Most articles on a customer’s lifetime value talk about formulas.

Some deal with “best practices.”

A mere handful explore the relationship between customer acquisition costs and lifetime value: what’s known as the LTV:CAC ratio.

None, however, take into account this uncomfortable reality …

Your ecommerce business might die before realizing your customer’s “lifetime” value.

In this article, we won’t teach you how to calculate the LTV. At least not by traditional definitions. Neither will you get an LTV calculator.

We’re not even going to talk that much about average order value, beyond the first purchase.

Instead, we’ll show you a new way to use hard data to engender trust, customer loyalty, and profit.

Even better, we’ll use Bambu Earth, Common Thread Collective’s 12-year-old skincare brand, as a real-life example alongside each lesson. Find out exactly how we grew our email list from 6k to over 230k, achieved six straight months of 16% compounding month-over-month growth, and increased our aMER by 61% year-over-year.

Here’s the path we’ll take ...

- Why Customer Lifetime Value Can Be Deadly

- What a ‘Cash Multiplier’ Can Do for Retention

- Why Your CM:CAC Should Be Your New LTV:CAC

- How to Measure Your New LTV, Cohort by Cohort

- Cash Multiplier for Business Decisions: LTV into Action

Want even more tactical guidance?

You’re in luck. To help you accelerate LTV, we’ve assembled 10 ecommerce retention strategies that don’t take a “lifetime.”

This guide draws on lessons not only from Bambu Earth but also from across the DTC world:

Why Customer Lifetime Value (LTV) Can Be a Deadly Ecommerce Metric

Most operators rely on paid acquisition to drive new growth.

Then, tack on retention strategies — like email marketing and loyalty programs — hoping to realize the lifetime value of that customer.

Unfortunately, as the cost of acquisition on platforms like Facebook and Google continue to increase, it’s no longer feasible to turn a profit that way. Regardless of your return on ad spend (ROAS).

You can’t rely on the same old formulas to grow your business.

Four quick definitions …

Customer lifetime value (LTV, CLTV, or CLV): Revenue value over the course of an average customer lifespan — i.e., future cash flows over his or her entire relationship with the company.

Churn: Absolute number or percentage of customers (churn rate) who stop reordering; the inverse of returning customers.

Customer acquisition costs (CAC): Total amount it costs to acquire an average customer, including agency fees.

Cash multiplier (CM): Revenue value of specific customer segments over limited time frames — payback windows — adjusted for sources and entry points.

At Bambu Earth, we have customers that have been with us from the beginning. They’re worth thousands of dollars, spread out over 50+ orders.

Given that loyal base, you might be tempted to think we celebrate and optimize heavily for LTV. We don’t. Not the way most brands think about it anyway.

Why not?

Because LTV is a hyper-inflated vanity metric. Useless to us — and to you. Worse, it isn’t indicative of anything actionable.

Sure, knowing your LTV tells you that people are coming back.

But it doesn’t help you figure out the average time between purchases or which SKUs attract the highest-value shoppers.

It doesn’t even help determine cost caps for Facebook ads.

For LTV to be actionable, you need to know how quickly you obtain that value over a certain time period.

You can’t wait a decade — nor a tenth of that time. In ecommerce, cash is king.

Here’s the secret: know the actual time intervals at which you acquire each dollar that makes up your LTV. Only then can you increase the rate at which you acquire that value to steepen that curve.

The latter is where post-purchase email marketing, upsells, and cross-sells come in.

To do this, you need a time-bound, governing metric that you can use in place of LTV.

Introducing: the cash multiplier.

What a ‘Cash Multiplier’ Can Do for Your Ecommerce Customer Retention

On the surface, the cash multiplier doesn’t look that different from LTV.

Functionally, it’s your 60-day LTV. But unlike LTV, you can surgically tailor it to your specific business.

For starters, the actual time period varies depending on repurchase rates.

The ideal number doesn’t exist. It could be 30, 60, 90, or even 120 days …

As long as it gives you as much time as possible to win your customer over to a second or third purchase while taking cash-flow needs into account.

When a customer buys from you, you need to know the lag time between their first and second purchases. This will help you plan out a post-purchase marketing campaign that keeps you and your brand top-of-mind.

The cash multiplier also gives you a baseline metric to know whether or not your post-purchase experiments are working.

Once you know your purchase frequency or repurchase rate, you’re aware of the time horizon you can work with. Now you know how long you can afford to wait and nurture your best customers.

You also know how long to wait before you send that upsell email.

Finally, optimizing your cash multiplier lets you ask (and answer!) thorny cause-and-effect questions, like:

- Based on when and which products a customer purchases, how much are they worth to my brand?

- When will they make their second and third purchases?

- How can we cut down the time between the first and second purchases (and beyond)?

For example, of the top ten products sold by Bambu Earth last year, only two are mini kits.

And yet, of the top-ten LTV generating products … eight are mini kits.

When we first noticed this discrepancy in August 2019, it revealed an intriguing possibility.

Our ad account was struggling, and we were finding it impossible to win on first-order CAC. But if we started running ads to the mini kits, that same poor CAC could transform from a major first-order loss to a net-positive outcome over the next 60 days.

That’s because people who bought mini kits — a low-AOV, small-format skincare sampler — came back in droves to repurchase the larger versions of their favorite products.

We shifted our Facebook strategy drastically. But, here’s the twist: ROAS did not improve. Revenue did.

In the 12 months before the shift, we were making a paltry $9,980 a month on average. We loved the business, but we were preparing to shut it down.

After the shift, average monthly revenue skyrocketed to $262,358. In 2020, it jumped to $381,626. Over the last year, $446,532 … with an all-time high last month of $807,416.

The team could run a SKU-specific test like this because we knew the usual time period between repurchases (60 days).

We wouldn’t have known to use the mini kit as their hero product if we didn’t have a clear understanding of which cohort we were testing. (More on cohort analysis later.)

Armed with detailed metrics, we also set about optimizing two email flows within Klaviyo.

First up: our Post-Purchase Skin Quiz. Here are two of the top performers:

Number two: our 90-day “Post Purchase - First Purchase” sequence. Here are both those flows in total:

And as for performance …

Finally, having a cash multiplier to work with gives you a roadmap on how to hit two customer acquisition milestones:

- Run Facebook ads that are profitable on the first purchase

- Have that first purchase account for only 50% of the total LTV of that customer to your business

This is why a cash multiplier is a more valuable metric for your ecommerce business, than straight up LTV. You learn to design and build post-purchase scenarios that encourage repeat customers, independent of your CAC.

Why Your CM:CAC Should Be Your New LTV:CAC

Businesses that sustain continued growth in their cash multiplier, relative to their customer acquisition costs, display a clear signal of brand development.

Namely, an increasingly valuable relationship with their customers.

For clients as well as in-house brands, Common Thread Collective uses what’s called The Rule of 30:100 — a 30% increase in LTV within 60 days, and a 100% increase of LTV within a year.

The 100% increase in LTV within a year means that your initial average order value (AOV) is only 50% of each individual customer’s total value to your business.

The exact time periods could be different for your business.

But again, it’s about the principle of knowing your cash multiplier, and setting measurable objectives in the short- and long-term to grow your customer base, relative to that.

Imagine if you can build these growth levers into your business. Each cohort you test systematically stacks profit on to your bottom line — whether that’s based on time, SKU, or offer.

A note on negative LTV

Did you know 40% of new customer acquisition is never profitable?

We suffered from this at Bambu Earth. Running close to 30% negative five-year LTV’s for multiple years.

This year, we got it down below 1%.

How?

Using diligent cost caps in our ad accounts, we ran a tactical strategy to balance first order AOV against CAC.

Take a look a the results:

How to Calculate CM (Your New & Improved LTV) Cohort by Cohort

If you select 60 days as your ideal payback window, your CM is made up of two factors:

- Total revenue in 60 days

- Total number of customers in that cohort

It’s a simple enough formula …

To keep the math simple …

Let’s say in Month 1, your total revenue for first-time customers was $100,000. In Month 2, they bought $15,000 more. Then in Month 3 — your cut-off date for a 60-day LTV — they bought another $25,000 worth.

Your total revenue for the 60 days was $140,000. If 1,000 new customers bought during that period, you’re CM — 60-day LTV — would be $140 in total: 1.4x or 40% in additional sales.

But here’s the tricky part: What starting point do you base the cohort on? In other words, at what point in time do you start counting people?

When Does the Customer Cohort Begin?

There are four ways you can slice customer segments to figure out your CM or 60-day LTV:

- Time period

- Campaign or audience

- Discount

- SKU

These four sources for the types of customers you serve are crucial in understanding what moves the needle for your cash multiplier and what doesn’t.

Time Period

This is the traditional way to calculate LTV: month by month.

For more pointed insights, you can further group time periods by seasons or quarters. For example, take the number of people who purchased from you during Black Friday, Cyber Monday to see how much more they spend over the ensuing months.

This will help you learn whether or not your BFCM campaigns are driving quality customers to your ecommerce store.

Campaign or Audience

You can also slice your customer data by campaign or audience. For example, if you have a fitness product, you can split up each cohort by Facebook audiences. Weightlifters, Crossfitters, and cyclists all get their own cohort.

By doing this, you can compare the CM of each of these different demographics, against the CAC of their lifecycle.

Discount (Sale Event)

Another popular — but oft-spurned cohort — are the ones who come from discounts. There’s an underlying narrative, especially in premium DTC brands, that discount purchasers are less valuable.

While this is true, as with any piece of advice, there are still exceptions to the rule!

For instance, you might be selling consumables where sampling is a crucial part of your process.

At Bambu Earth, the mini kit — a discounted collection of products — actually attracts better-quality customers than full-priced single products.

So it is possible to see discount customers have a better CM to CAC ratio than full price purchasers.

We’ve experimented with more dramatic offer testing for new customer acquisition, as well:

- Complimentary gift with top seller

- Free sample of top seller over $50

- 20-30% off bundles by ad type

- 50% off a starter kit

All these offers are meant to try to dramatically change the LTV:CAC equation.

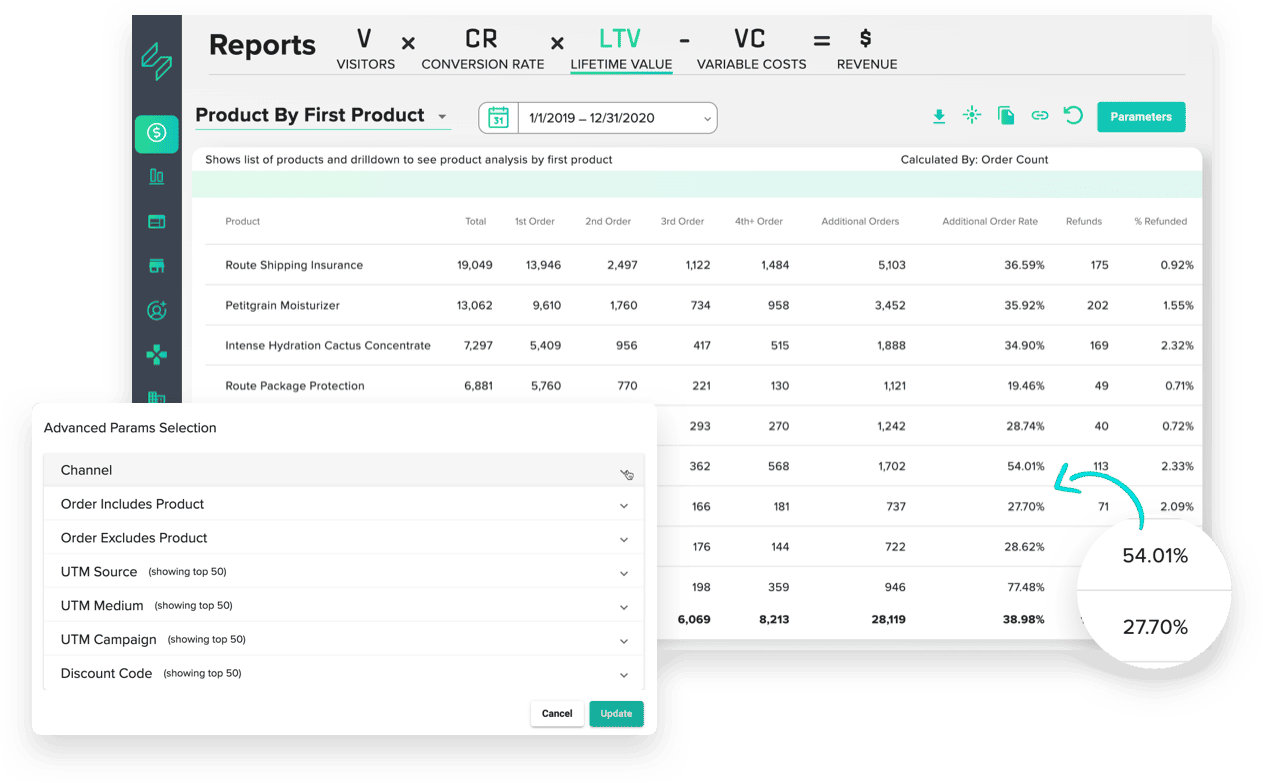

SKU by First Product Purchased

Some products or collections will attract high CM customers, and some won’t. This is why it’s important to look at the 60-day LTV, based on the first SKU they purchased.

At Bambu Earth, we tested several different SKUs until we landed on the mini kit. We tested if a customer coming in on a mini kit — a collection of five different products — would result in a higher 60-day LTV than a customer who came in from an individual moisturizer.

We found that mini kit purchasers had substantially higher value than those who bought single items.

Thanks to this knowledge, the Bambu Earth team could spend more on the CAC side because the kit has a higher AOV and LTV (CM).

Once you understand which SKU performs better than others over the same time period, you can highlight that SKU in most of your ads.

After you nail the most lucrative SKUs in your collection, you can even drill deeper to figure out which specific creative angle or product value proposition hits hardest.

Calculating 60-Day LTV Still Too Hard?

This kind of complex cohort analysis requires a lot of hacky workarounds. There’s currently no ecommerce platform on the market that lets you visualize your data the way we just laid out.

We get that. But imperfect metrics are better than none.

If accessing this data is a challenge for you, start by calculating the cost per acquisition and 60-day LTV for your entire account. We guarantee that if you focus on improving this number — even if it’s not 100% accurate — you will see your business grow and your cashflow settle down.

At 4x400 brands and for Common Thread Collective’s clients, we carefully track cohorts through Statlas, a proprietary tool we’ve developed in-house. This brings together data from Shopify, Google Analytics, recurring subscriptions (i.e., ReCharge), and paid media.

Statlas makes it possible to far more easily track payback windows based on a variety of cohorts:

- Product by first purchase

- Time of purchase (seasonality)

- Acquisition channel, campaign, or offer

Cash Multiplier for Business Decisions: Using Your New LTV

The magic no longer lies in a single-account ROAS or in your customer lifetime value. Instead, it’s about extracting value from existing customers in the short term. Enough to cover your costs and make long term plays.

The cash multiplier replaces your LTV because it gives you an actionable metric you can ratchet up and cater to specific customer segments at will.

In fact, it could very well be the most important metric in profitable ecommerce.

It’s about establishing trust, discovering the best-fit entry points, and nailing reorder timing plus tactics.

As long as your customer spends on a product and comes back within 30-90 days to buy more, you can scale your business endlessly.

We won't send spam. Unsubscribe at any time.

Cassidy Monforte is the Director of Retention at Common Thread Collective. Based in Portland, Oregon, she has spent the last nine years exploring how to use owned channels, primarily email and SMS, to improve both subscriber experience and lifetime value. Cassidy can be found on Twitter and LinkedIn talking all things food, dogs, and ecommerce.

Kohlman was the General Manager of Bambu Earth, 4x400’s poster child of a successful acquisition and turnaround. He helped guide the brand to ~30x YoY growth and magnified the founder’s mission to encourage women and challenge fear-based marketing in the beauty industry. Connect with Kohlman on Twitter or LinkedIn.