Exclusive Access to the DTC Metrics that Matter Most

27 Key Metrics, Updated Weekly

From store CAC to Facebook ROAS, the DTC Index contains charts tracking year-over-year data points from all parts of the funnel.

Subscribe Now

Apple’s iOS 14.5 update has arrived. And with it, a flood of changes to Facebook Ads Manager.

Not to mention … uncertainty, confusion, and fear.

This article contains everything we know about the new iOS changes — as well as their impact on Facebook advertising and ecommerce trends. But, let’s cut to the chase …

Jump Straight to the Action, or …

As an index, we’ve compiled data from ~200 ecommerce brands totaling +$5.9 billion in online revenue over the last two years.

Those businesses are drawn from Statlas — our proprietary ecommerce growth tool; they represent Common Thread Collective (CTC) clients, ADmission members, and Statlas users.

All metrics have been standardized to Facebook’s default attribution.

For clarity, the following charts represent trailing 12-month YoY data. Each metric is also calculated for the three months before iOS 14.5’s release (Feb.–Apr. 2021), and three months after (July–Sept. 2021), excluding May and June 2021 to account for iOS 14.5’s rollout.

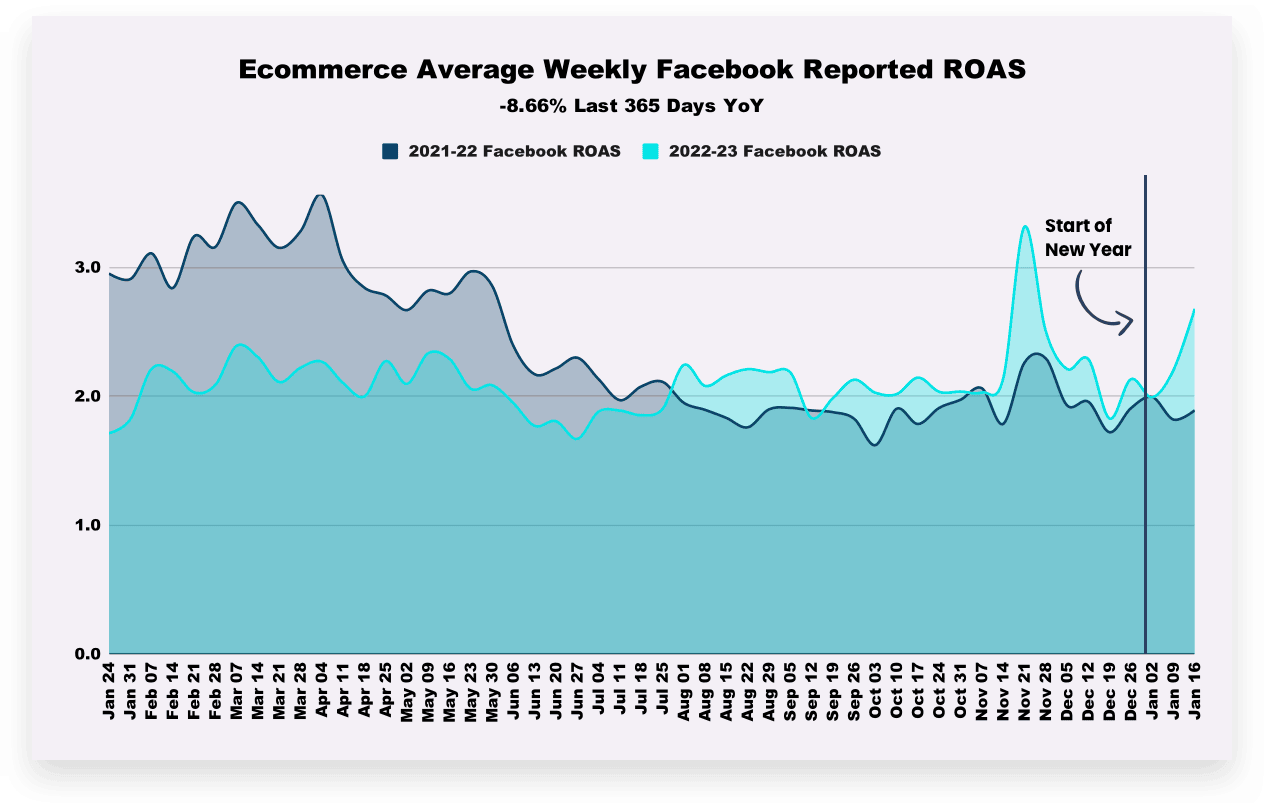

Average Facebook Reported ROAS

iOS 14.5 Effect on Facebook Reported ROAS

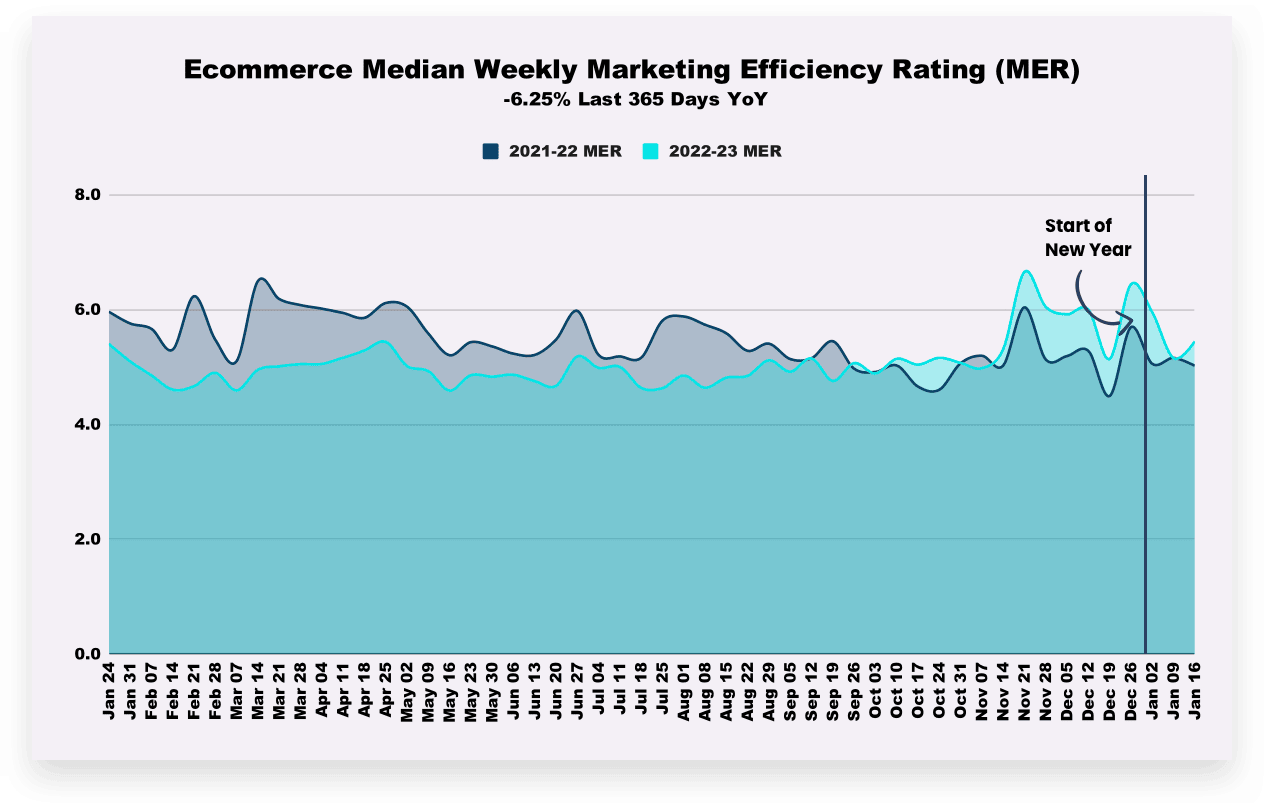

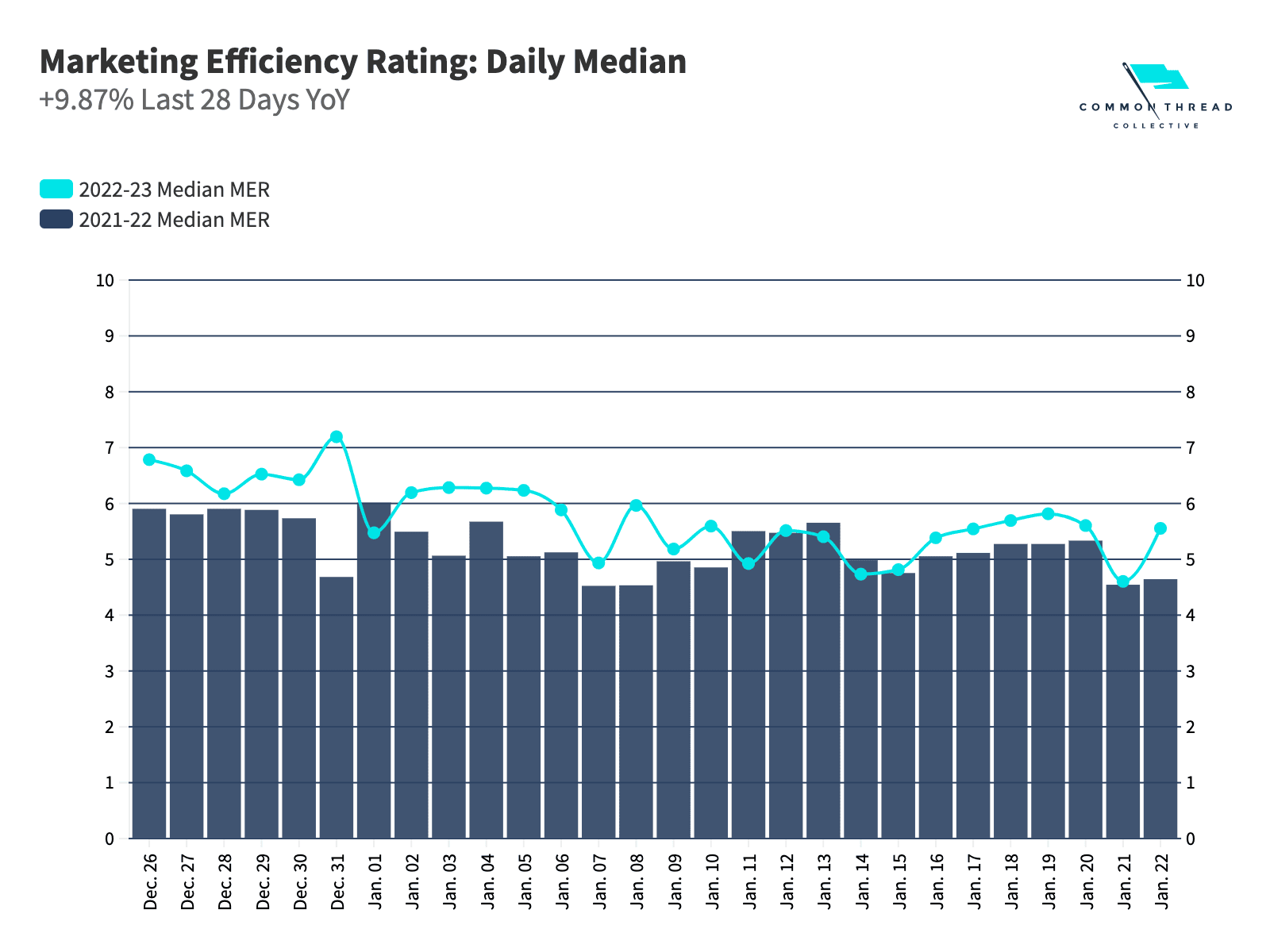

Average Marketing Efficiency Rating (MER)

MER = total revenue ÷ total ad spend; often referred to as “blended” ROAS.

iOS 14.5 Effect on Marketing Efficiency Rating

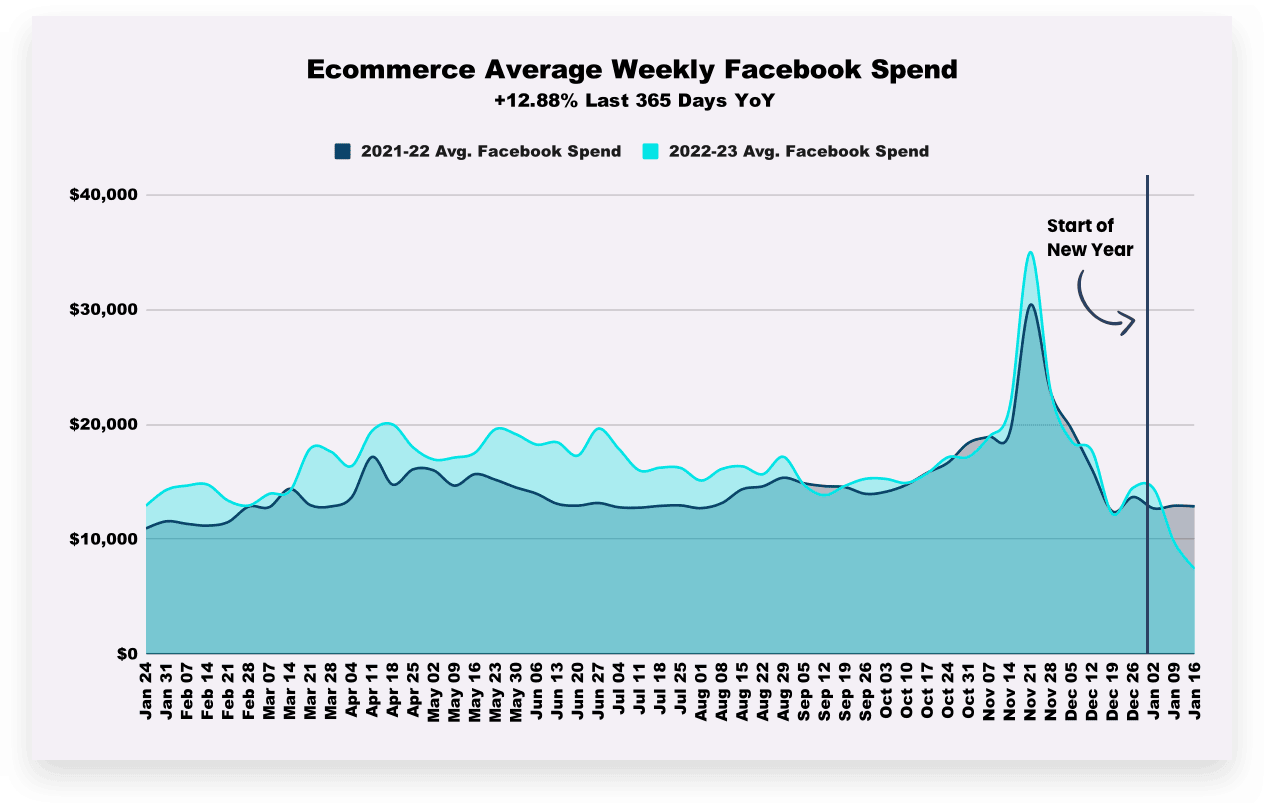

Average Weekly Facebook Spend per Account

iOS 14.5 Effect on Weekly Facebook Spend

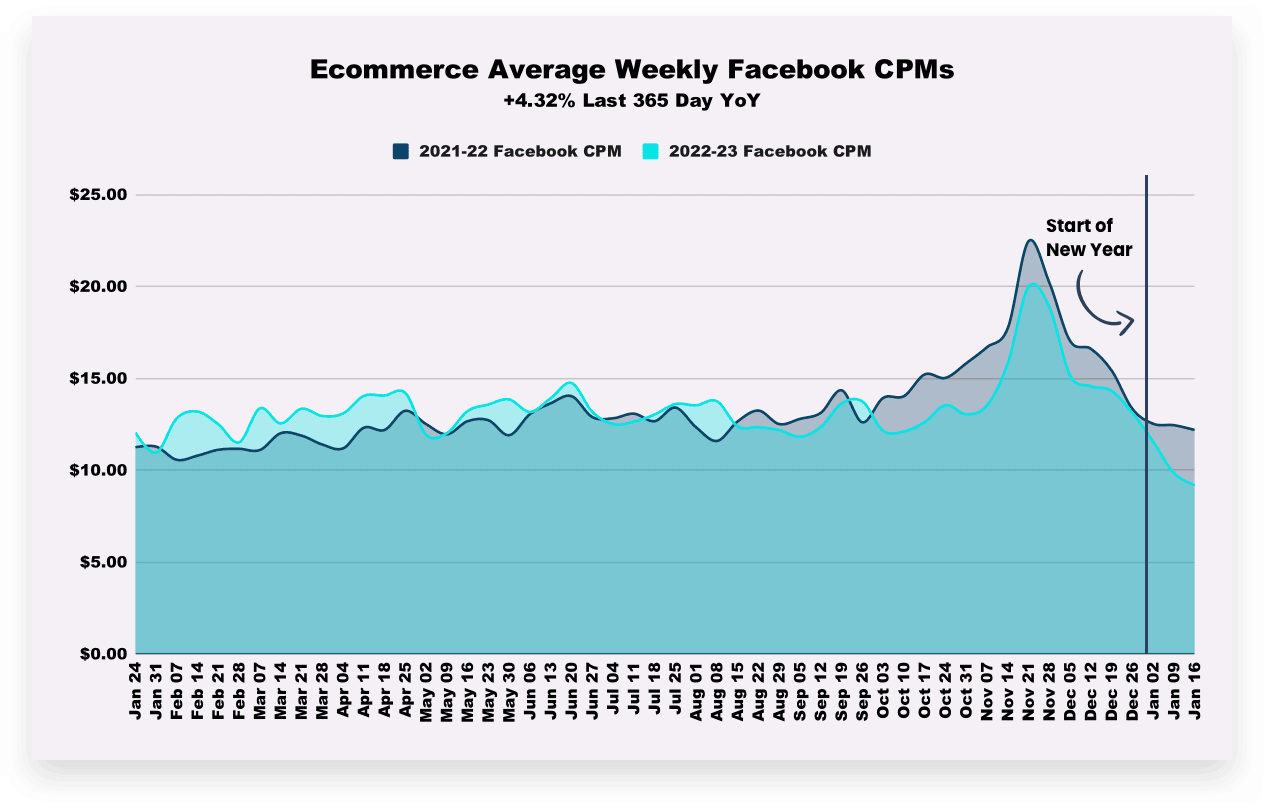

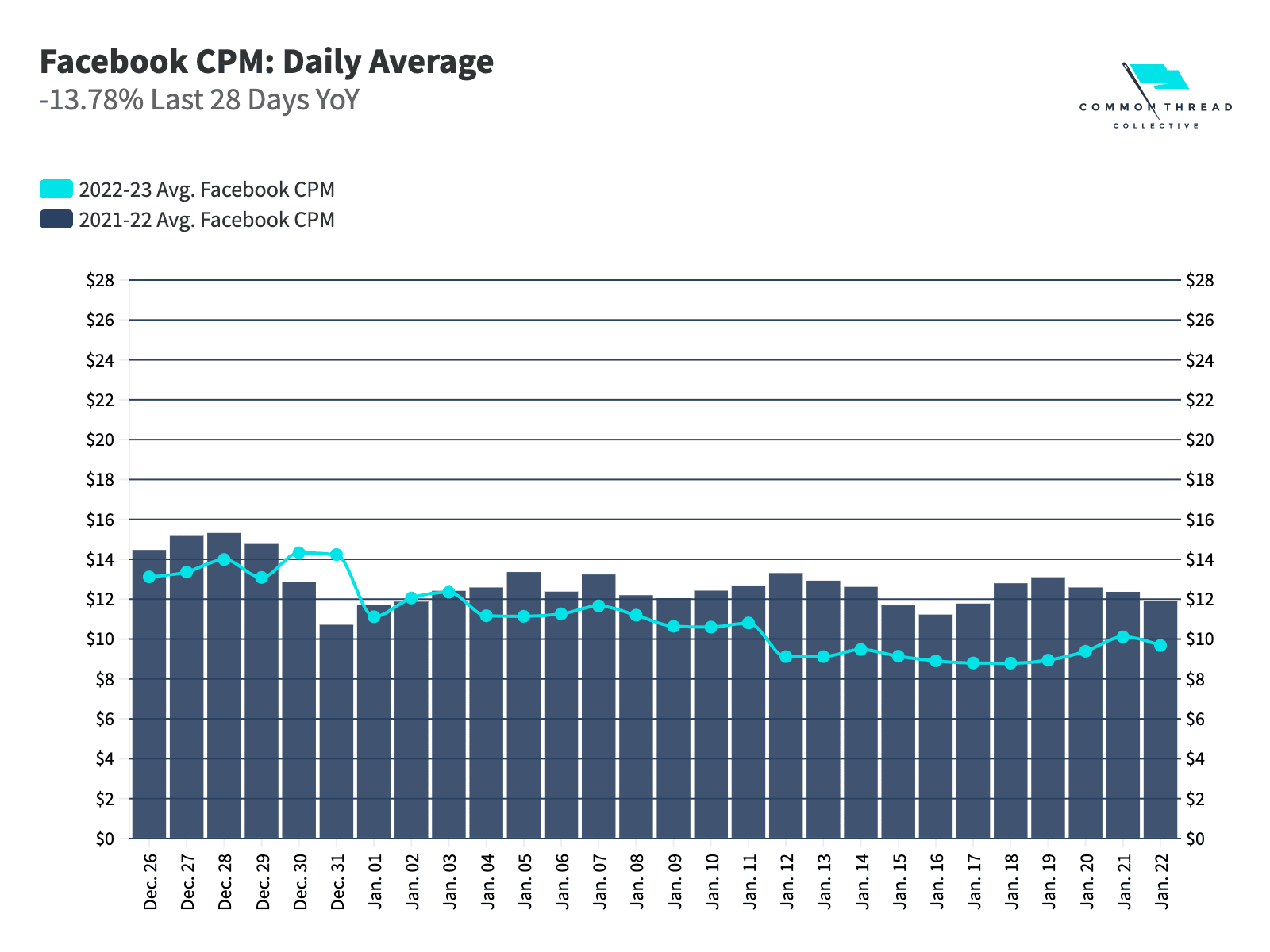

Average Facebook CPM (Cost per 1k impressions)

iOS 14.5 Effect on Facebook CPMs

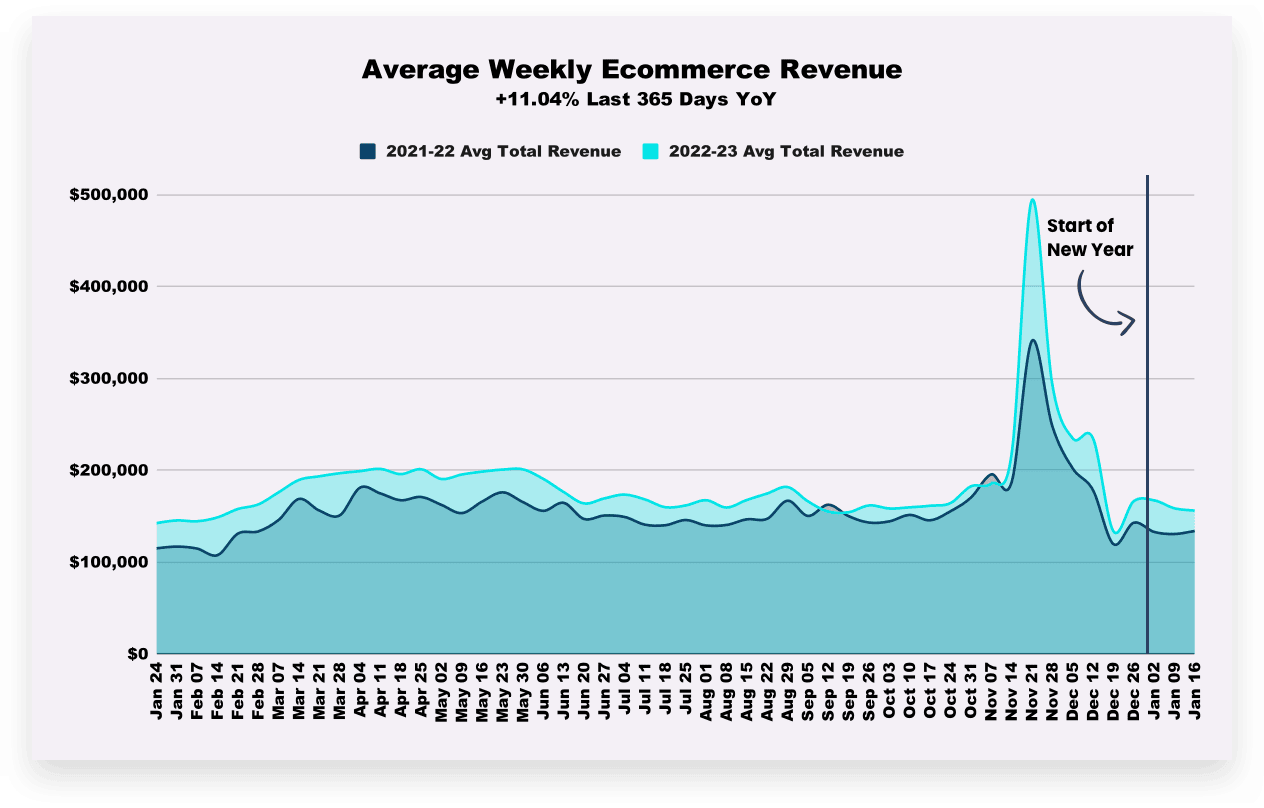

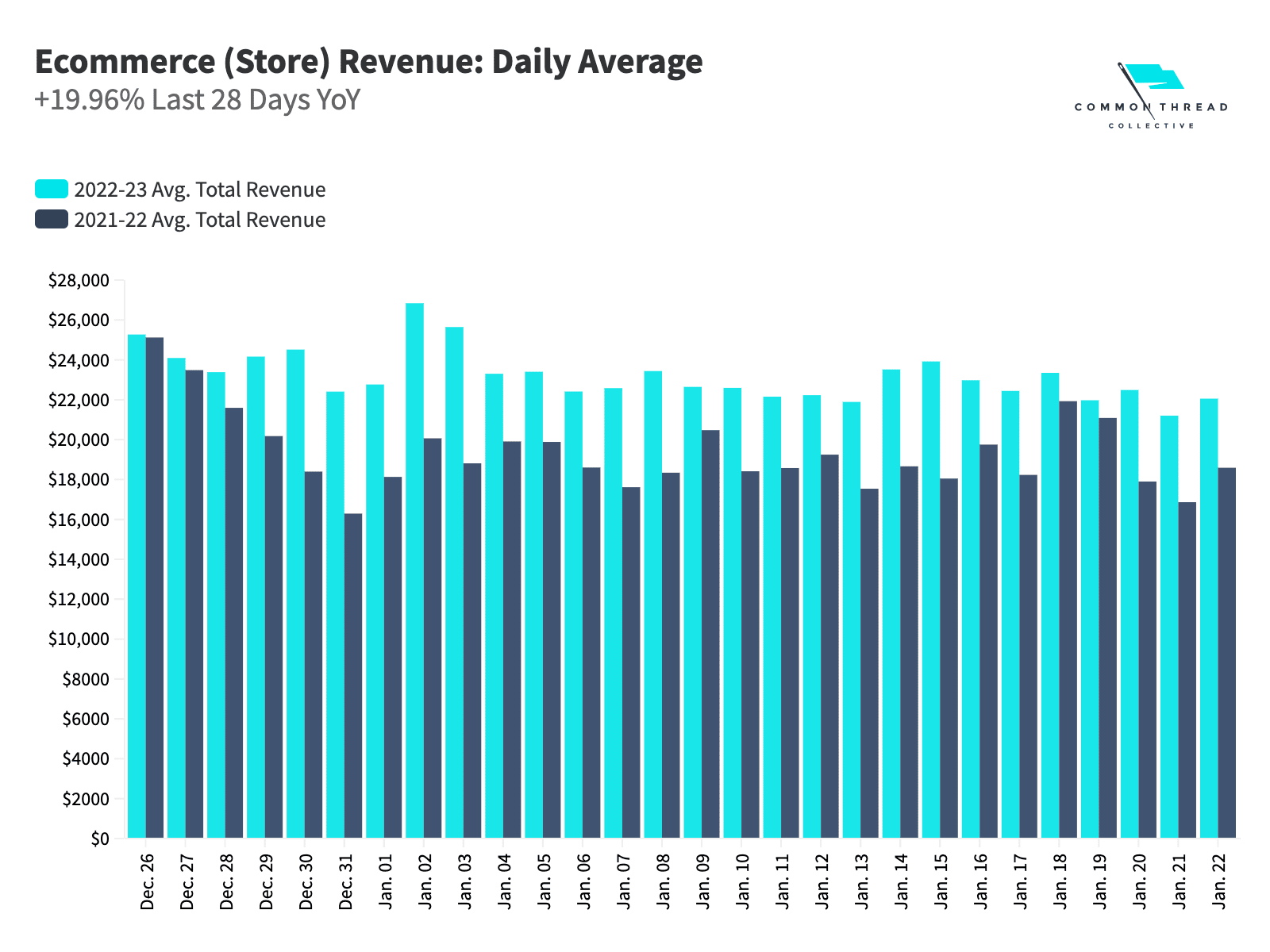

Average Weekly Ecommerce Revenue

iOS 14.5 Effect on Average Weekly Ecommerce Revenue

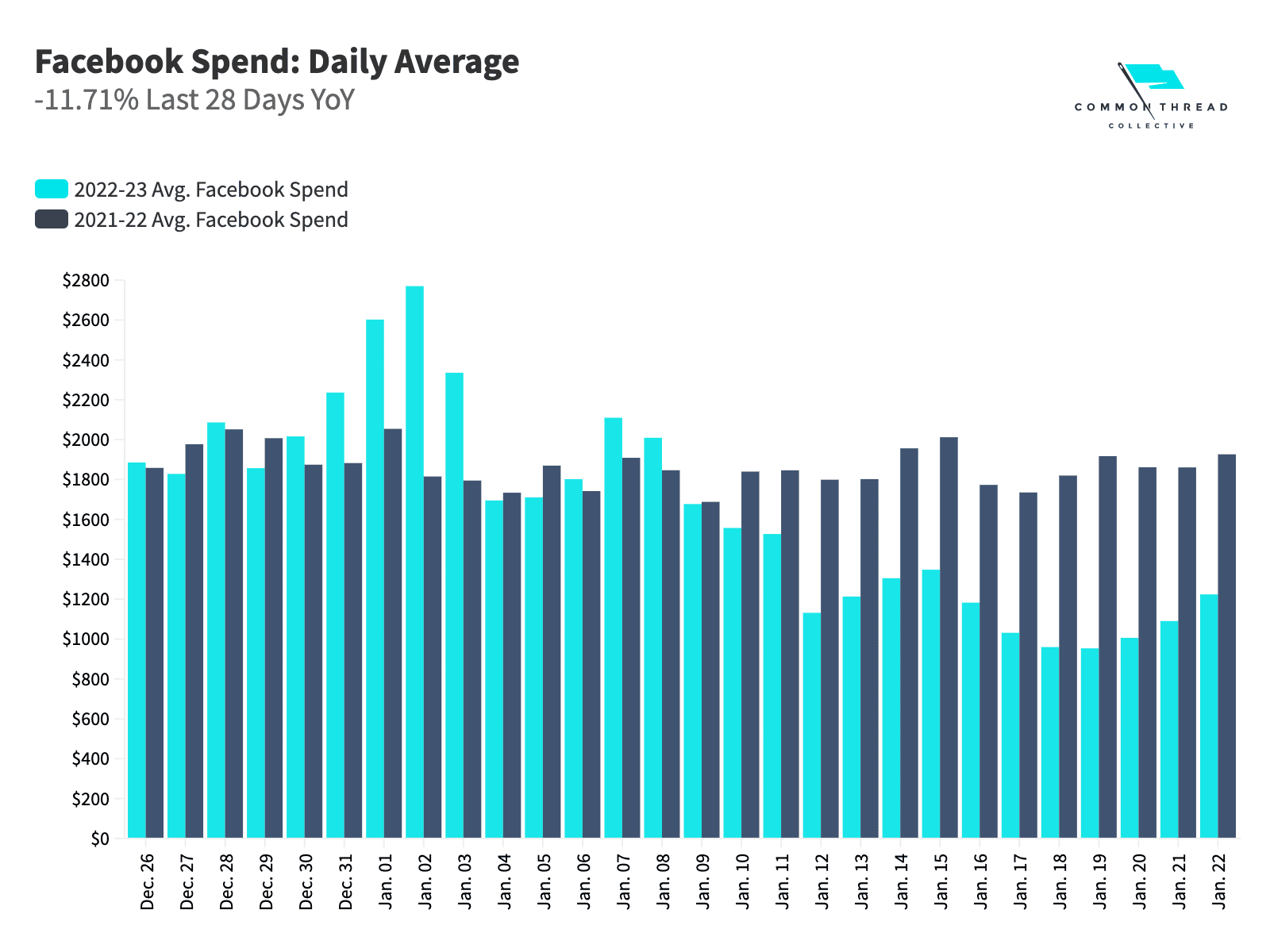

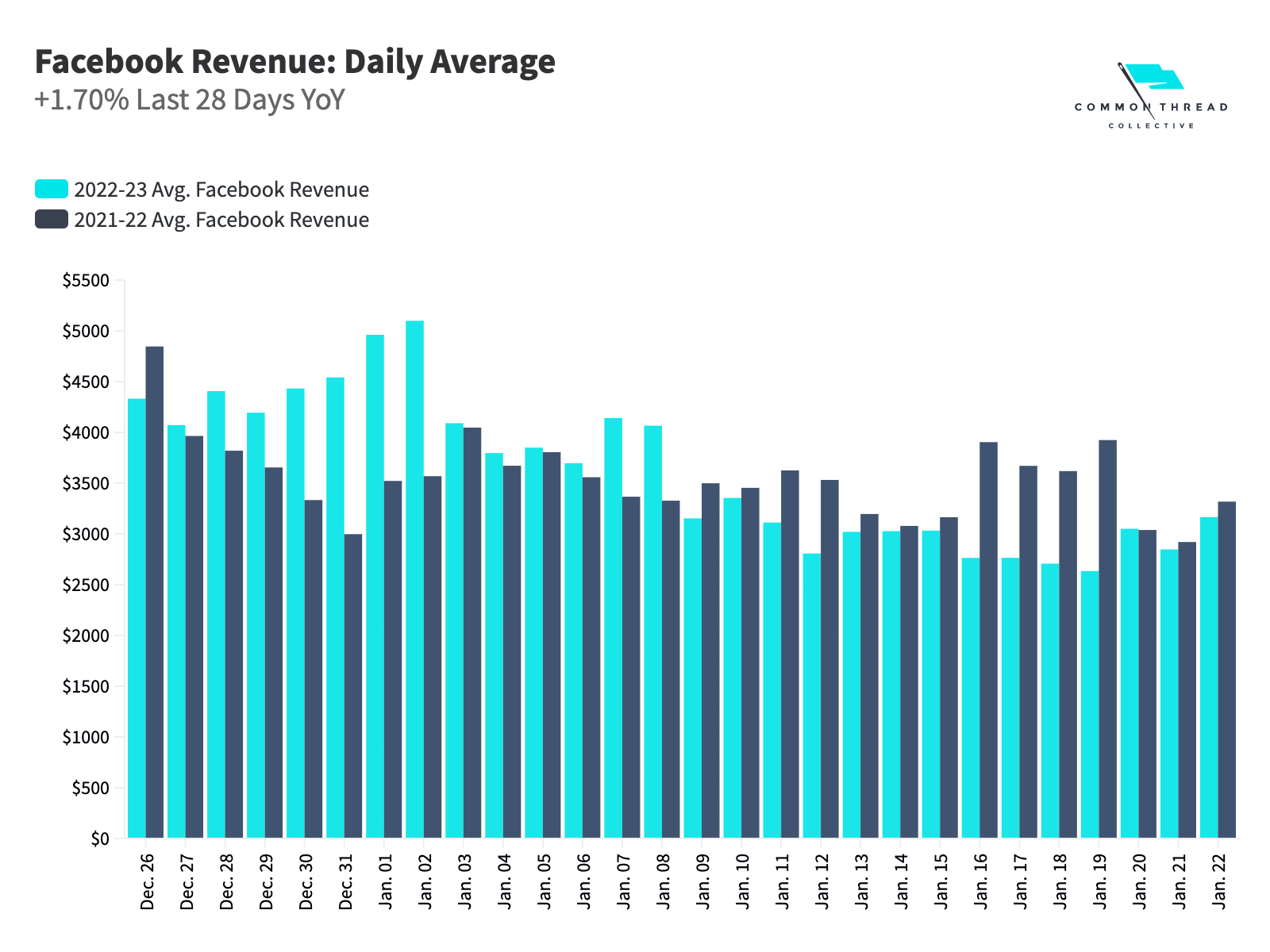

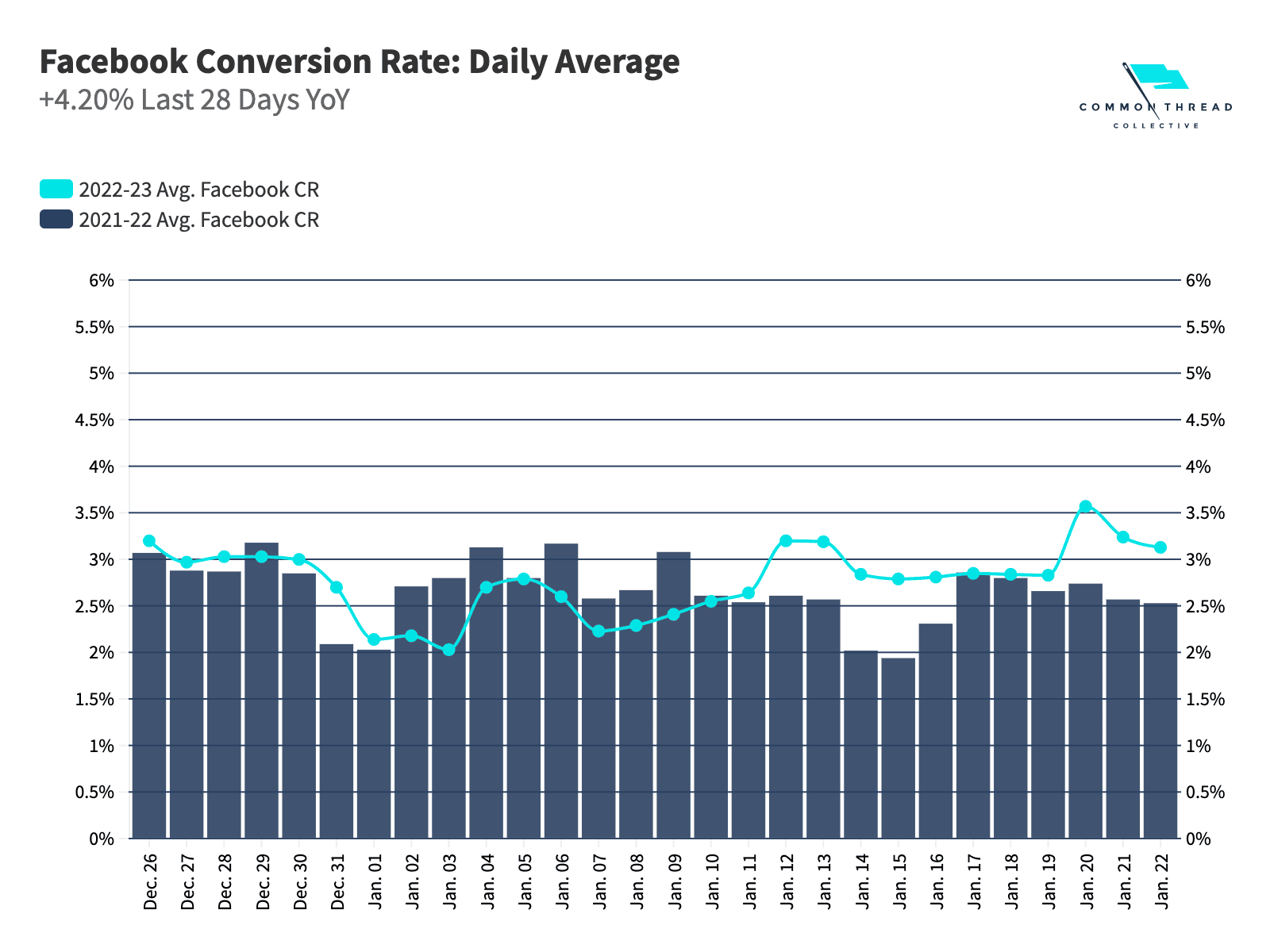

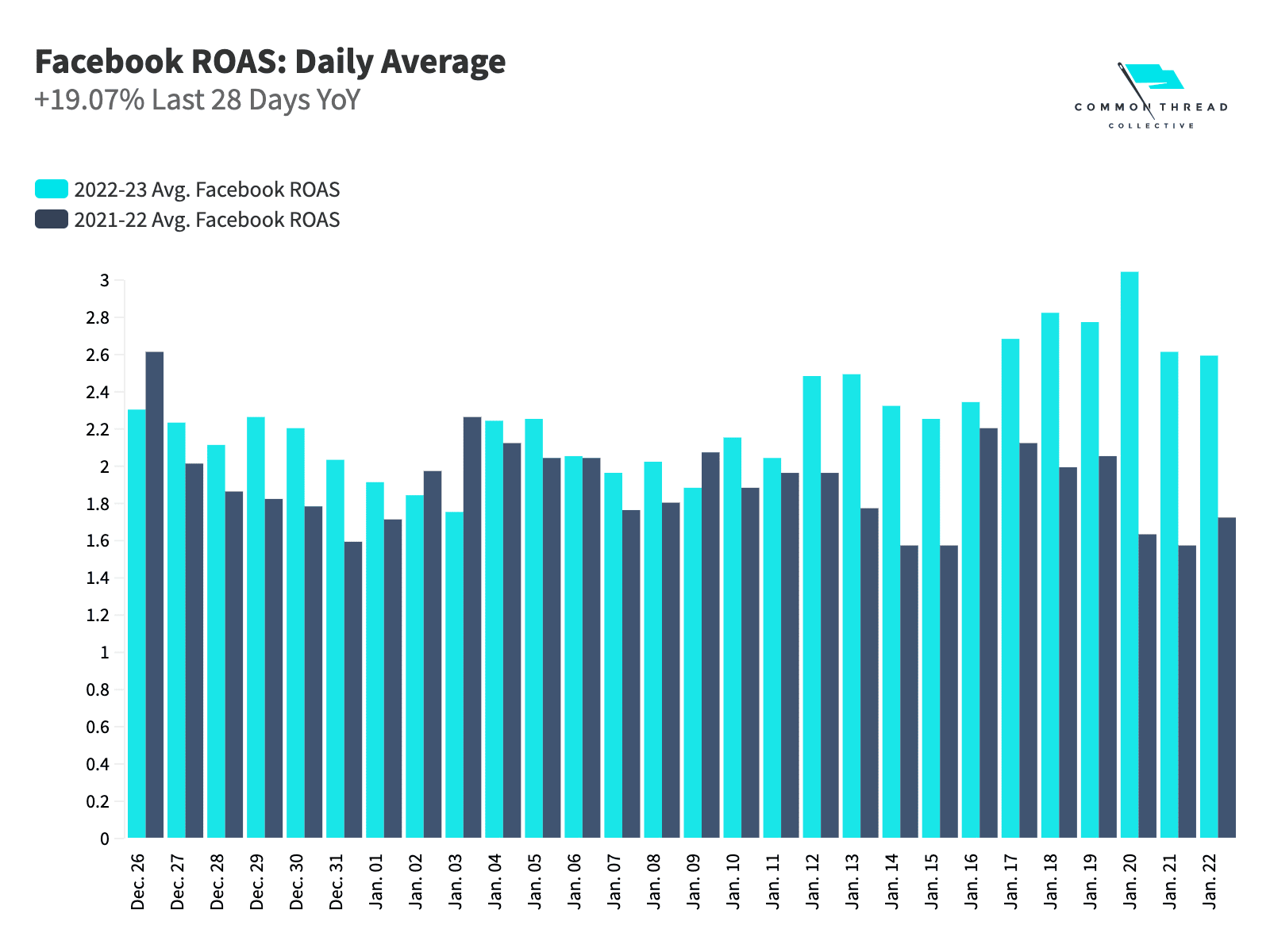

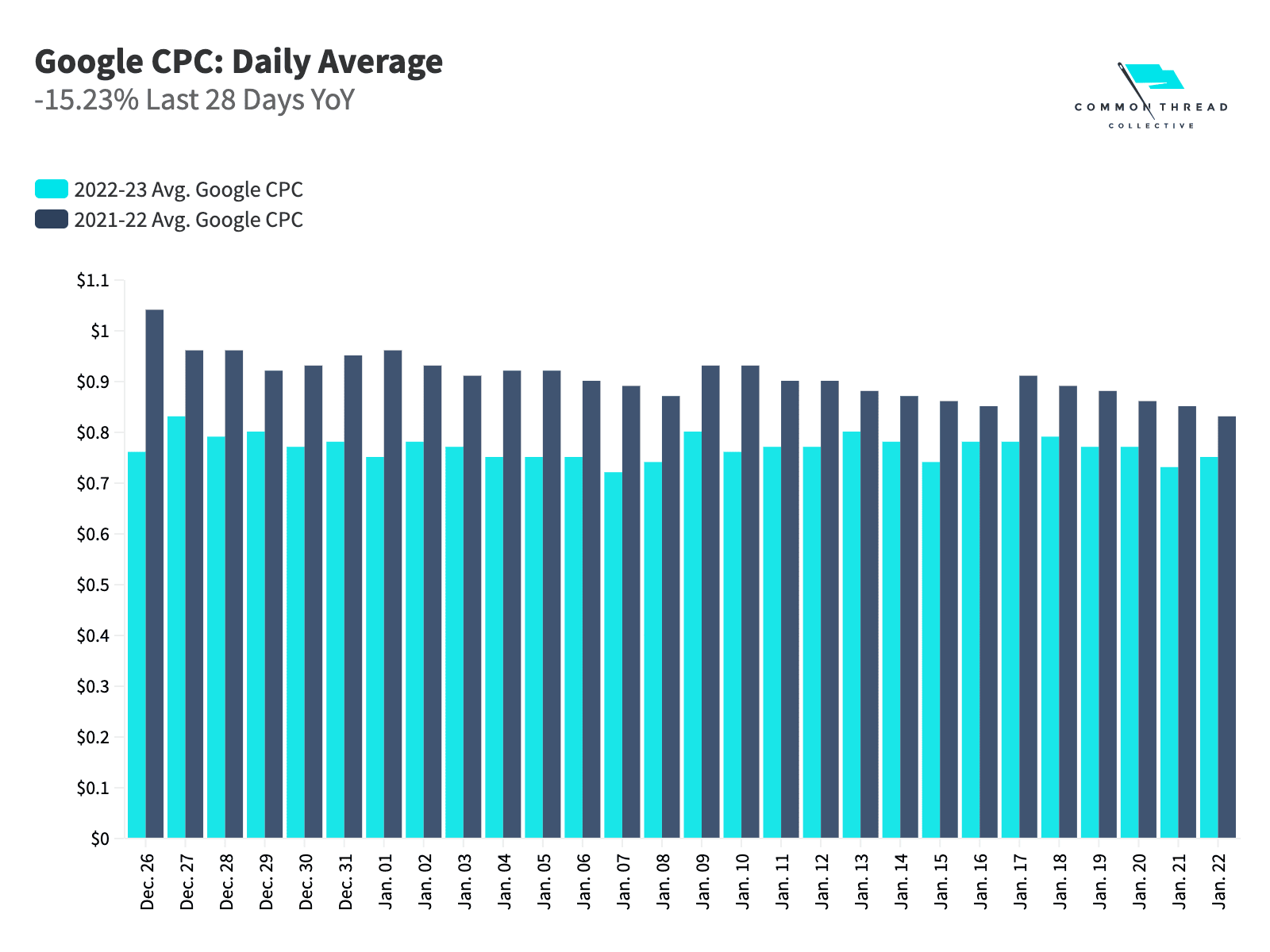

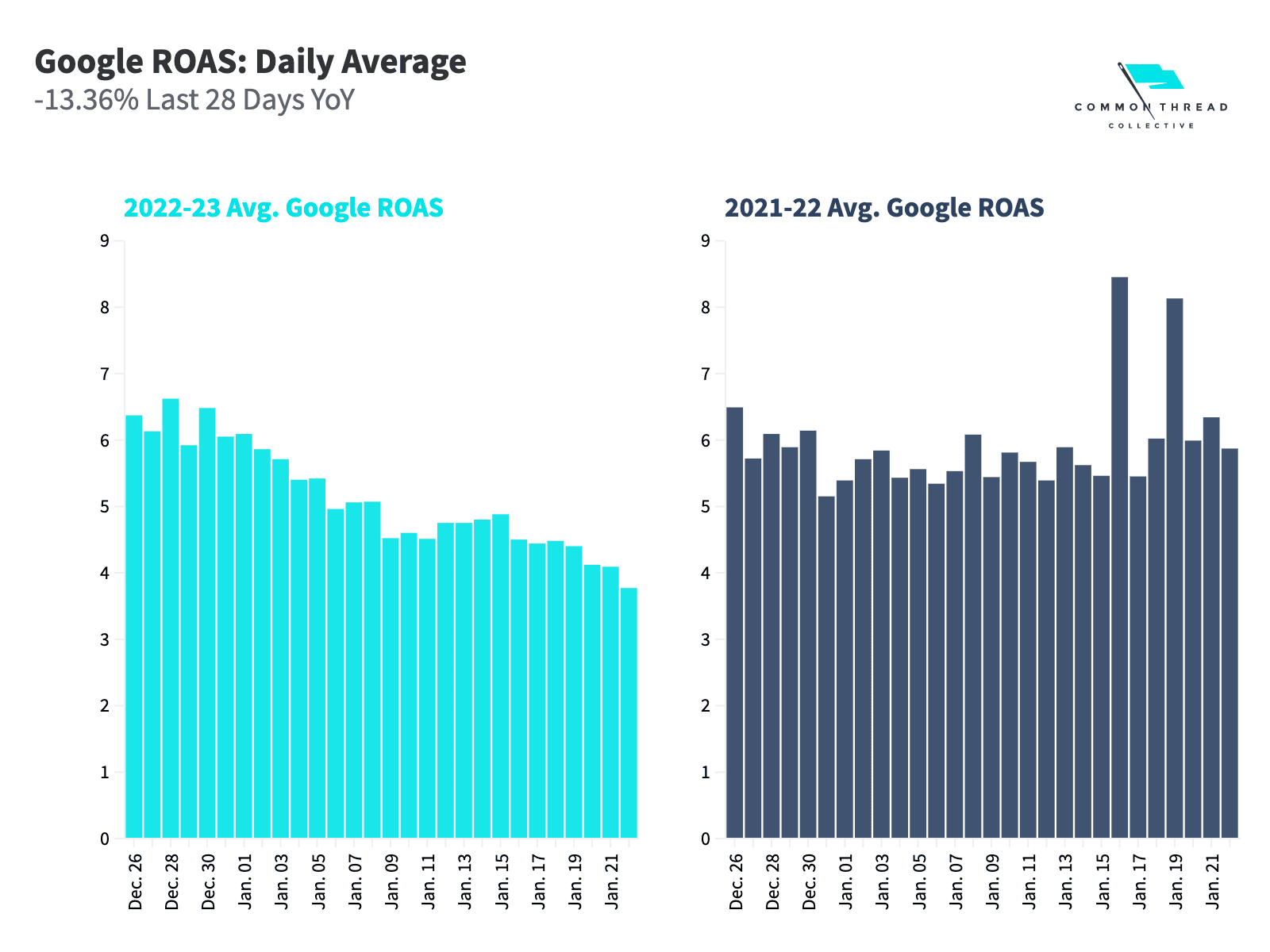

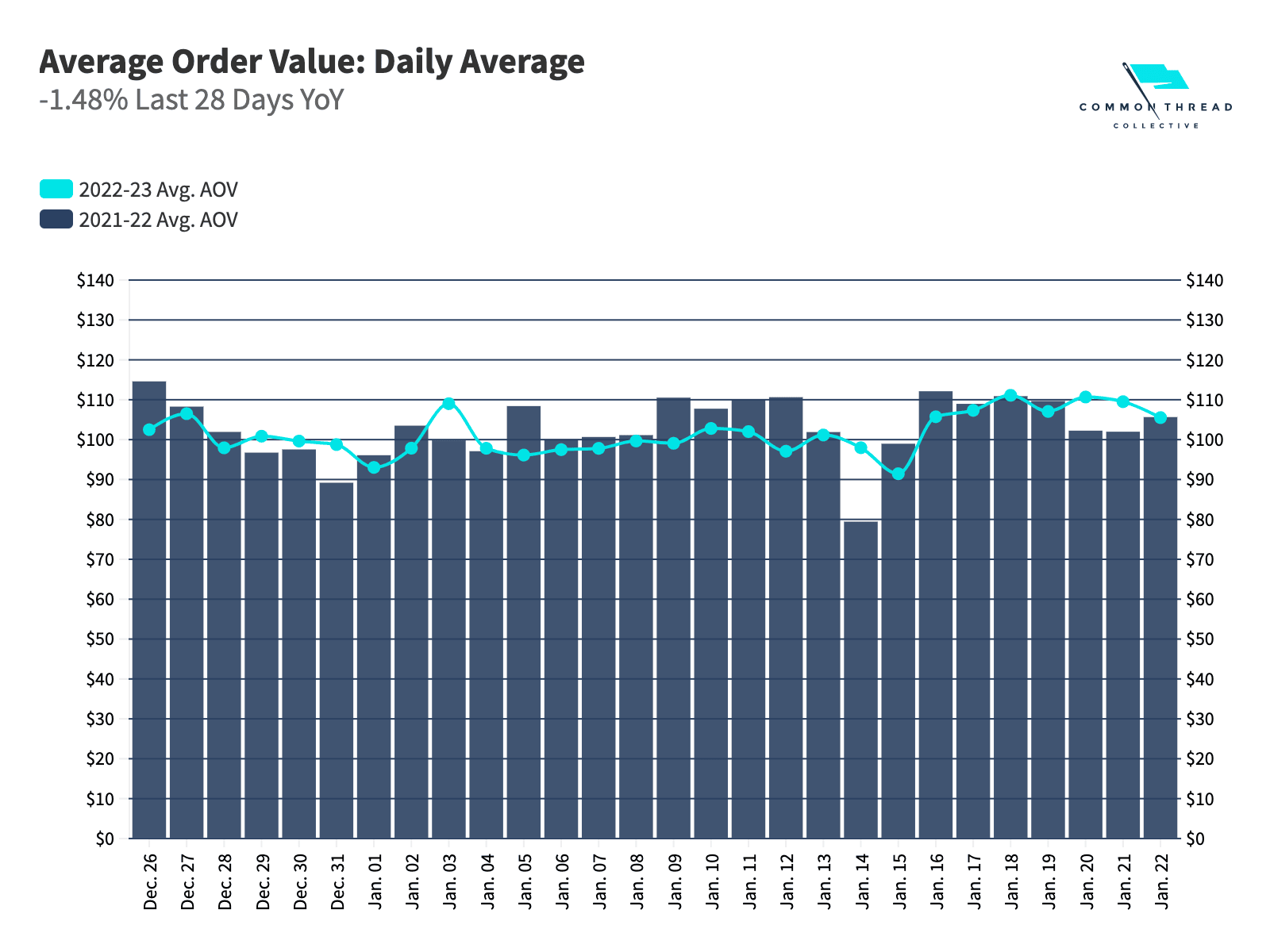

Comparing daily averages for the last four weeks year-over-year (YoY) …

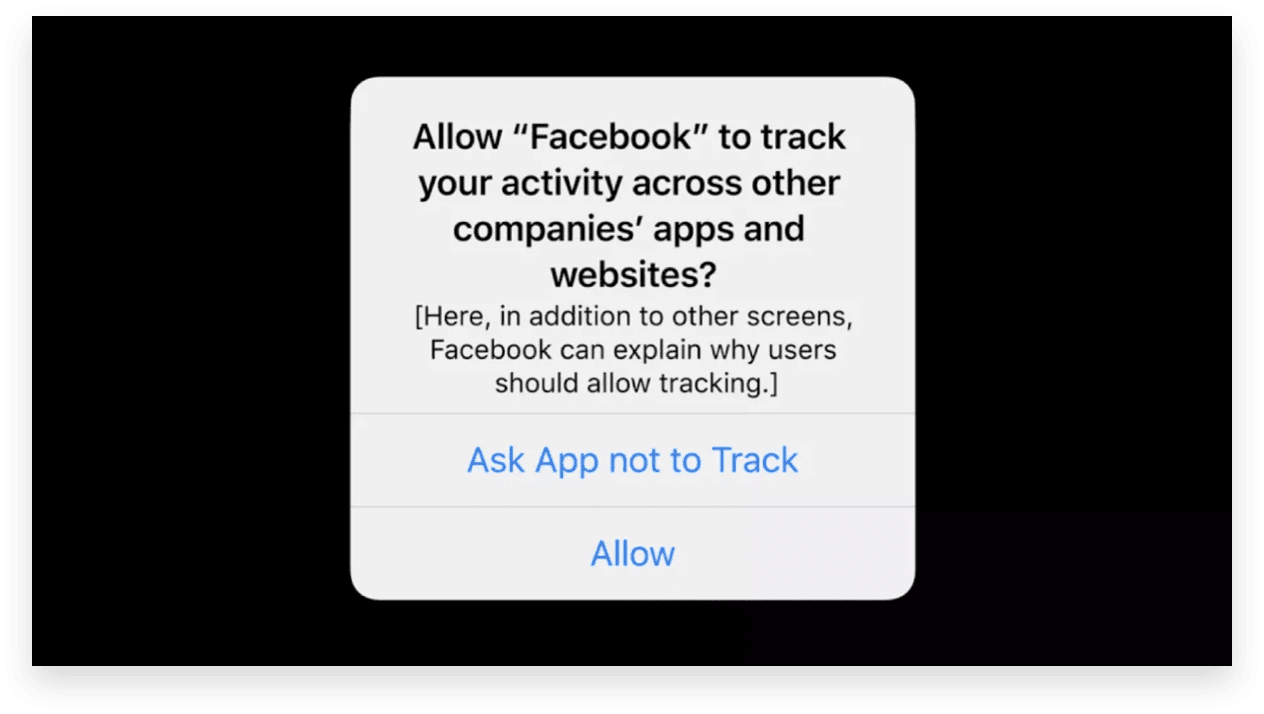

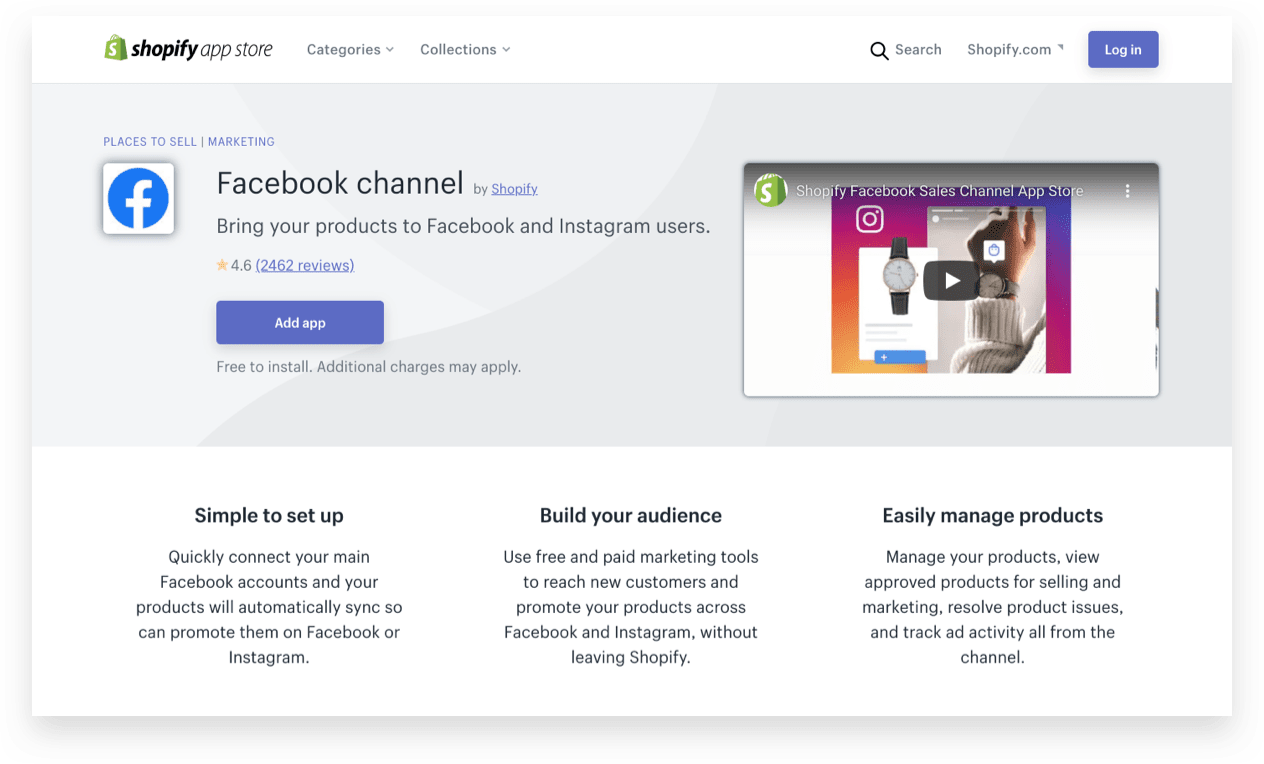

As of early May, Apple users on all mobile devices are receiving the App Tracking Transparency (ATT) Prompt — giving them the choice to opt-in or opt-out of data tracking.

Before this update, the Pixel could directly connect Facebook users’ app-to-onsite activity — in other words, actions on Facebook with actions on a business’s website.

Now, Facebook’s data, attribution, and tracking will be severely limited.

![]()

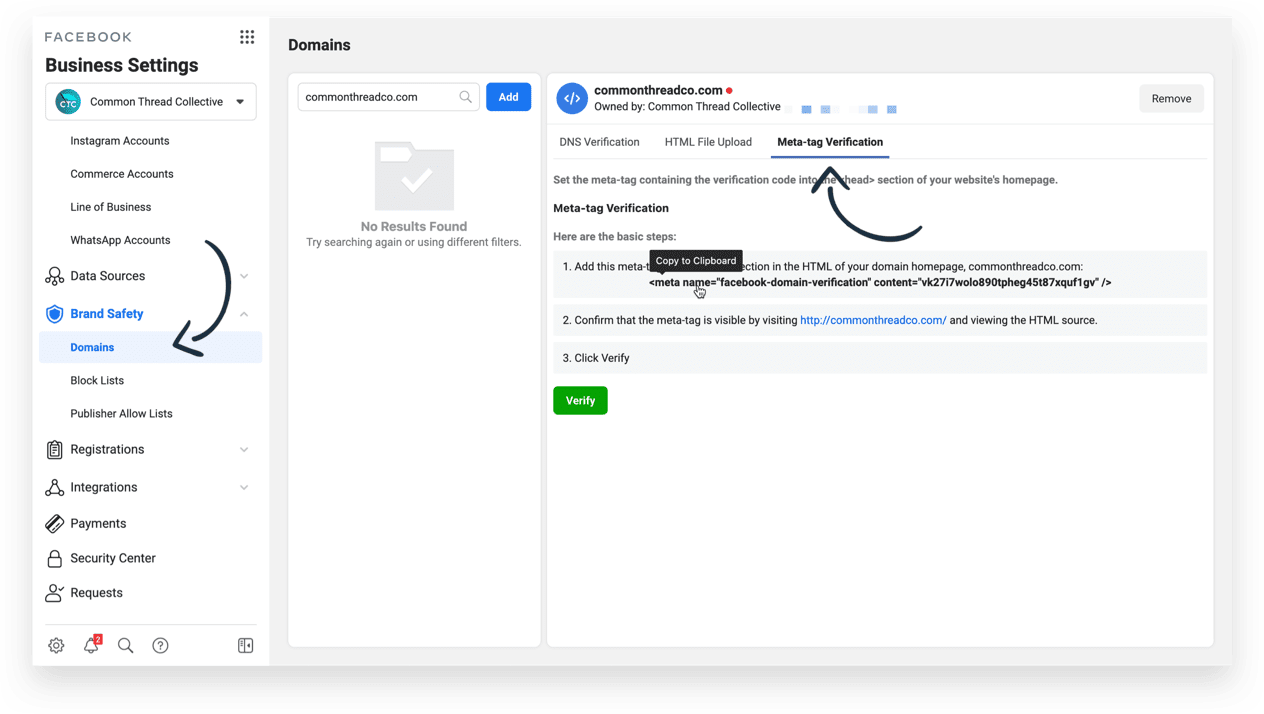

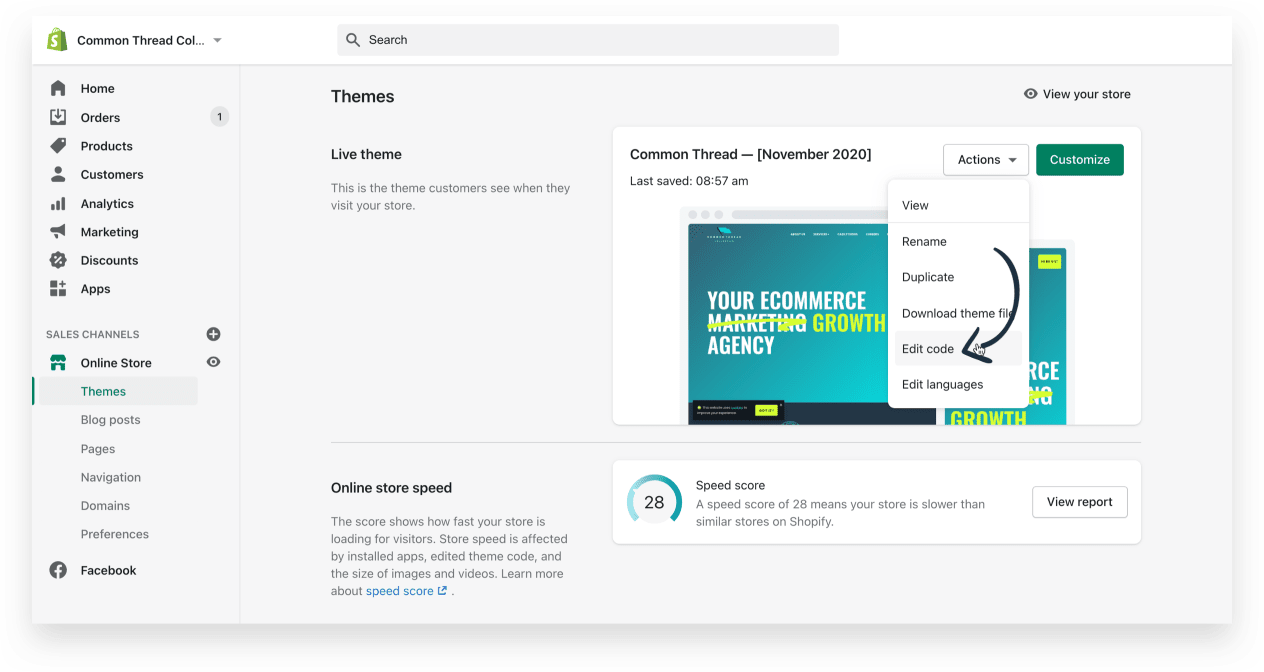

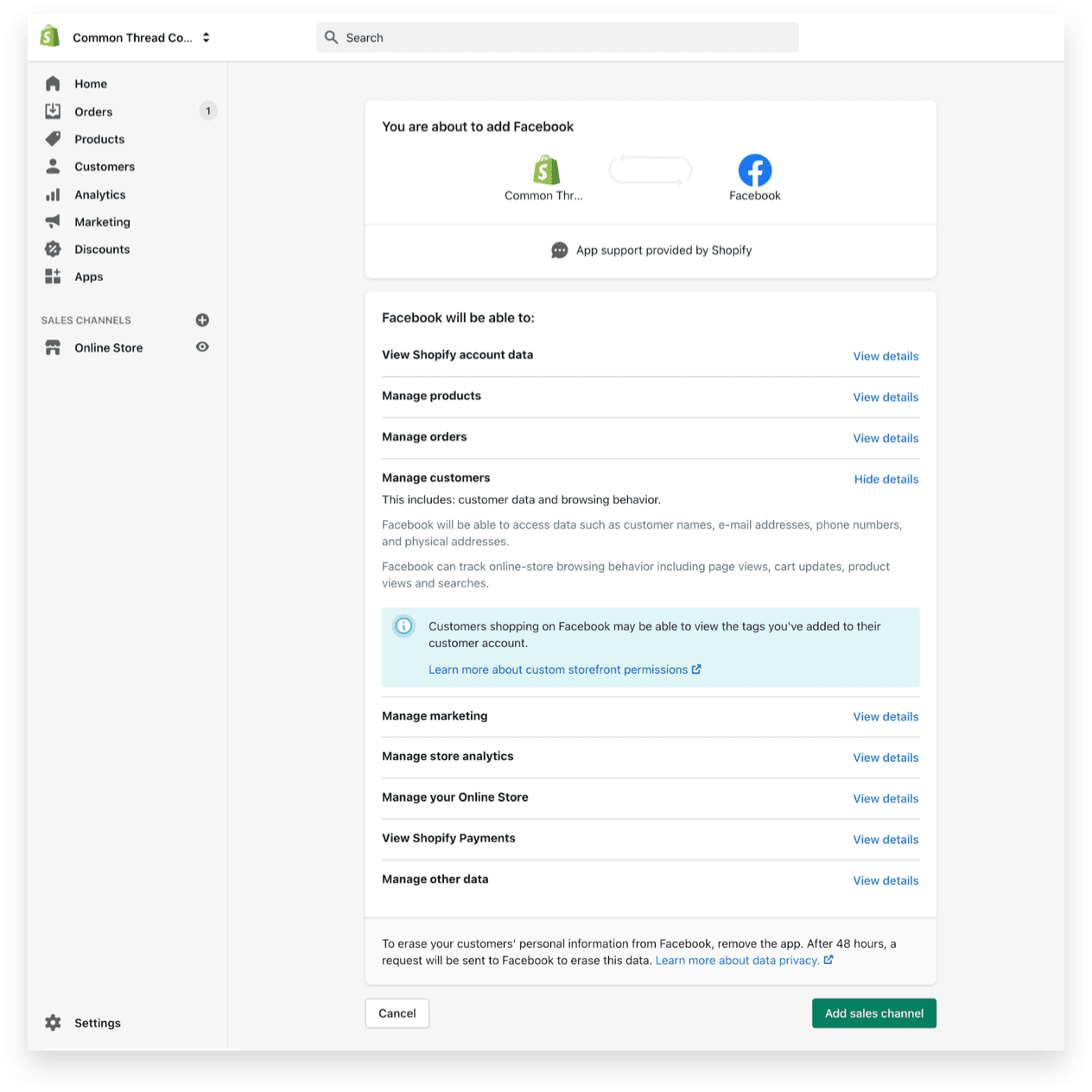

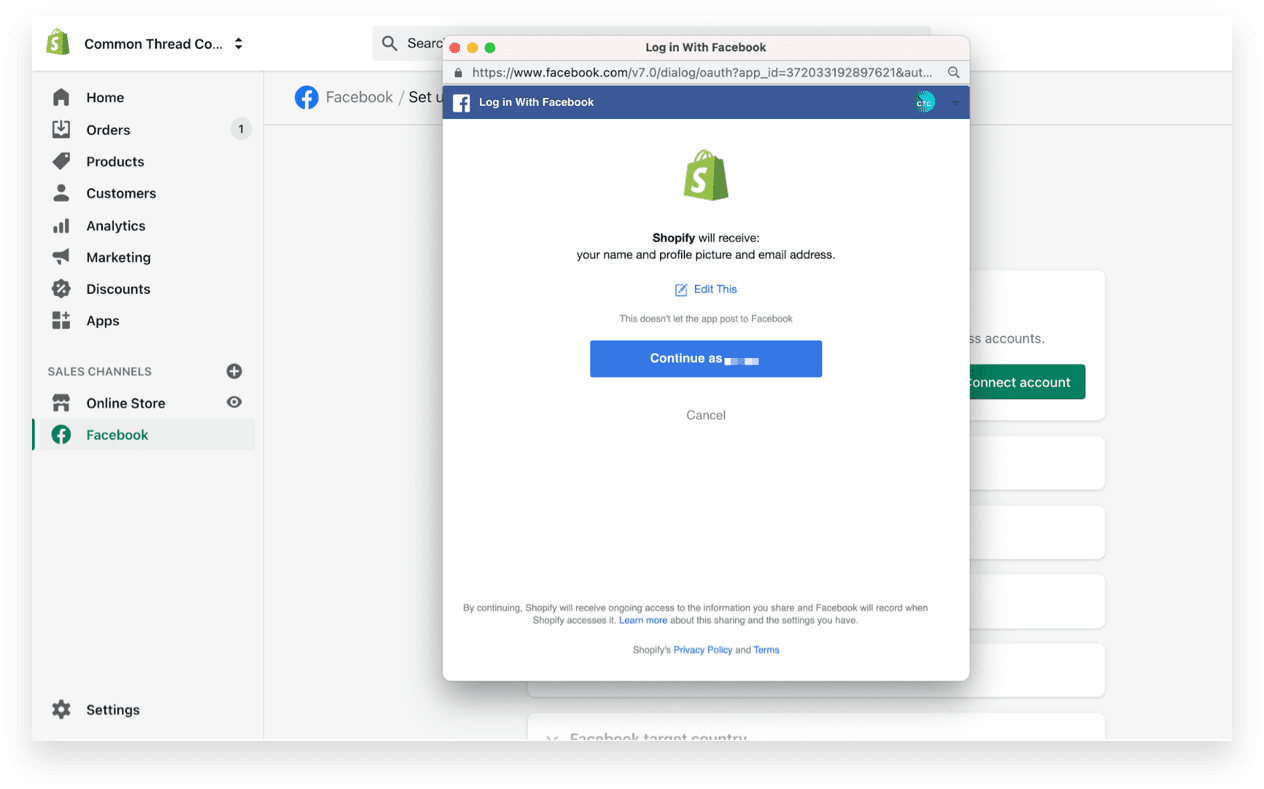

Verifying your domain is the first, most-immediate, and most-pressing step.

It’s so critical, I created a video walkthrough on exactly how to go through the verification process yourself:

Two notes about error messages …

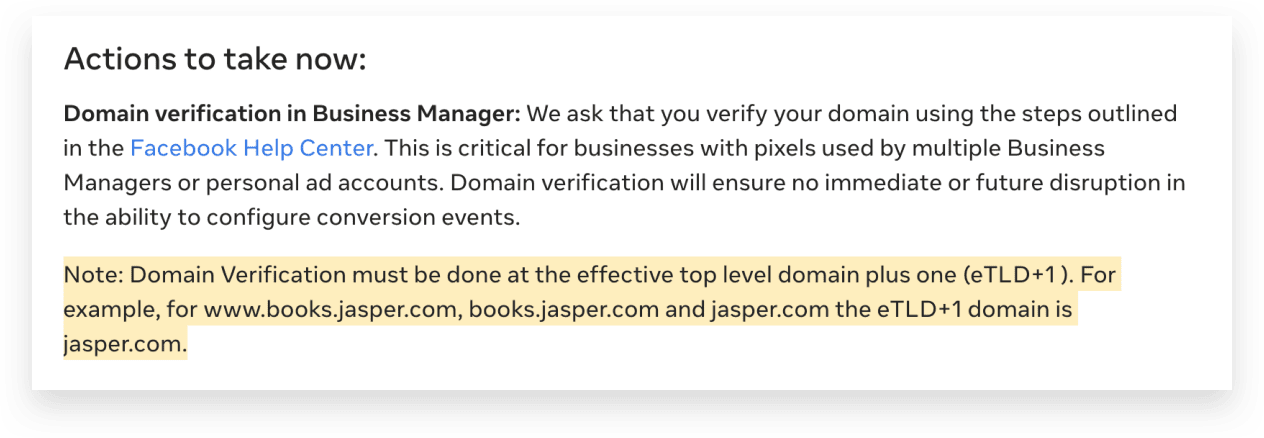

First, if you don’t use the Meta-tag method inside Shopify and verification fails, ensure that you’ve set it “at the effective top level domain plus one (eTLD+1 ).”

Second, you might also get an error related to your Facebook Pixel. For now, you can ignore this message as the rollover to Event Manager and Business Manager continue. For our own sites, this error resolved itself with a day of verifying.

![]()

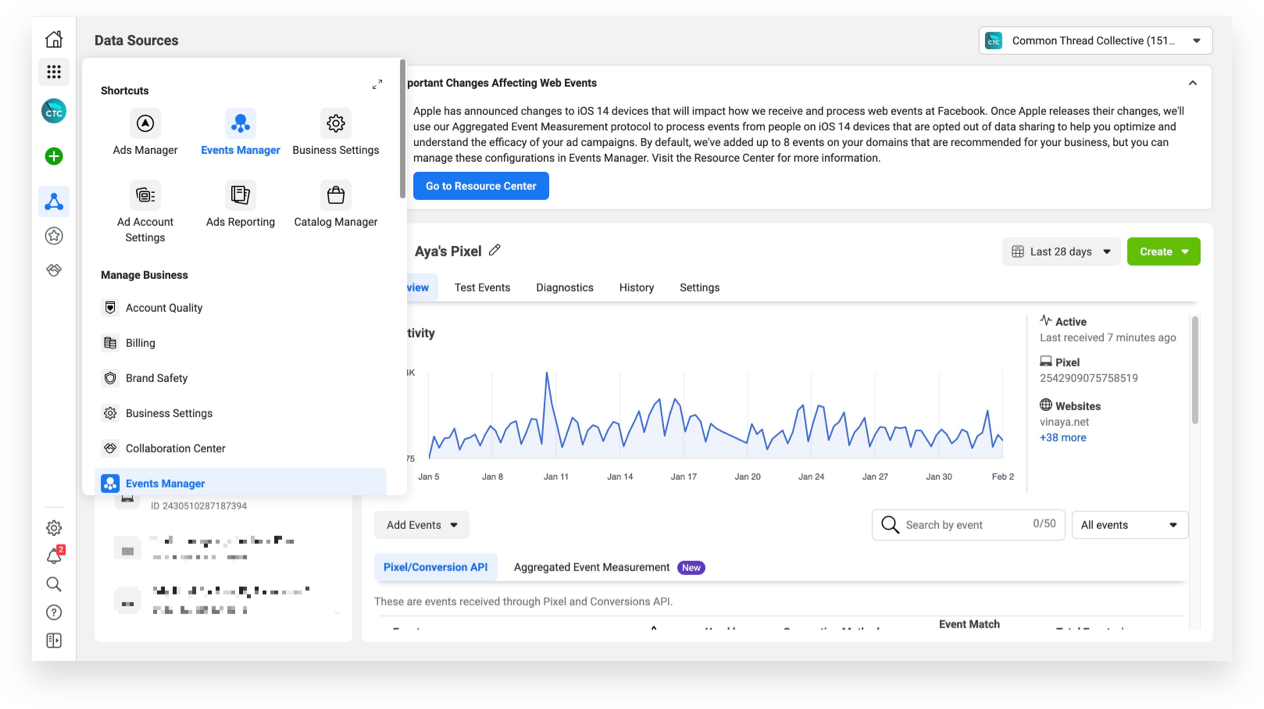

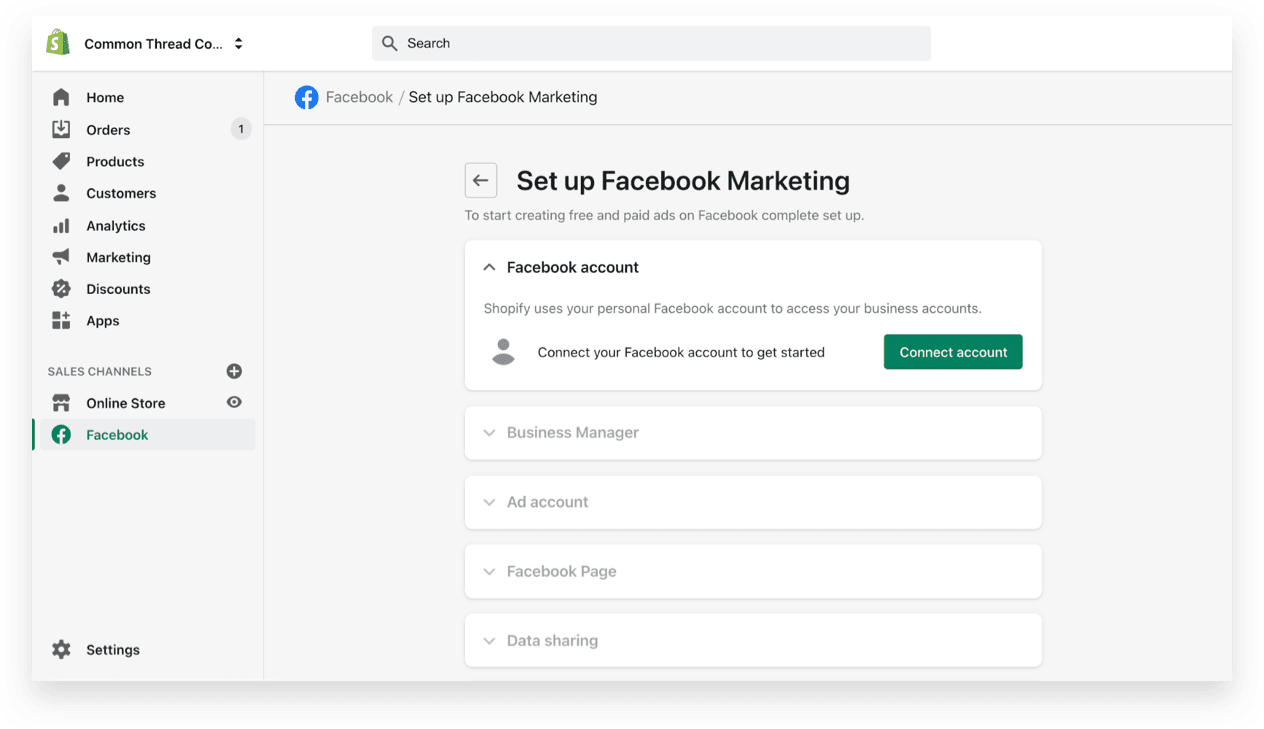

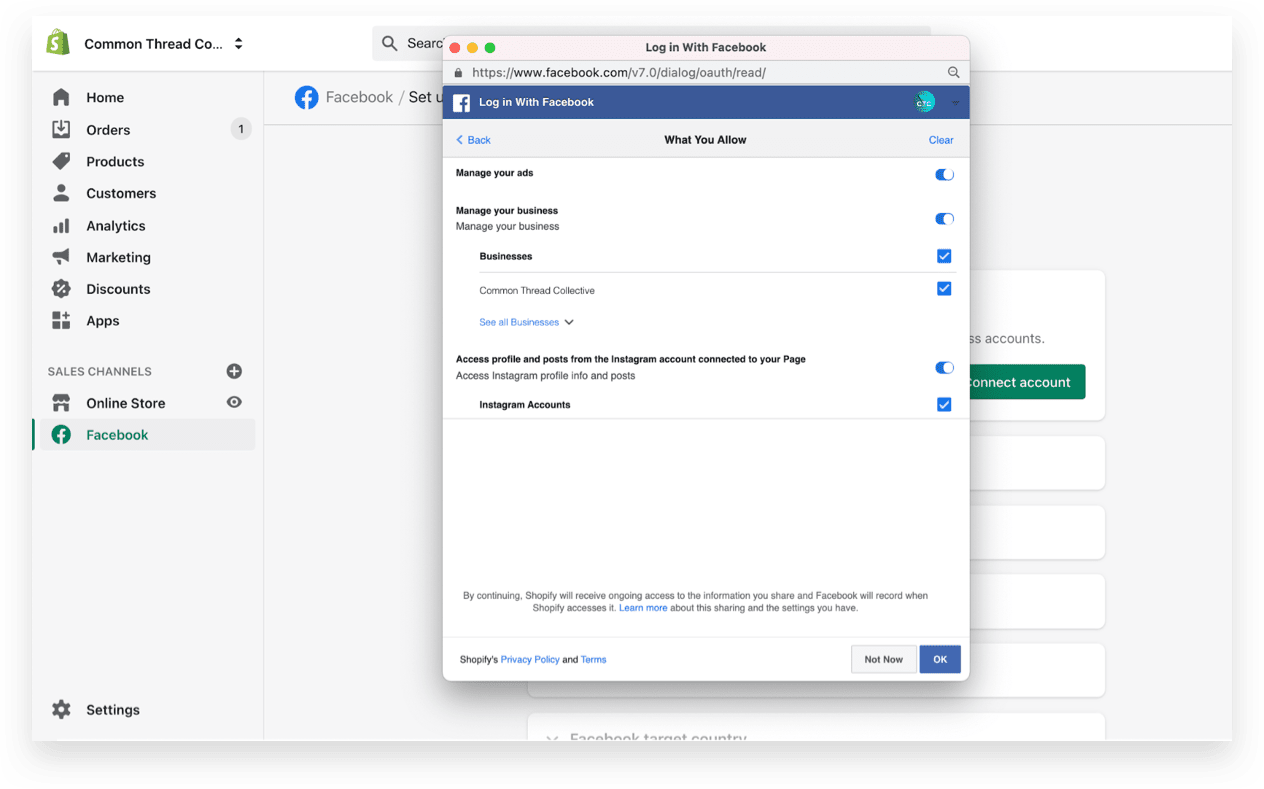

In total, Facebook will be limited to eight conversion events for each domain. Those events will be ranked manually within Ads Manager: that is, prioritized for tracking and optimization.

For users that opt-out of ATT, Facebook can only track the highest priority event. Even for users that opt-in, you’ll still be limited to eight.

Here’s how to configure your Aggregated Events Management …

Lastly, ensure your product catalog feed for DPAs (Dynamic Product Ads) is set-up correctly and prepare for management through one conversion event per catalog.

![]()

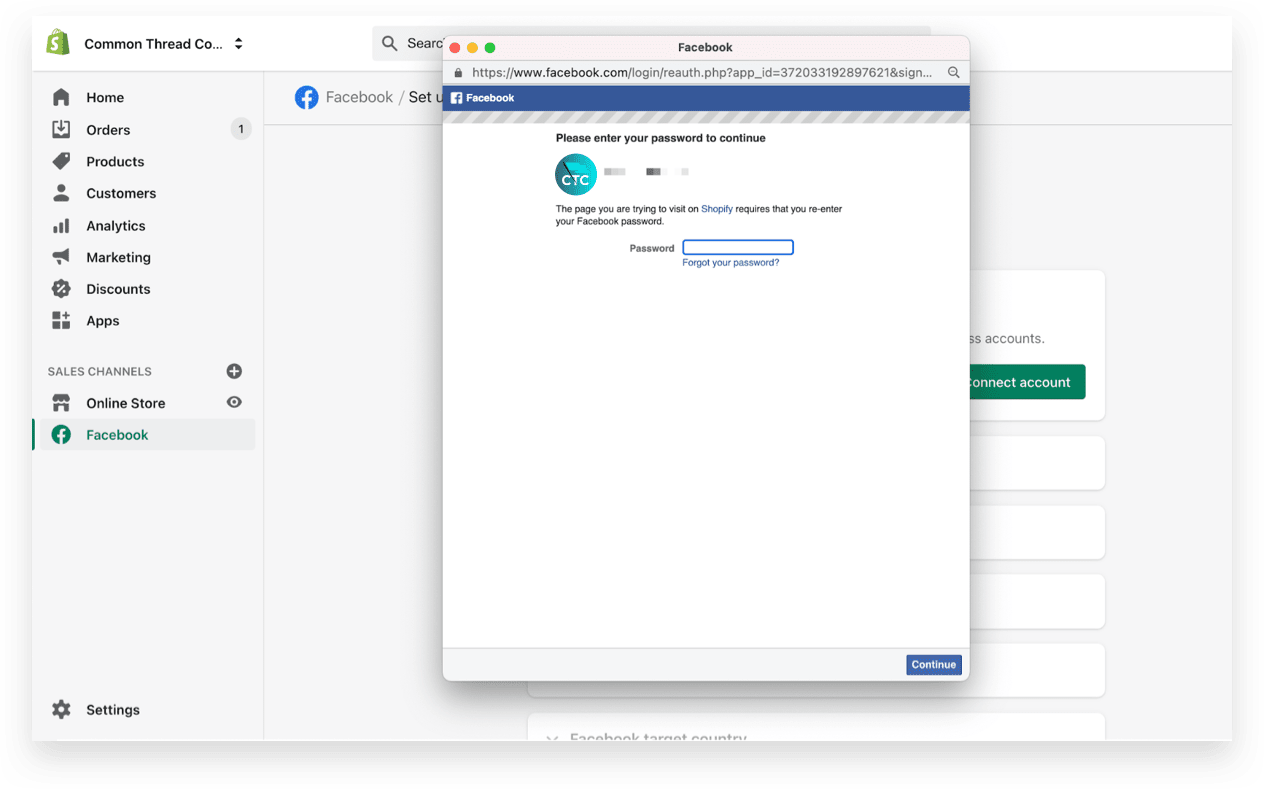

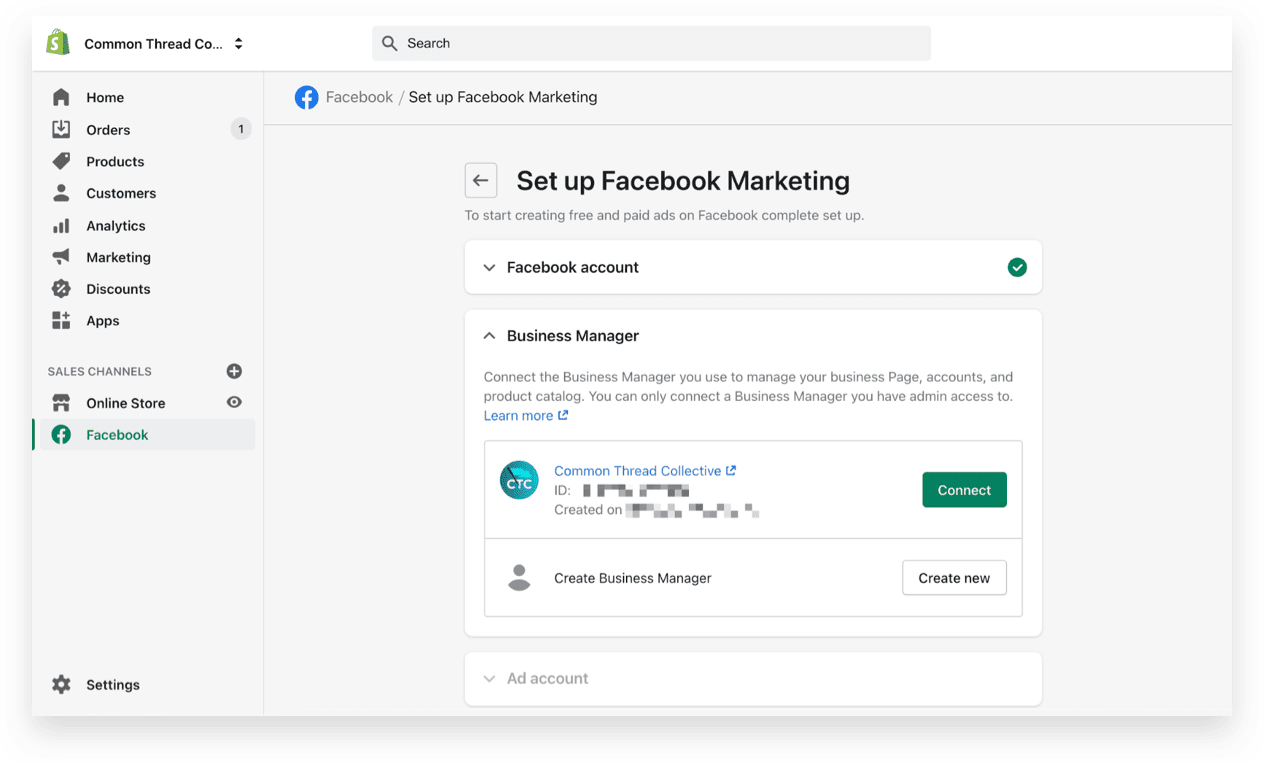

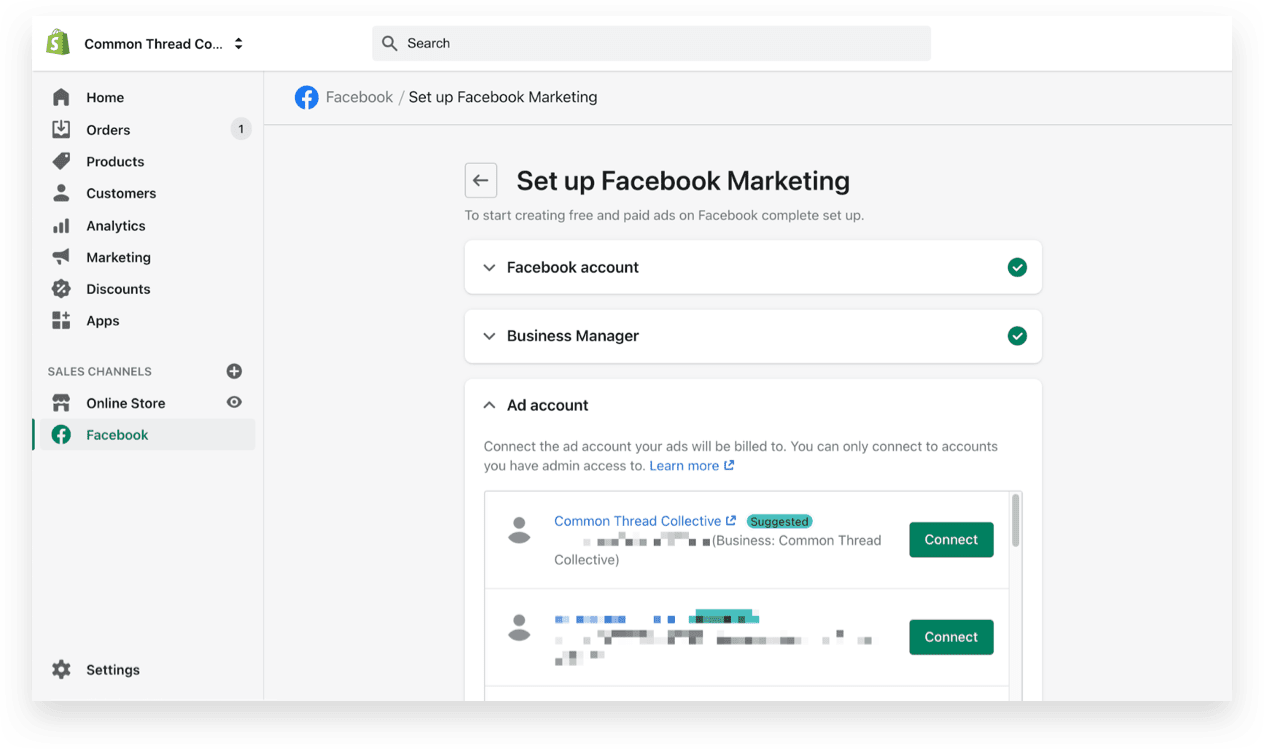

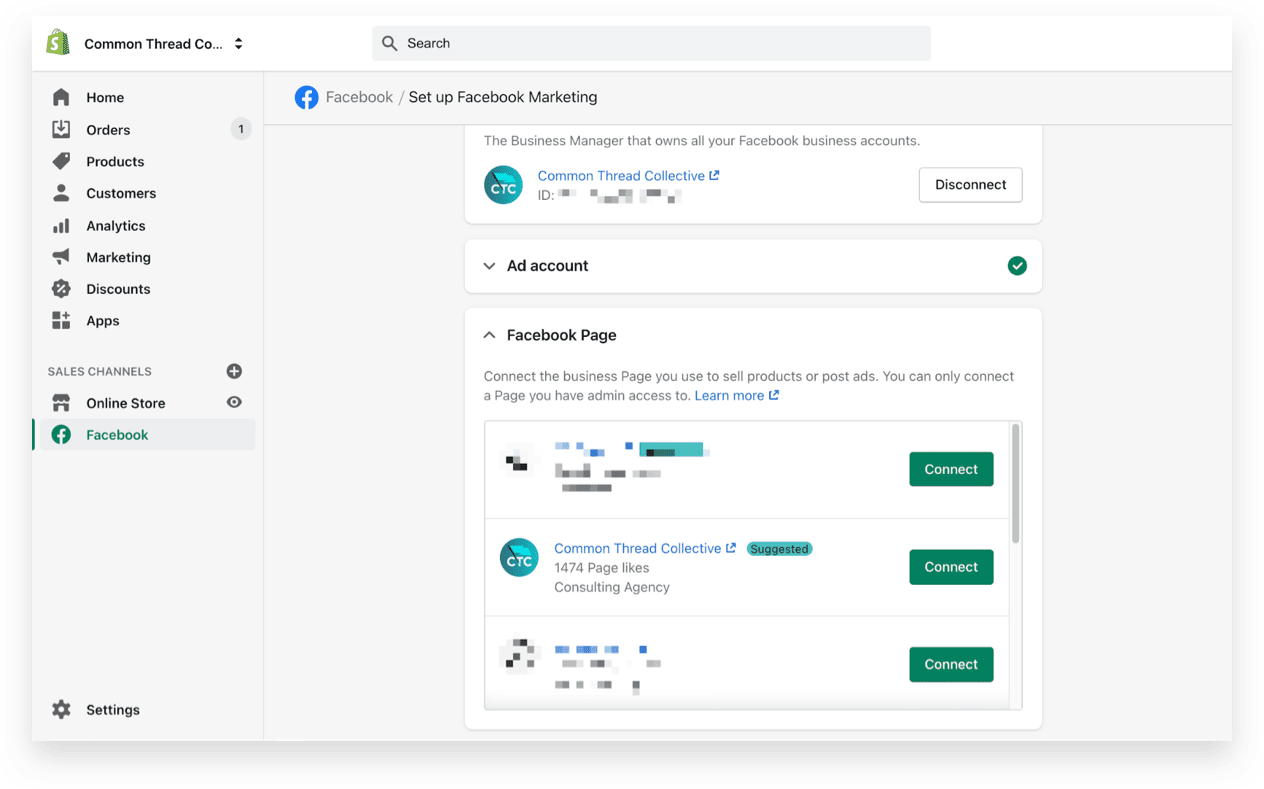

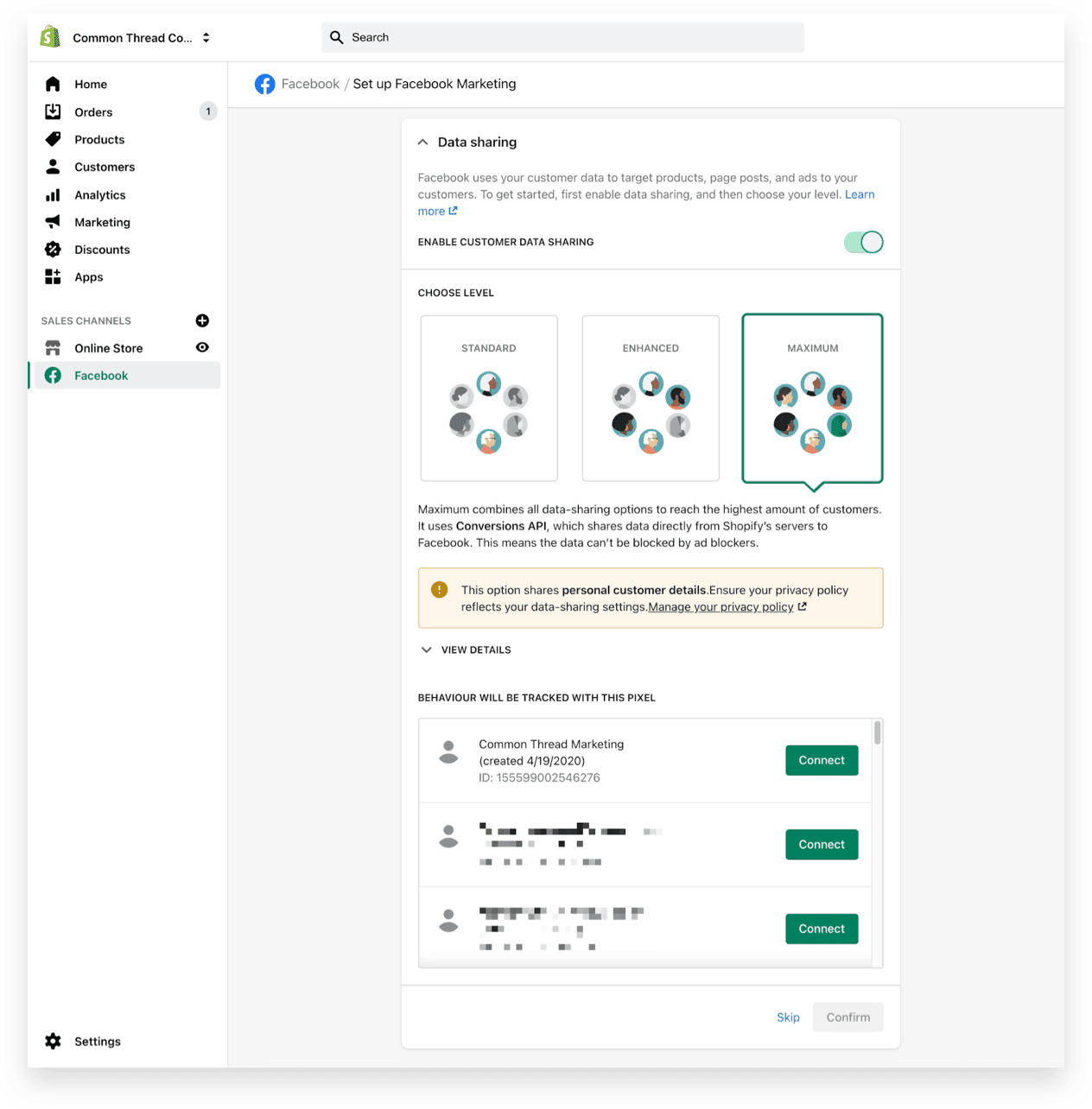

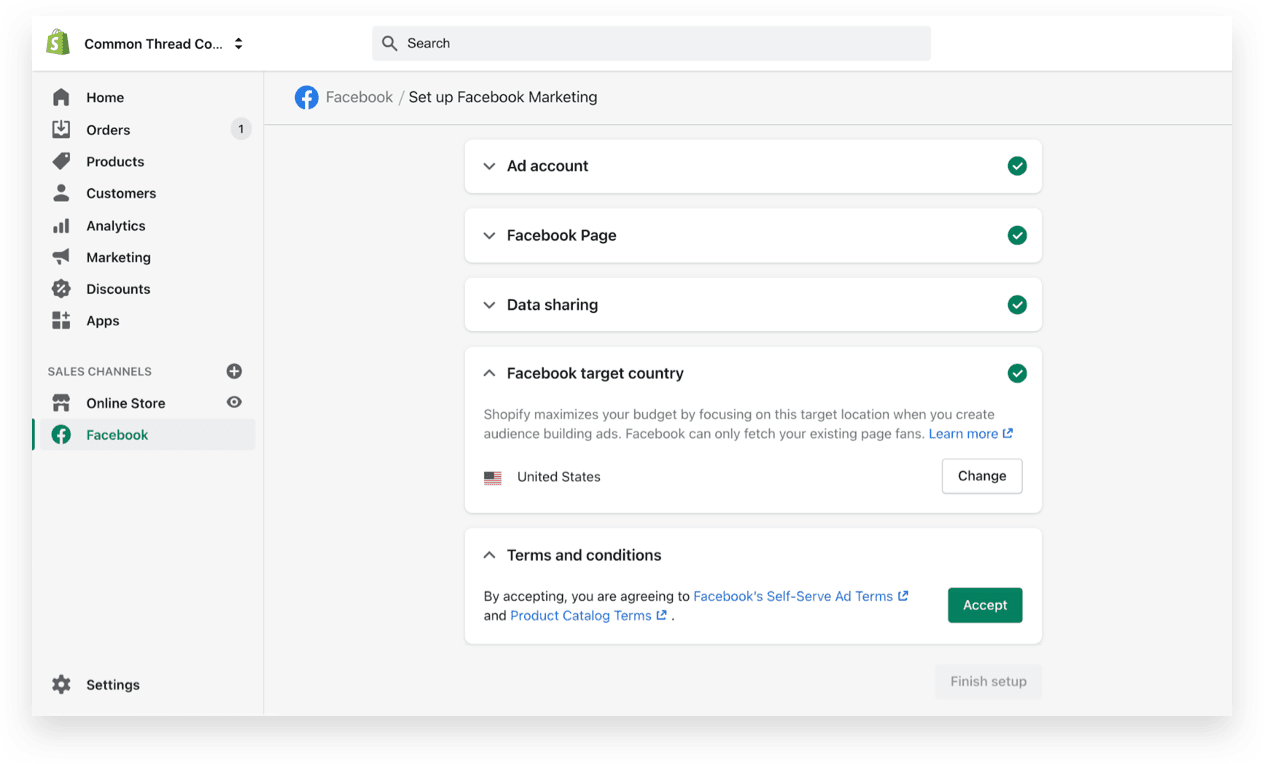

Through the remaining drop-downs, connect your …

Validate your setup by …

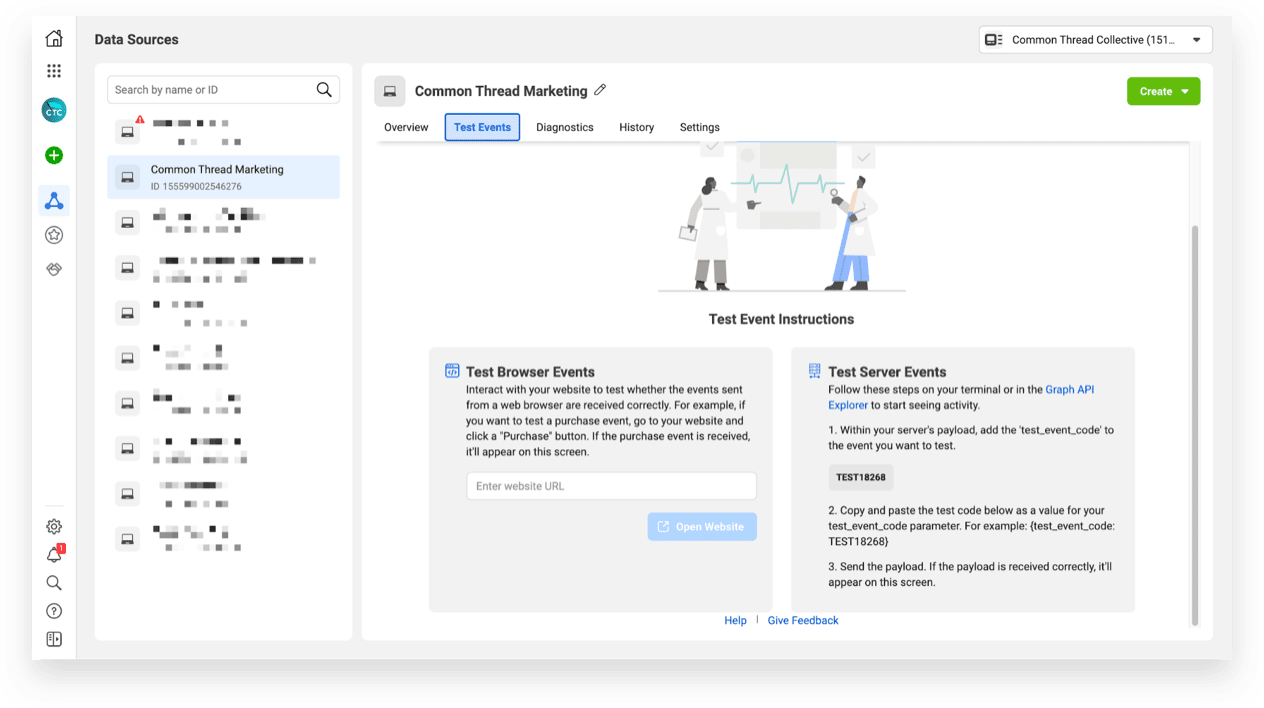

Option one: running a test within Facebook’s Data Sources > Test Events > Test Server Events.

Option two: monitoring Purchase activity within the Overview.

There are no negative effects to adding the Shopify Conversions API. It will be deduped (de-duplicated) with your regular pixel events and not cause any over reporting. It will simply provide a “lift” in purchase events that we wouldn’t normally see because of ad blockers.

Already, the ecommerce world was preparing for the end of Facebook’s 28-day attribution window. iOS 14 has pressed home the need to collect, store, and evaluate existing data all the more.

To understand the historical impact of your ads, you’ll need to use a program like Supermetics to import 1-day, 7-day, and 28-day campaign performance into a Google Sheet. Note: This will only apply to pre-iOS-14 time periods and you can no longer access that data directly through Ads Manager’s breakdown.

In addition, you’ll need to anchor that data in a source unaffected by Facebook’s changes. We’ve chosen Google Analytics’ last-click attribution.

Google Analytics data does not rely on Facebook’s new attribution window and ads tracking. However — because Google Analytics can only measure last-click by UTMs — you’ll see lower ROAS than Facebook’s previous 28-day default.

To adjust targets, we’ve pulled month-by-month 2020 data from Google Analytics and Facebook for all of our clients as well as our in-house brands.

To help you do the same, we’ve replicated that template and created a video tutorial …

We’ve covered diversification before. Always with a warning.

Typically, what ecommerce owners and marketers mean is: “Let’s find a channel that generates the same or better returns than Facebook and Instagram at the same or better volume.”

To be blunt, such channels don’t exist.

For years, Facebook’s Pixel has sat on virtually every ecommerce storefront online. That data is Facebook’s moat. Not monthly active users, not usage time, not ad creative; data.

iOS 14’s privacy update may finally signal an end to Facebook’s hegemony.

That doesn’t mean a wholesale shift in customer acquisition costs. It does mean the dog days of customer retention, Google, and DTC’s hesitancy toward Amazon are over.

In anticipation of mounting third-party data restrictions …

First, the almighty email just got a whole hell of a lot more almighty. As did first-party data collection.

With retargeting audiences suffering the most, prioritize onsite contact capture (pop-ups), ecommerce email marketing, and customer lifetime value. Community cannot be a buzzword but instead should connect your brand to social causes your customers care about.

Second, demand-generating opportunities on Google — including Google Shopping, Google Ads, and YouTube prospecting — must be as aggressively pursued as demand capture.

The same can be said for other ad platforms, though none are immune from the challenges iOS 14 (see Pinterest, Snap, and TikTok’s statements on Apple’s IDFA Guidelines in the resource at the end of this article).

Third, knee-jerk reticence toward Amazon ought to be reevaluated by DTC operators.

And Google. And email. https://t.co/MyFgZnZHY4

— Common Thread Collective (@CommnThreadCo) December 17, 2020

As we look to the future, we’ve set our sights on answering a handful of questions.

As always, we’ll share our learning as it develops.

Be sure to check back on this article or sign up to get weekly data drops on every metric. That’ll add you to our data-only email list (so you won’t miss a single update).

In the end, the final protection comes from the nature of Facebook and the nature of humans.

Driven by supply-and-demand — if performance dwindles, so does price. The system itself is built to require equilibrium.

Less success translates into less spend. Less spend, lower CPMs. Lower CPMs, lower cost per acquisition. And lower costs should drive the platform back into balance.

Visibility could certainly suffer, especially visibility within Facebook Ads Manager. But, Facebook reporting is not the end-all, be-all of your business. At least, it shouldn’t be.

Are these uncertain times? Yes. Is the sky falling? No.

(After all, despite the challenges, people with iPhones are still using Facebook and Instagram, still shopping, and still buying. No prompt, no missing data, will change fundamental human behaviors.)

Interested in the history and technical side? Keep reading, we have you covered …

Just when 2020 seemed put to bed — and 2021’s ecommerce future beamed bright — enter … back-to-back days of full-page ads from the world’s sixth-most-valuable company targeting the third-most-valuable:

For ecommerce businesses whose growth strategies hinge on direct-to-consumer relationships, the crux of the matter isn’t so much politics and PR; but rather, performance.

If we’re tracking correctly (pun intended), iOS 14’s new privacy policy will dramatically affect app developers’ ability to measure and monetize advertising strategies as well as “those that optimize, target, and report on web events.”

How severely this will impact the Facebook Pixel remains to be seen. Especially the relationship between in-app activity on iOS devices and onsite activity by shoppers.

In short, the controversy surrounds three acronyms:

First, Identifier for Advertisers (IDFA) is a unique Apple ID assigned to every device that persists across a user’s applications. On Android devices, it’s known as the Google Play Services ID (GPS ADID). Both are brand-specific subsets of MAIDs (Mobile Advertising Identifiers).

Think of IDFAs as the user-to-app equivalents of cookies-to-browsers or pixels-to-shoppers. On Apple devices, IDFAs track, target, and personalize in-app advertising.

Second, SKAd Network refers to how Apple’s SDK (software development kit) — the set of tools governing how mobile apps get created, run, and managed — interacts with advertising. Once iOS 14’s privacy updates go into effect, app installs as the result of in-app advertising will be mediated by Apple’s SKAd Network.

That’s a mouthful. Luckily, it applies predominately to application developers and not ecommerce or social-media advertisers.

Moving forward, the SKAd Network will provide click-through attribution for Publisher ID, Campaign ID, and Conversion Value (set by the advertiser). It will exclude view-through attribution for apps as well as click-through attribution for browser, email, and non-in-app ads.

As a result, Facebook will have significantly less insight into the apps its audience installs and runs. By extension, so will business owners and marketers.

Third, App Tracking Transparency (ATT) — or, “AppTrackingTransparency Framework” — is a new and universal prompt that will appear on all apps to all iOS users.

For ecommerce business, ATT lies at the heart of the issue.

![]()

Apple’s “User Privacy & Data”

Examples of tracking include, but are not limited to:

The following use cases are not considered conversion tracking, and do not require user permission through the AppTrackingTransparency framework:

We believe users should have the choice over the data that is being collected about them and how it’s used. Facebook can continue to track users across apps and websites as before, App Tracking Transparency in iOS 14 will just require that they ask for your permission first. pic.twitter.com/UnnAONZ61I

— Tim Cook (@tim_cook) December 17, 2020

In late Apr., iOS Apps that collect data for “personalized advertising” began displaying Apple’s ATT prompt. This is an additional layer of privacy atop the current settings:

![]()

When a similar prompt was introduced by iOS 13 regarding geographic information, opt-in rates to allow sharing “with apps when they’re not in use” plummeted from 100% to below 50%.

Facebook’s statements reflect similar projections: “In testing we’ve seen more than a 50% drop in Audience Network publisher revenue”; and, “Our studies show, without personalized ads powered by their own data, small businesses could see a cut of over 60% of website sales from ads.”

In context, it’s crucial to point out that Facebook’s figures are preliminary estimates that may mix ecommerce with SDK implications (i.e., app revenue).

Equally unknown, is how hyperbolic Facebook is being to drum up fear in a PR war to make Apple the enemy.

We won't send spam. Unsubscribe at any time.

27 Key Metrics, Updated Weekly

From store CAC to Facebook ROAS, the DTC Index contains charts tracking year-over-year data points from all parts of the funnel.

Subscribe Now