Growing your ecommerce business can come with a painful price tag.

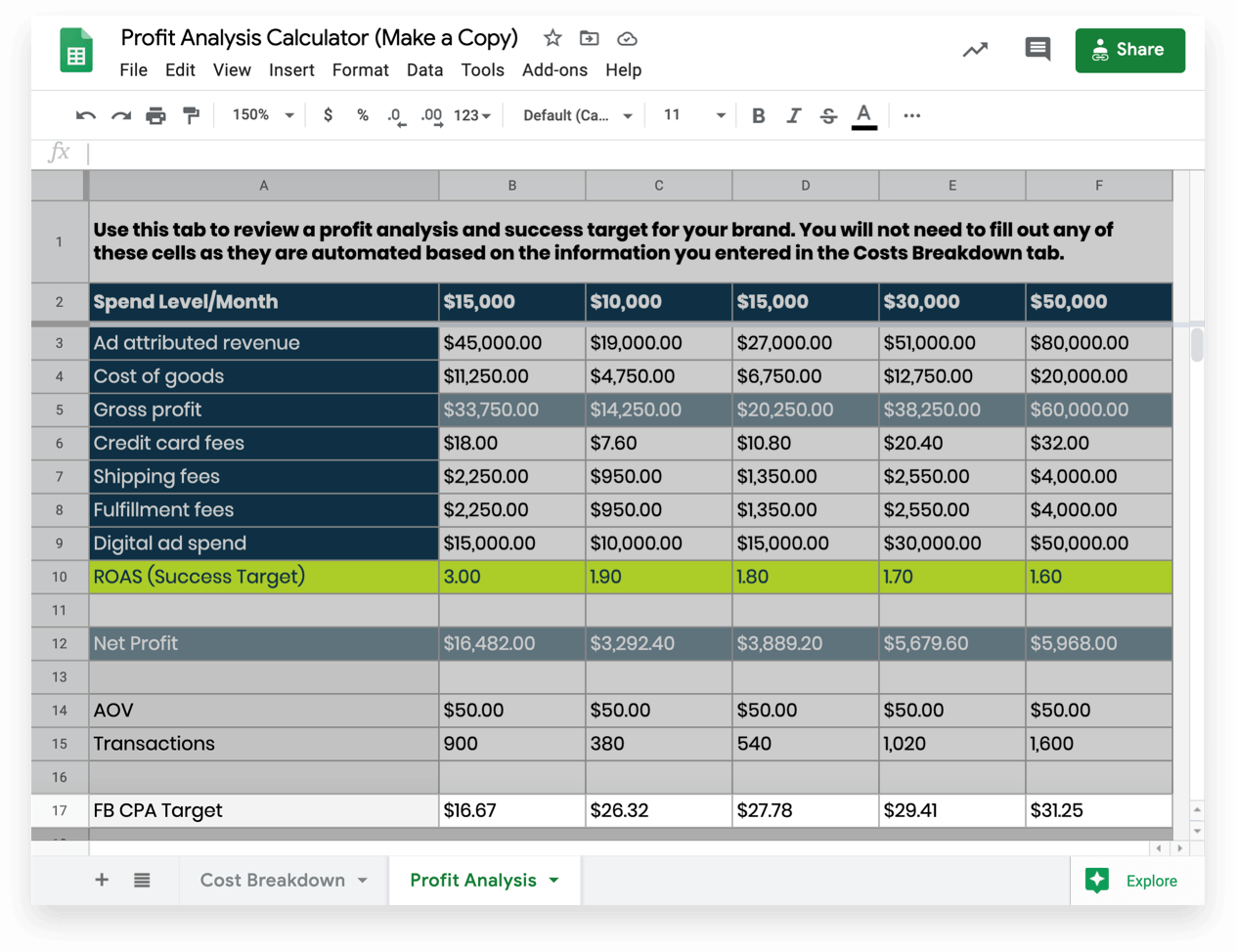

All customer acquisition costs degrade over time. New shoppers get more expensive to reach, attract, and convert.

Why?

Because the larger your audience, the more product-market fit wanes and the faster your social-media advertising needs to adapt.

In this article, we’re going to show you how to understand your average cost of customer acquisition and lower it through five steps:

- Defining ‘Cost’ Metrics in Online Advertising: Formulas

- Calculating Customer Acquisition Costs with a CPA Model

- Understanding Growth’s Dark Side: More Spend, More Costs

- Adapting Your Digital Marketing Strategy: Creative Examples

- Planning for Your CAC & CPA to Rise, While Staying Profitable

Before diving into the acronyms and formulas …

First, let’s take a big-picture look why costs increase as you move beyond the startup phrase and how to address them.

Second, I want to introduce you to a crucial resource we use in ADmission — our paid-membership community here at Common Thread Collective.

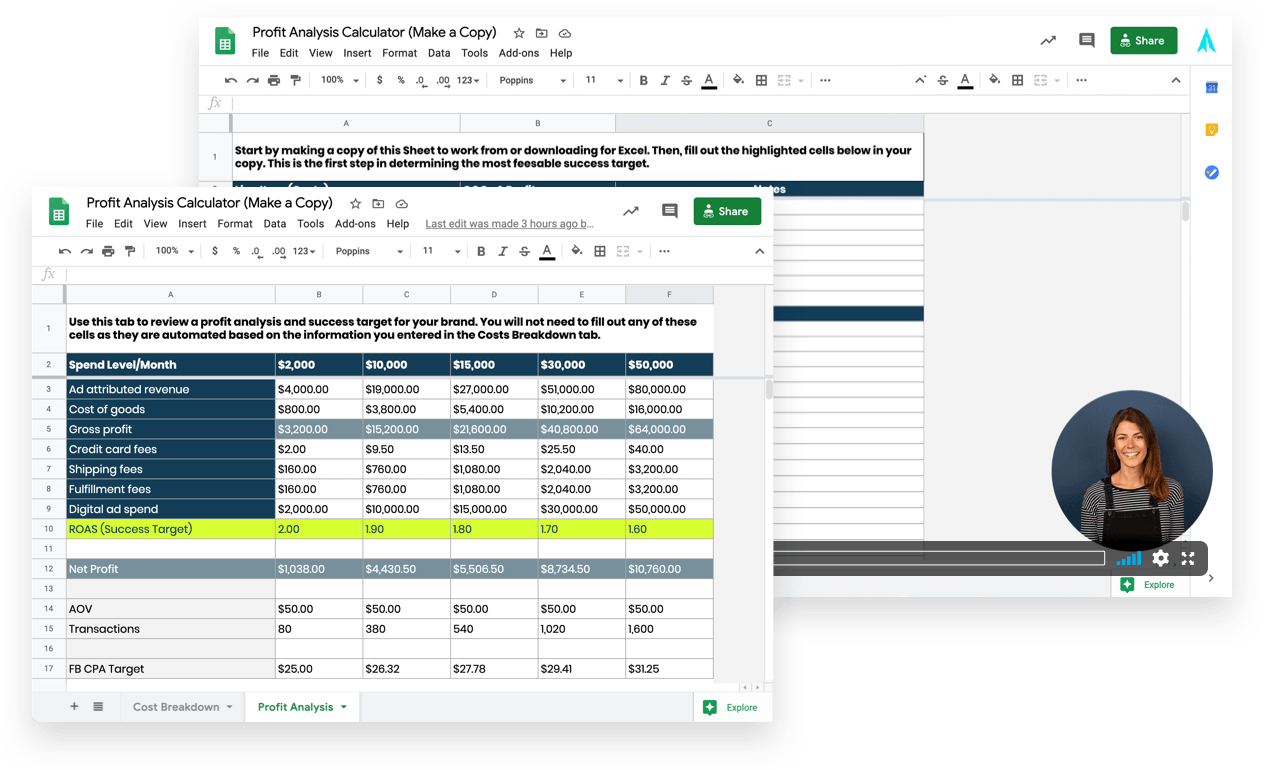

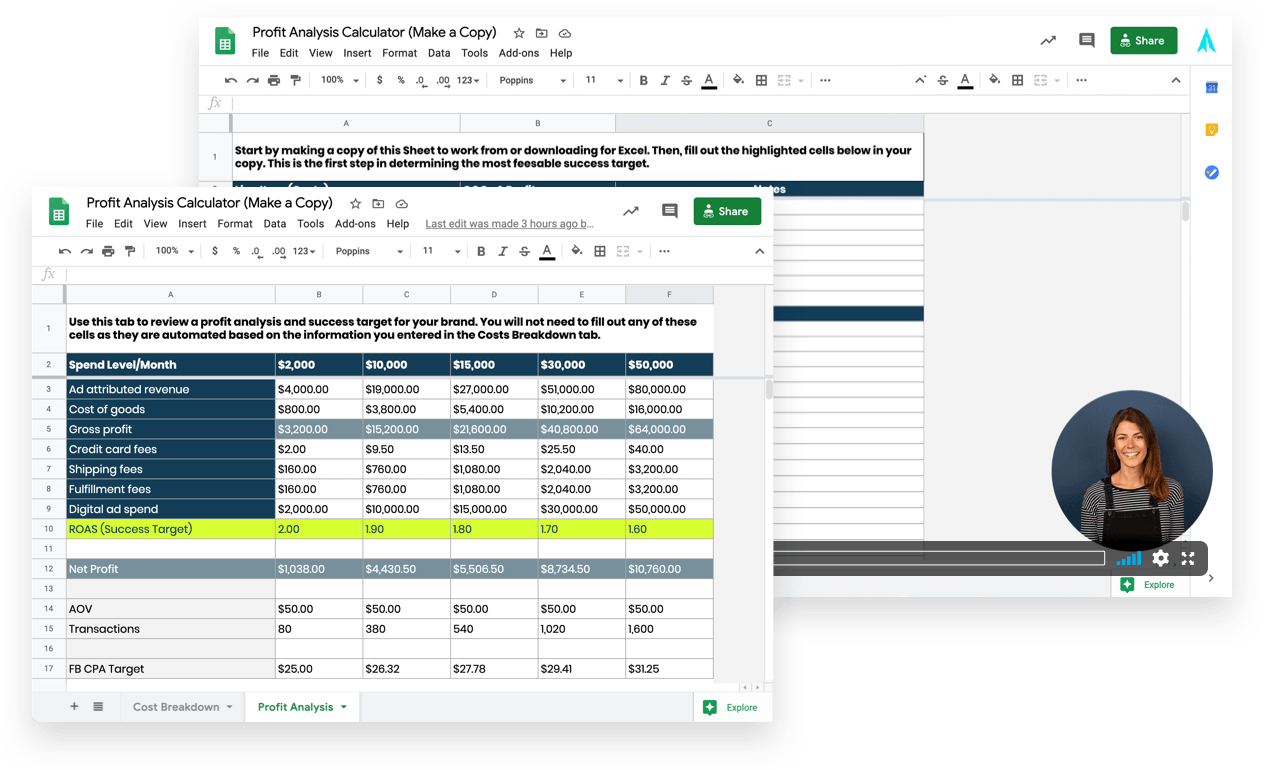

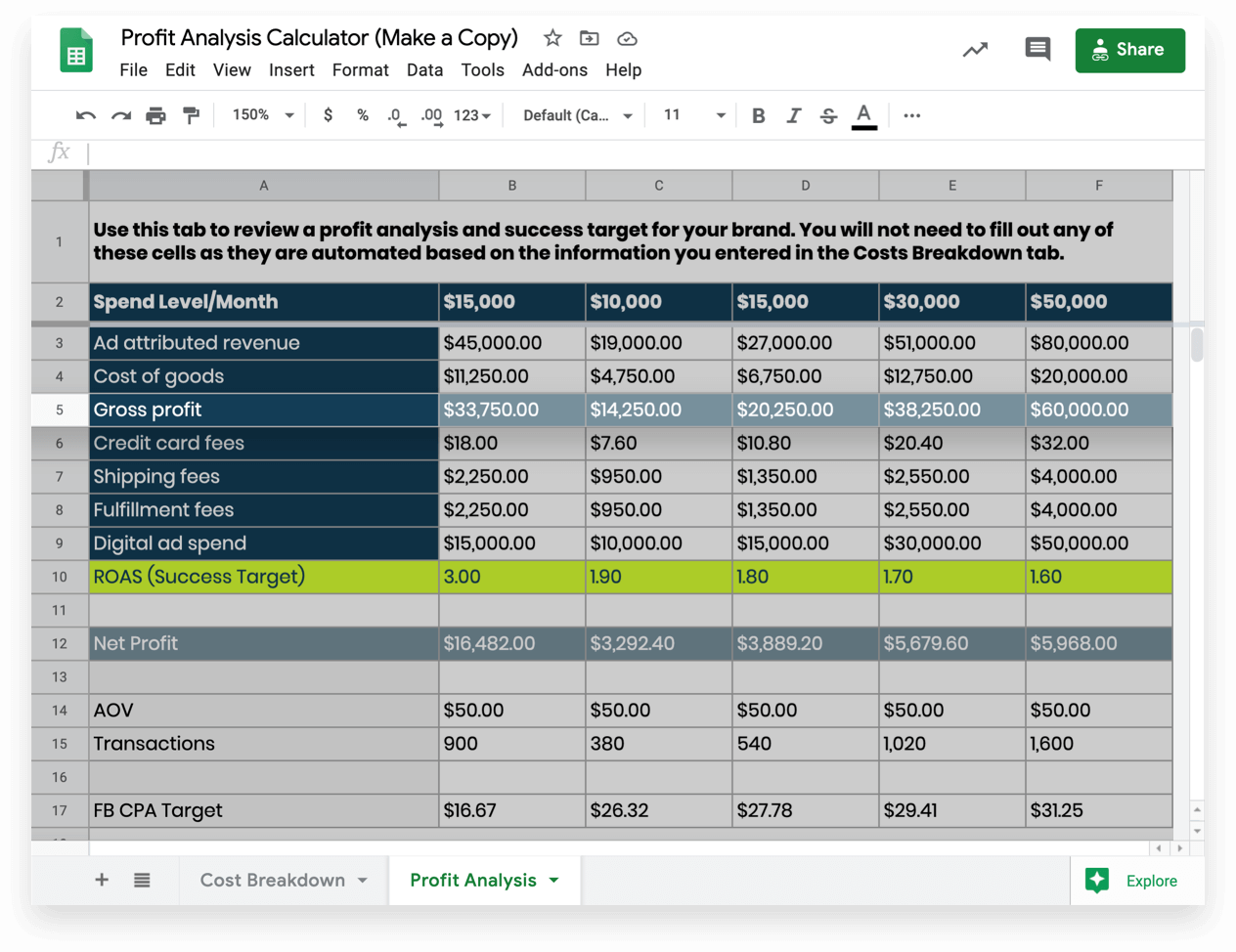

It’s called the Profit Analysis Calculator and it’s the tool you’ll need to determine your own CPAs.

Third, a warning. The acquisition strategies we’ll cover have been built explicitly for ecommerce. We won’t address B2B or SaaS company issues related to customer relationship management (CRM), SEO, sales teams, churn, or automation.

1. Defining ‘Cost’ Metrics in Online Advertising: Formulas

Costs are a tricky thing in marketing campaigns.

They’re even trickier when it comes to answering the question: “How much should we spend on Facebook ad costs compared to the rest of our digital marketing plan?”

For starters, there’s a host of acronyms; all of which need clear definitions. The problem is — even if you know what they mean — you may not know what they mean for your ad account and business model.

That’s why this section will unpack both the technical and practical definition of each.

Cost per Mille (CPM)

On an auction-based platform like Facebook, cost per mille (CPM) refers to what you pay per 1,000 impressions or “ad views.”

Tracking this metric will help you understand if your ad campaigns are generating awareness. They fluctuate based on factors internal and external to your ads.

Internally, your audience influences CPMs the most: the kinds of people interested in your product, price point, and conversion goals. The more valuable an audience you want, the more you pay for them.

External to your ads, supply and demand hold sway: i.e., your direct competitors as well as all advertisers in the system. When demand for ad inventory peaks (say, during the holidays), CPMs follow suit.

CPM: Total amount spent, divided by impressions, times 1,000.

Cost per Click (CPC) & Pay per Click (PPC)

Cost per click (CPC) or pay per click (PPC) is how much you pay when someone clicks your ad. This metric indicates whether your creative is performing — the cumulative effect of your copy, visuals, and offer.

CPC and PPC also vary based on how your audience targeting is set up, the price-points of your products, seasonality, and what the competition is doing.

Lowering the cost of a click requires ad creative that compels people to stop scrolling and propels them to take action.

CPC or PPC: Total amount spent divided by number of link clicks.

Cost per Action (CPA) or Cost per Results (CPR)

Measuring cost per action (CPA) allows you to track and optimize a variety of goals.

While the vast majority of ecommerce campaigns should be optimized for conversions (meaning, purchases), there are times when you’ll want to measure things like leads, sign-ups, and other onsite behavior.

Alternatively, you can create your own custom conversions on Facebook. If you do, Facebook will label this “Cost per Result” in your dashboard.

CPA (cost per action): Total “actions” taken divided by total cost.

Conversion Rate (CVR)

Your conversion rate (CVR) looks at how many visitors take the action you want them to. In ecommerce, that’s typically the number of sales and the number of unique outbound clicks (visitors).

Conversion rate optimization (CRO) is a science and art unto itself.

For now, one principle should be at the forefront of your mind: clarity. Andrew Faris, previously the CEO of 4x400 — our in-house DTC holding company — puts it like this:

“The number one thing you need to communicate on a product page is what the person’s buying. It’s remarkable how much just giving more clarity about what exactly it is and what gives the product value does for CRO.

“Clarity over any salesmanship goes so far.”

Remember, small or incremental gains in your conversion rate often yield exponential returns to your bottom-line. Especially as you scale spend.

CVR (or, CR): Number of conversions divided by number of visitors.

Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) measures the total amount it costs to acquire your average customer. Just like conversion rate, entire articles, books, and courses have been developed around CAC.

Even though the formula is the same, every business has to set CAC differently. Equating it to something as straightforward as CPA does it a great disservice. Plus — as a business metric — CAC doesn’t even exist within Facebook nor any native ecommerce analytics dashboard.

The real danger is hunting for some “average customer acquisition cost” to serve as a benchmark.

Thankfully, it can be boiled down to three inputs:

- Value of a customer: Average order value (AOV) or lifetime value (LTV) within a specific payback window

- Costs: Sum total of your advertising, marketing, and sales investments (plus agency fees) over that same period of time

- Financial constraints: How fast you need to realize the marginal value of that customer as set by cash flow and inventory needs

CAC: Total costs divided by total number of customers for a specific period of time.

Unfortunately, CAC doesn’t necessarily help you determine how much you should be spending at the tactical level of Facebook advertising.

Cost per Acquisition (CPA)

Unlike CAC, CPA can set your exact cost of acquisition via specific marketing channels, campaigns, and individual ads.

It is the most important metric you should use in all your planning, reporting, and budgeting.

Why? Because CPA is essentially the inverse of ROAS (return on ad spend).

If you know which channels or campaigns have the lowest CPA, you know where to allocate more of your ad budget and marketing expenses.

But before you make that decision, you need to know how much money you should be spending in the first place to stay profitable.

A brief interruption about customer lifetime value …

Much could be said about LTV, CLV, CLTV, the “LTV:CAC ratio,” and CPAs. In fact, we’ve written our fair share about it, too:

- Customer Lifetime Value for Ecommerce: A New Definition Beyond LTV:CAC for Limitless Scale

- Ecommerce Customer Retention: An Unexpected Definition & 10 Strategies That Don’t Take a ‘Lifetime’

Here, the important point is to focus on the 30:100 ratio — raising your LTV by 30% in 60 days and by 100% in a year.

If a customer’s LTV increases 30% within 60 days, then you know your product quickly found a place in their life. If LTV goes up by 100% within a year, then you also know that you’re pulling the right levers to provide on-going value.

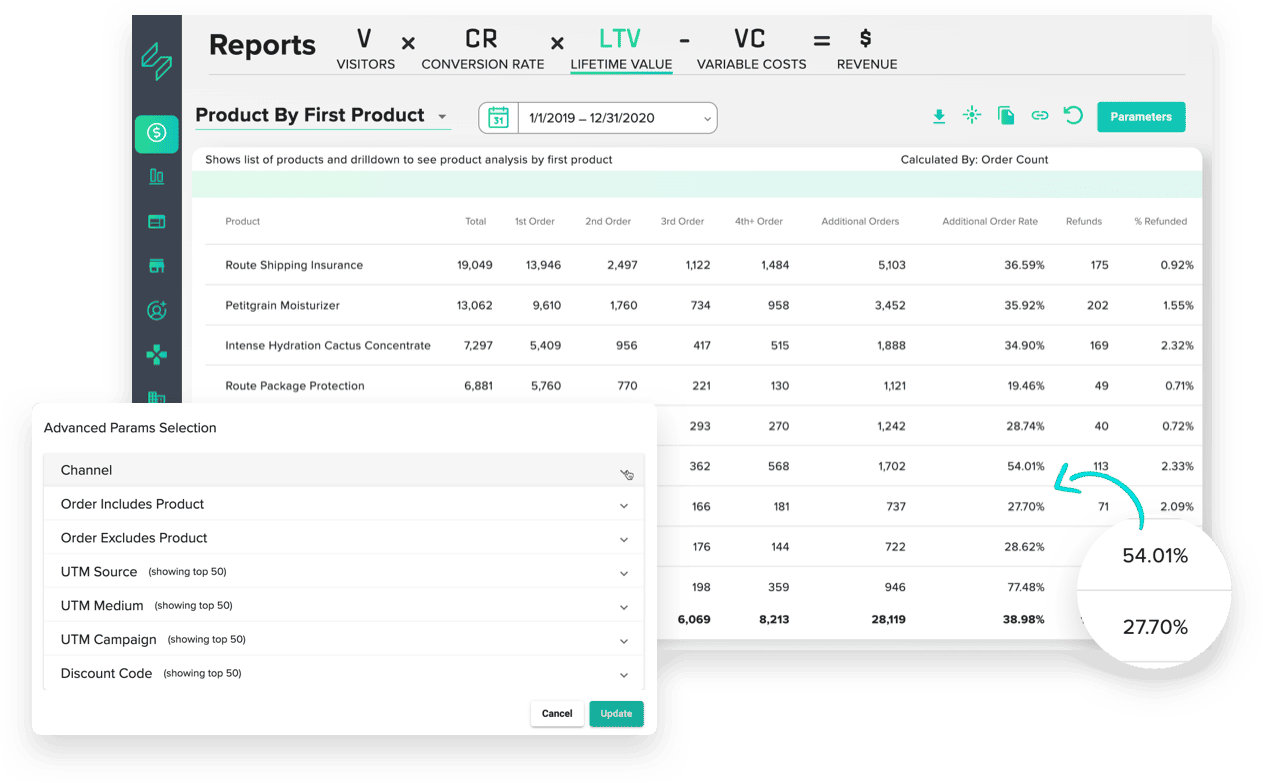

For clients — as well as our own brands — we carefully track cohorts with Statlas, a growth data tool designed to bring all your business’ data into one place.

Uniting data from Shopify, Google Analytics, subscription services, and paid media, lets you easily track LTV based on a variety of cohorts:

- Product by first purchase

- Time since first or last purchase

- Time of purchase (seasonality)

- Acquisition channel, campaign, or offer

Not surprisingly, we also use Statlas for CAC calculation at the business level.

Two metrics deserve mention. One, acquisition marketing efficiency rating (aMER). Two, weighted CAC (cost of new customer).

Acquisition MER (top left) is calculated by dividing total new customer revenue divided by total ad spend. It’s expressed as a ratio. Cost of new customer (top right) is calculated by dividing total ad spend by total number of new customers — expressed as a monetary value.

Now, back to your regularly scheduled strategies.

Calculating Customer Acquisition Costs with a CPA Model

Too many ecommerce brands spend without actually knowing what it looks like to win.

Before you come up with your CPA target and a budget for your total marketing spend, you need to run a profitability analysis.

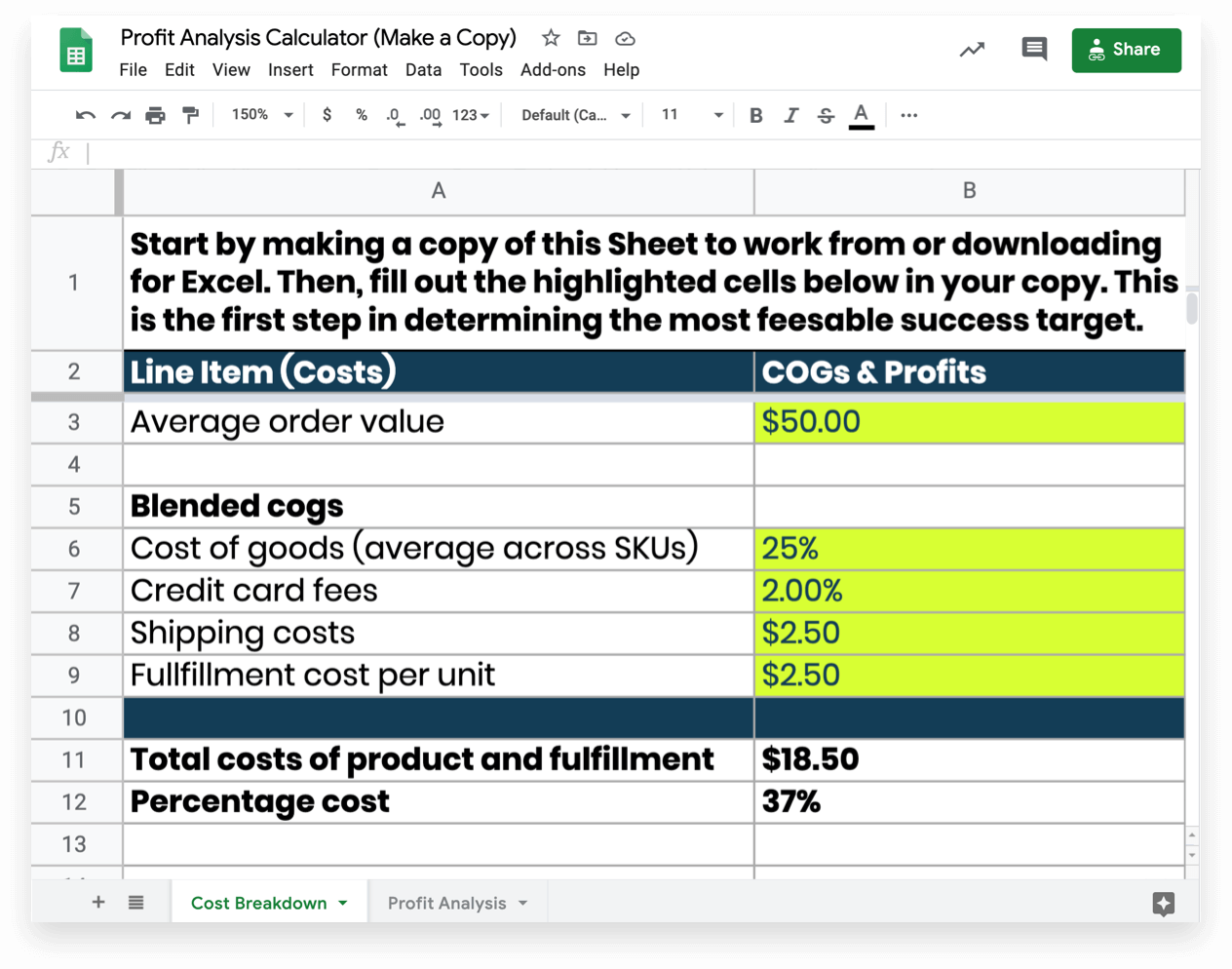

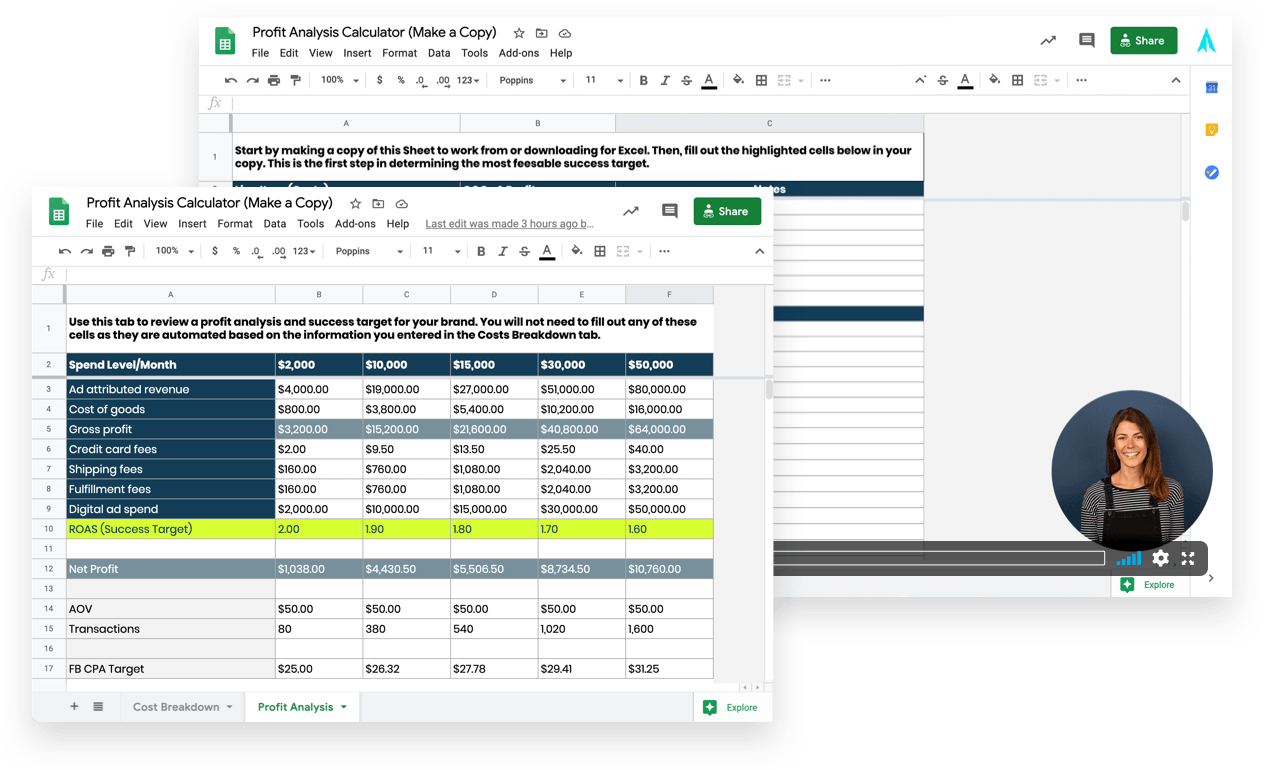

To make this actionable, we’ve created a Google Sheet you can download to make your own: Profit Analysis Calculator.

Filling out this sheet is the first step in determining the most feasible success target for your business.

It ensures that new customers will actually have a return on investment not over their lifespan … but within 30–90 days relative to CPA. It guides you into unit economics: the cost and margin opportunities of individual sales.

The green cells are editable, the rest contain formulas. In other words, don’t mess with anything but the green cells.

We’ll work from the top down, starting with your average order value …

Average Order Value

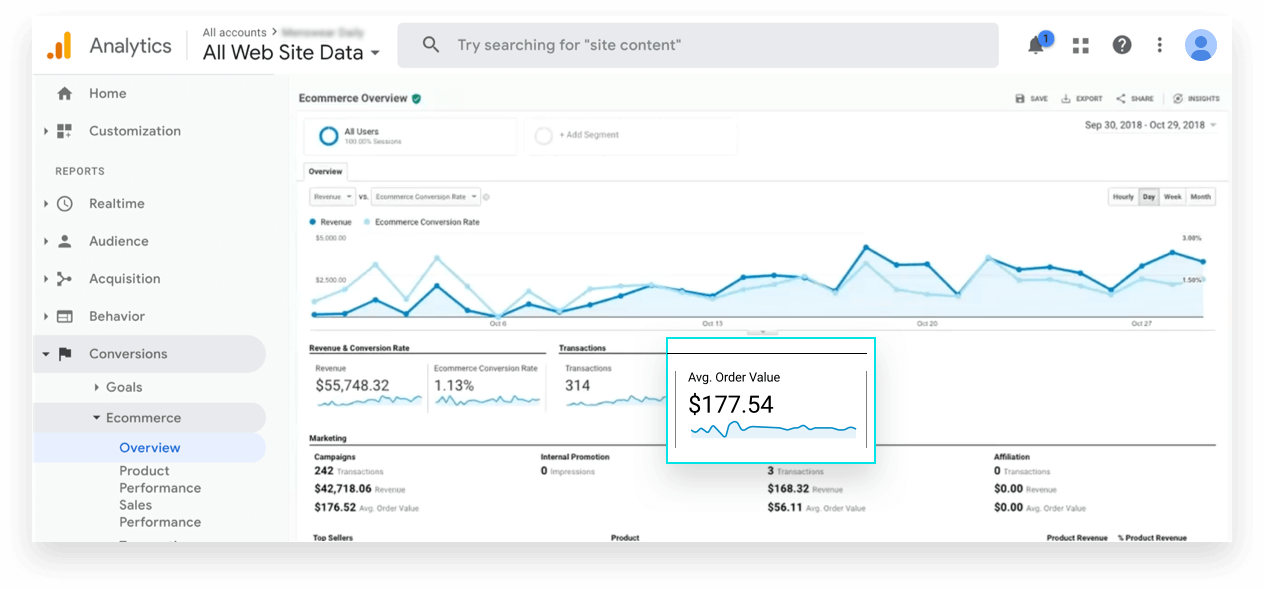

There are two places you can find your AOV.

Google Analytics dashboard > Conversions > Overview > Average Order Value:

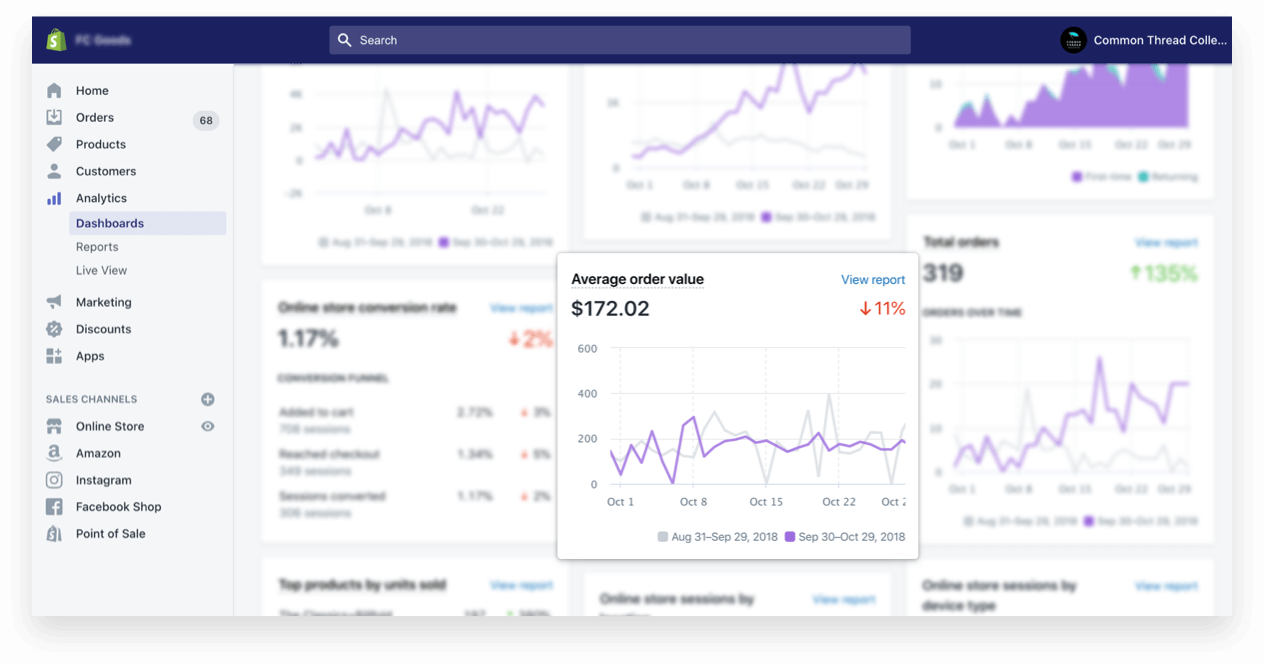

Or, within Shopify’s overview dashboard > Analytics > Average order value:

Keep in mind there can be a discrepancy in these numbers depending on how you set up the tracking in relation to tax and shipping. It doesn’t matter which one you use, but just use one to pull data consistently from.

For consistency, we’ll use Google Analytics.

If you don’t have historical data for your store, then you will have to estimate AOV and then re-run this analysis after 30 days of purchase data.

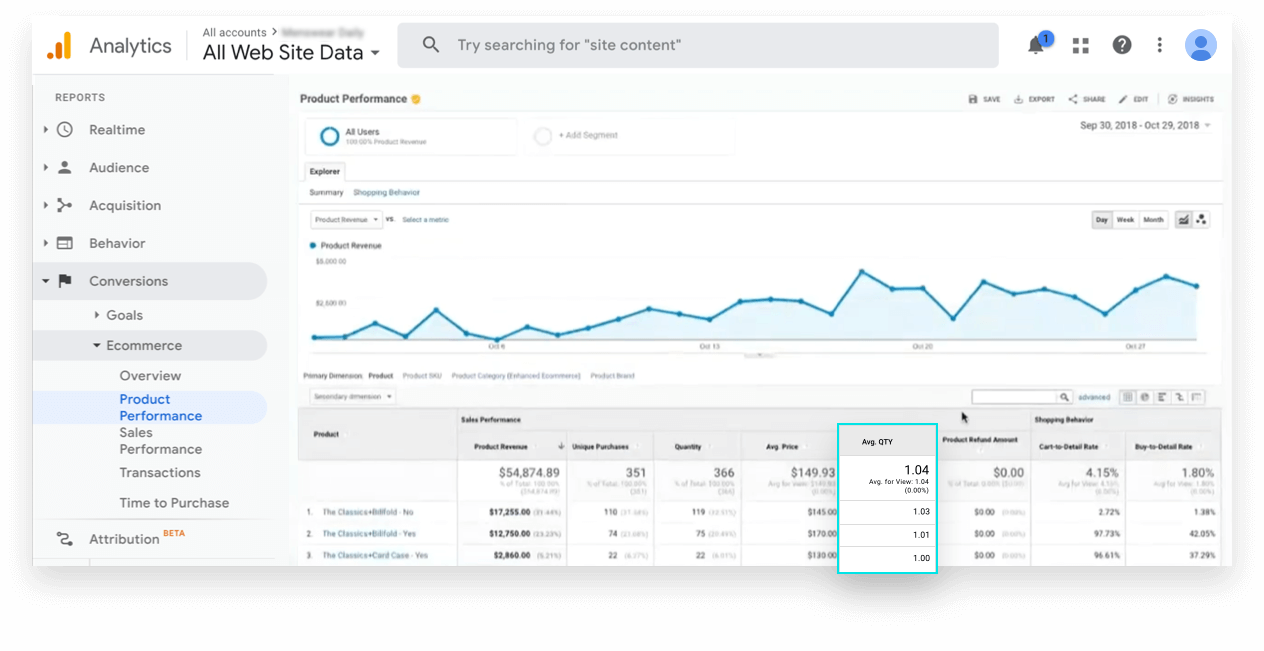

Once you get that number, the next important number to understand is how many units does that AOV represent.

Google Analytics dashboard > Conversions > Product Performance > Average QTY:

Blended COGS percentage

This can be a hard number to figure out, depending on the breadth of your SKU line.

COGS stands for cost of goods sold. What do we mean by “blended”? Answer: the average cost to manufacture, receive, and ship your products.

If you have one product, that will be easy to work out. If you have lots of products, the smartest way is to average them. If you go into retail channels or sacrifice some of your margin to sell on Amazon, you’ll need to build this into your COGS cost breakdown too.

Be sure to also account for …

- Payment processor fees: the amount your credit card processor or digital wallet provider takes per order

- Merchant account fees: the amount your store merchant takes per order (if it’s a fixed monthly fee, just put $0)

- Shipping costs: the average cost to ship your product from either your USPS account or 3PL

- Fulfillment cost per unit: the fee charged per item or order by your fulfillment agency to pick and pack every individual order (if you fulfill and ship orders from home, enter a flat $1.50 per order as a baseline to plan ahead for a 3PL)

You might be wondering why aren’t we accounting for other costs such as rent, salaries, or software?

When looking at the success of your advertising, you should never included fixed costs.

Let’s say you’re paying $5,000 per month in rent and you apply it to your COGS analysis. You’d likely see a net-negative result. A natural response would be to think your ad spend is not working.

In reality, the answer to fixed costs is to increase profitable ad spend. It wouldn’t matter if you’re only selling one or 500 units, that fixed costs won’t change based and, therefore, shouldn’t be factored in.

Gross Profit

Once you’ve filled out all of the costs associated with your blended COGS, you’ll see what the total cost is to fulfill an average order and the percentage cost.

That brings us to Gross Profit. Think of it as the gas that you have to put into your advertising engine.

AOV - Total Costs To Fulfill Average Order = Gross Profit

Once you have Gross Profit nailed down, you have to do some critical thinking as an entrepreneur to answer this next question.

How To Calculate Your Target Margin

For some of you, the answer to this (and it might seem crazy) should be $0 on your initial order margin.

An example would be subscription businesses. You’ll pay a lot more to acquire these customers. But, you’ll have a lot more money coming in over the lifetime of that customer. If your 60-day LTV is 2x your AOV, then acquiring your customers at breakeven makes a lot of sense.

For everyone else, target margin hinges on how much money you need to order more product.

Say you have a 20% target margin. When you go back to your supplier or manufacturer, if you aren’t hitting 20%, you will be eating into your net cash to order more product.

Over time, you’ll have to order less product because you’re left with less money than you need to make the order.

This is why payment terms are so important. If you can get net 30 or longer, you can pay them with the money you make on the product.

Many businesses have to pay 100% of the manufacturing cost to sell a single unit. So you need to protect enough margin to be able to place those orders — which is why your target margin is so important.

CPA & ROAS Targets

After you’ve worked your way through these numbers, you’ll see the spreadsheet populate your CPA and ROAS targets.

ROAS Target = AOV / CPA Target

This number tells you how much return you need for every dollar spent.

CPA Target = Gross Profit - Target Net $

CPA looks at how much you spend acquiring customers. So the number you see on your spreadsheet is how much you can spend acquiring a new customer.

Facebook Manager will report back on these numbers to help you understand your ad performance in relation to spend. You can work off your ROAS or CPA target.

We prefer to work off a CPA target when spending at scale versus a ROAS target. That’s because larger than average AOVs will skew ROAS data.

Finally, if you’re looking for some kind of benchmark …

Before we acquire a brand at Common Thread Collective, we ask ourselves one question: can we win at 2:1 on Facebook? Can we be profitable at 50% CPA.

3. Understanding Growth’s Dark Side: More Spend, More Costs

For the sake of simplicity, let’s start at the very beginning: the day you’re launching your business.

At the far left of the customer adoption bell curve, you’ve got “mom” — your biggest fan. Though not an innovative, she is free to acquire every time.

At the far right, you’ve got a subsistence farmer in rural China. They don’t have access to the internet, don’t speak English, and don’t care about the problems your product solves. “Rural farmer” is an extreme example, but that’s the point.

In the early stages, product-market fit is tight; often one-for-one because the people you’re reaching are exactly who it was made for. As you expand, fit deteriorates.

The result? Your marketing efficiency takes a hit and you find yourself paying more and more in CAC and CPA:

To bring back efficiency, you need to understand how each group approaches its buying decisions. Then, you need to know how to align your messaging and creative to the different stages of both paying customers and potential customers.

4. Adapting Your Digital Marketing Strategy: Creative Examples

Innovators: Introductory Prospecting Ads

This group takes up a small fraction of the total market. Yet they play an important role in influencing the early adopters. Innovators are risk-takers by nature, adventurous, and want to be the first to try a new product.

Innovators should be discovered during product development, early user trials, and prototyping before mass-market delivery.

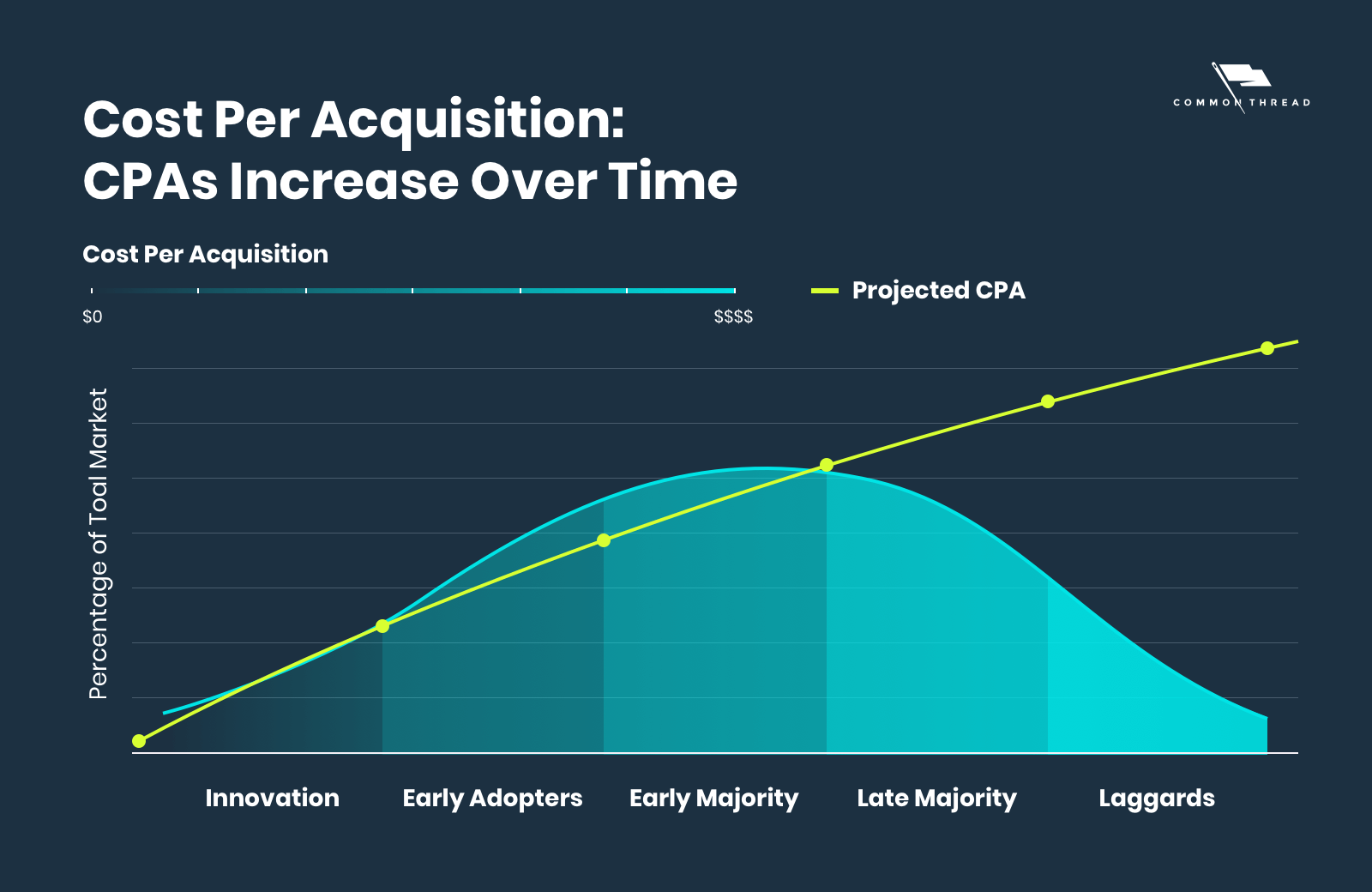

Incrediwear’s products use new technology to increase circulation to reduce inflammation and swelling, relieve pain, restore mobility, and accelerate recovery.

The following examples of their prospecting ads play to an innovator’s eagerness to try new products and lures them in with ad copy that speaks to specific results such as “accelerate recovery for chronic injuries by up to 46%.”

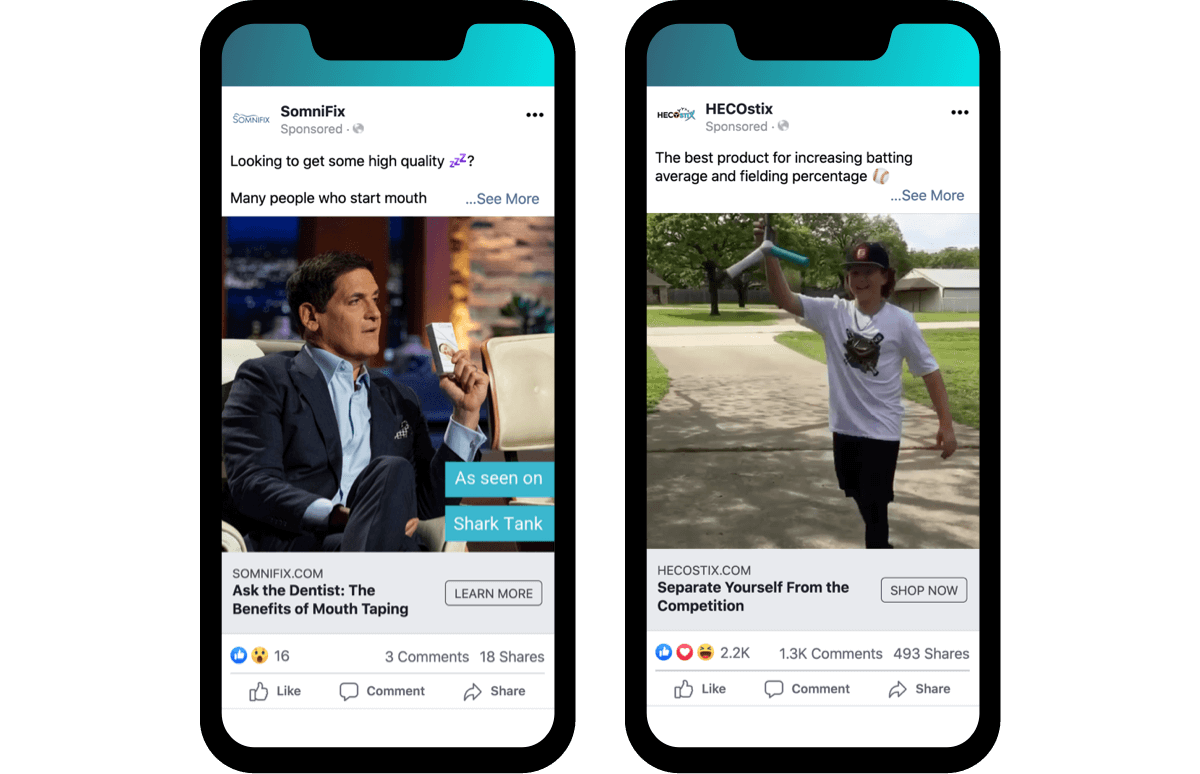

The next example from SomniFix leverages Shark Tank — a TV program designed to surface new and innovative products — and an image of Entrepreneur Mark Cuban who invested his own money in the product.

The ad takes you to a landing page with an article written by a Doctor to reinforce the benefits of this product and how it works.

HECOstix has developed a new twist to a simple game of playing catch. They’ve leveraged an influencer who provides in-depth reviews on baseball gear to demonstrate how the product works.

The ad copy taps into the psychology of a competitive athlete and positions it as a product that will help you get ahead of your competition.

Early Adopters: Introductory Prospecting Ads With a Touch of Social Proof

Early adopters are often described as social leaders who are popular and educated. They pay attention to what the innovators are discovering. They aren’t as big of a risk taker as the innovators; however, they are very influential people within their market space.

Once they find something they love, they’ll communicate to their followers and generally create trends through their opinions.

They are the people who stand in line waiting to be one of the first to get their hands on a product, even though they know it will be cheaper to buy later on. This class of consumer can be relied on to provide feedback about the product and to help you build up your user-generated content.

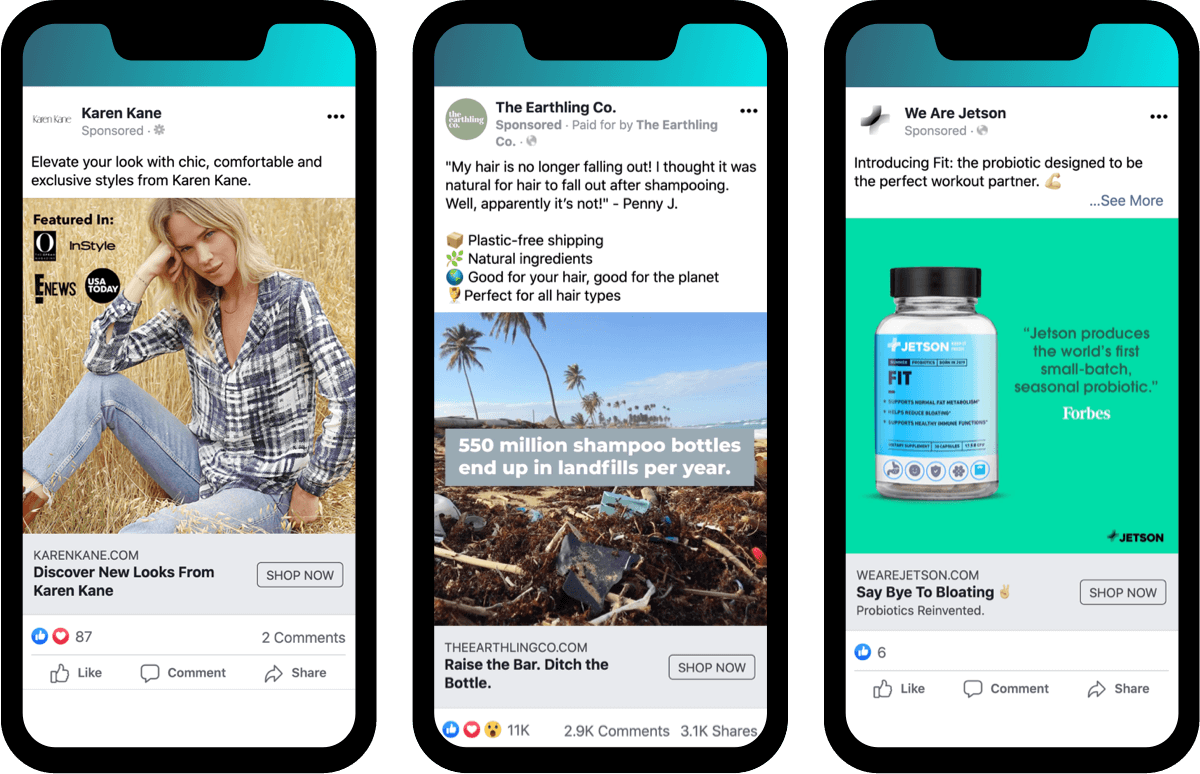

As you can see in the example below, Karen Kane uses a touch of social proof on the ad image, by including logos from prominent TV programs and publications where the collection has been featured.

The Earthling Co. focuses on driving their brand mission and values via the ad copy and video. Early adopters are typically the first to provide reviews so you can leverage user-generated content — just like the example below.

We Are Jetson leverages a quote from Forbes to reinforce its innovation. The rest of the ad copy is designed to introduce the product and its benefits to early adopters.

Early Majority: User-Generated Content, Reviews & Influencer Ads

By this stage, your product has begun to reach mass-market appeal. This type of consumer is risk-averse and wants to make sure they are spending their money wisely. Therefore, they rely on the opinions and feedback from the early adopters to influence their purchase.

Fresh Clean Tees uses a fitness model influencer (early adopter) to post a video to demonstrate how the t-shirts fit on him, and how much he loves the product. To top things off, there is a clear discount code to entice viewers.

In a similar fashion, Mott & Bow use Business Insider’s strong claim as their social proof and provides a discount.

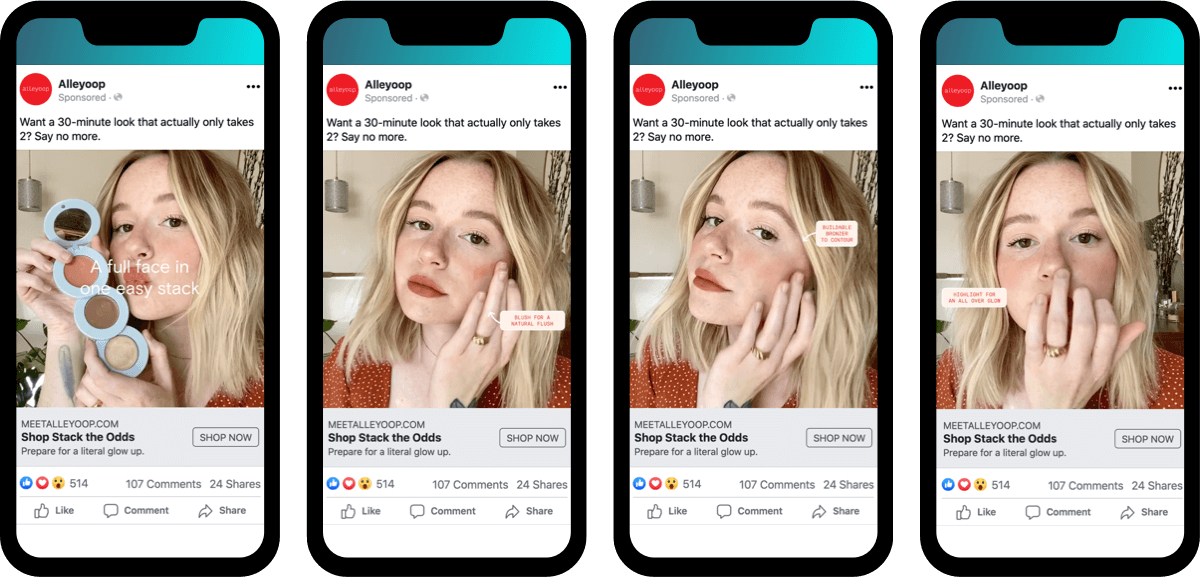

Alleyoop’s example features a short how-to video showing viewers exactly how easy it is to use the product and achieve the desired look.

There’s no discount. Instead, the “Shop Now” button takes the viewer directly to the product page featuring stacks of customer reviews, information about the product, and smooth UX — all the ingredients you need to convert.

Late Majority: Ads That Focus One How the Product “Changes Lives”

Referred to as the skeptics, they put their money towards tried and tested solutions. They will adopt the product if they feel everyone else is doing it or if someone they really trust — like a close family member or friend — tells them they should.

Generally, this class of consumer doesn’t have much money and isn’t swayed by opinion leadership from early adopters or innovators.

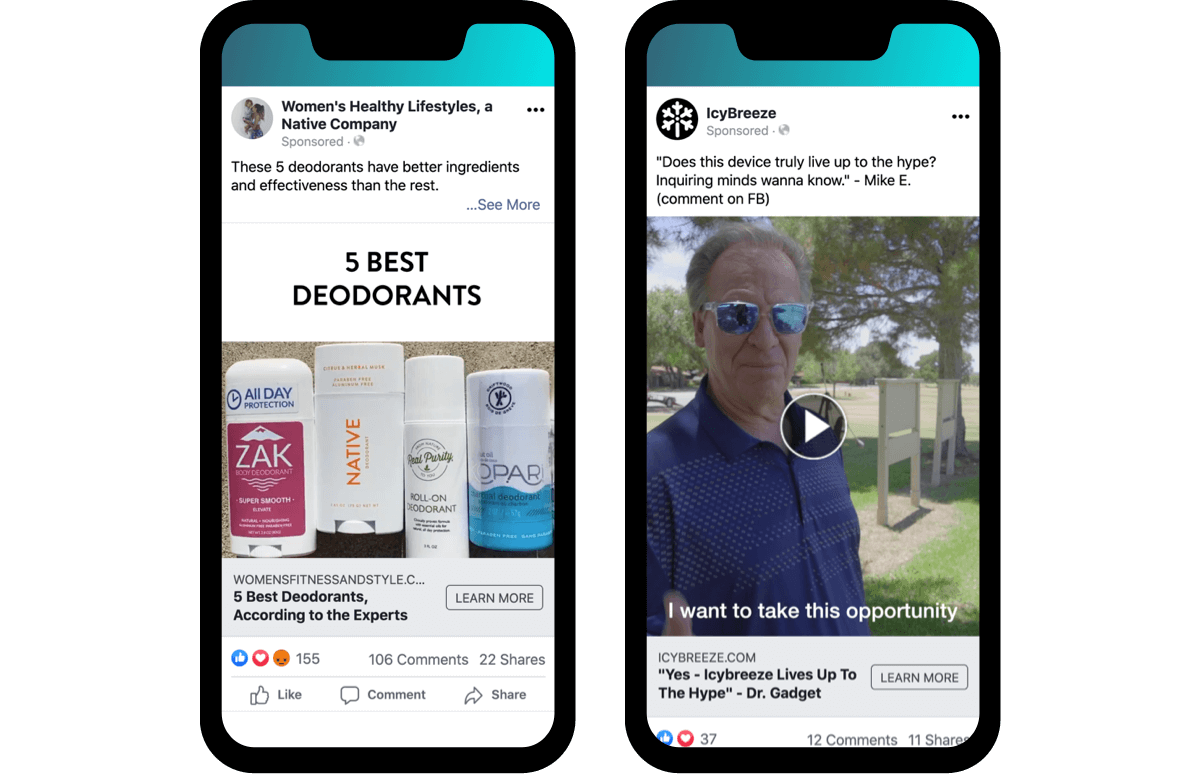

The ad example below is sponsored by Native Deodorant. This ad targets the late majority perfectly because it’s pitched through an online blog that has more influence on the readers than if the ad came directly from the brand.

The article comes across as unbiased as it features other products to compare and has plenty of social proof. Native has made sure their deodorant is featured first and is the only product to offer an exclusive discount to the readers.

IcyBreeze has cleverly taken a real comment on Facebook from someone who would be considered in the late-majority adoption and used an influencer to explain why the product does in fact live up to the hype.

The video is long enough to ensure the viewer can see exactly how the product works and why it's worth it.

Laggards: Product Comparisons, Features & Benefits

The last to adopt a product, their arrival is typically a sign that a product is declining in popularity.

Laggards typically focus on the traditional method of doing things, are highly risk-averse, and don’t like change. They don’t seek opinions outside of their social circle of family and close friends. In many cases, laggards are older people who are less familiar with technology.

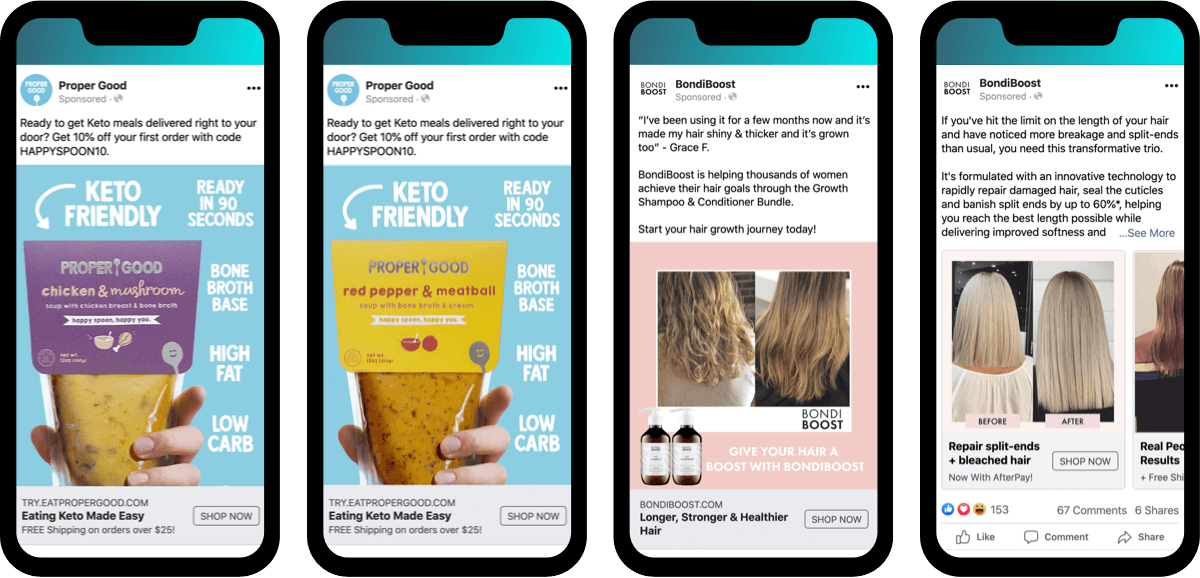

Proper Good makes it obvious what the product is, there’s a discount, and the benefits of the product are super clear.

The final two examples from Bondi Boost provide clear feedback on how their products have helped women achieve healthier, shinier, and thicker hair. There’s a good mix of user-generated “before and after” content, written reviews, and clear product benefits.

Keep in mind, these are general observations. They should not be used to stereotype individuals as it’s entirely possible to have mixed audiences, particularly between stages.

Nonetheless, mapping your Facebook creative to the types of buyers you’ll encounter as you expand can guide you into …

5. Planning for Your CAC & CPA to Rise, While Staying Profitable

Rising costs for a growing customer base are inevitable. At the same time, it becomes less of a variable if you plan for it.

Be conservative and understand your numbers before you spend. Anticipate how your marketing efforts will need to change as you reach further and further out.

And be sure to grab the Profit Analysis Calculator:

If you’d like more ecommerce training on growing your business, then check out ADmission. Or, if you want to simply off-load your ad buying to a trusted partner … then start a conversation here.

We won't send spam. Unsubscribe at any time.

Adrianne Austin is Growth Strategist at Common Thread Collective, where she helps some of the most-recognized DTC brands scale profitably. She’s also “mama to Valor boy,” an investor in Our Spare Change — a social enterprise creating jewelry out of high quality metals — and baked sourdough before the pandemic. If you’d like to connect, reach out to her on Twitter.