow.

Step 1: Set Profitable Goals from the Jump

Start by nailing down goals that allow you to acquire customers at scale.

This is done by calculating your ad spend and setting budgets based on profitable cost-per-acquisition (CPA) targets.

Instead of single-account ROAS, hone in on either:

- SKU-specific targets for your hero products

- Group your targets by buyer types for collections

Mott & Bow does this at a prospecting level for gender-specific products as well as gender-neutral collections.

Step 2: Consolidate Your Ad Account

Having too many ads running at one time eats away at your budget and doesn’t give you escape velocity to break out of the “Learning Phase.”

To achieve this, you’ll need to secure at least 50 conversions per week. It’s a structure we call “consolidated ad accounts.” And you should always build it using Campaign Budget Optimization (CBO).

Step 3: Let the Facebook Pixel Do Its Thing

Configured correctly, you can rely on the Facebook Pixel through broad targeting to do what it does best — use artificial intelligence and machine learning to find the right customers.

As long as you’re optimizing for purchase conversions, your pixel will get smarter and you’ll get more out of your ad spend.

Step 4: Retarget Your Audience

After customers interact with your ads or visit your site, Facebook remarketing is rooted in tight exclusions between four audience segments:

- Website visitors

- Page or collection visitors

- Cart or checkout abandoners

- And, recent customers

What matters is relevancy: matching the person’s last interaction to the next ad they receive.

When that happens, it’s magic. Even better, it drives down costs dramatically.

Okay. I get retargeted ads. But @BornPrimitive is taking it to the next level serving me an ad showing my sport of choice. Think they have one for biking/lifting/running/etc and show the right sport for the viewer? 🤔 pic.twitter.com/LeDKrqECax

— Val Geisler 🖤🏳️🌈💌 (@lovevalgeisler) February 13, 2021

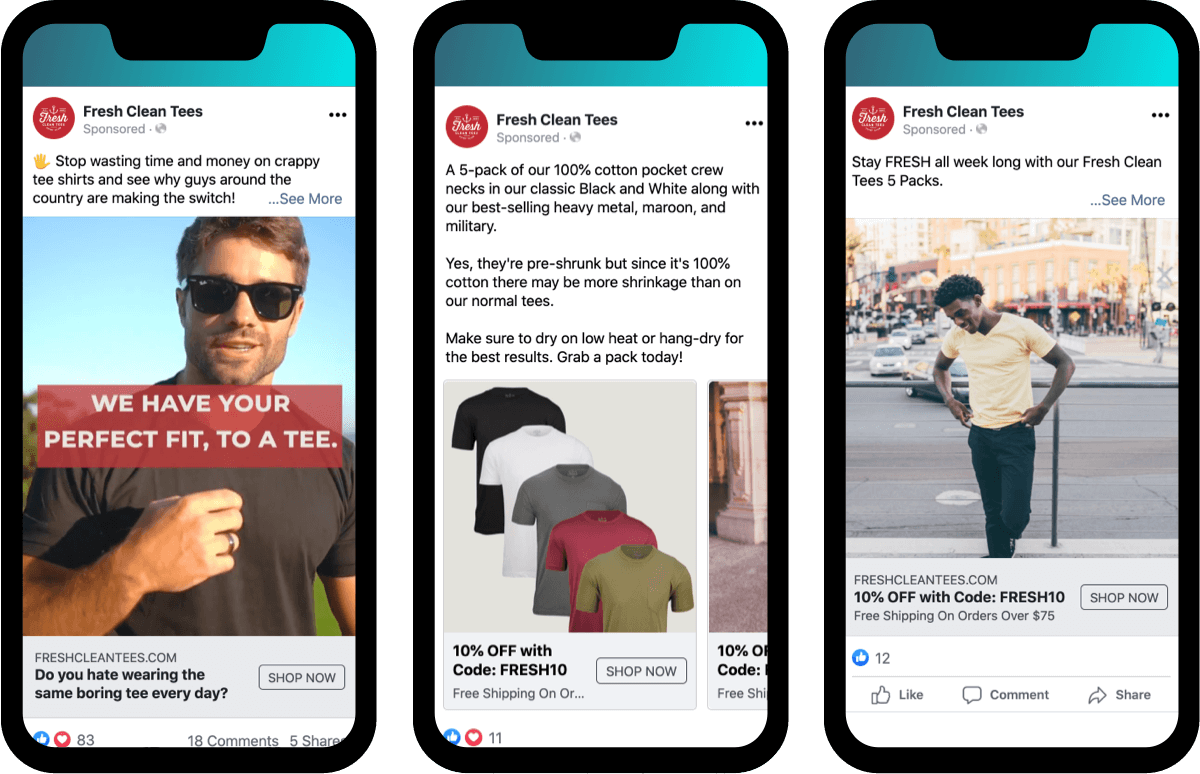

Step 5: Connect with Impactful Creative

The Pixel, and its amazing AI capabilities, may be extremely intuitive but it can’t replace human ingenuity. Where the Pixel lacks emotions and feelings, your business can supplement with hard-hitting creative.

Your ad creative should target customer pain points, highlight reviews, and develop a sense of community to make a meaningful connection with your audience.

👑 Leverage Influencer Marketing Alongside & Within Paid Social

Fashion is all about the now. Your customers are out there on social media searching for the latest trends.

- How are they finding what they’re looking for?

- Where are they getting the ideas to buy?

- Who are the gatekeepers in the fashion industry?

That power lies within the micro and macro fashion influencer communities.

Fashion influencers have spent months, years, and in some cases decades building their online presence and earning the trust of their audiences.

And your customers are hiding within these communities.

How can you reach those customers and direct them to your ecommerce store? By building genuine relationships with influencers who align with your brand and have them create highly targeted content. This content can then be used for paid and organic campaigns.

DIFF Eyewear had their influencer marketing strategy in a chokehold but, somehow, there was still a disconnect.

It was spending a ton of coin on quality, pay-per-post style ads and using the power of Instagram’s biggest names to drive sales. But the sales weren’t coming and the decline of organic traffic on Instagram and Facebook made this strategy even more difficult to maintain.

Instead of focusing on high-quality static posts DIFF shifted into more relatable ads that were native for mobile. It also gathered user-generated content from A-listers, like the Kardashians, and ran ads through their personal pages.

This creative was used to retarget visitors and customers by interests.

Coupling this with a social mission to donate a pair of reading glasses to those in need resulted in exponential growth: 200k Facebook purchases kinda growth.

We collaborated to flip their old ecommerce marketing strategy on its head.

That’s the power of influencer marketing and it isn’t limited to big names.

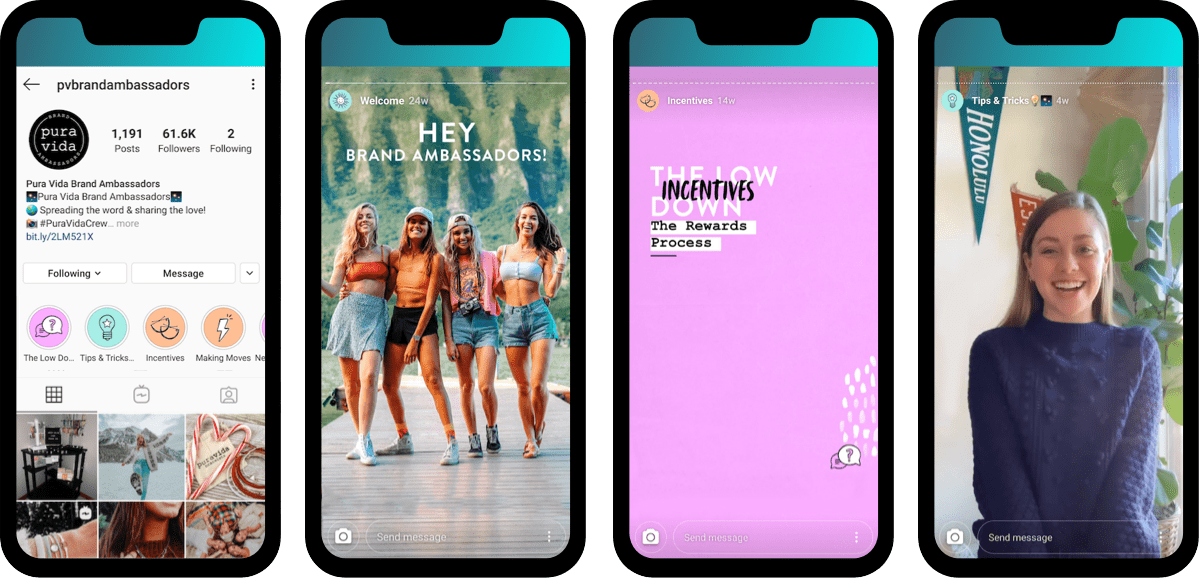

Pura Vida Bracelets, an ecommerce jewelry brand, mastered the micro-influencer game by outsourcing content to its community.

Through a private Instagram account, its referral program members get access to a specialized training program that teaches them how to create organic content for Pura Vida. In turn, the brand uses that content with zero dollars in ad spend required.

That’s what real influence looks like.

🔥 Hype, Hype, Hype with Product Drops & Hauls

Driving visitors through product drops and hauls is an elite method for putting your brand in front of new customers.

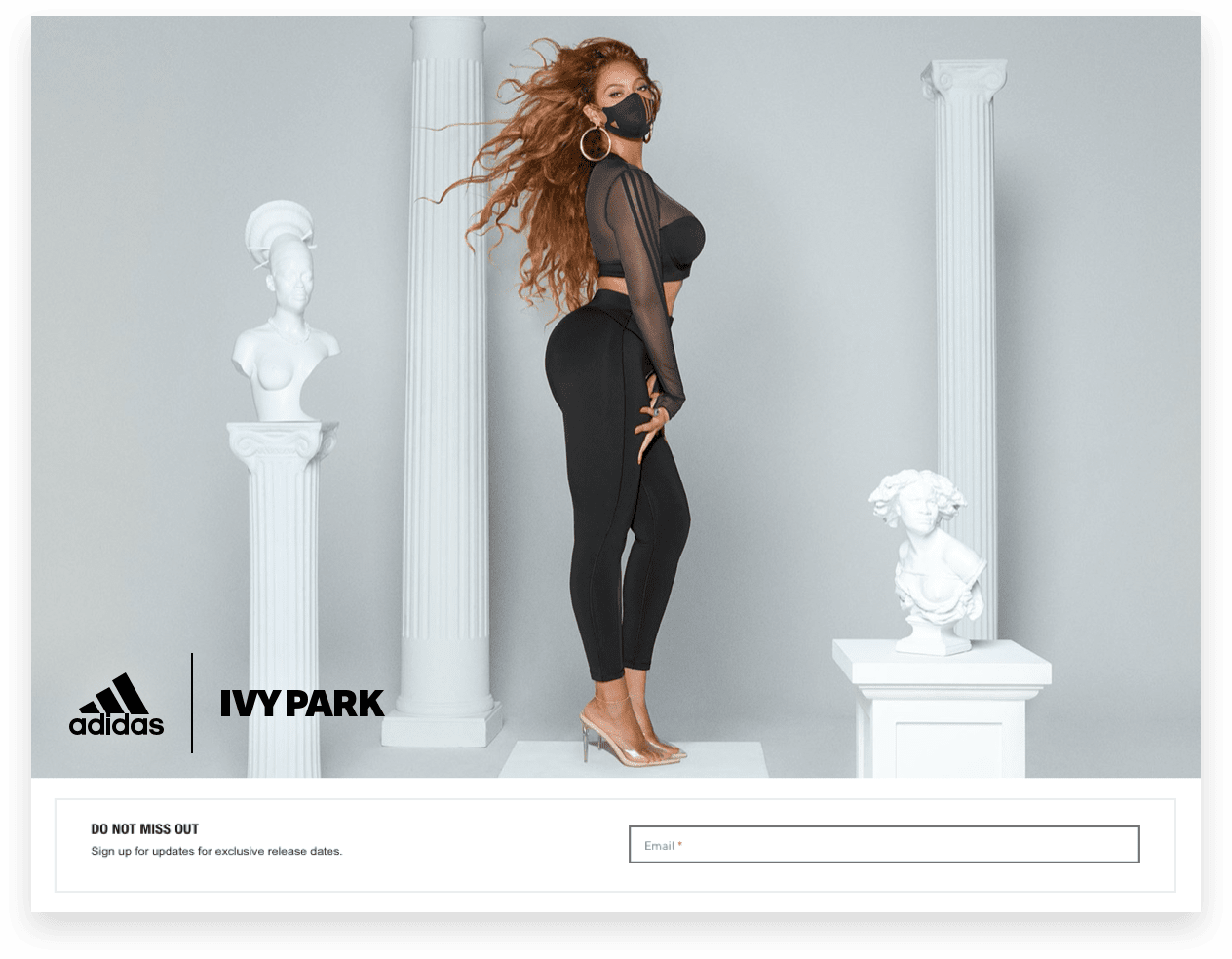

As with everything she does, Queen Bey — and her flawless Ivy Park collaboration with Adidas — are the archetype. Ivy Park heavily uses the power of influencers to increase visibility through highly targeted product drops.

Traffic is directed from social media to the Adidas website where new and returning customers can sign up to be notified when the collection actually becomes available.

Because the Ivy Park brand is built on a strong fan/customer base, it’s able to bypass ad spend. Hype is created within the “Hive” community, or the communities of the featured influencers like Gucci Mane, and the product sells out within minutes.

The entire Ivy Park homepage acts as a digital billboard because you don’t actually purchase from the site. Instead, you must rush to the Adidas website to make a purchase before everything sells out.

Another strategy involves appealing to your potential customers through product haul videos. This is where influencers try on fashion products and show them to their community. It’s engaging and it allows you to gain valuable content that can be used in paid social and organic search.

Mega Influencers like Patricia Bright garnered over 850k+ views on her Ivy Park haul by hyping her favorite pieces and combinations.

It should be noted that Ivy Park’s ability to leverage and navigate this strategy comes from years of brand building.

For smaller DTC brands it’s important that you build an intimate relationship with your community and get to know them through extensive research before diving headfirst into this type of campaign development.

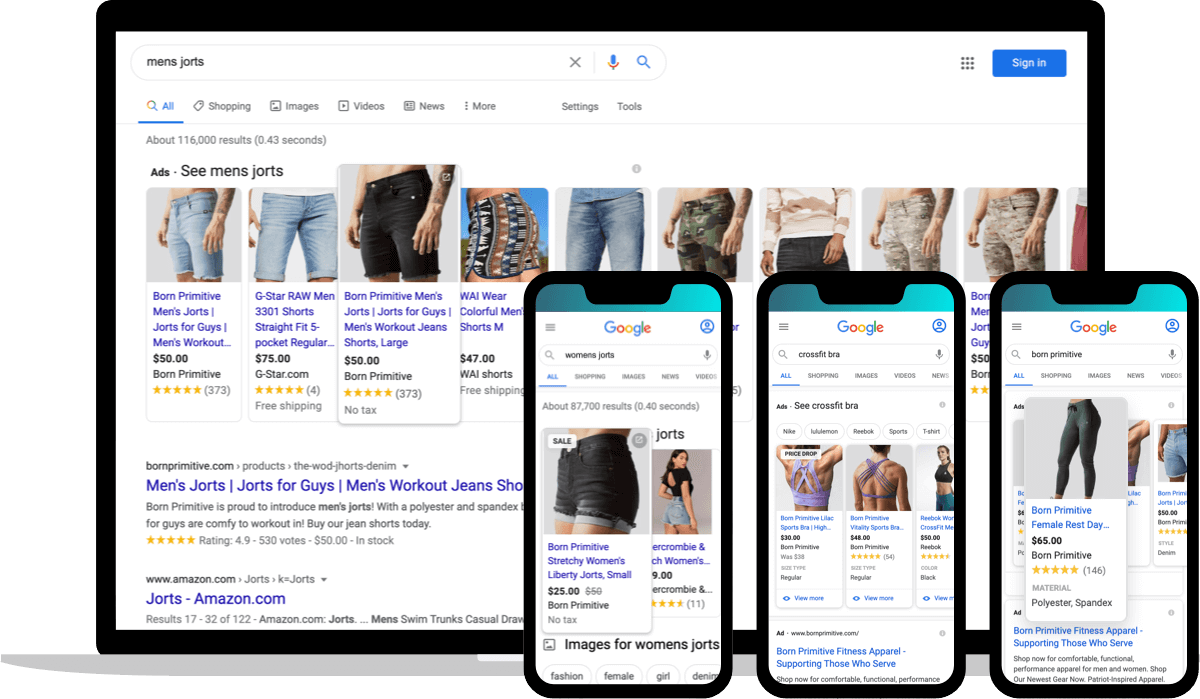

👀 Capture Demand with Paid & Organic Search Marketing

As you expose more people to your brand on social media, the likelihood of them looking for you in other places increases exponentially. It’s an omni-channel strategy Google has named the “messy middle”; we prefer the phase “brand lasso.”

Rather than pit the two platforms against each other in the ultimate Verzuz battle — Google ads vs Facebook ads — you win by uniting them.

At minimum, you need to capture this direct, brand-focused demand through search engine marketing (SEM) and search engine optimization (SEO).

Search Engine Marketing vs. Search Engine Optimization

The difference between SEM and SEO involves time and money. SEM helps your brand rank through Google Shopping ads. This can be ideal for larger DTC brands who have available ad spend.

Two-thirds of PPC clicks on Google go to product listing ads (PLAs), also known as Google Shopping Ads.

The downside is that SEM is short-term and requires a constant flow of cash to keep your ecommerce store’s ranking. This isn’t ideal for growing DTC brands.

We combat this issue with search engine optimization (SEO) and content marketing to rank organically for these types of searches. User-generated content created through influencer marketing supports organic ranking.

As rules of thumb, your SEM and SEO strategy should include:

- Owning branded searches

- Majoring on Google Shopping

- Testing Google Ads around your Facebook targeting

- Creating content that will rank for product-focused searches

- And then extending into YouTube and Display Network retargeting

Investments here not only catch the demand generated by your own campaigns, but also the demand created by your competitors.

Conversion Rate: Optimize Your Fashion Funnels

Spending ain’t easy. But it should be for your customers.

Visitors alone won’t increase your profits unless you’re (a) driving the right type of traffic and (b) maximizing your traffic through optimized conversion methods.

When visitors arrive on your website, you have only a few seconds to

- Convince them to stick around

- Collect important data

- Make a sale

So, what are the best ways to convert traffic?

📊 Build Funnels Around the Almighty Offer

Every offer combines three things: (1) product, what you sell; (2) price, how much you sell it for; and (3) positioning, who you sell it to through your creative.

This is usually where your prospects will experience your brand first, so it has to be carefully crafted. Does it …

- Include a discount or incentive?

- Feature a single item offer or a bundle?

- Grab the attention of your audience and lead to action?

These questions help you push the limits, discover what your prospects are truly after, and how you can use that data to continually improve.

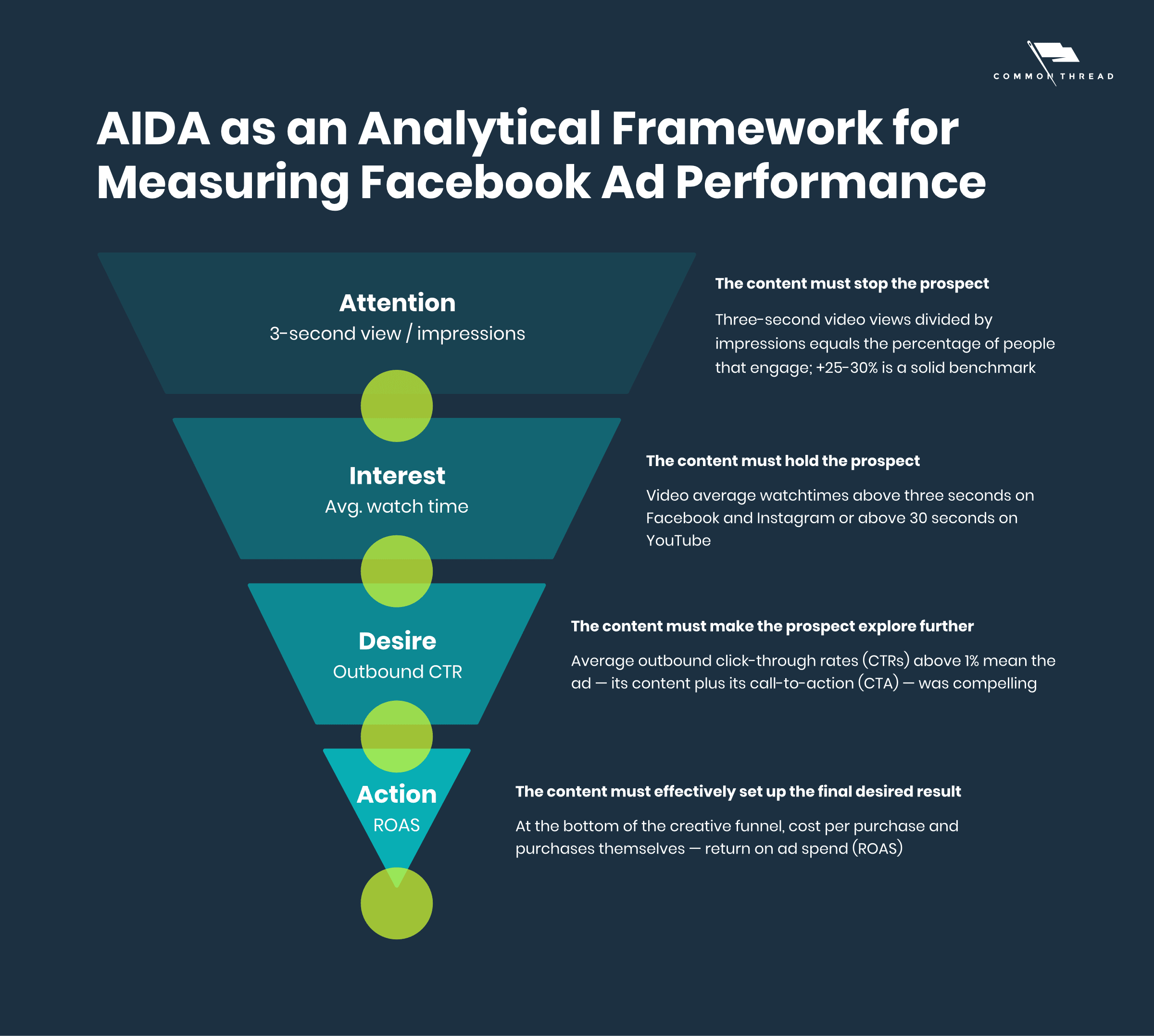

We heavily rely on the AIDA model for guidance on building or readjusting our funnels, especially at the top.

The top of the funnel, effective ad campaigns should be based on an offer that, at minimum, yields:

- Above average profit margins

- Relatively high average order value (AOV)

- Strong lifetime value that leads into additional products

From there, you can experiment with different ways to present this offer to attract attention from your target audience. Options include bundling top products or throwing in a limited-time discount.

But don’t forget to keep that same energy for the ad creative, too!

You don’t just want your audience’s attention. You want 3-30 seconds of their undivided attention.

At this point, the offer has been dressed up and is dripping in so much sauce that your audience should be itching to get to your website to make a purchase.

And that’s how you get a flawless return on ad spend (ROAS).

🤑 Digital Fashion Merchandising: Product Descriptions & Product Recommendations

A confused customer isn’t a paying customer. In fact, a confused customer isn’t a customer at all.

Ecommerce doesn’t come complete with a virtual salesperson and most online shoppers don’t like hunting for answers to their questions.

Do them a favor and have the answers available to them right on the product page.

This is achieved through detailed and creative product descriptions.

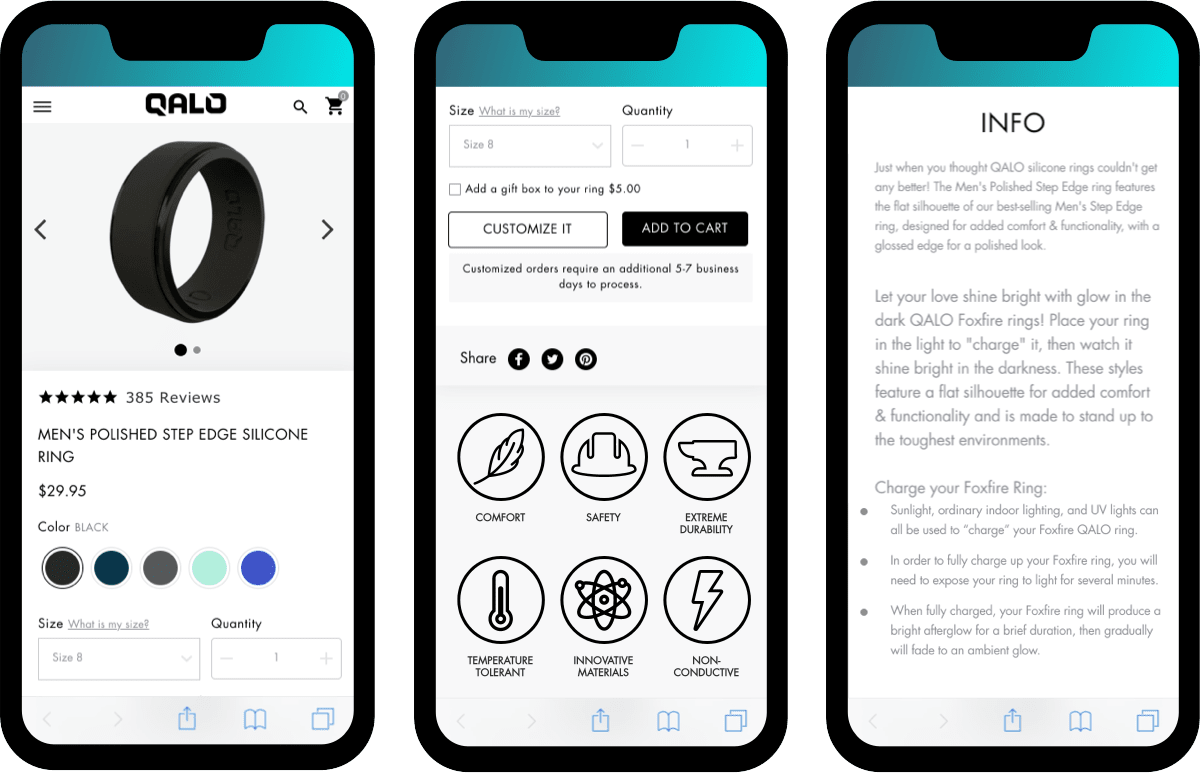

For example, QALO’s product pages follow a three-part pattern:

At the top, immediate information about the product to include color, size, and clear pictures. Below that, FAQs organized by icons. At the bottom, detailed product information through creative copy.

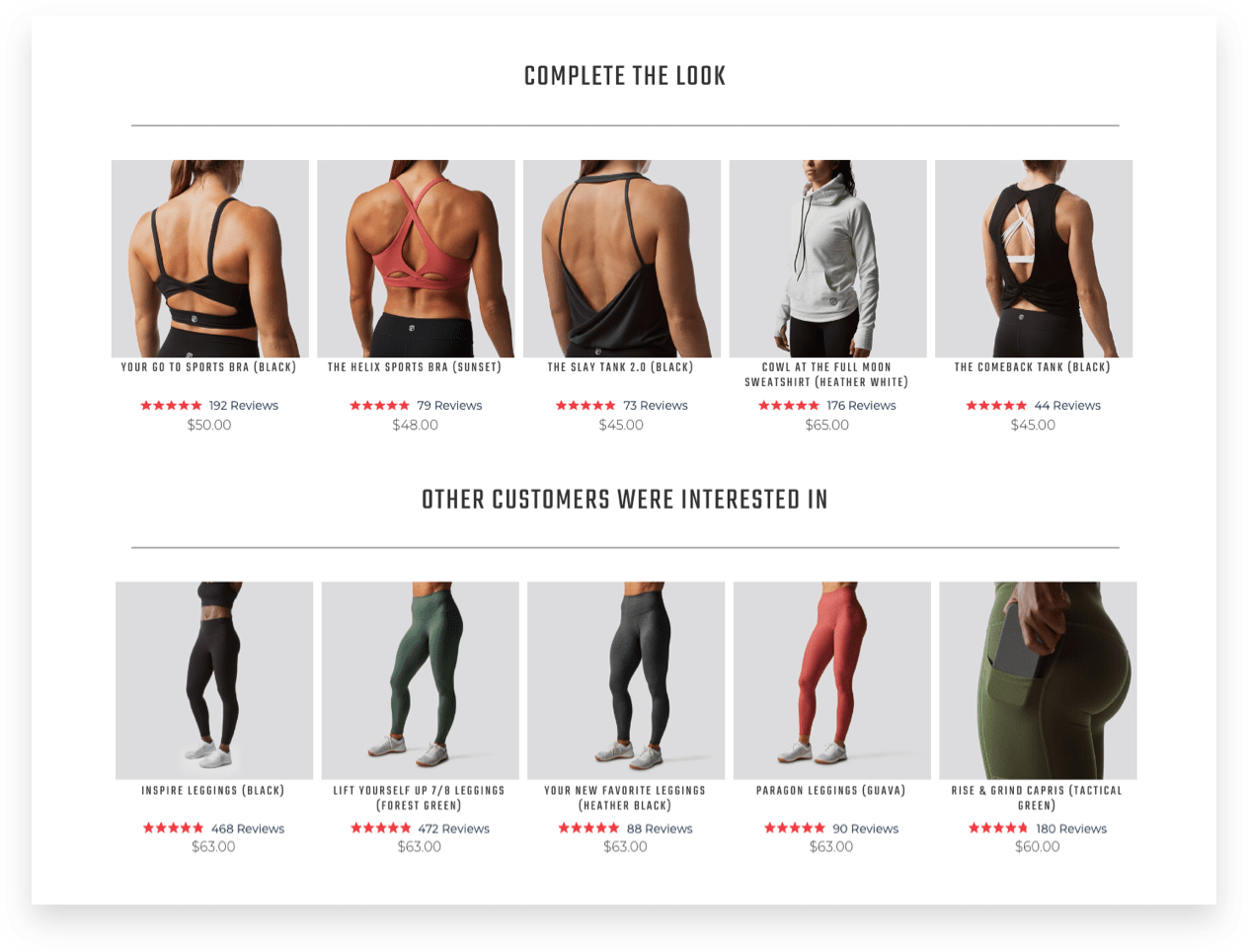

Additionally, product recommendations help you personalize your customer’s shopping experience while increasing your overall AOV.

Below are product recommendations for Your Go To Leggings 2.0 from Born Primitive. They include a “Complete The Look” section and an “Other Customers Were Interested In” section to show recommendations that closely match the current product.

This makes it easier for your customers to see more of what they like and less of what they don’t.

🛒 Improve Site Browsing, Discovery & Checkout Experiences

Adjusting your ecommerce store’s browsing, discovery, checkout experience is just as crucial as a brick and mortar store’s layout.

Do you remember walking into a Hollister store? It was a complete vibe!

That’s what you’re looking to accomplish with your ecommerce store.

Total vibes.

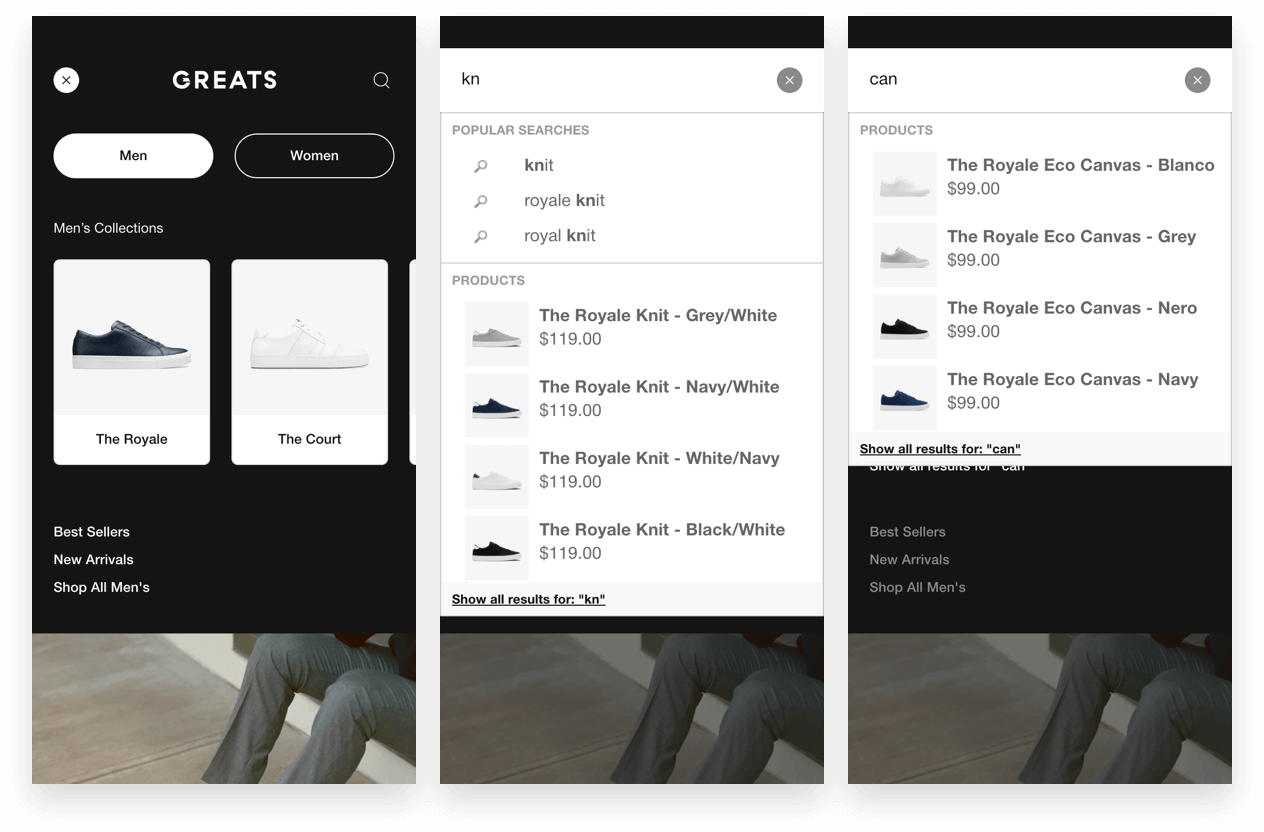

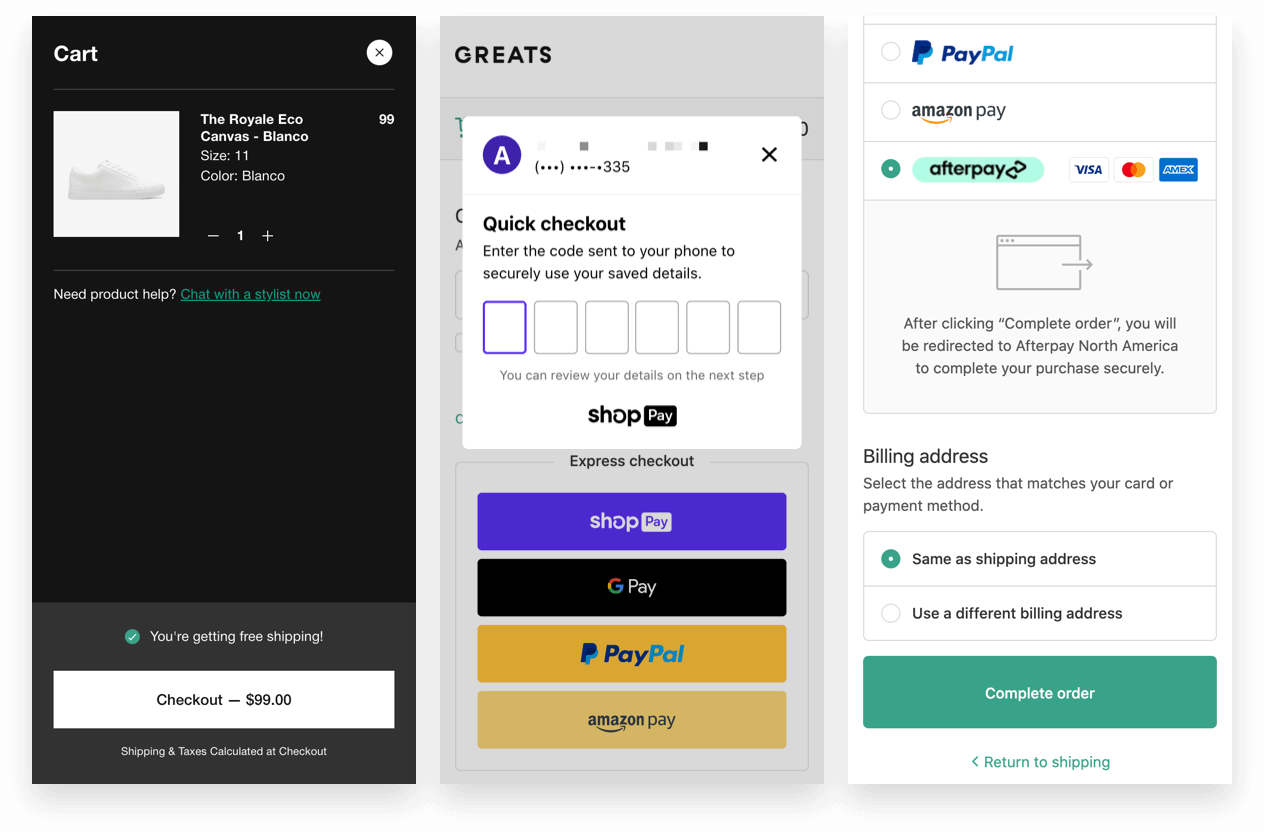

GREATS, for instance, guides customers with its onsite search tool. The tool opens with a demographic filter based on gender. Then, dynamically suggests products as the customer types their search:

It also improves the checkout experience with a fantastic cart-to-checkout flow that:

- Notifies customers when they hit the free-shipping threshold

- Opens with express payment options designed for mobile

- And ends with a dropdown option to buy-now, pay-later

Lifetime Value: Retention, Email Marketing & SMS

Don’t die … waiting a “lifetime” for LTV.

What is your customer worth to you over a lifetime?

How long is a lifetime?

Whose lifetime are we referring to?

Okay, don’t jump head first down the “lifetime” rabbit hole because it gets real dark down there.

Ultimately, we’ve come to the conclusion that we will all die before a fashion ecommerce store realizes their “lifetime” value. What’s the alternative?

We like predictability when it comes to cash. Income generated within a fixed payback period are the rabbit holes that we’ll gladly jump down. We typically use a 30, 60, or 90-day LTV window for our clients. We call this the “Cash Multiplier.”

Find Your Cash Multiplier

Our allstar is the “Cash Multiplier.” This is a brand-specific window built around customer behavior and cash flow.

For many of our clients, a 30-day window captures the bulk of ad-driven sales. Then, a 60-to-90 day period captures returning customers.

For example, if a new customer spends — on average — $25 within 60 days, then our Cash Multiplier is $25 and fills the LTV slot in our growth equation.

For other clients, the nurturing window tends to be quite a bit longer, and we use a 90-day window. We can’t tell you for sure what the right window is for you, but you should already have a reasonable idea based on your own customer behavior.

What we can do is give you a method for measuring your ecommerce customer retention over the short-term. This gives you readily available data on how profitable your business is and how much value your customer experience is actually creating.

To do this, we use the rule of 30:100. Within 60 days, you should have at least a 30% increase in LTV. This shows that your product is in demand and profitable.

Within a year, your LTV should increase by 100% to show that you’ve successfully created value and those same customers are willing to pay more for your product over time.

Leverage Email Marketing

But email is dead. Don’t believe the hype. Email is very much alive and still kicking major ass.

Think about how many times you’ve checked your email in the past hour. Your customers are doing the same and you should be using this to your advantage.

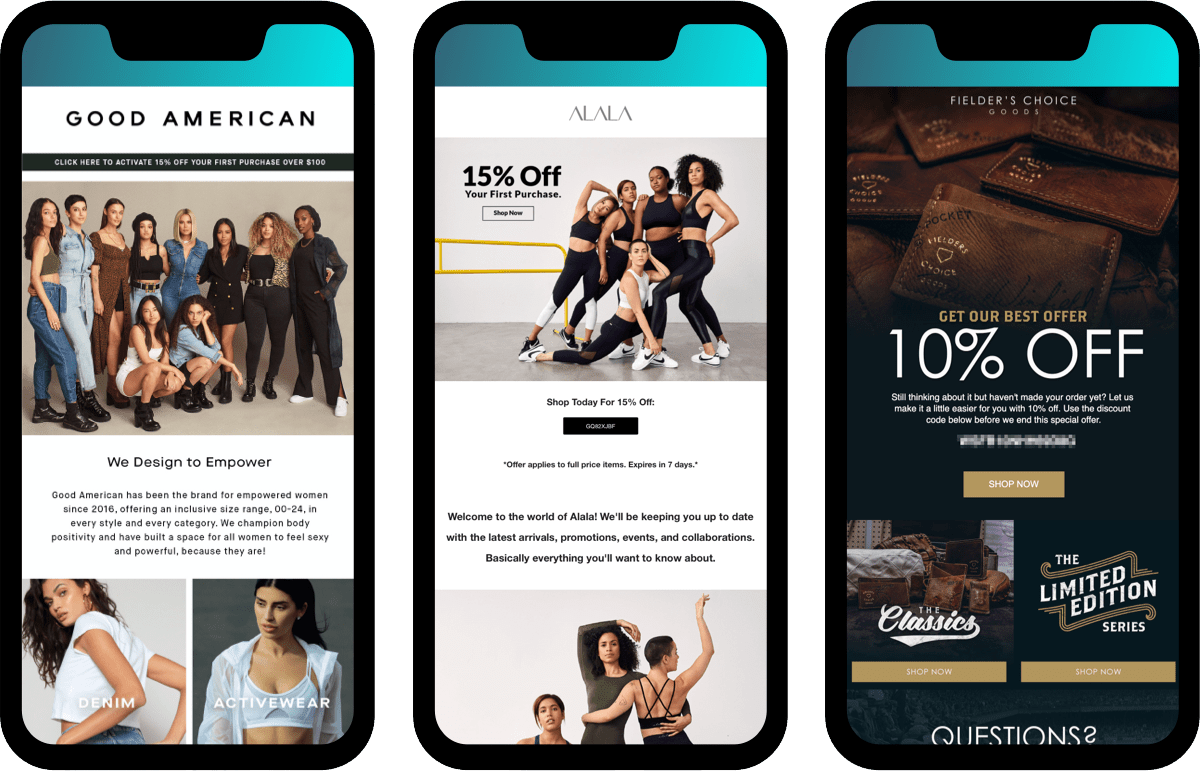

Your welcome emails will be the most valuable automations in terms of the overall revenue generated. Typically, second only to a cart abandonment series.

Open your welcome flow with a simple “Thank You” email, introducing them to your brand story. Make good on any sign-up incentives promised in your pop-up. Capture rates and revenue generated from welcome series emails are significantly higher when an incentive is present.

For apparel retailers, a three-to-four email welcome series is typically the sweet spot for maximum conversions and engagement, but keep an eye on your open and click rates throughout.

Whether delivering immediate value, or delivering the promise of additional value moving forward, the right email at the right time can get your recently-converted customers even more engaged and loyal to your brand.

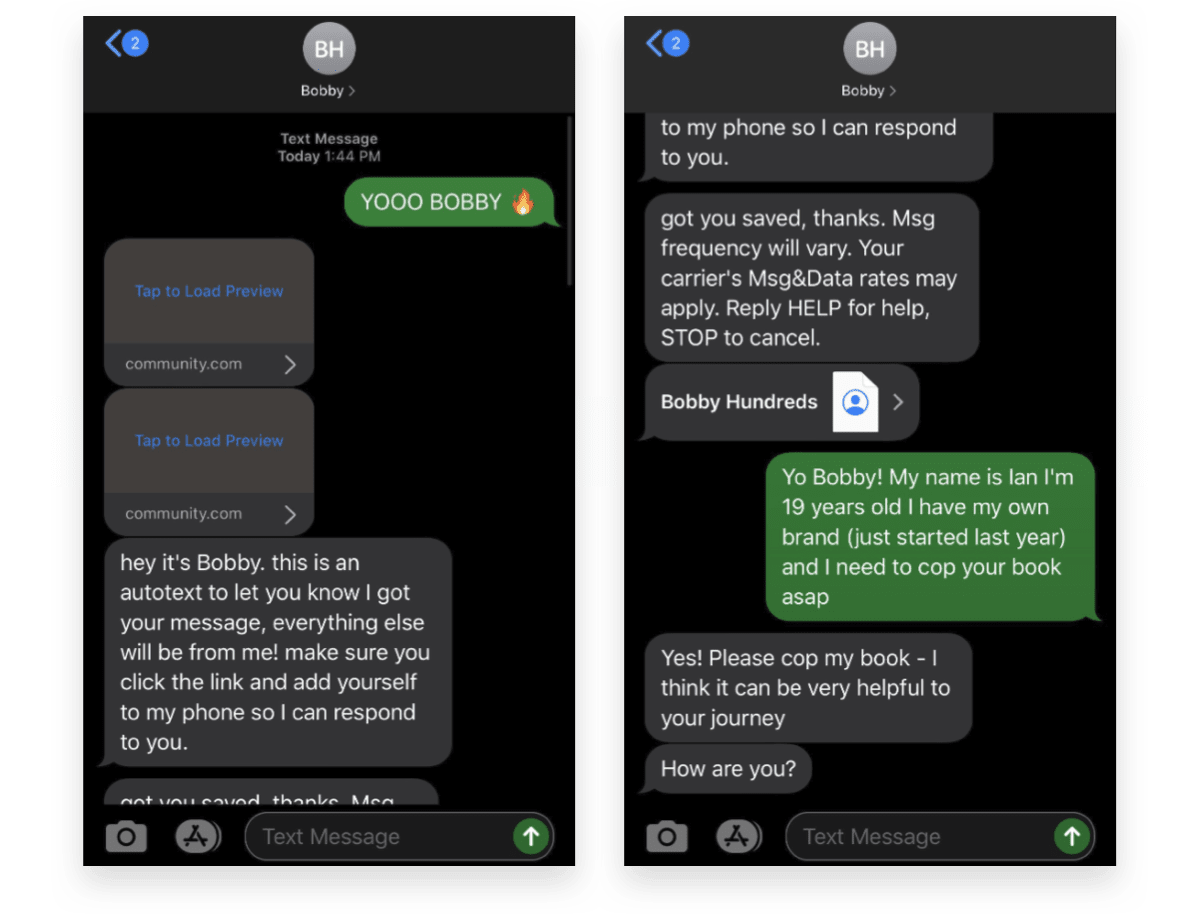

Engage in SMS Marketing

Nothing’s more personal than a text message. Which is exactly what makes SMS marketing so powerful … and precarious.

- Don’t spam

- Don’t bombard

- And get super specific with segments

Begin with letting new customers sign up for SMS transactional messages, like shipping updates. During that process, get explicit consent to also market through SMS. But only begin marketing after you’ve proven the value of your texts.

This is an especially effective way to keep in touch with your customers in between purchase cycles — and to re-engage them after long periods of radio silence.

Bobby Kim, co-founder of The Hundreds, actually has a text line set up that allows him to engage directly with individual audience members:

Variable Costs: Shipping & Optimizing Returns In Fashion Retail

“More money, more variable costs.” Or whatever Diddy said.

Variable costs are costs that go up as your order volume increases. They’re unavoidable and come with the ecommerce territory.

- Cost of goods sold

- Shipping costs

- Payment processing fees

- Fulfillment fees

- Returns

How do you decrease costs without allowing the quality of your processes and products to suffer?

Negotiate Better Deals

Your suppliers, tech providers, and vendors want to keep your business. It never hurts to reach out to negotiate a better deal.

In other words, shoot your shot and you’ll be surprised at how much money you can save just by simply asking.

That’s right, go ahead and negotiate lower shipping costs, processing fees, fulfillment rates, and other discounts. What’s the worst that can happen?

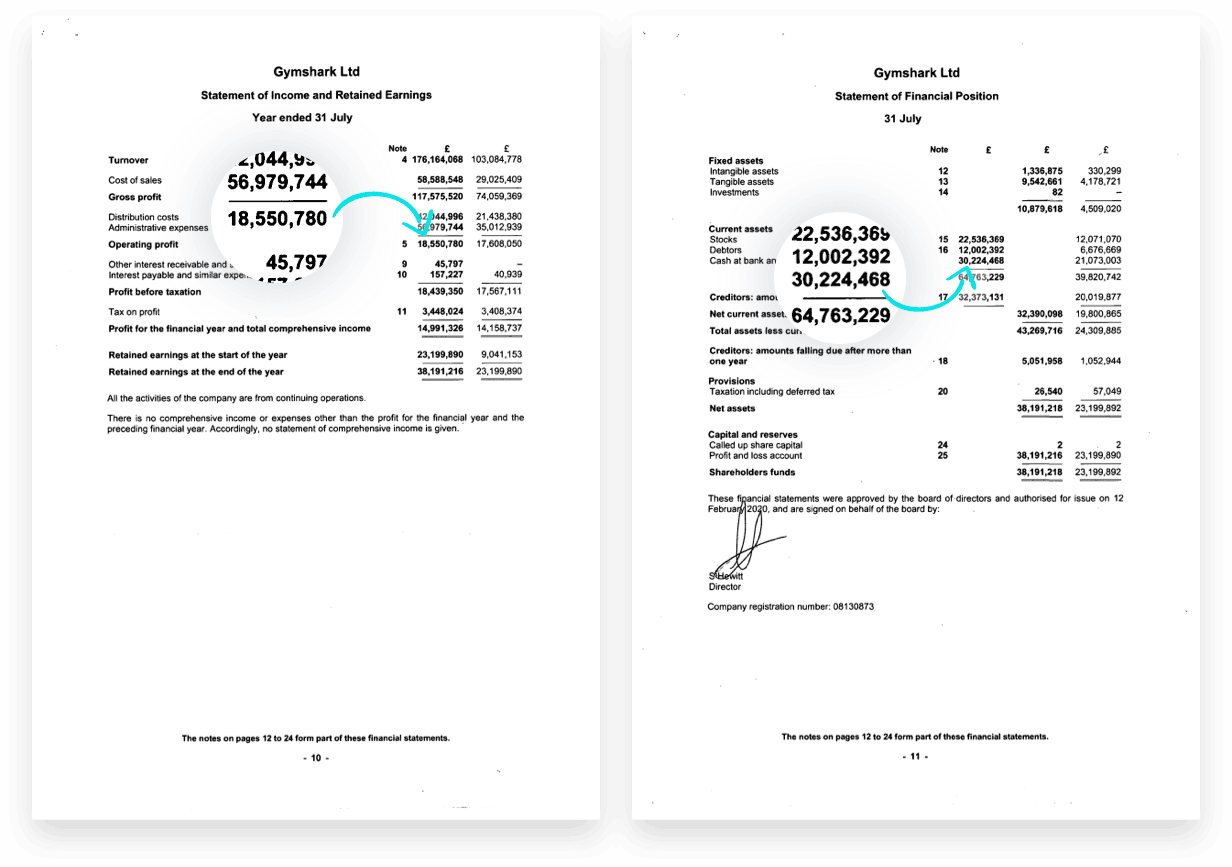

For example, Gymshark demonstrated how proper negotiations can help your business grow without the need for extra capital. It effectively negotiated longer payment terms with their suppliers creating a negative cash conversion cycle.

In English, that means it used vendor money to finance operations.

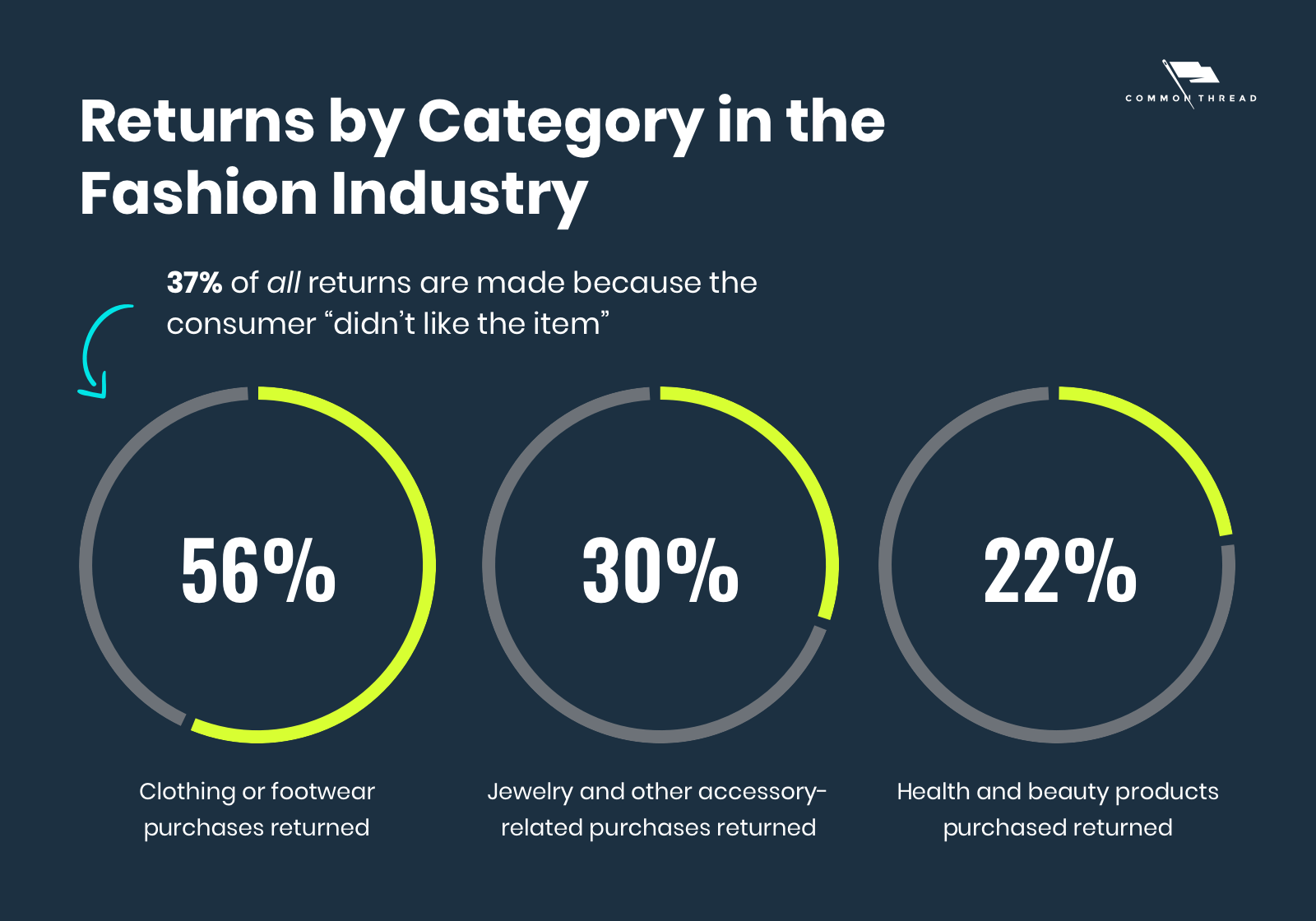

Optimized Returns

While returns and exchanges pose a problem in most ecommerce industries, they hit fashion the hardest. According to Global Web Index, consumers return:

- 56% of clothing and footwear

- 30% of jewelry and accessories

- 22% of health and beauty products

But wait, there’s more. The report shows 37% of all returns are made because the consumer “didn’t like the item.”

This poses a major problem for ecommerce companies whose products need to be seen, felt, and worn.

What if you embraced returns, knowing that each exchange means another opportunity to provide value?

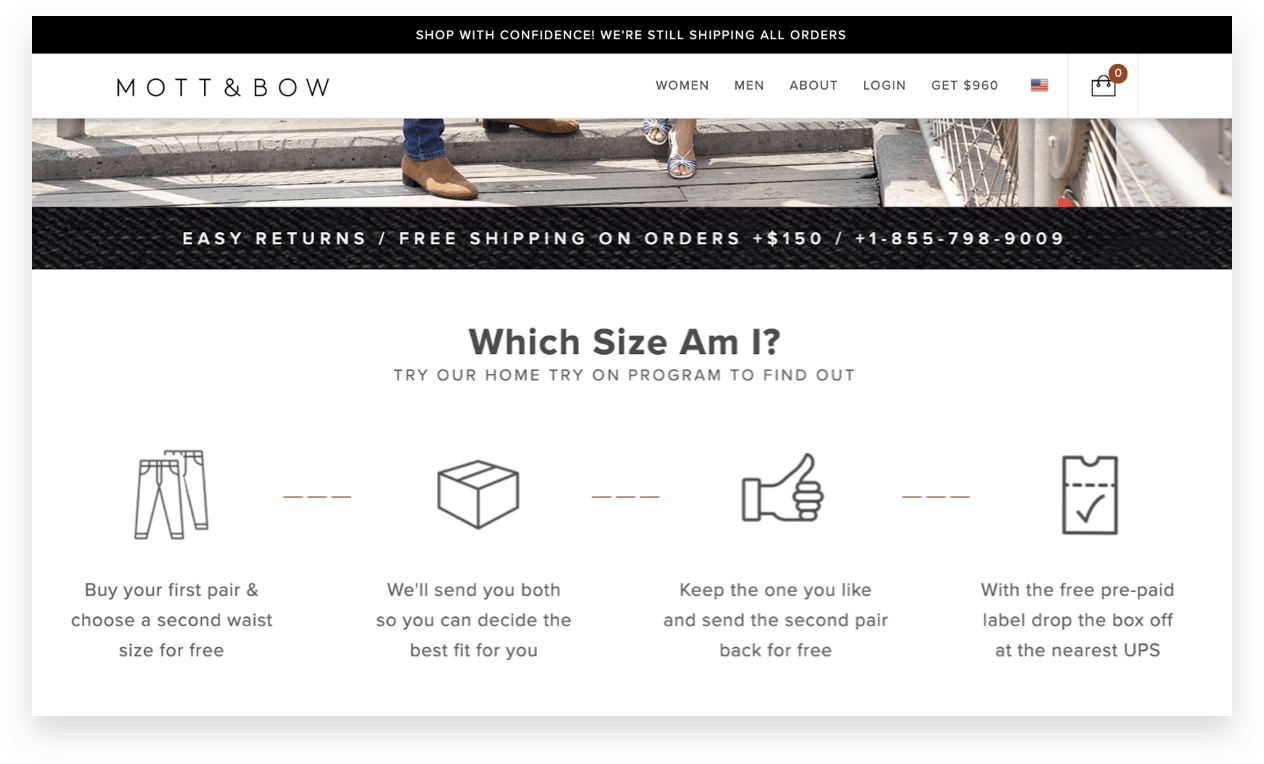

Mott & Bow, for example, sends customers items in multiple sizes upfront to ensure the customer gets the right fit.

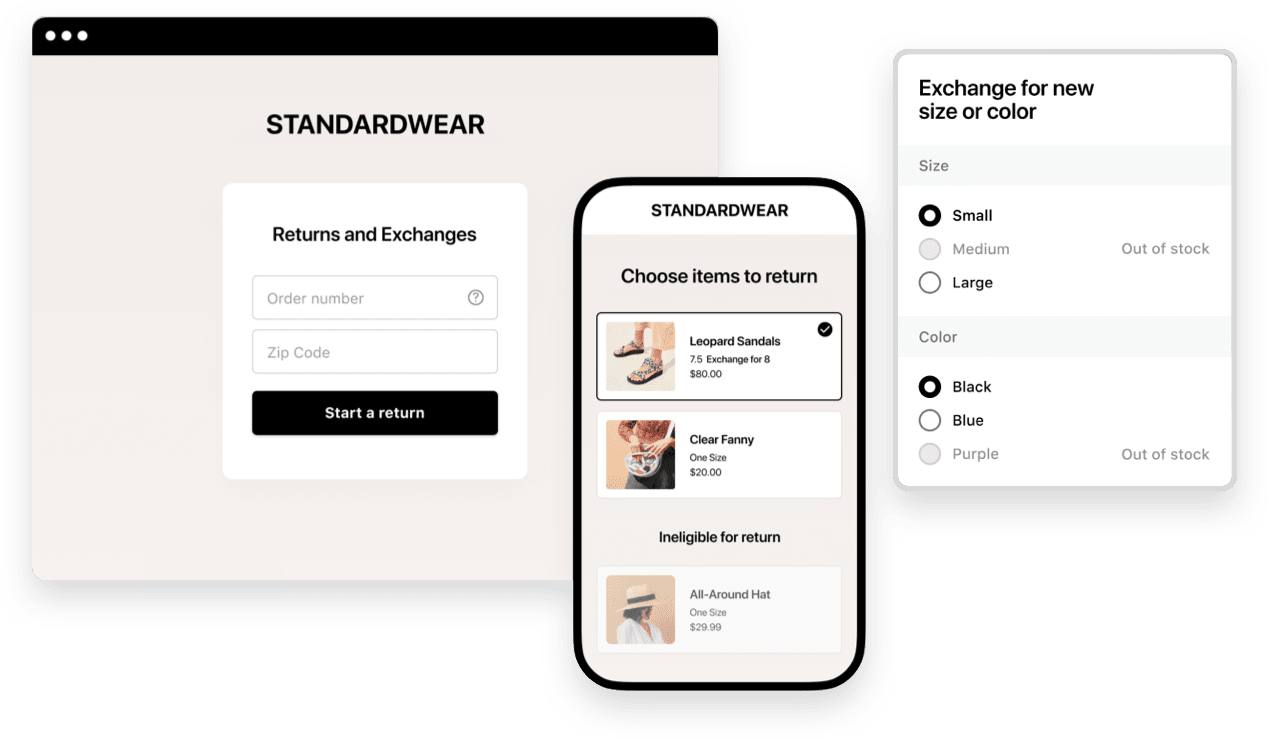

Instead of seeing returns and exchanges as a “necessary evil” within the fashion industry, Loop helps automate the return and exchange process to deliver even more value to your customers.

By creating a separate and simple return portal, your customers can initiate the process with just an order number and their zip code.

When something goes wrong with an order, the last thing your customer wants to deal with is a complicated return process. Then there’s also the issue of the 37% of customers who “don’t like the item.”

Loop also gives the customer the opportunity to simply exchange the item for something they do like without initiating a refund.

Inventory Management

Inventory management isn’t a problem — until it is.

Do you have enough inventory for an upcoming sale? Is your inventory overflowing due to slow shipping times?

Lead times will ultimately guide your inventory management strategy. If you want accuracy in your inventory, you’ll need to think about creating an analysis that matches up with how fast you’re selling vs. how fast you can stock your product.

You can use inventory management software to help automate the process in collaboration with other strategies, like waitlists or presales.

Depending on your goals, each strategy can help with building product hype and demand forecasting. It can also help decrease the likelihood of other issues, such as over-ordering and shortages.

6. Personalization ‘Coutures’ the Online Store Experience

Given fashion’s focus on self-expression, it makes sense that modern fashion consumers actively seek personalized experiences.

This goes well beyond the typical personalization techniques that have become status quo by today’s standards. Things like including the customer’s name in your emails or delivering product recommendations based on their purchase history are table stakes.

Hyper-personalization digs into the customer’s behaviors, preferences, and purchase history to determine how best to deliver value to them moving forward.

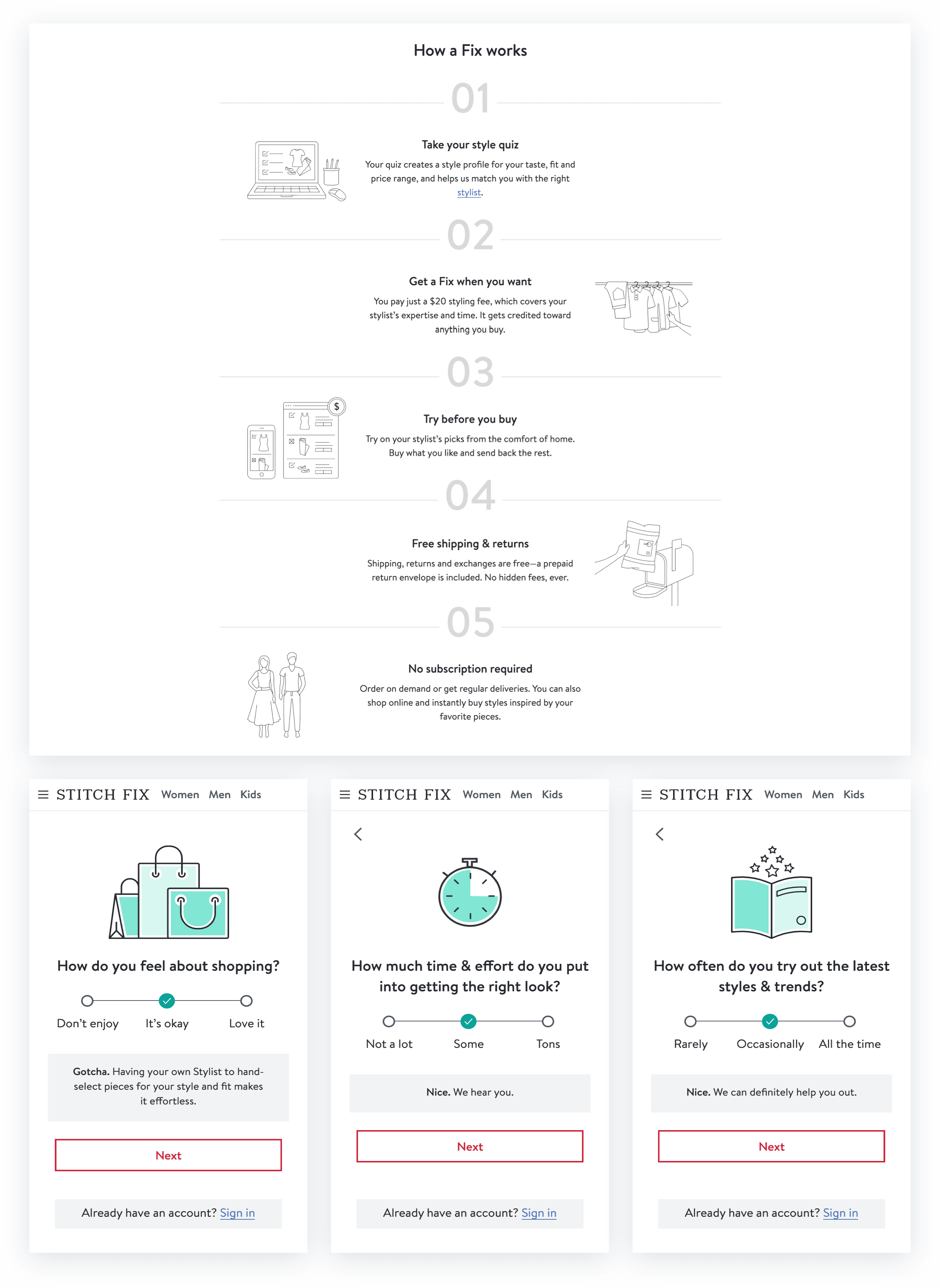

The exemplar of this trend is Stitch Fix. Since its inception in 2016, the DTC startup has grown in value to roughly $0.52 billion as of Nov 2022.

Through the use of artificial intelligence and machine learning, Stitch Fix determines the exact products to deliver to its individual customers on a subscription basis.

That level of personalization may feel out of reach. Thankfully, the principles behind it are anything but.

For starters, quiz funnels have become a staple of new customer acquisition for Common Thread Collective’s fashion clients as well as our in-house brands.

Tools like Octane AI or Typeform (if you really need to be scrappy) make frontend creation easy. They also make backend integration smooth with email marketing platforms like Klaviyo. With each, direct access to your product catalog and customer information (e.g., Shopify, Magento, or WooCommerce) must be accessible.

Onsite tools such as Nosto take hyper-personalization a step further, delivering dynamic onsite content to users based on their engagement history. This goes for product recommendations, page copy, and more.

7. Multi-Channel Demands Immersion through Social Media

With the above in mind, it should be no surprise that multi-channel marketing has become a necessity. Terms like multi-channel and omni-channel often feel cloaked in complexity. Especially for growing retailers.

Put simply, multi-channel ecommerce means establishing a consistent and purchase-centered experience on the digital spaces consumers inhabit. It need not span the internet.

Nor does it demand being everywhere for everyone.

Instead, savvy brands expand one channel at a time: mastering and prioritizing their presence along four frontiers …

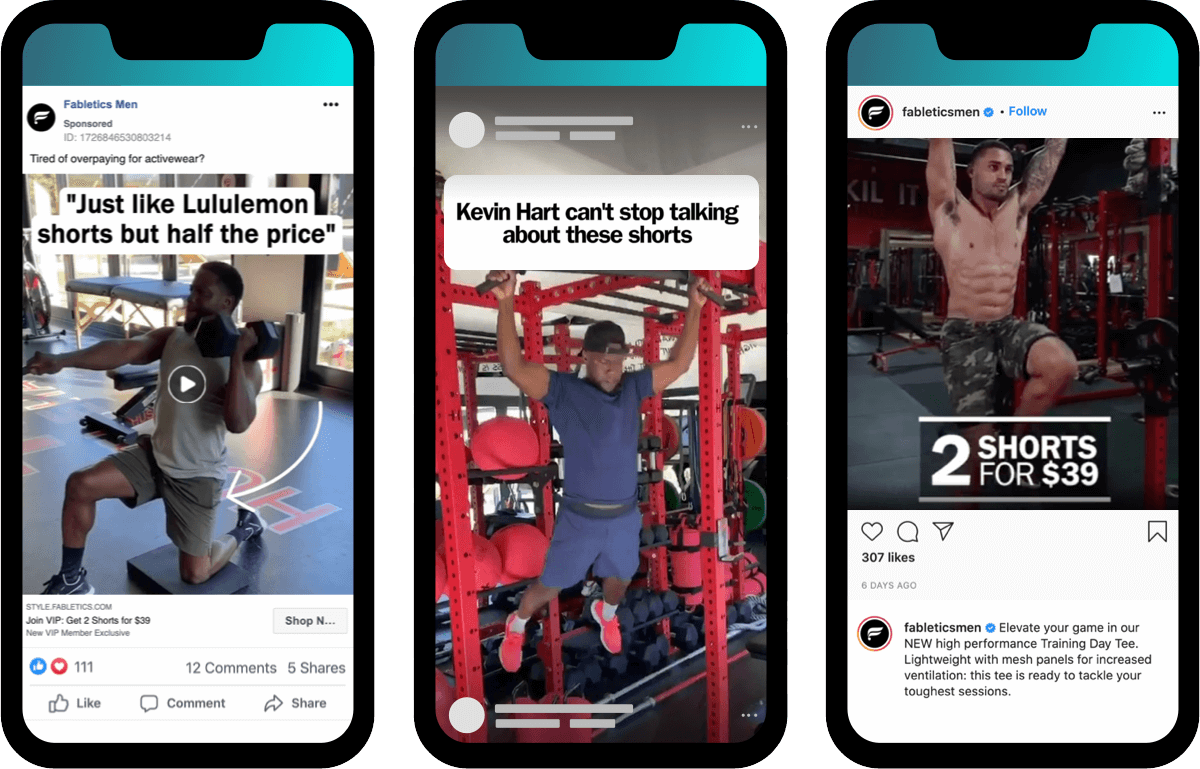

As a guide, consider Fabletics.

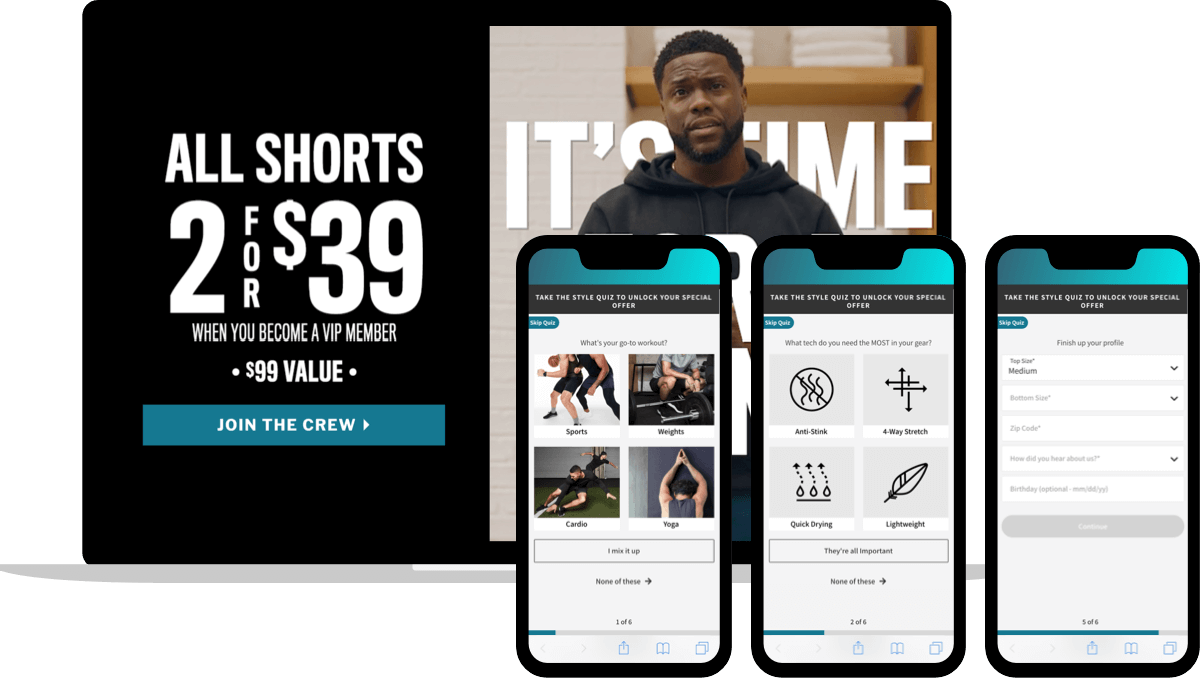

Recently, the brand launched a straightforward sales campaign with Kevin Hart. It began with a series of ads run natively through Kevin’s Instagram, led to a custom landing page (rather than the homepage, product page, or collection page), and culminated in a six-part quiz:

Simultaneously, Fabletics released paid and organic content through its own social-media accounts, also featuring Kevin as well as competitive messaging:

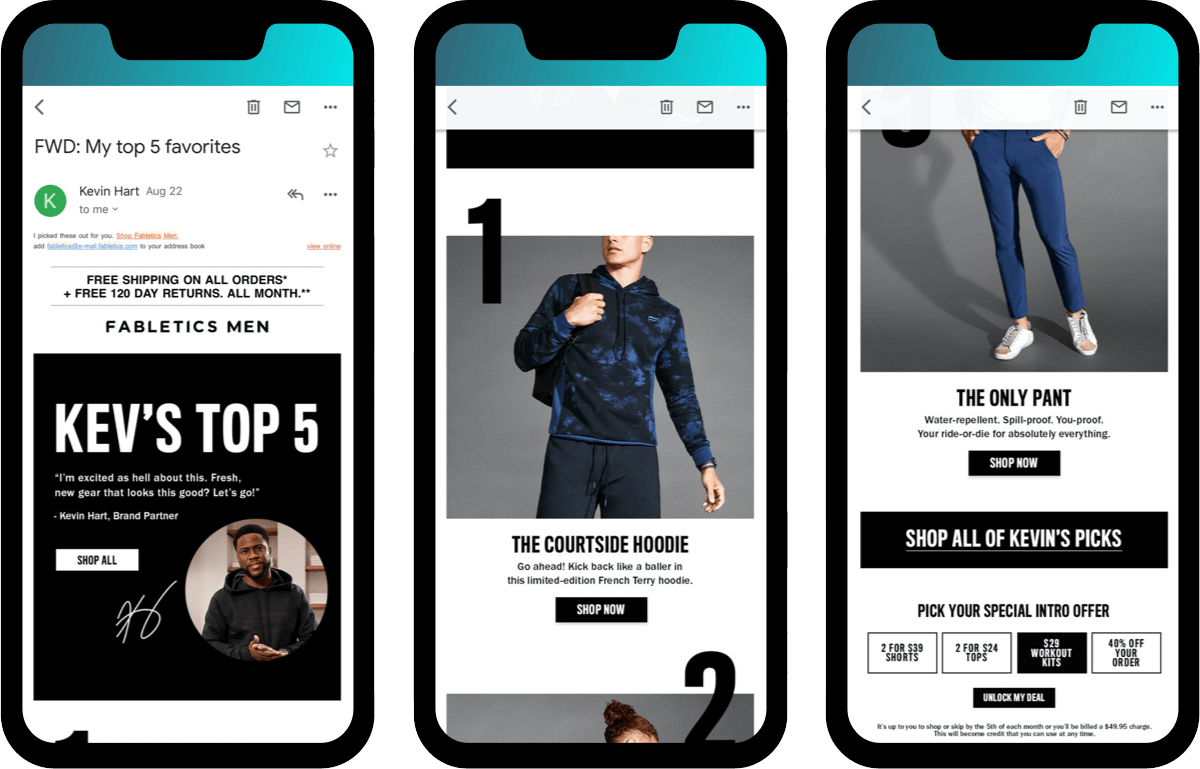

The campaign’s crowning glory appeared on what is often considered the least “cutting-edge” channel: an email from Fabletics sent through Kevin Hart’s name:

For all its seeming complexity, the approach essentially runs on three channels: Facebook, onsite (through a custom landing page and quiz), and email.

But because they interlock with a consistent message, those channels immerse their audience.

Lifestyle accessory brand, Dorsal, does something similar: anchoring its spend on Facebook and Snapchat, then extending into halo efforts on …

- Branded Google Ads to capture demand

- Worldwide advertising to extend its reach, and

- Email as well as SMS depending on traffic source

In addition to enhancing the customer experience for their current audience, this allows fashion businesses to expand intentionally.

Whether targeting new audiences, experimenting with new social-media platforms, or testing new creatives – multi-channel marketing is a key to growth in the fashion industry.

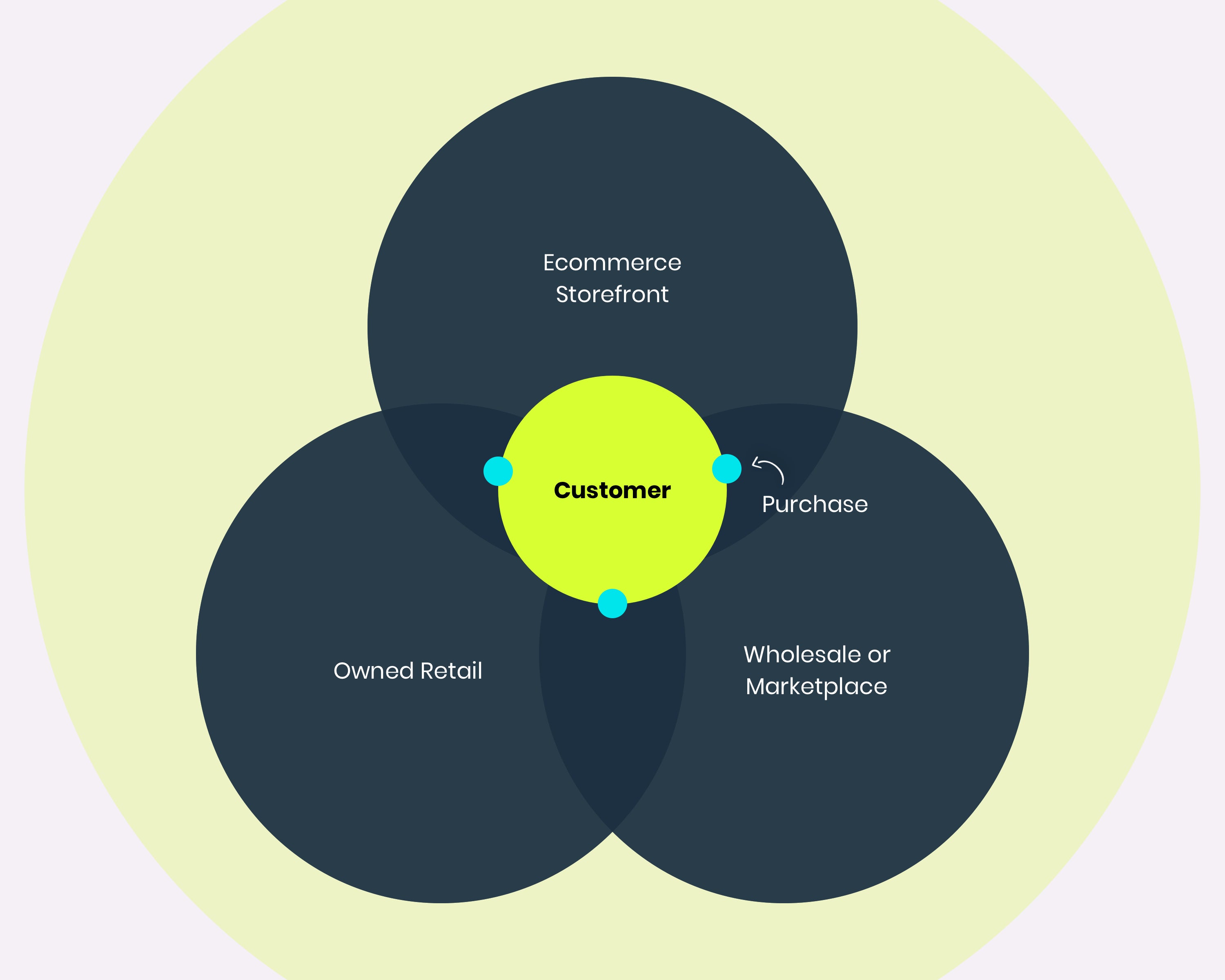

8. Retail Fashion Remains, Beckoning Omni-Channel Operations

Where multi-channel connects digital experiences, omni-channel bridges the online-to-offline divide through a “single view” of customers (i.e., data) with three points-of-purchase:

- Ecommerce website

- Owned retail location(s)

- Wholesale partnerships or marketplaces

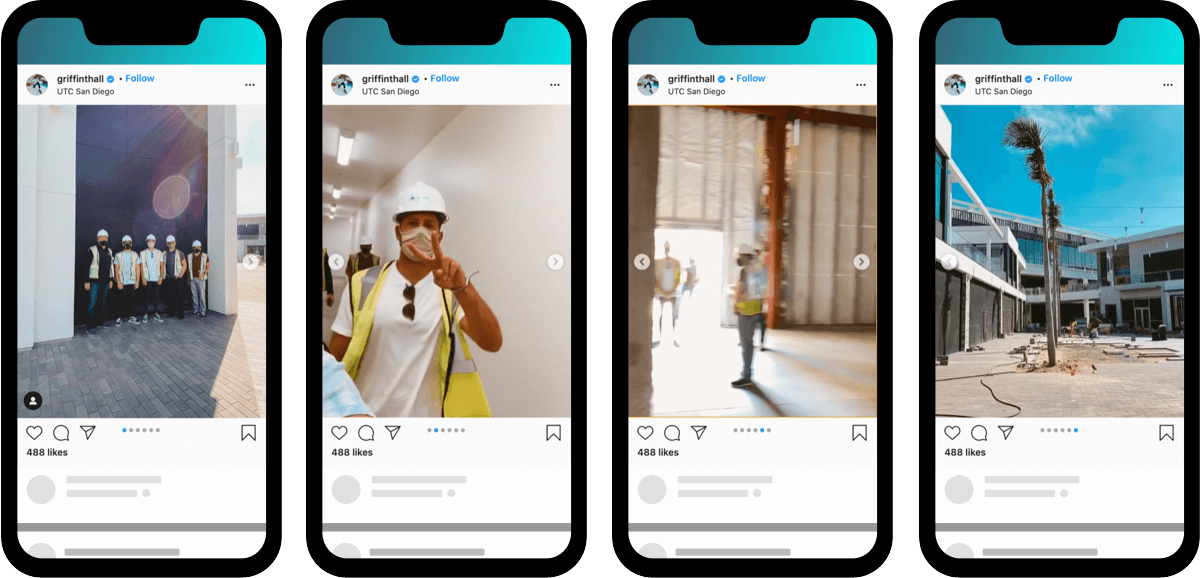

Numerous born-online fashion labels have already proven the value of maturing into owned retail. Chief among them, names like Lululemon, Happy Socks, UNtuckit, and Rhone.

Shoe brand APL (Athletic Propulsion Labs) inverted that traditional path by starting its journey in luxury retailers, expanding into online DTC three years ago, and then establishing its flagship store in late 2019.

Even amidst COVID-19, DNVB juggernaut Pura Vida Bracelets made its groundbreaking announcement.

Why? Because in addition to creating a cohesive customer journey, omni-channel operations allow fashion brands to create tactile customer experience.

As Nate Checketts, Rhone’s co-founder and CEO, explains: “While transactions continue to scale and tilt towards seamless digital environments, the impetus for transactions are influenced by IRL offline.”

For Rhone, as with most apparel, that “impetus” includes (1) what customers currently own and love, (2) what friends or family own and talk about, and (3) in-person, in-store interactions.

9. Fashionable Predictions: Social, Loyalty & Intimacy + Returns

What report on ecommerce fashion trends would be complete without predictions?

Rather than peer into the future through hazy buzzwords, instead let’s hone in on three problems and three predictions … from three leaders at the forefront.

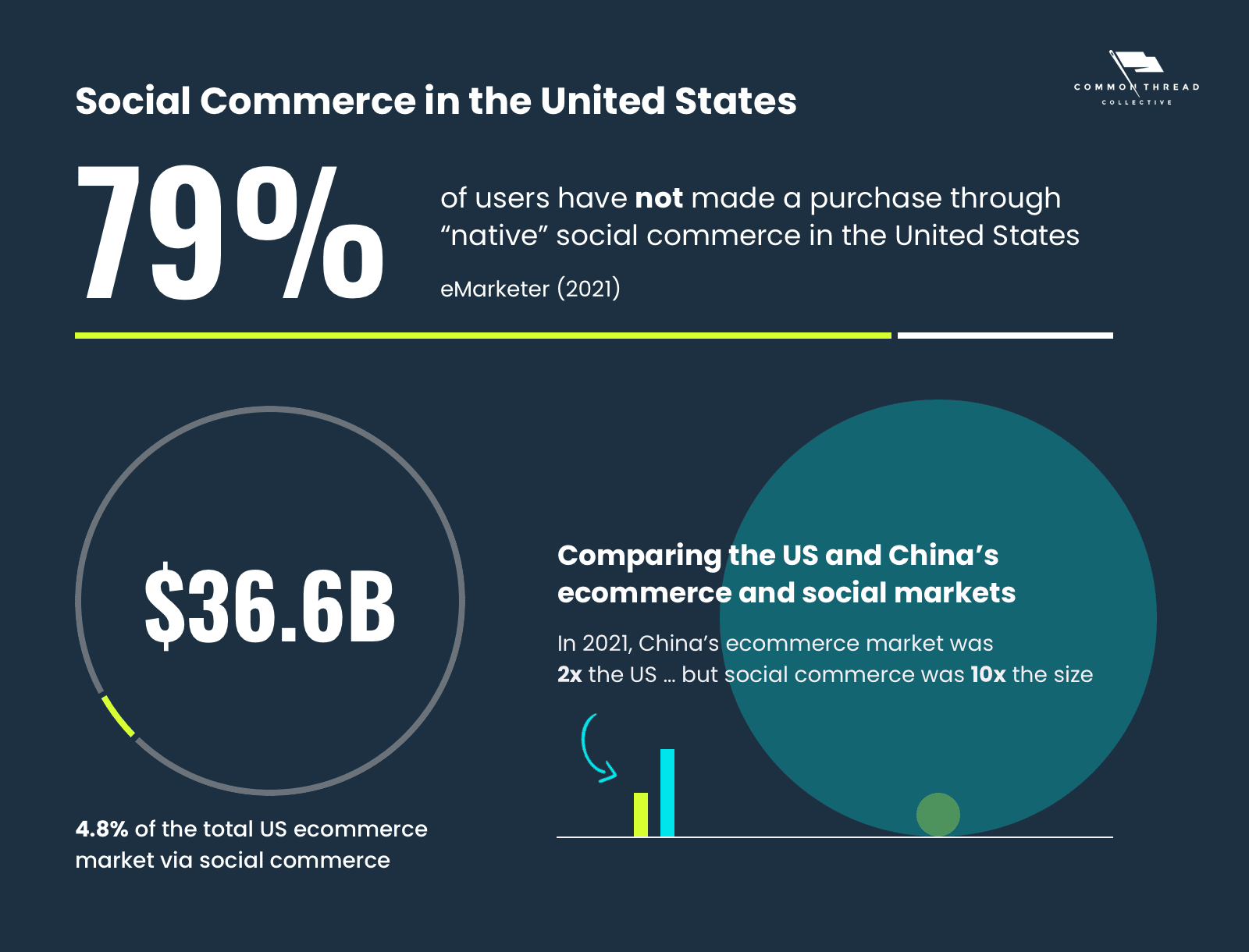

Problem: Online Shoppers Aren’t Buying Native Social Commerce

Despite feature releases, PR, and new integrations, native commerce — i.e., buying inside social-media platforms like Facebook and Instagram — has had a tough go of it.

At best, consumers are still getting used to the idea of making purchases directly through social media. At worst, it’s a losing battle that won’t be won for at least another generation.

Prediction: Social Media Becomes Fashion’s Landing Page to ‘Just Let Me Buy’

Marco Marandiz, Ecommerce DTC Strategist

“I see a big transition from the website being the primary channel for how you generate transactions. Moving forward, we’ll see a lot more drops as a business model, a bigger part of the revenue mix for direct-to-consumer businesses.

“Websites will become less relevant and social media channels — TikTok, Instagram, Twitter, YouTube — those are going to be far more powerful for driving online sales directly to a specifically built site to make a sale. There won’t be the whole lifestyle photography and product descriptions and all of that stuff.

“There’ll be a shift towards using social media channels as your landing page and very simple transactional experiences for commerce. Maybe that’s not ‘DTC 3.0,’ but it’s the next iteration because most people are deciding to buy things when they see the ad, when they see the influencer, when they see the content, that’s when they make the decision to purchase.

“If someone’s already bought-in on an influencer, already bought in that this celebrity is going to sell me this hoodie, then just let me buy it.”

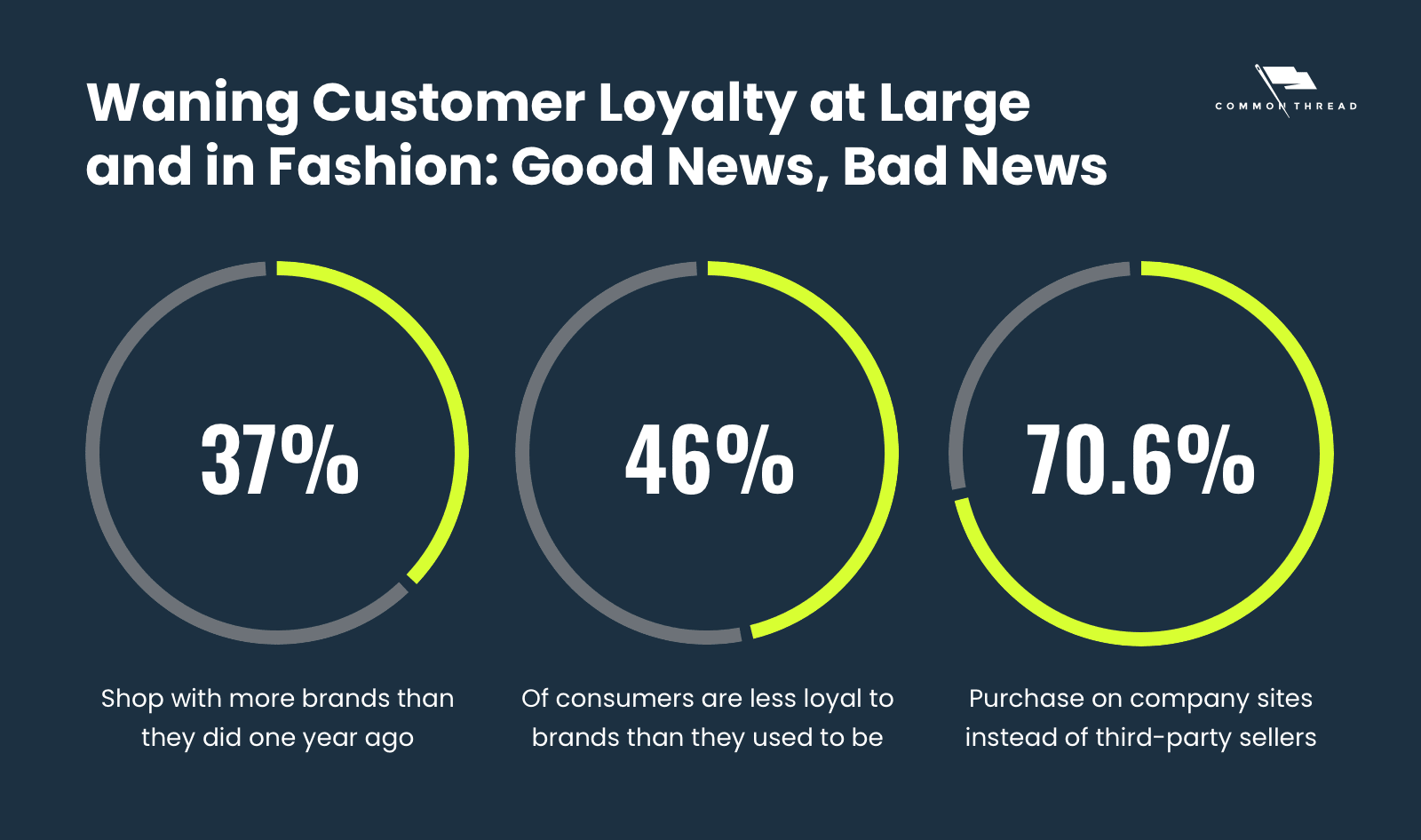

Problem: Loyal Customers Are a Rare Commodity in the Fashion Industry

According to a survey from Qubit, 37% of consumers shop with more brands than they did a year ago — and 46% are less loyal to apparel brands than they used to be.

At the same time, 70.6% of fashion consumers say they make purchases on company websites instead of third-party sellers.

Consumers don’t mind being loyal — they just need to have good reasons.

Prediction: Retention Data by Cohort Will Feed Cash Flow & Center on ‘Happiness’

Jeremy Cai, CEO & Founder of Italic

“Primarily relevant for brands looking to scale: you need to be realistic in looking at your business from an objective and quantitative lens.

“Invest in reporting early on and develop competency around understanding and dialing in the metrics that matter for your business on a cohort basis. The sooner you do this, the better equipped you’ll be to answer how to grow your business. Don’t put this off.

“Let’s say you sell your hero product for $100 and your contribution margin is $50, and let’s say you were acquiring early customers at $30 on Facebook, that’s great, double down. But once your CAC has grown to $60, it’ll be too late to course-correct.

“What you have to know is how much those customers who bought your hero product — and any other leading products — are worth to you month after month. Not over a lifetime, but inside timetables that feed your cash flow.

“Economies of scale are purely theoretical in DTC and you need to invest in becoming a data-driven organization early on. The radical part of Italic’s model is that we get to prioritize our members’ happiness by making retention our driving metric.”

Problem: Online Shopping Lacks Intimacy, Especially for Support & Returns

As ecommerce adoption escalates and first-time shoppers turn online, a chief danger is losing intimacy. Retail can forge relational experiences, but customer support is often the only option for online apparel brands. Particularly, immediate support and functionality— before, during, and after a purchase.

Rising return rates are another danger that loom large over online fashion:

Prediction: Tiny Keyboards Can Address Both Problems in Real-Time

Vanessa Skaggs, Marketing Manager at Pura Vida Bracelets:

“SMS and mobile messaging will overtake all channels as the primary source for people to reach out. Future generations will find ways to take mobile shopping, mobile checkouts, mobile payments to another level through Messenger platforms, texts, live chat, and chatbots.”

“Take a highly aesthetic and digitally native Gen Z movement like VSCO girls. When a VSCO girl laughs it’s ‘SKSKSK.’ It doesn’t sound like laughter. But if you look at your phone keyboard, where are S and K buttons located? Immediately underneath your thumbs. So, ‘SKSKSK’ has replaced ‘LOL’ or ‘Hahaha’ — even though H and A are maybe one or two keys more inside.”

“With social trends influencing buying trends, more and more people will want direct interaction immediately on the places they live — their phones. Hardwired mobile users whose expectations of online shopping won’t be limited to fashion ecommerce stores, ecommerce sites, or online shops.

“They’ll also want to take care of returns and exchanges through those mobile devices. The beautiful thing is the more active you get on those tiny screens, the more proactive you get as someone shops, returns not only get faster but fewer.”

10. The More Fashion Changes, the More Fashion Stays the Same

In the end, the state of ecommerce fashion is good. Evolving? Yes. Risky? Sure. Without challenges? Of course not.

Nonetheless, every source declares: “From biggest to even bigger.”

Common to each trend is the centrality of customers. Seasons change. Tastes transform. Fads come and go.

But people stay people.

Regardless of style … we all want to belong. We all want buying to be easy. And we all want to look good.

If you want help growing your fashion brand along those same lines, then start a conversation with us today.

Or, if you want to see us prove it first, download the Fashion Industry Report and Ecommerce Fashion Marketing Guide — packed with tactics and real results from Common Thread Collective clients.

Frequently Asked Questions (FAQ)

Is fashion the biggest industry?

Online, yes. With a global market value of $775 billion in 2022, apparel, accessories, and footwear are the number one ecommerce sector in the world. By 2025, it’s projected to grow to +$1.2 trillion.

What is the future of the fashion industry?

Ten trends shape the future of fashion, particularly the ecommerce fashion industry. The most influential include global expansion, fast fashion’s deepening divide from luxury, social-media influence, and omni-channel uniting retail with online shopping.

How profitable is the ecommerce fashion industry?

In short, it depends on the business itself. Profits stem from understanding the ecommerce growth equation — (V x CR x LTV) - VC = $ — and running your own numbers through a framework like unit economics to calculate costs and margins on a per-unit basis.

We won't send spam. Unsubscribe at any time.

Melissa Rosen is the Director of Marketing and Content at Common Thread Collective. Based in San Diego, California, she has spent the last decade exploring how to create engaging content that inspires, teaches, and entertains. Melissa can be found on Twitter and LinkedIn talking all things content, marketing, and ecommerce.

Previously the VP of Marketing at CTC and Editor in Chief of Shopify Plus, Aaron is now the Head of Marketing at Recart SMS. His content has appeared on Forbes, Mashable, Entrepreneur, Business Insider, The New York Times, and more. Connect with Aaron on Twitter or LinkedIn.