Surges in sales. Immunity from financial downturn. And an ecommerce market share outpacing online retail as a whole.

By every metric, the pet industry represents one of the most lucrative opportunities for online brands. Every metric … except one.

Despite strong numbers, it’s a dog-eat-dog world with the biggest of the big devouring far more than their fair share.

Intense competition marks the pet food, pet care, and pet supplies landscape — especially mass merchandisers privy to high-volume sales, the luxury of lower margins, and scale.

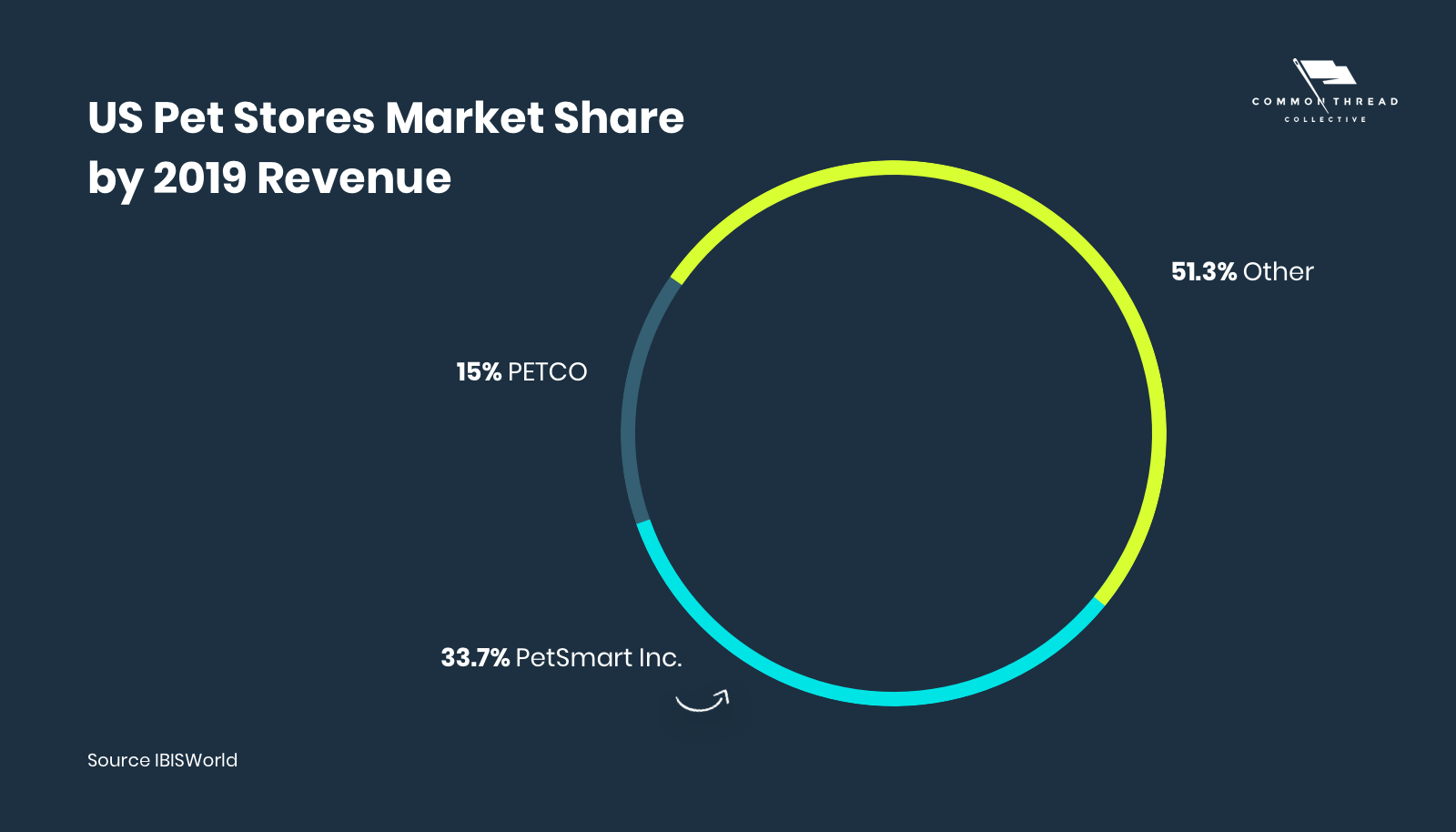

Two players, PetSmart and PETCO, account for nearly half of all online pet product revenue. Amazon’s debut into white-labeled pet-food challenges start-ups lacking methods to address variable costs like supply-chain logistics and shipping.

What’s more, traditional retail giants like Walmart and Target are expanding their online presence — redefining the pet market and shoppers’ expectations.

How can DTC catch up with the pack? Good news: there’s plenty of hope.

With real numbers and tested strategies, this guide provides an overview into the state of the pet industry broken into two parts along with tactical lessons from ecommerce brands doing it right:

Pet Industry Trends: Growth & Statistics in 2022 and Beyond

- The Boom of Ecommerce’s Pet Market

- Pet Ownership and Buying Behaviors

- Data on Three Verticals within the Industry

- Pet Stores, Retail, and Pop-Ups

- Amazon: The

ElephantGreat Dane in the Room

Pet Industry Marketing: Unleashing Your Ecommerce Strategy

- Visitors: Driving Paid Traffic

- Conversion Rate: Ad Creative & Web Design

- Customer Lifetime Value: Cash Multiplier

- Variable Costs: Profitability

- Case Studies: Lessons from Three Pet Brands

Don’t miss that last section …

There you’ll find detailed examples — packed with tactics and lessons — from three fast-growing ecommerce companies …

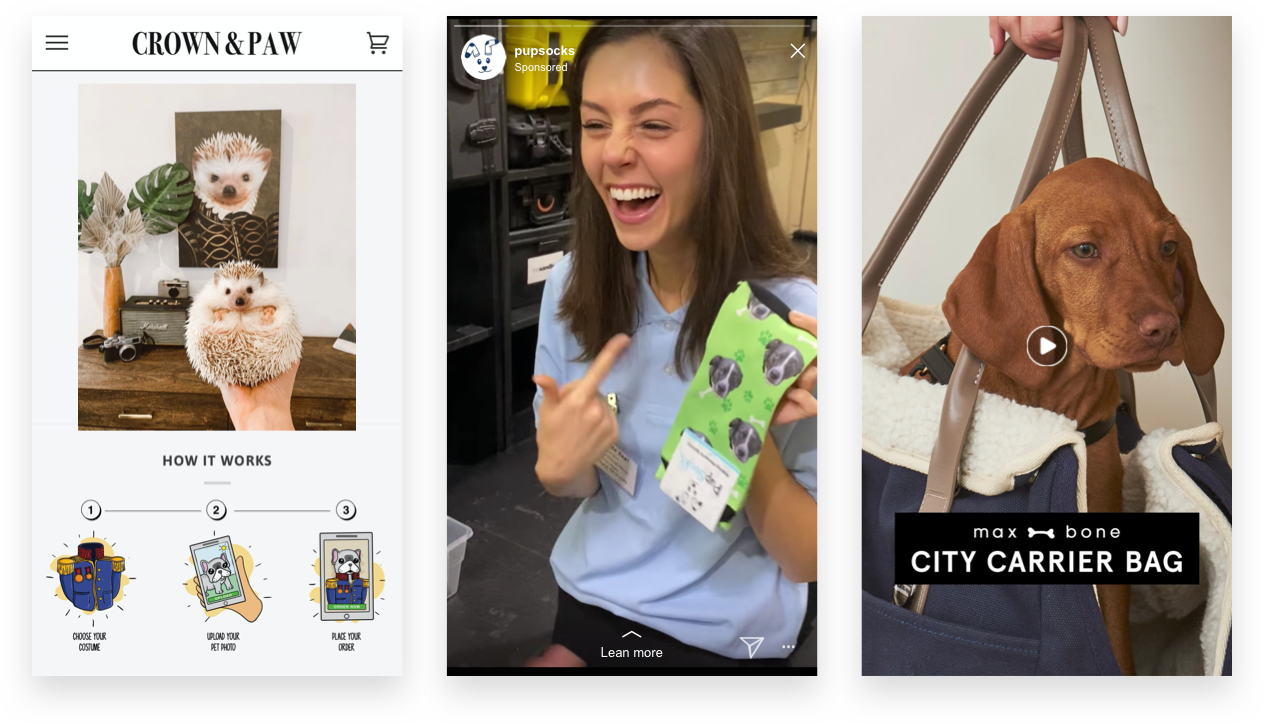

Crown & Paw: After 3Xing conversion rates in the lead up to Black Friday, Cyber Monday, this custom pet portrait retailer 6X’d conversions in Dec and 10x’d growth to close out its first year at over $11M in sales.

PupSocks: Two years of record-breaking left its audiences exhausted and its reach tapped. The answer? A creative infusion that led to a 9.1% CVR, YoY growth of ~60%, and 2.6 ROAS on +$6M in spend.

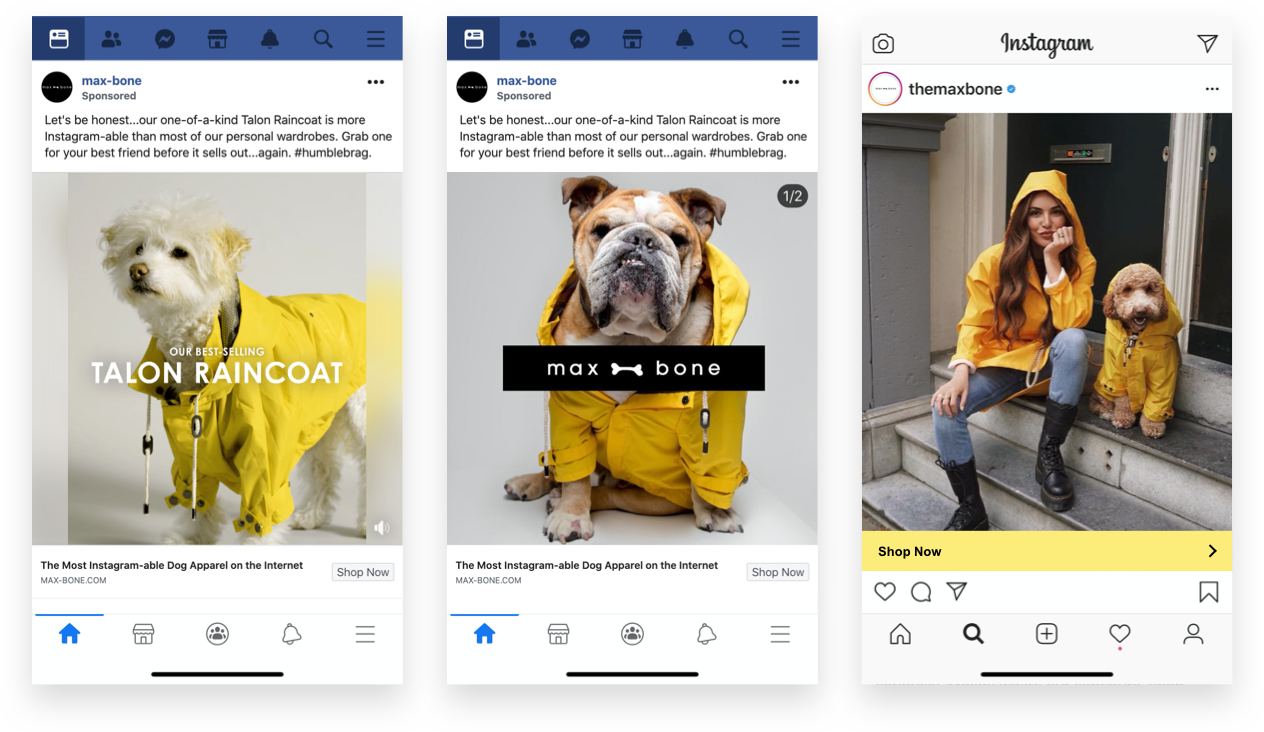

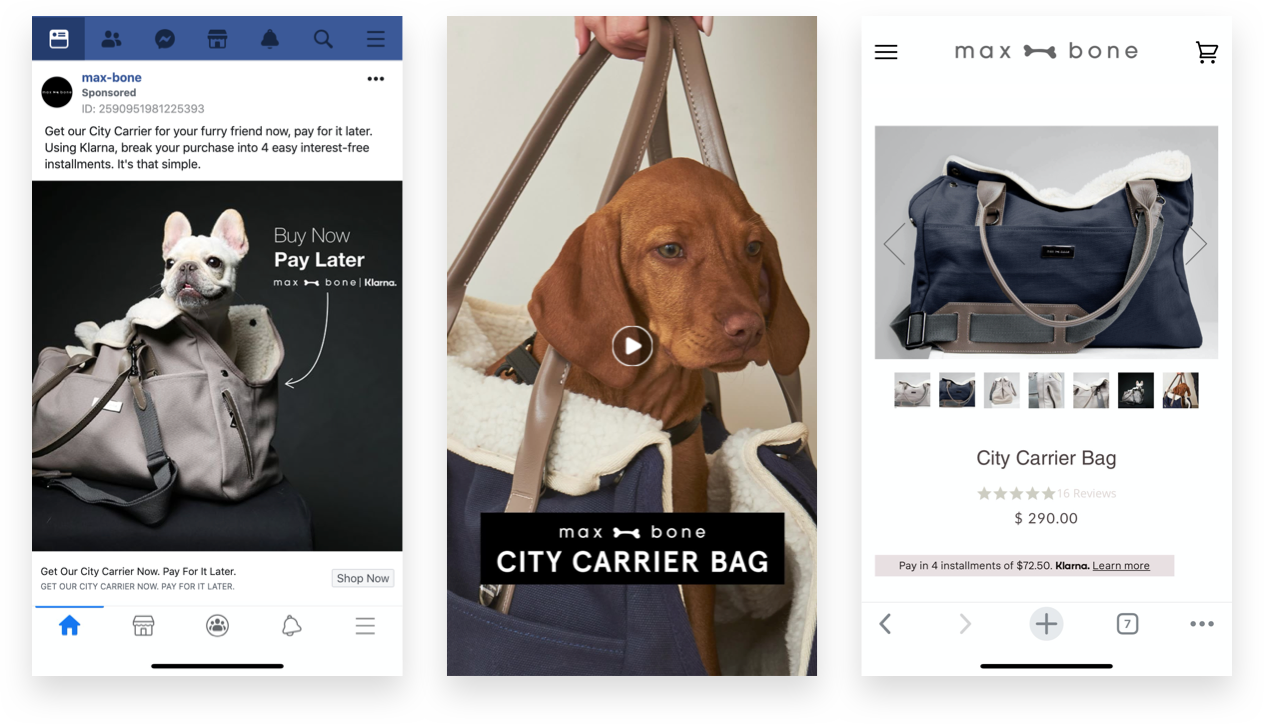

MaxBone: As a luxury-lifestyle pet brand, both the challenge and opportunity was increasing customer lifetime value. By combining design-forward content and high-LTV first purchases, it 3X’d YoY revenue.

Pet Industry Trends: Growth & Statistics in 2022 and Beyond

Mapping data across the pet industry is notoriously difficult. Unlike fashion marketing, health and wellness, and the beauty industry, no single source of market research exists.

Thankfully, by coordinating resources, we can get clear answers on a number of pressing questions, namely …

How profitable is the pet industry?

How much is the pet industry worth?

Is the pet industry growing or shrinking?

What is lacking in the pet industry?

And what challenges do pet brands face?

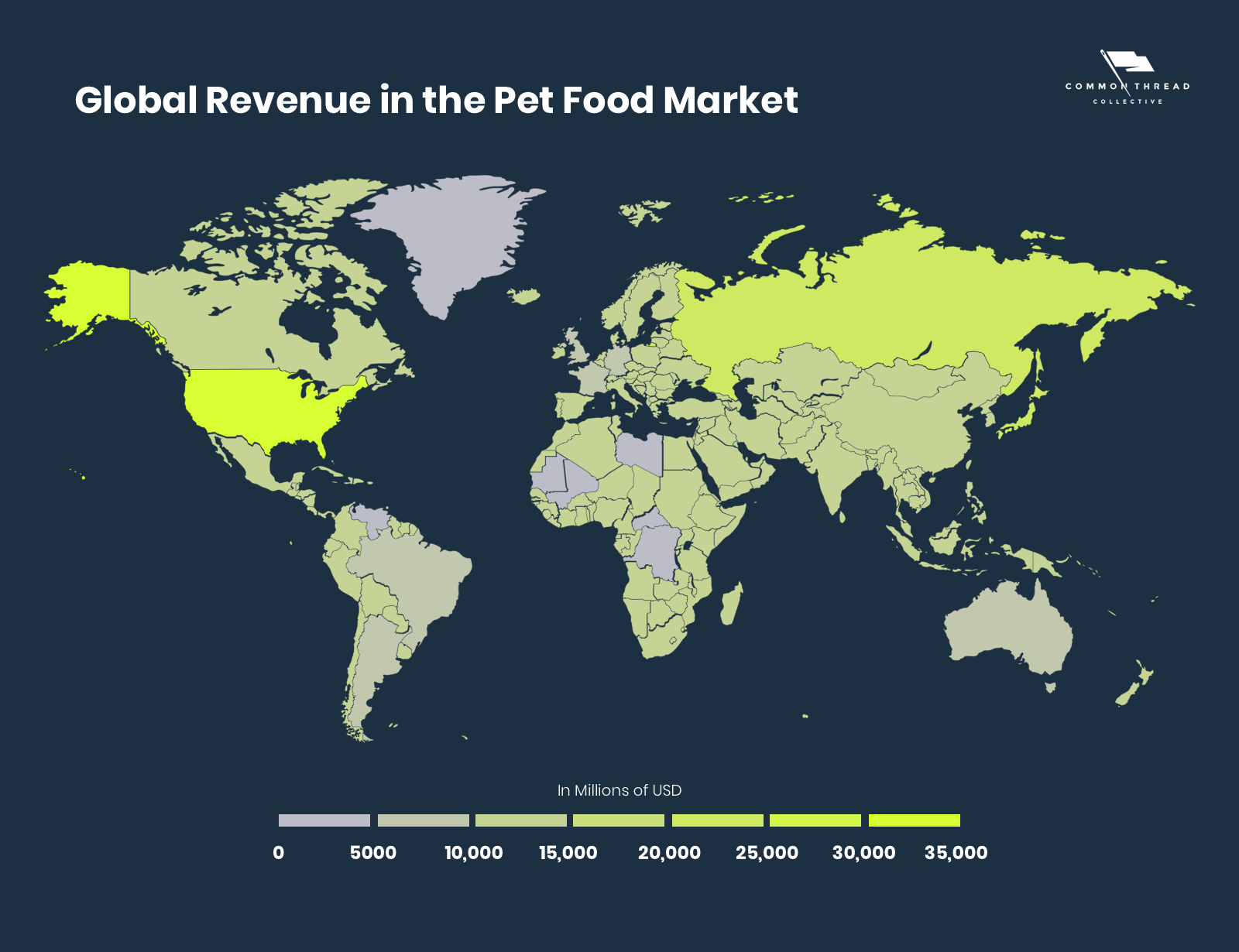

Globally, the pet care market has grown to $261 billion in 2022; up from $245 billion in 2021. An estimated 6.1% compounded annual growth rate (CAGR), will catapult that figure to $350 billion by 2027.

While North America and Western Europe are mature, they still offer possibilities for an uptick in consumer purchases relative to the growth experienced worldwide.

Space exists for the development of new products and especially new channels: an advantageous lifecycle stage for emerging brands to enter and thrive.

1. The Boom of Ecommerce’s Pet Market

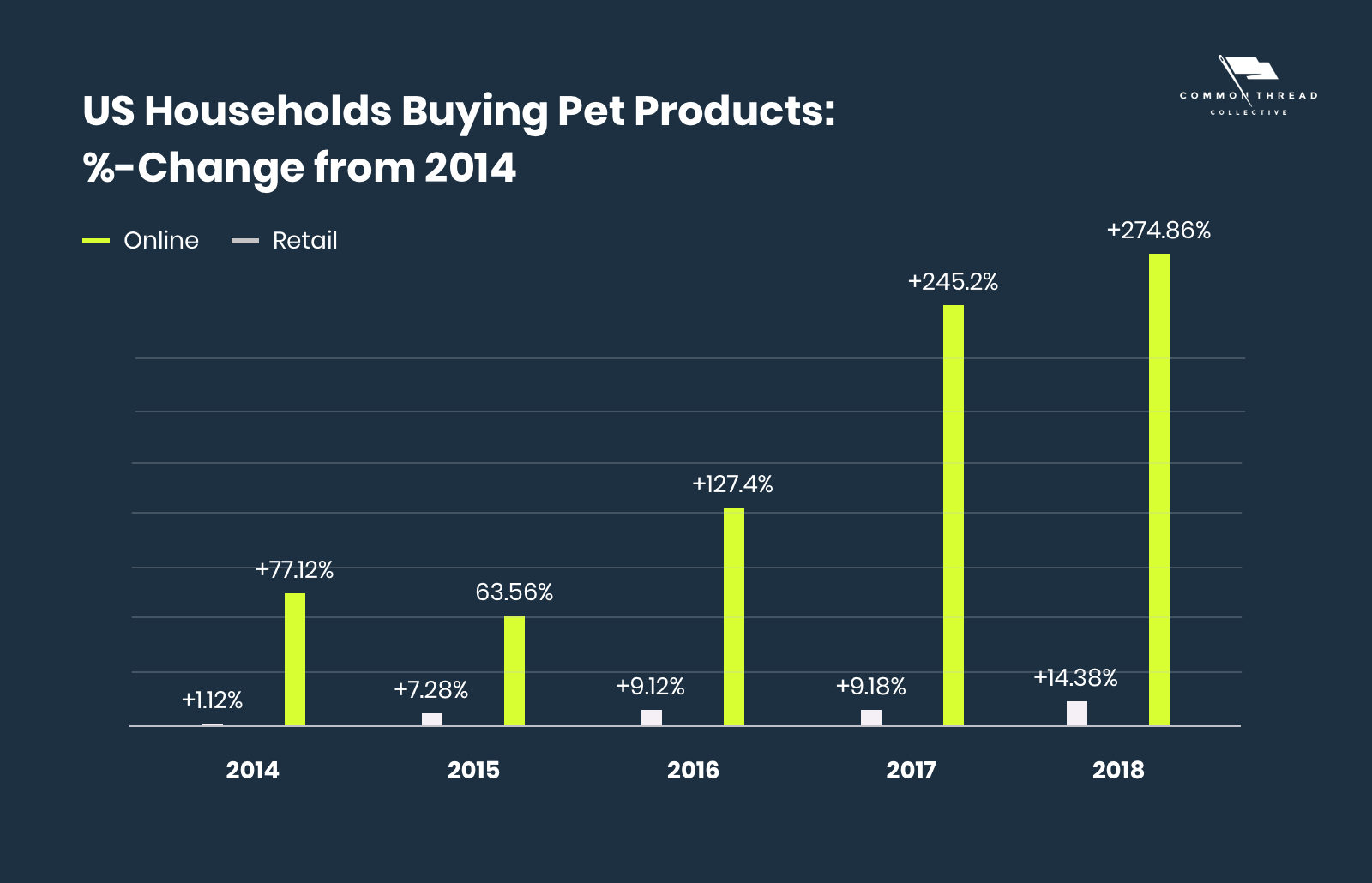

While retail stores have seen a slow increase in buying, the online pet market has nearly quadrupled since 2013.

With pet ownership rates continuing to rise, the target market for the industry as a whole will expand, allowing new penetration points.

Yes, the big-box pet stores are experiencing good fortune. But, to fear the competition is to miss the way forward.

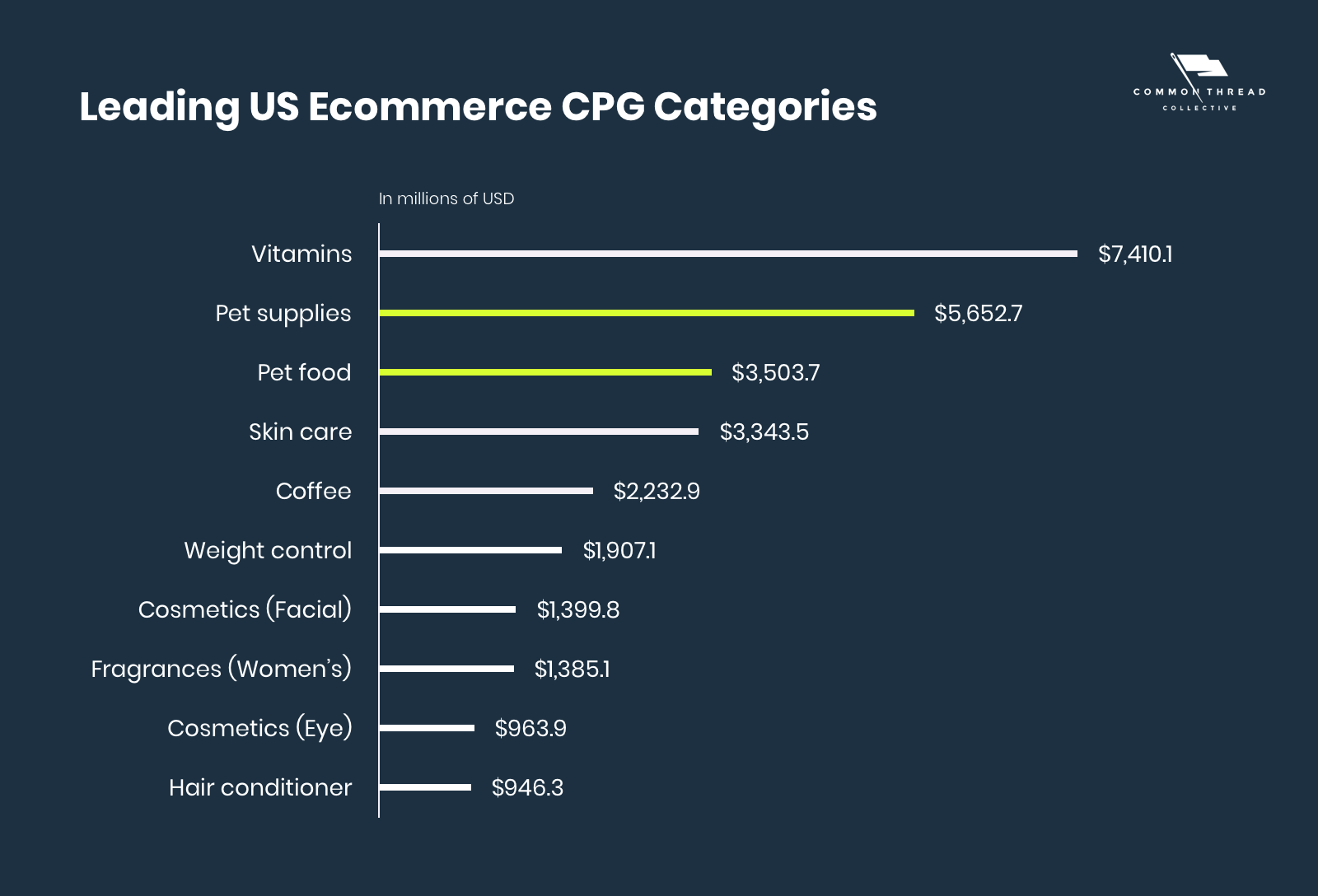

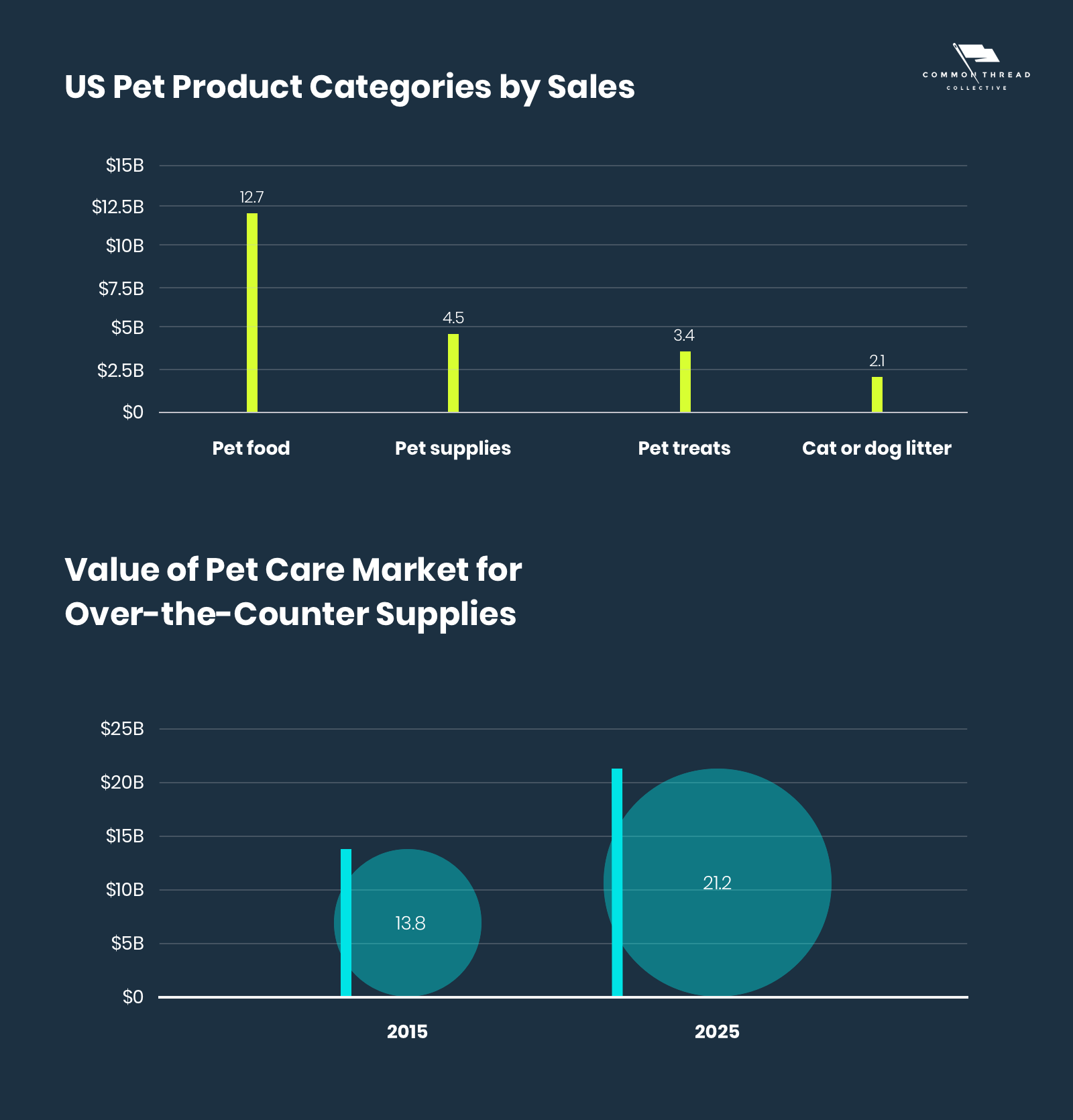

For entrepreneurs eager to penetrate new markets, pet food and pet supplies are the second and third biggest ecommerce CPG categories across the industry. The promise of prosperity is acutely high within the natural foods, animal care, and supply sectors.

Within the ecommerce sector especially there is significant room for maturation, as customer preference for shopping for pet products on ecommerce sites is estimated to grow at 9.4% — a sizable increase over its already 13% market share.

Whether it’s a rise in the number of household pets or diversified shopping platforms — the result is an expansion of the global pet market. No surprise, the area of opportunity for businesses looking to expand market share in the pet industry is online.

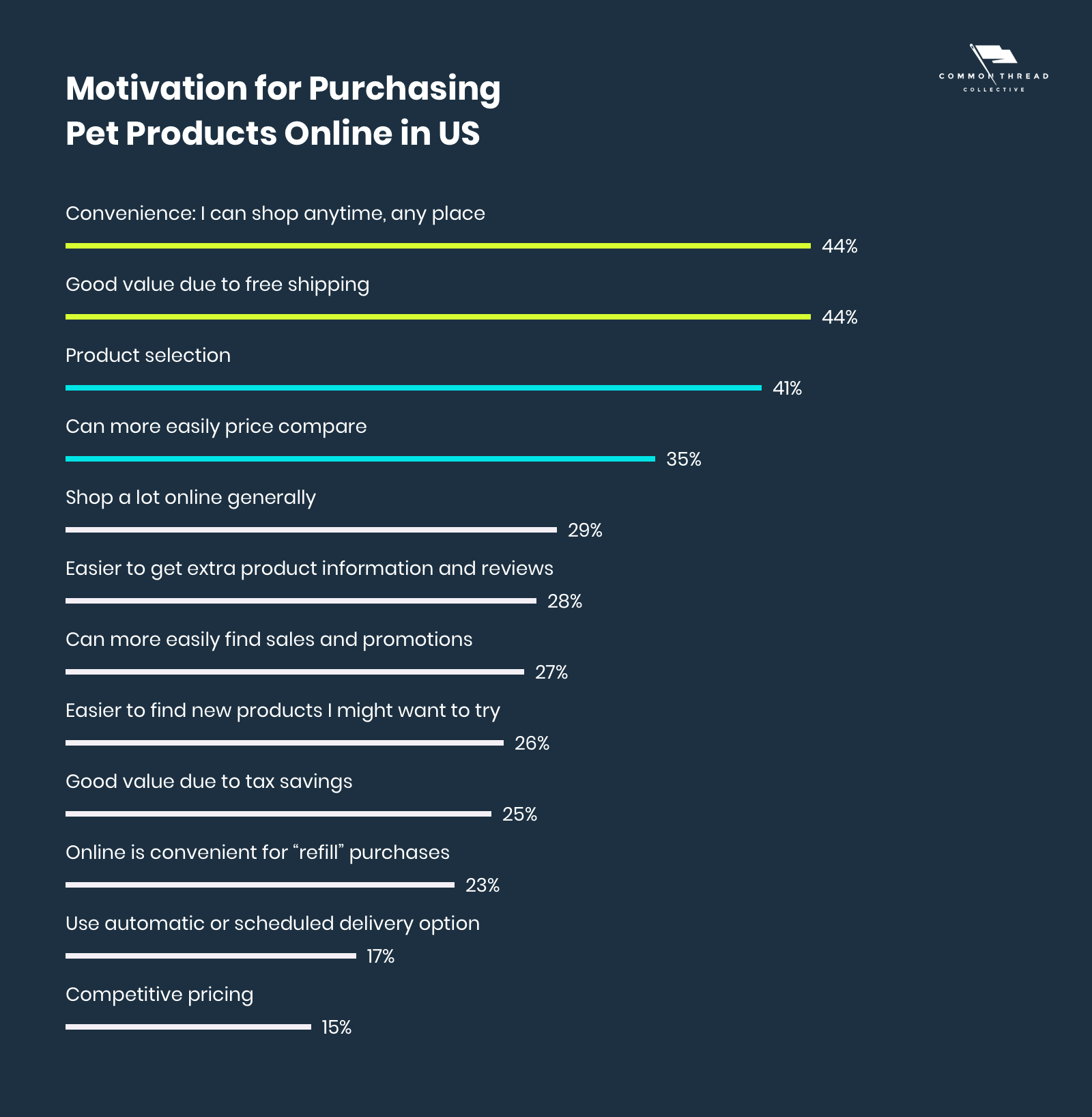

Ecommerce gives pet owners exactly what they want …

- Convenience and comfort

- Product information and choice

- Pricing comparisons that make value clear

- Devoted focus on customer relationships

The traditional model relied upon by the major industry players clashes with what customers have come to expect in the world of digital.

This digital disconnect offers an opening for ecommerce brands to leap up and capture market share. Their opportunity lies in creating a unique brand identity within their pet market niche and the advantage of ridding themselves of middleman margins in comparison to mass-market pet brands.

Looking to the future, it’s a game of how high will ecommerce sales go.

However, to focus on the sales numbers alone is to miss an even more compelling signal: a generational shift.

2. Pet Ownership Demographics and Preferences

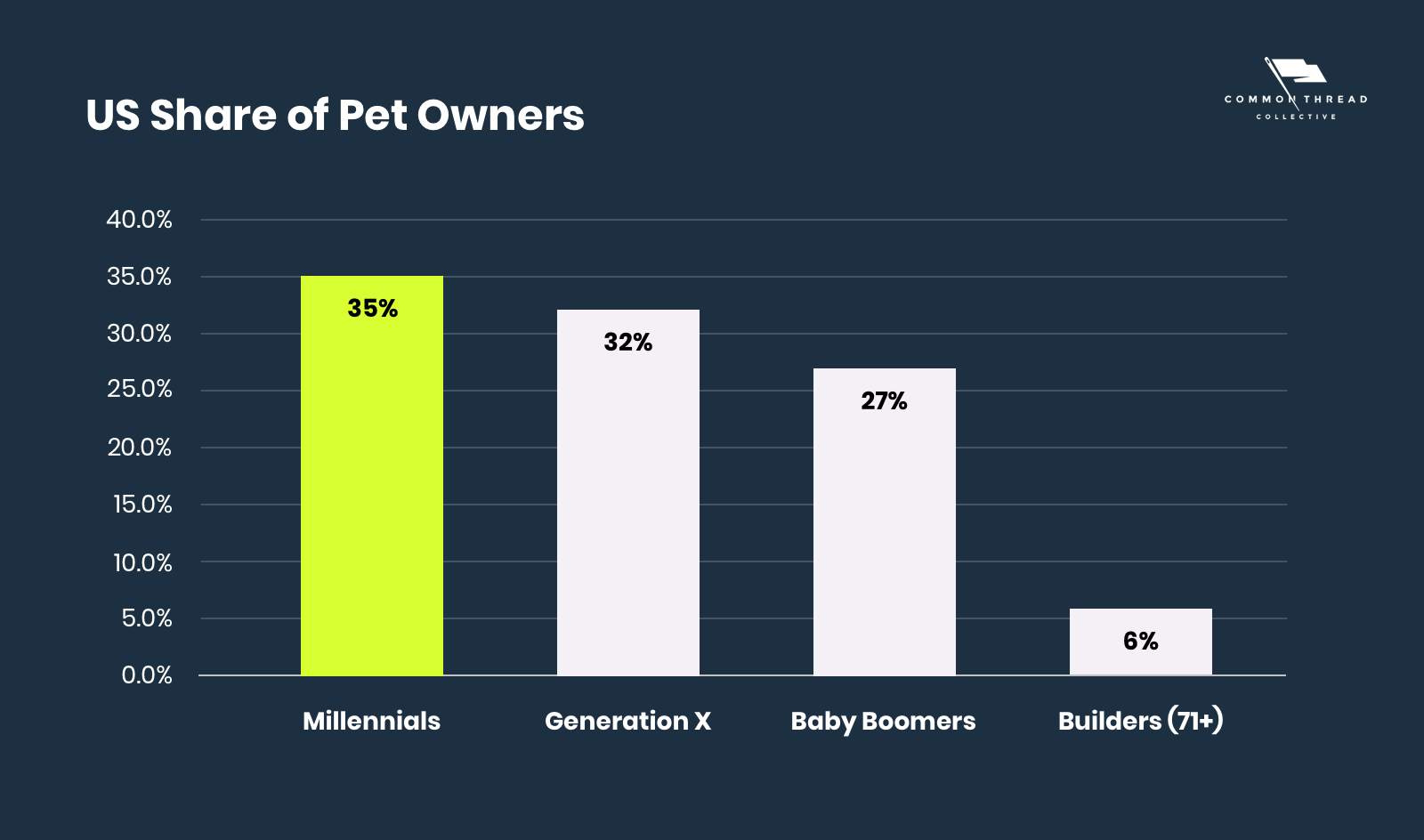

No longer do Baby Boomers represent the largest portion of pet owners; that title now belongs to Millennials. Pet brands who will win the future of the industry must understand how Millennials differ from the other generations.

Digital purchasing power cannot go without emphasizing the importance of marketing within that space. Millennials nearly double baby boomers in relation to time spent on social media: 90.4% of millennials are active social media users compared to 48.2% of Baby Boomers (eMarketer, 2019).

By nature of how users natively wield social, the pet category seamlessly fits within the realm of sharable content. Thus, retailers who meet millennials where they’re at — even if that means entering new worlds created by Web3 — can be a make or break difference for brands looking for competitive channel advantage.

In addition, competitive pricing, convenience, and personalization are blowing the brick-and-mortar house down.

The response: dual-channel retailing, faster fulfillment, improved cost controls, and advances in home delivery. Demand for high-quality products from millennials further attributes to industry profit because of the generally higher mark-ups of premium products.

Making this data actionable for means examining ecommerce trends and statistics within three segments, each with its own unique value propositions …

3. Data on Three Verticals within the Industry

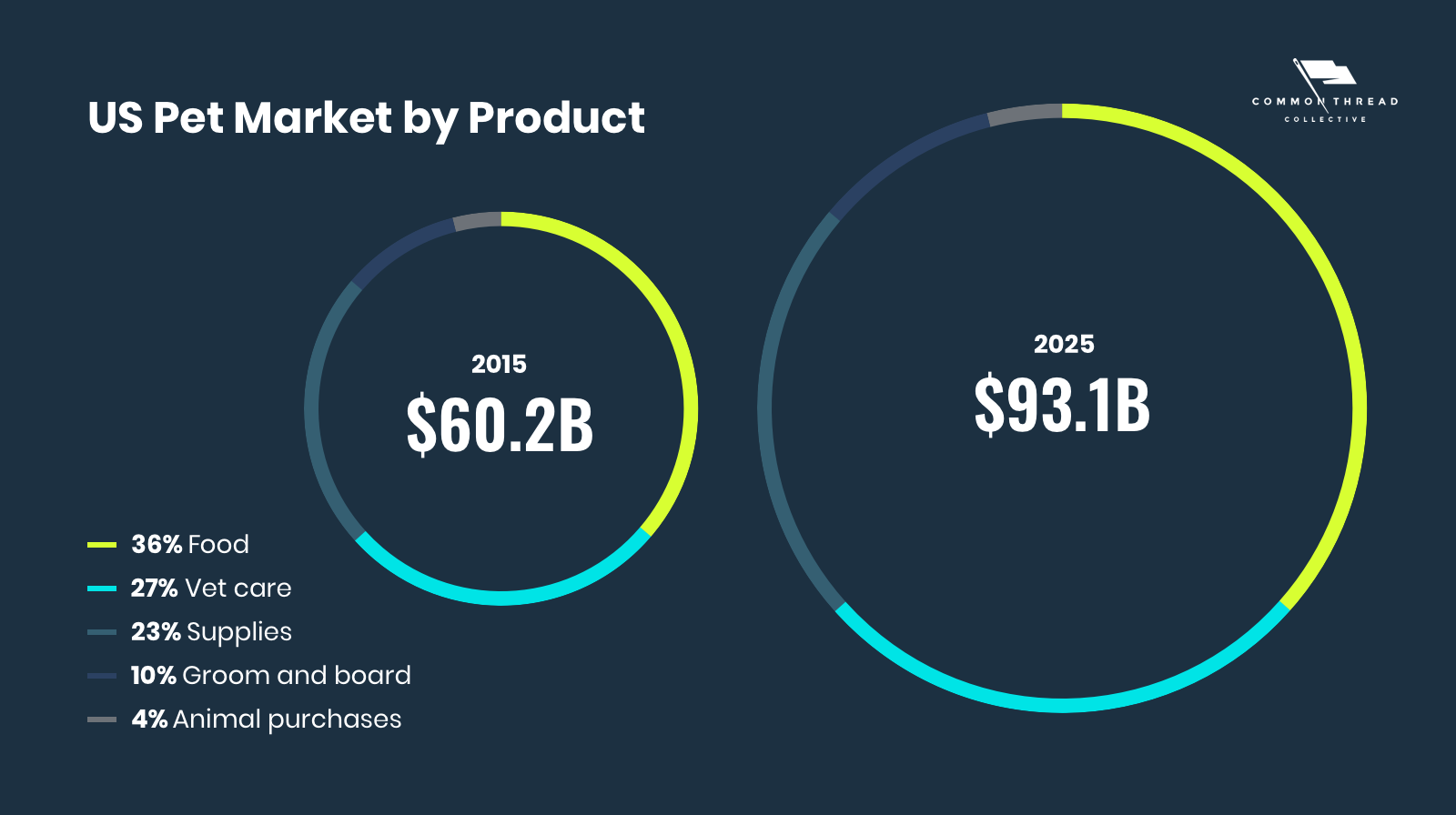

(1) Pet Food Market

At $91.1 billion worldwide, pet food represents the single largest niche within the larger space:

Within the United States’ 2020 market volume of $30.9M, most revenue is generated by the food segment, which also includes treats and supplements.

Add to this the potential for premium pet food products within the market segment. Natural and organic food products tend to come at a higher price tag, affording operators to earn greater markups.

An increasing penetration of retail sales has augmented the growth of the pet food market. At the same time, availability of pet food on ecommerce platforms entices consumers with convenience and the stripping away of physical shopping constraints.

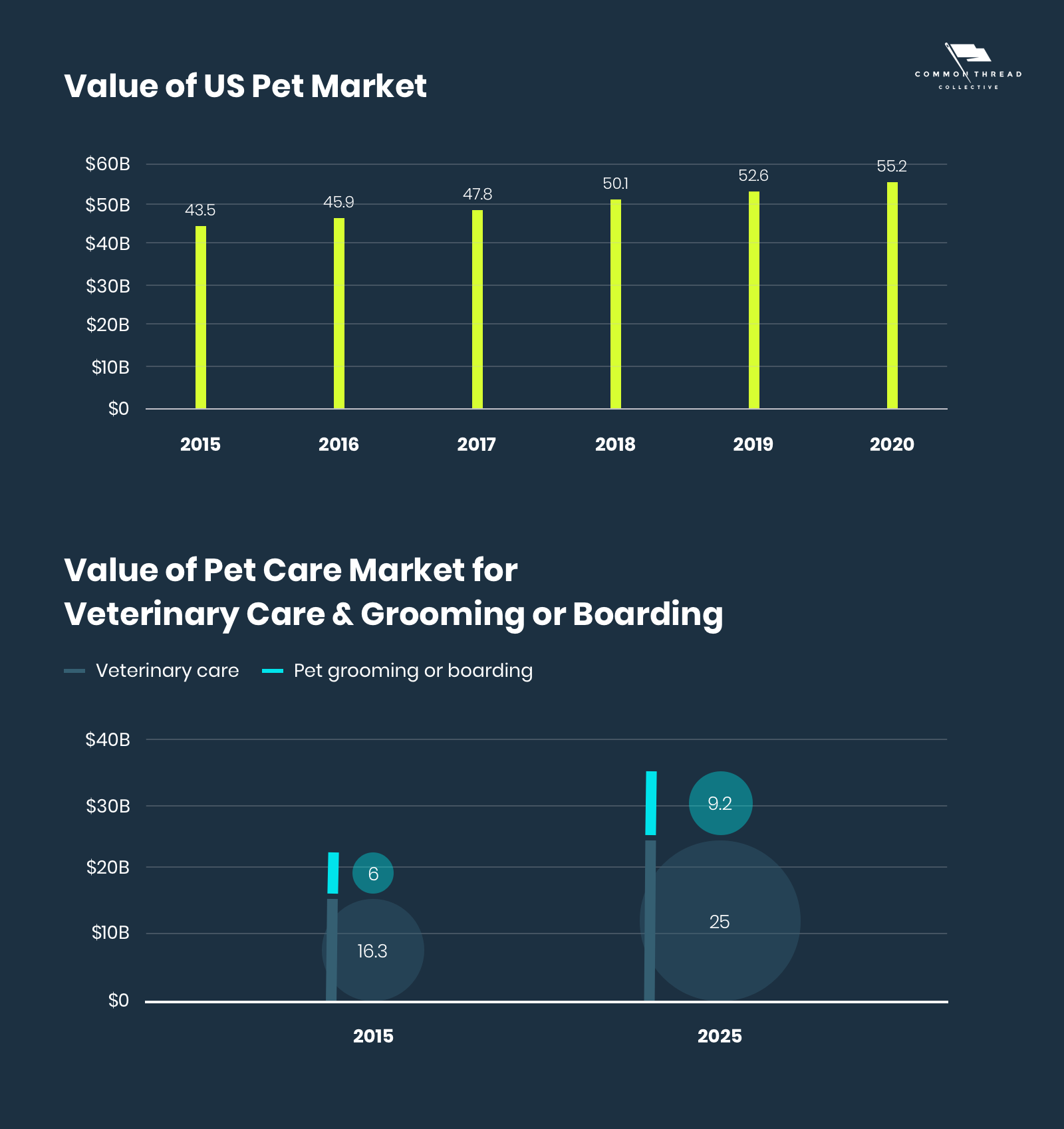

(2) Pet Care & Services

The pet services market includes grooming, boarding, training, and care.

Over the past five years, it has been the fastest-growing product segment under the industry umbrella. With more and more owners considering their pets as family, it’s rise is driven by interest in pampering and specialty services for furry family members.

Alongside it is the veterinary care industry, which has undergone growth as a result of mass household penetration.

Rising per capita income and growing pet adoptions for companionship lend to an increase in spending on pet care which will continue to boost the market.

Regardless of the distribution channel, brands within the pet care industry that offer premium services may see further gains.

Because households are obtaining higher incomes, they are able to afford premium discretionary service. It also affects the lifestyle of pet owners, affording them more ability to travel, thus increasing the importance of the boarding services segment.

(3) Pet Products & Supplies

With food and pet care holding the top two spots in terms of industry sales, there are more promising prospects within the pet supply market because it is slower growing and encompasses niche products like clothing, food bowls, collars, and carriers.

A key driver for this industry will be the wide range of availability of fashionable and multifunctional pet accessories.

Pet supplies are a leading industry category in the United States, with sales of approximately 4.54 billion U.S. dollars and positive sales growth of 2.7%.

Its share of revenue also spread due to the “pet parenting” trend, in which pet owners treated their pets as family members and started supplying them with complementary products. This segment accounts for an estimated 40.6% of total industry revenue in 2019.

Of those buying pet products, approximately 17% reported buying pet products online in 2017, up from approximately 13% in the previous year.

Pet supplies and accessories sold by retailers also encounter mounting competition not only from mass merchandisers but by smaller outlets because there are no regulations that limit their sales.

For online retailers, favorable economic conditions in the pet supply segment can be complimented through product innovation. Since mass-market brands offer goods with little differentiation, the spike in exclusive niche products will help diversify the current price competition.

In this way, niche product marketing will become mandatory to success for brands positioning themselves apart in the space.

4. Pets Stores, Retail, and Pop-Ups: Don’t Bite the Hand That Feeds You

PetSmart and Petco still hold the largest market share. Two retailers account for ~40% of the landscape, compared to more fragmented verticals like the home furnishings industry where 13 control 55%.

According to Pet Business’ Top 25 Retailers list for 2019, while PetSmart added a net total of 48 stores (versus more than 100 in 2017), Petco added a net total of 10 stores (versus 39 in 2017).

“Despite mounting competition from supermarkets, mass merchandisers and online retailers that offer similar products at greater convenience and competitive prices –traditional brick-and-mortar establishments have successfully positioned themselves as pioneers and exclusive providers of high-quality food and service offerings, such as grooming or daycare,” states the IBIS World Industry Report.

Meanwhile, digitally native pet brands are steadily gaining more market share.

Their success reflects how advances in technology within the human consumer retail market are driving change in the companion animal market as well.

None illustrate this shift more than …

5. Amazon: The Elephant Great Dane in the Room

With Amazon’s main website and third-party sellers taking up 35% of the online market share, pet startups are left to fight over the remaining food in the bowl.

Coupled with the launching of Amazon’s first private-label pet brand Wag, might have traditional retailers with their tail in between their legs. The Wag brand offers dry food, the highest moving categories within pet, exclusively to its Prime members.

While Amazon’s scale and market share might seem daunting, it does offer a glimpse of hope for brands looking to enter the online pet space. Amazon’s success shows that there is money to be made in the ecommerce space for the pet industry.

It further affirms pet brands need to take things digital in order to succeed and gain more market share.

Pet Industry Marketing: Unleash Your Ecommerce Growth Strategies

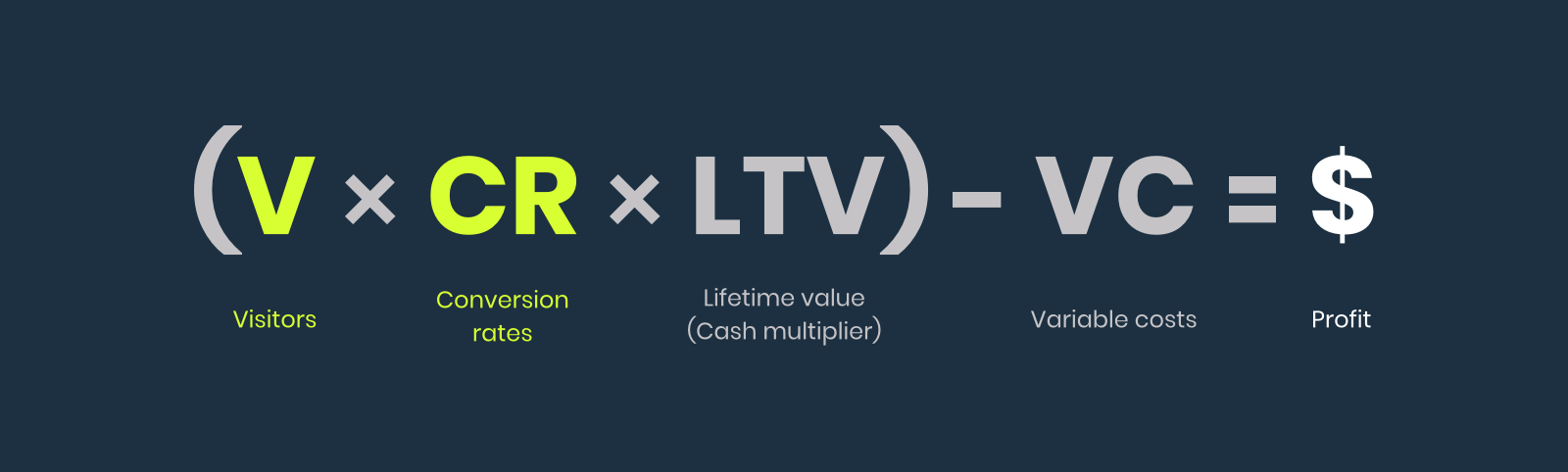

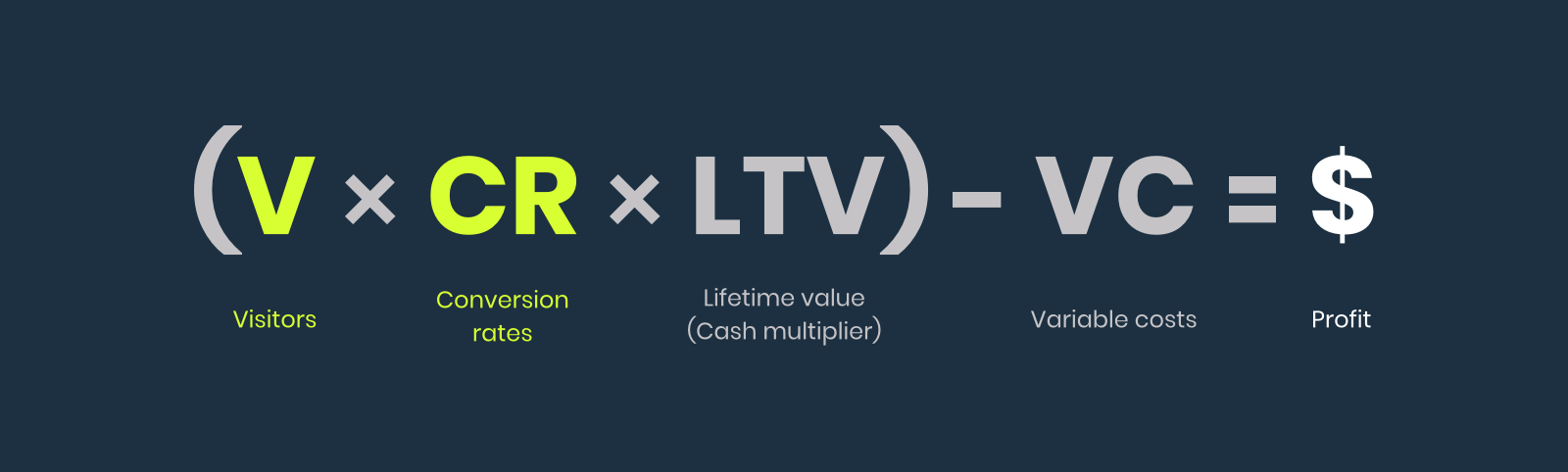

Despite all its complexity and all the data, pet brands grow based on only four metrics: visitors, conversion rate, lifetime value — your 60-, 90-, or 120-day payback window (cash multiplier) — and variable costs.

We call it the Ecommerce Growth Formula. And it’s the framework for every successful digital marketing strategy or plan …

There’s no other way to impact your profitability than to affect one of these four variables — propelling them forward through a master plan built for growth.

1. Visitors: Driving Paid Traffic

Entice new and returning customers (your target audience) to your online store across every channel available.

Social Media Advertising

According to a study from Mars Petcare, the world’s largest petcare company, 65% of owners post about their pets on social media an average of 2X per week.

Whether it’s through organic or paid traffic, pets dominate social media pop culture.

For brands looking to draw visitors, capitalize on using social to insert yourself as a voice within pop culture, playing to the trend of pets as entertainment.

Focus your investment in paid along three lines.

First, calculate your Facebook ad budget based on profitable cost-per-acquisition (CPA) targets. Second, organize your campaigns into a consolidated account structure that unites prospecting and remarketing. Third, build those campaigns around SKU-specific or buyer-persona funnels.

Influencers

Call the paw-purratzi (sorry, we had to). According to Mars, 30% of pet parents follow celebrity pets on social media. It highlights how pets aren’t just an important part of pet owners’ lives, many are a staple of pop culture.

Leveraging influencer marketing within digital marketing efforts offers a strong entry point into the social pet phenomenon.

“Through a pet influencer program,” says Taylor Lagace of Influencer Marketing Agency, Kynship, “brands within the space would (1) maintain an ongoing organic social conversation, (2) build out a highly-converting content library, and (3) expand their audience pool within the exact niche they’re targeting.”

Search Engine Marketing

An integrated and thoughtful SEM methodology is critical for growing any brand online, including retailers that cater to our furry friends. All SEM starts by understanding keywords and search volume for your industry.

Get to know what your potential customers are searching for and think about how your products match up to those searches.

“When it comes time to Google Ads for ecommerce, start with a Google Shopping campaign. They are almost always the highest returning campaigns and will be worth the investment in resources,” recommends CTC’s Director of Paid Search, Tony Chopp.

YouTube

Search engine marketing doesn’t end with Google. “Don’t forget about YouTube!” adds Chopp, “We’re seeing solid returns on prospecting and remarketing campaigns on YouTube for our pet brand clients.”

Utilize this channel to reach an active, engaged audience with high-quality content.

Organic Traffic (SEO)

When developing a plan of action, start with demand generation via social, capture that demand with SEM — particularly branded search terms — and then combine them both with organic search.

“If you’re a new brand, you’re not going to have organic traffic right off the bat,” says Growth Guide, Andy Reese.

“When you start spending on Facebook, which is a demand generator, you ultimately are driving brand awareness regardless of if someone clicks on the ad or not. As a result, later down the line, we see that paid search, organic direct, and social traffic are all affected by what we do on social.”

2. Conversion Rate: Ad Creative & Web Design

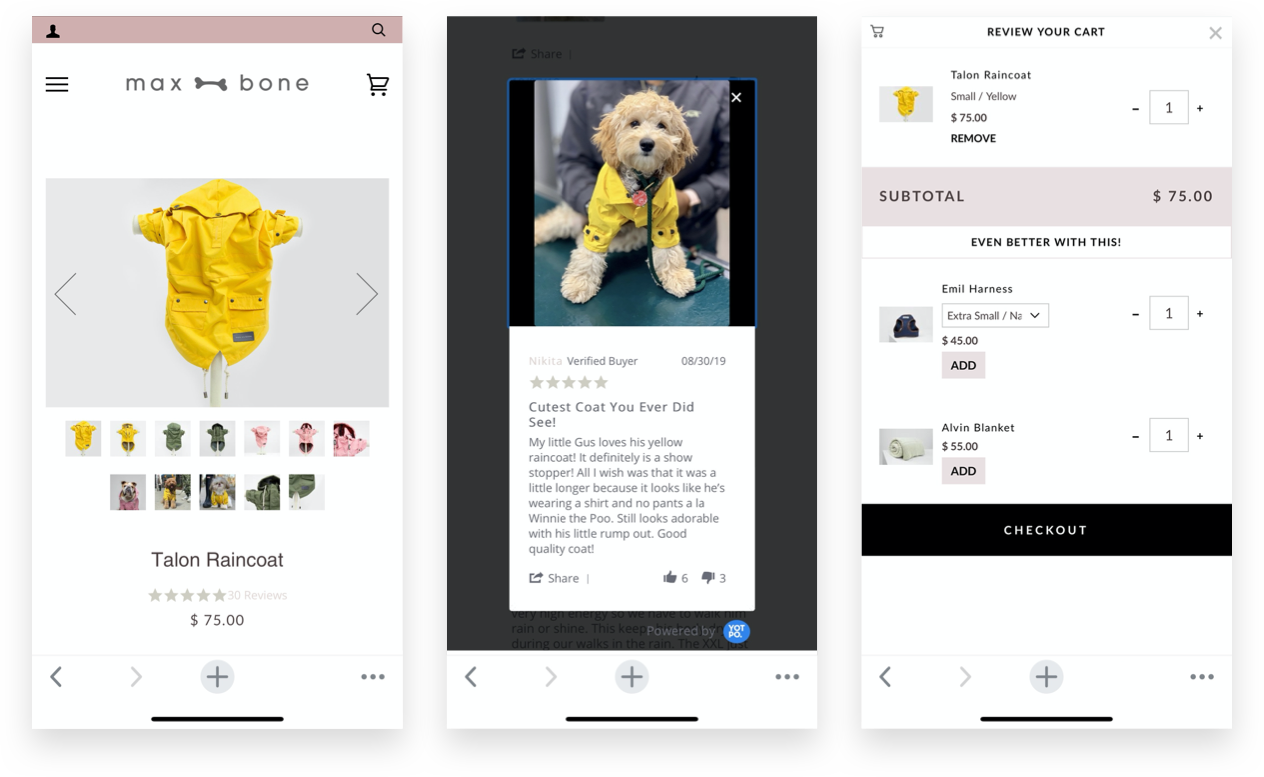

Acquire new customers and increase AOV by optimizing your onsite experience.

To set yourself apart from the pack, incorporate visual storytelling and message mapping that breeds brand equity.

From driving visitors through ads to the design experience, conversion rate encompasses the culmination of digital marketing efforts within your sales funnel to finalize a purchase.

Tactics to boost conversion rate include breakthrough creative and an analytical approach to content development.

Onsite, this includes email capture, reviews, trust seals, user-generated content, subscriptions, and in-cart or post-purchase upsells. Layer on site speed and mobile optimization and you’ve have a seamless shopping experience that will leave your customer like a dog with two tails.

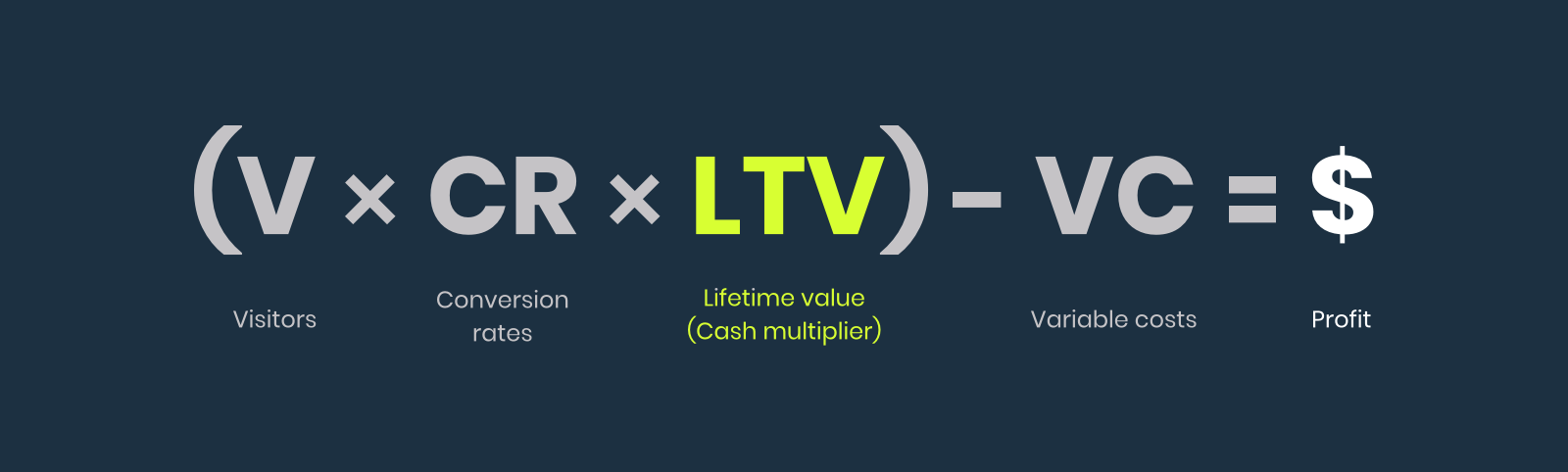

3. Customer Lifetime Value: Cash Multiplier

To build your business in the long and short term, the most important and often overlooked metric is your LTV or “cash multiplier” (CM).

Rather than thinking about the entire lifetime of a customer, you want to know what your customer is worth in a very specific payback period.

Start by determining your 60-, 90-, or 120-day LTV (depending on your SKUs normal reorder or upsell cycles). Then, execute a plan that fits your cash flow while also front-loading the products and offers that yield the highest ROI.

Tactics like memorable unboxing experiences or email marketing can generate an owned community of customers that find your brand worth barking about.

Email Marketing

Retention, retention, retention. We repeat, email marketing is critical to improving your customer lifetime value (LTV) and maximizing revenue.

The good news is, we’ve already laid out the blueprint to drive visitors to your site. Use their arrival to your advantage by encouraging subscriptions to your email lists, which will drive purchases further down the line if they don’t convert the first time around.

Whether your email subscriber is a future or past purchaser, educate your customers about your product but also revere email as a space to engage with them.

Drivers like loyalty or subscription programs are tactics that build community around your brand and lead to upsells further down the line.

From welcome flows to post-purchase flows, ensure your messages speak to your brand and provide value to your consumer’s stage in the customer journey.

4. Variable Costs: Profitability

An area that is of highest competitive advantage for online retailers lies in variable costs.

By undercutting price due to lower cost of goods, plus the convenience of doorstep shipping — online pet brands can get ahead of brick-and-mortar retailers that haven’t streamlined their fulfillment or supply chain processes under the new rules of the digital landscape.

“Online retailers offer similar products at greater convenience and competitive prices,” states the IBIS World Industry Report. “An increase in demand from online pet food and pet supply sales will likely decrease demand for traditional brick-and-mortar stores.”

Of course, the real question is: what does all that look like in action?

5. Case Studies: Lessons from Three Pet Brands

To bring each variable in the growth formula to life, let’s take a look at three pet brands mastering the new digital world …

Crown & Paw: If You Don’t Sell, It’s Not the Product That’s Wrong

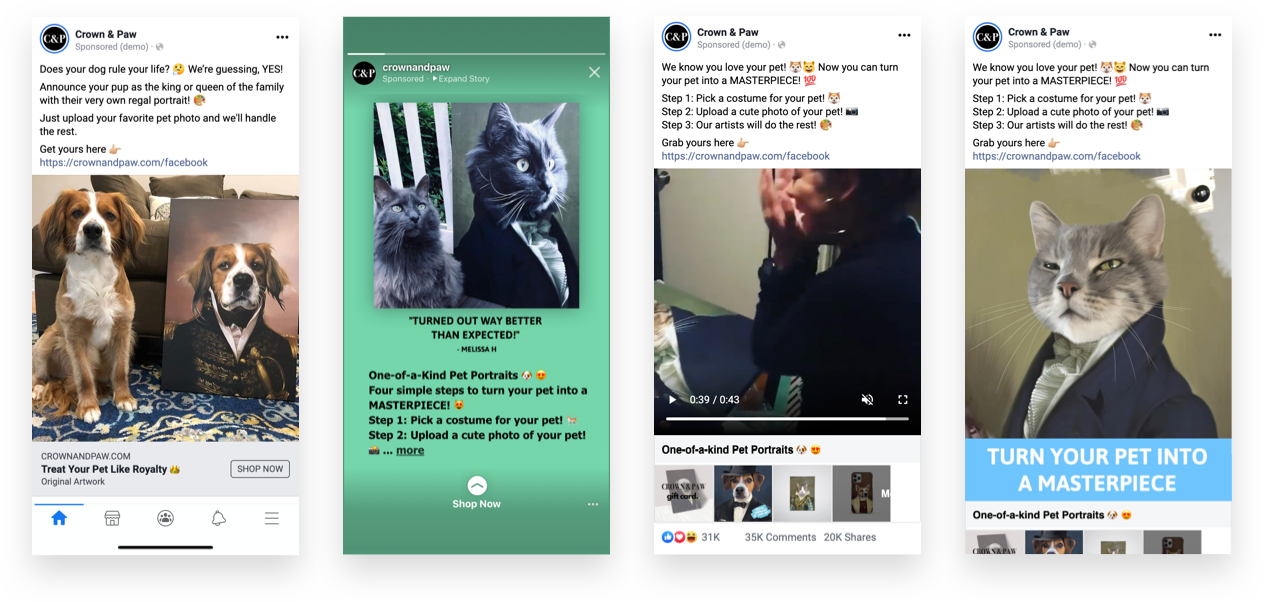

In Mar. of 2019, Crown & Paw started out of a small town in England. By Dec. of the same year, it had 10X’d growth and was distributed worldwide.

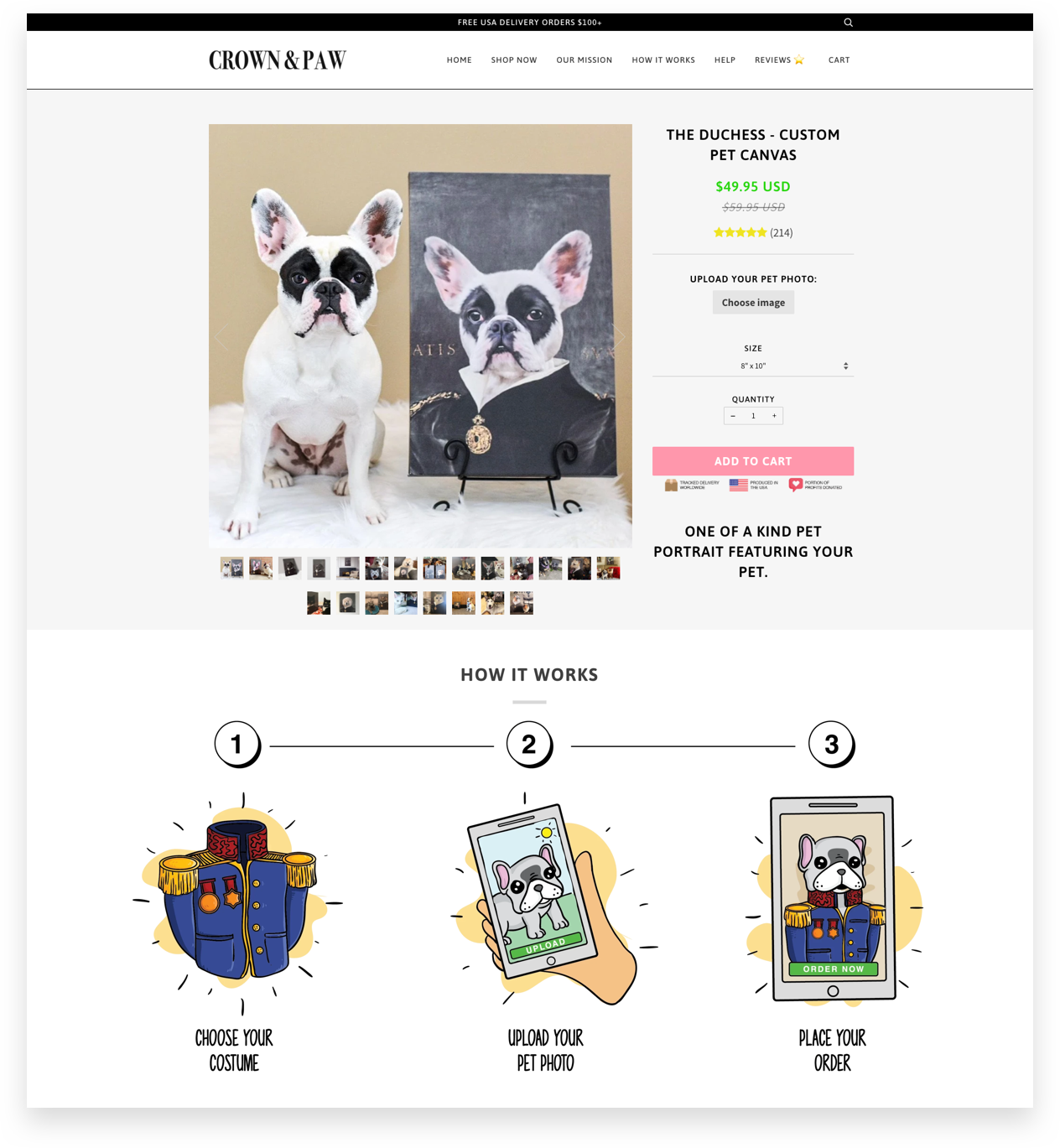

Crown & Paw is a fun-loving custom pet goods brand dedicated to helping pet owners express their love (and sometimes even their obsessiveness) with their pets.

Pet owners simply submit a photo, then Crown & Paw’s artists turn them into a hilarious Renaissance-era portrait.

It was a product unlike anything on the market. But, even the best products need awareness to sell.

Through paid advertising, Crown and Paw grew exponentially to become one of the most successful digitally native pet brands on the internet.

The catalyst to that victory came down to three factors:

- Maximizing click-through rate (CTR)

- Lowering cost per unique add to cart (ATC)

- And optimizing conversion rates across its funnel (CR)

(1) Click-Through Rate

The first step in driving more traffic meant creating thumb-stopping ads that brought the value and delight of the product to life. Producing content that felt native across platforms and clearly communicated its one-of-a-kind nature quickly improved CTRs.

But there was another problem …

(2) Cost Per Unique Add To Cart

Initially, add-to-cart rates were fairly low for the brand; in turn, driving up costs.

“We realized that this was largely attributed to choice overwhelm. We had too many options on the site, so people didn’t know where to start, would get overwhelmed, and bounce,” says Reese.

“In order to increase conversion rate, we had to start by making it as simple as possible to add-to-cart onsite.”

To do so, the website was redesigned to simulate a sales funnel. This meant reducing clutter on the home page, removing unnecessary outbound links within product pages, and clarifying “How It Works”:

“These adjustments simplified product selection — reducing any friction for the customer to be taken away from choosing their image, adding to cart, and then converting once in the cart.”

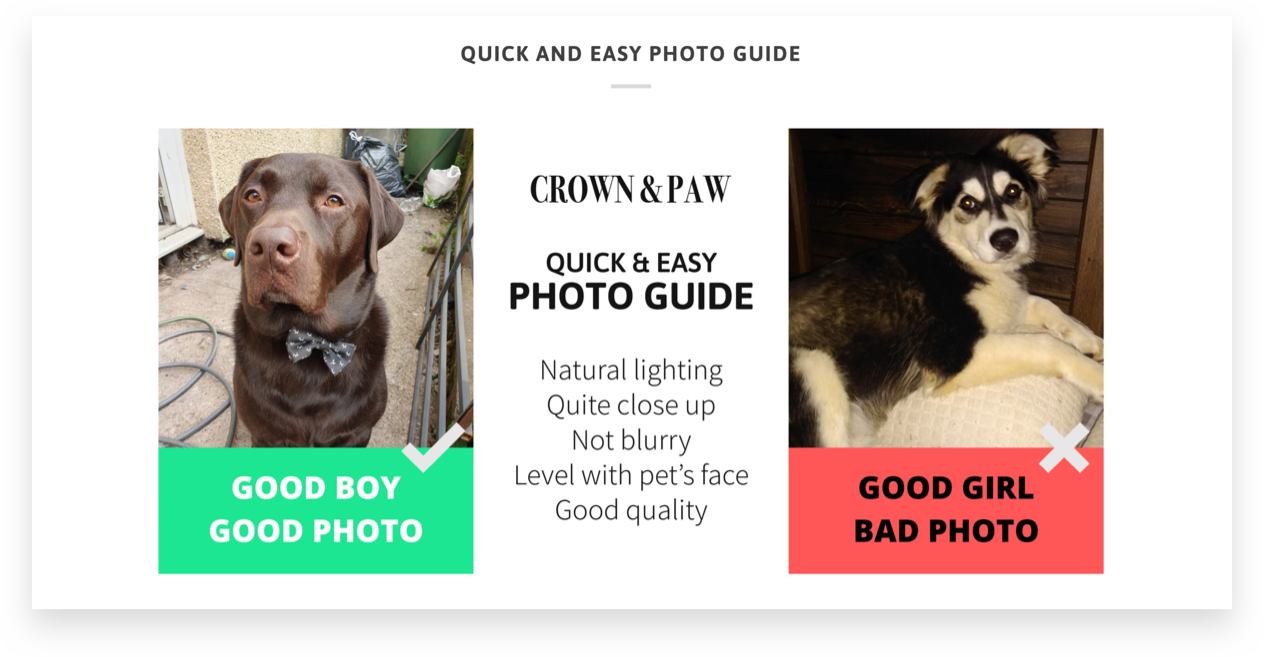

Two additional keys were adding a “Quick and Easy Photo Guide” directly to product pages — rather than hosting it on a separate URL or within a pop-up.

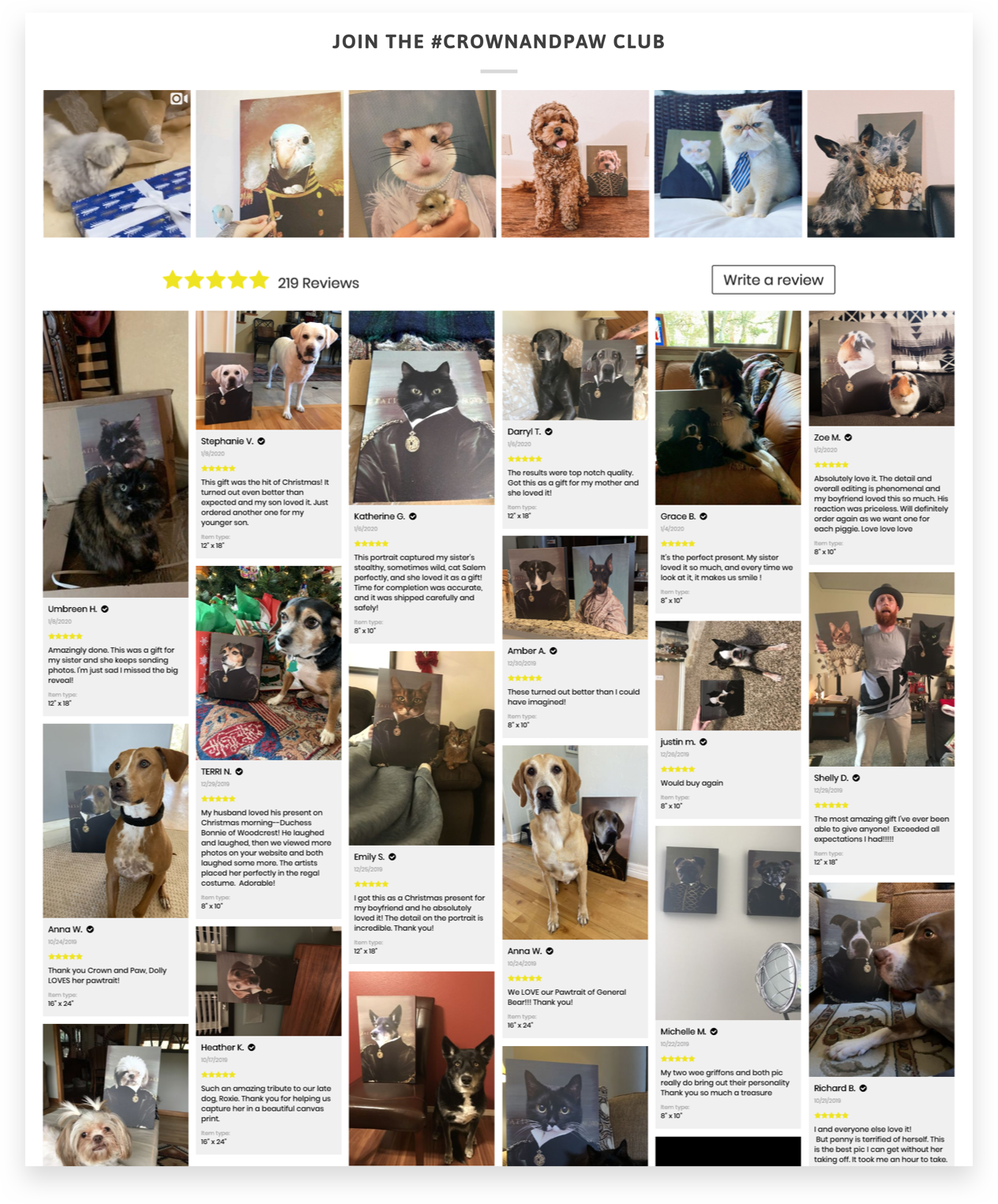

And, as a final touch, a virtual waterfall of reviews and UGC located at the bottom:

(3) Conversion Rate

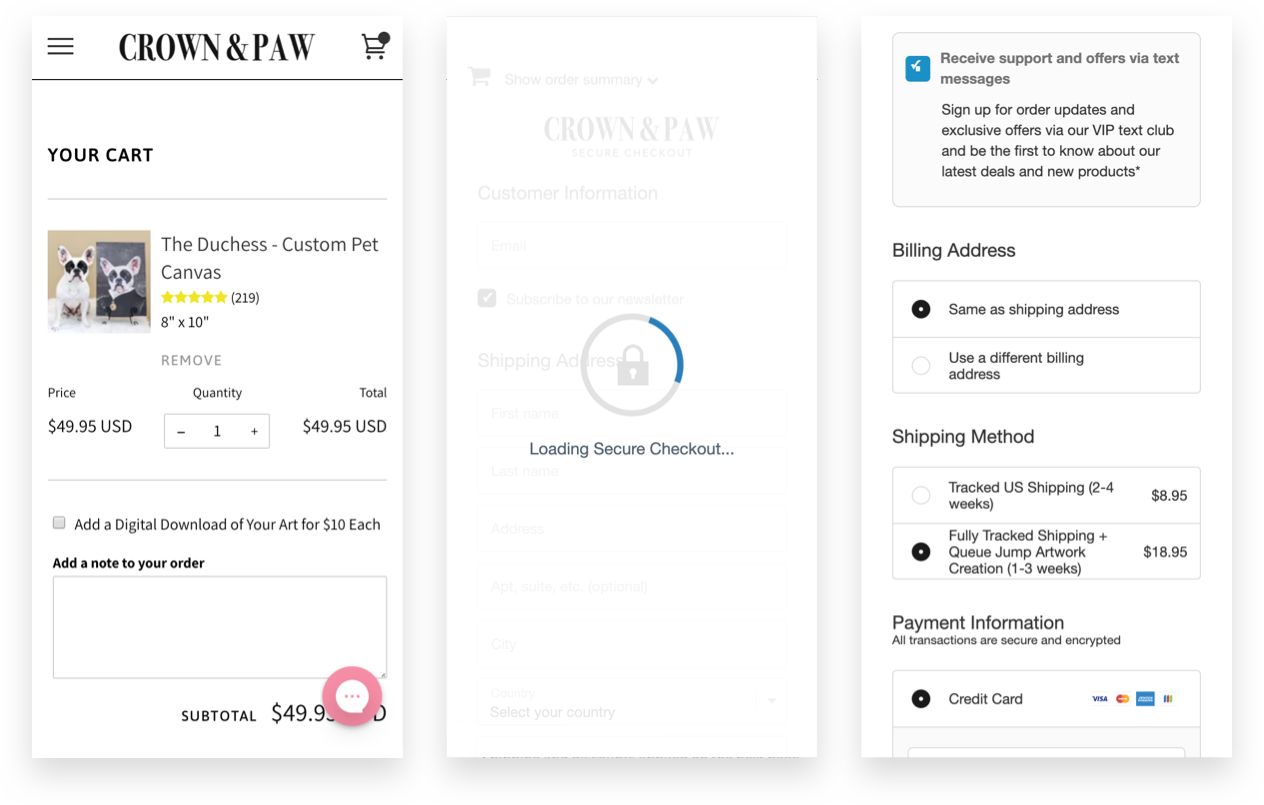

As the sales funnel neared its end, conversion rate became the key variable to be optimized. An on-page upload process led the way; as did subtle trust signals immediately below “Add to Cart” calling attention worldwide delivery tracking, USA production, and profit donations:

Once inside the cart, trust was the unlock. This meant …

- Making security measures obvious

- Adding reviews and a digital down option

- Keeping the checkout on Crown & Paw’s branded URL

Incorporating these elements reduced cart abandonment and catapulted conversion rates. These efforts culminated when the holidays hit …

By scaling the account during seasons of gifting, sales skyrocketed.

In Nov., Crown & Paw saw a 3x increase in conversion rate heading into Black Friday, Cyber Monday. By Dec., it doubled to a 6x increase.

Paid media isn’t the only thing on Crown & Paw’s mind. Now that paid efforts have driven initial brand awareness, their organic traffic on Google has seen a strong uptick. Plus, PR efforts led to its inclusion in BarkBox.

The Lesson

6x’d conversions and 10x’d growth in less than a year is no small feat.

If something doesn’t sell, it’s not necessarily the product that’s wrong. By understanding your customer’s buying behaviors, you can profitably drive awareness and optimize the onsite experience. The rest will follow.

PupSocks: You Can Teach An Old Dog New Tricks

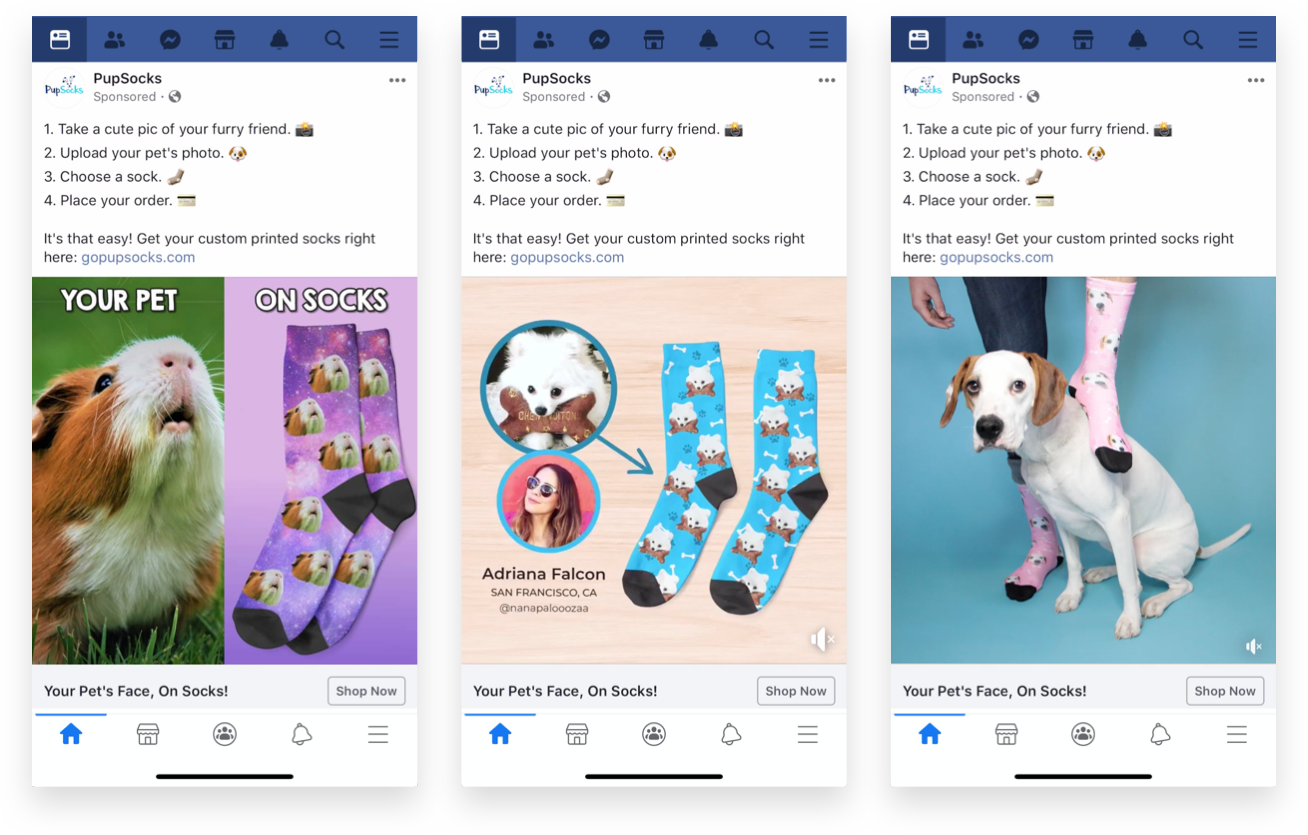

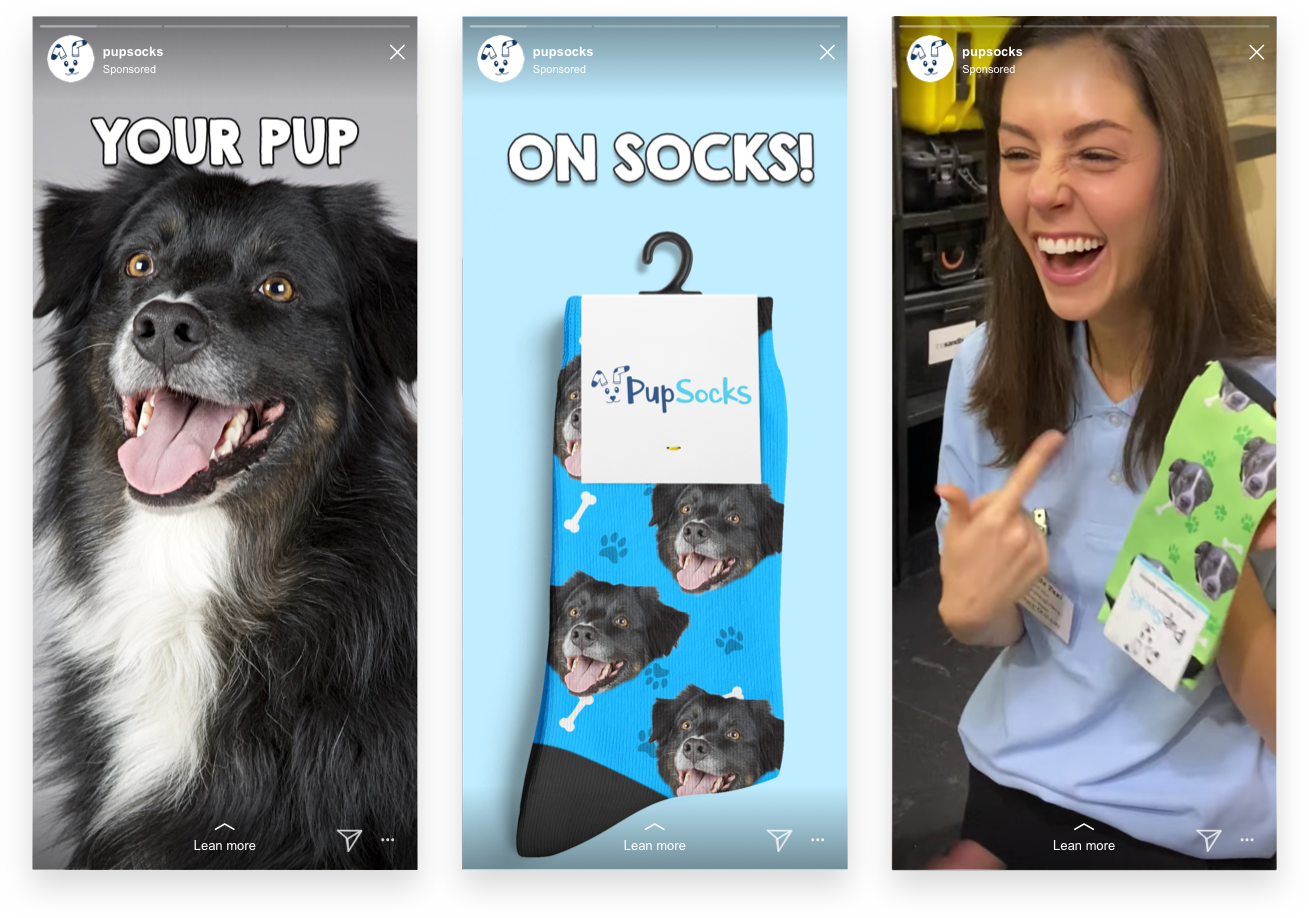

Based in Atlanta, Georgia, PupSocks makes custom pet products that feature customers’ favorite photos of their pets. Selling in 39 countries, it’s proof people everywhere want to combine their love of furry friends with trendy fashion.

Being both a gifting product and an impulse buy, Pupsocks was a one-two punch for a strong conversion rate, averaging a whopping 9%.

With the goal of amping up holiday sales, driving new visitors through paid media has been a key component of Pupsocks’ strategy.

In 2017, Pupsocks ran a conversion campaign on Facebook during the holiday season targeted to animal lovers, which generated more than 90% of the company’s annual revenue and yielded a 3.7X return on ad spend.

But, as we all know too well, it’s not 2017 on Facebook.

With returns lower than they used to be, it was time for a new approach to amplify visitors and conversion rates.

“We had exhausted our broad audiences,” says Trent Kerth, Lead Paid Media Buyer for Pupsocks. “The brand awareness was there, every potential visitor had been reached. Now it was a matter of getting them to convert.”

To revive an exhausted audience, the lifeline came from expanding Pupsocks’ creative library.

Refreshing the account with new creative reduced ad fatigue. But it didn’t stop there — whether it was a different sock color, pet breed, or ad format — it continually tested and iterated on best-performing ad creative to find the winners ahead of Black Friday.

Like the early bird that got the worm, Pupsocks dominated holiday sales, since the winning creative formats were identified ahead of time.

“When you’re spending over $1M a month on Facebook ad costs, eventually people are going to get banner blindness from seeing that ad multiple times,” says Kerth.

With extensive creative variation, Pupsocks was able to combat that fatigue — granting more scale and reaching other audiences that you wouldn’t be able to otherwise with just one ad.

The Lesson

The amount of ad creative made was more than any other year and, as a result, Pupsocks had their biggest revenue year in the history of the brand.

On the heels of two consecutive record-breaking years, the brand saw …

- Visitors jump by 78%

- A conversion rate of 9.1%

- And revenue increase by 57.5%

What’s more, across the account’s lifetime at Common Thread Collective, PupSocks has maintained a 2.6 ROAS on $6M+ in spend.

Max Bone: Revenue to Bark About

“Max-Bone targeted the under-served luxury pet segment by creating highly practical products with innovative twists,” said CEO Parisa Fowles-Pazdro in an interview with Forbes.

“The brand, which is one of, if not the first wide-scale luxury pet brand with major distribution, creates unique, sophisticated offerings from hand-knit jumpers designed to keep shedding hairs in place for dogs, dog and cat baby starter kits to owners spoiling their pups with a sold-out line of teepees.”

For a luxury brand, both the challenge and the opportunity was in increasing customer LTV.

Creating a lifestyle brand for your pet is very similar to that of apparel DTC’s like Buck Mason, Everlane, or Outdoor Voices where retention is critical.

For Max-Bone, it meant convincing an audience that everything they buy for their pet has to be design-forward, the same way they might think that all of the workout clothes they buy for themselves have to be high-end.

To start driving qualified traffic for Max-Bone, involved messaging the brand’s unique product offerings in a way that was relevant to their customer personas.

“As a design-forward brand, we were deliberate in choosing the product to prospect with,” says Growth Guide, Garrett Hord.

Building a strategy around increasing LTV began from the moment customers first became aware of the product right in an ad right through to the product page, onsite reviews and UGC, as well as in-cart upsells for related items.

The real key, however, was tracking LTV by first-product purchased. Data to understand what SKUs impacted LTV became critical to decisions in the ad account and where to allocate resources.

“For example, Max-Bone has a $290 pet carrier bag. If that’s somebody’s first purchase and they love the product,” explains Hord, “are they going to turn into a higher value customer than somebody whose first purchase is a $50 sweater? That’s where the data helps us.”

You can’t do a great job tactically without having the information on hand. Rather, strategy evolves from understanding, what to track to being with — understanding LTV by first product.

The Lesson

As a result of identifying products that generated the highest customer lifetime value and then prospecting using the highest LTV-yielding products to attract more new customers ...

Max-Bone’s revenue increased by more than 100% from Q2 to Q3 and more than 200% from Q3 to Q4.

The Right Partner: Do You Need a Pet Marketing Agency?

After growing brands like Pupsocks, Crown & Paw, MaxBone, and more we pride ourselves on being experts in every stage of the online sales process within the pet market space.

From creative content to media buying, our solutions are specifically tailored to tweak the variables that create revenue.

If you’d like to take this article with you on the go, grab it as a PDF. And, if you’d like to know more about how we can help grow your pet brand, then start a conversation here.

We won't send spam. Unsubscribe at any time.