From every side, the pressure mounts.

Competition? Up. Customer acquisition costs? Up. Production, labor, and fulfillment? All ratcheting skyward.

The last year has squeezed ecommerce margins in vice after vice. But that’s not the only source of pressure …

At the same time, story after story piles upon you with the rapid growth of NFTs and digital art selling for millions.

Insult to injury. Rocks atop hard places. Especially for time-strapped leaders left wondering: Am I already too late?

Good news, you’re not.

Better still, NFTs offer potent relief to depleted margins. Seizing the future demands answering three questions …

Already familiar with NFTs and want to jump straight to the action?

No problem!

Grab the PDF version of this article and we’ll also connect you with our partners at Crypto Packaged Goods (CPG) Consulting.

As a founding mentor (Taylor) and mentee (Luke), we’re excited to have been chosen as the community’s exclusive agency. Our role is straightforward — to help retail and DTC organizations move forward profitably.

What? Five Definitions for ‘Late’ Arrivals to Crypto

Any attempt to leverage the trends set before ecommerce brands must begin by understanding the technologies at their core:

- What Is the Blockchain?

- What Is a Cryptocurrency?

- What Is the Meaning of NFT?

- What is the “Metaverse”?

- What is Web3 versus Web2?

1. What Is the Blockchain?

The blockchain is a database that verifies transactions on a network of distributed computers; though not always, decentralized transparency characterize its structure.

As a metaphor, imagine your bank statement: a ledger of transactions (data) that form your financial history and balance of capital (database).

Now imagine — instead of being stored on a single server owned by your bank — that statement was housed in a Google Sheet …

- Stored piecemeal across every device with access to it

- Kept secure by formulas that verified and locked every new transaction based on the one before it

Both contain a list of credits and debits. Both your history and balance. However, when you share a Sheet, it doesn’t get copied; it gets distributed.

In short, that’s the blockchain.

- Block: A transaction (data) is created

- Network: Shared across peer-to-peer computers

- Proof: The network computes the data and checks its hash — mathematical fingerprint — against the previous block

- Chain: When the hashes match, the block is immovably linked and …

- Distributed: The blockchain is simultaneously updated — fully open and transparent

Because no single entity controls the blockchain, the need for third-party validation is removed. It establishes a “trustless” record whereby information (and, therefore, value) can be transferred directly between individuals.

2. What Is a Cryptocurrency?

Cryptocurrencies are byproducts of blockchains, incentivizing the power needed to run them; when demand for a blockchain increases, so does the value of its currency.

Just like government-controlled money, cryptocurrencies are fungible tokens. While those terms might be unfamiliar, the concepts aren’t.

Fungible simply means interchangeable. One $5 bill is the same as any other and can be combined or divided — e.g., two $5 bills into a $10 bill or one $5 bill into five $1 bills.

Tokens refer to the objects themselves: symbolic representations of value — i.e., vouchers that can be exchanged for goods or services.

What’s the difference between traditional money and cryptocurrency?

Rather than being issued by governments and settled through banks, cryptocurrencies are issued on-chain and settlement happens on a decentralized network.

New tokens enter circulation through “mining.”

Similar to extracting gold from the earth, the process is costly and resource-intensive. It requires sophisticated hardware to solve complex mathematical problems related to both the transactions as well as their hashes.

To illustrate, we can lay mining on top of our previous diagram:

- Request: Use of the blockchain for a transaction (data)

- Miners: Peer-to-peer computers acting as individuals

- Mining: Miners compete to compute and check the hashes

- Cryptocurrency: New token issued on the chain to the winner

- Value: As demand for the blockchain exceeds supply, the value of that chain’s cryptocurrency increases

In this way, miners get paid for their work as laborers and auditors.

Some of the most notable cryptocurrencies include …

- $BTC: Bitcoin blockchain

- $ETH: Ethereum blockchain

- $SOL: Solana blockchain

- $ADA: Cardano blockchain

- $FLOW: Flow blockchain

As a representation of blockchain’s “value,” cryptocurrency will continue to grow as more individuals, institutions, and nation-states adopt decentralization for investments, balance sheets, and legal tender.

3. What Is the Meaning of NFT?

NFTs are non-fungible tokens used to prove the provenance of rare assets, both digital and physical; they also bestow utility — access and benefits typically built around specific communities.

This time, let’s use a social security card as our metaphor: a numerical representation of a unique person stored in a database and carried on a piece of paper.

NFTs do the same thing. Represent a unique asset in an equally unique way.

Like cryptocurrencies, NFT ownership, storage, and creation (called “minting”) take place on the blockchain.

Unlike cryptocurrencies, NFTs cannot be separated or interchanged. That’s what non-fungible means, indivisible and one of a kind.

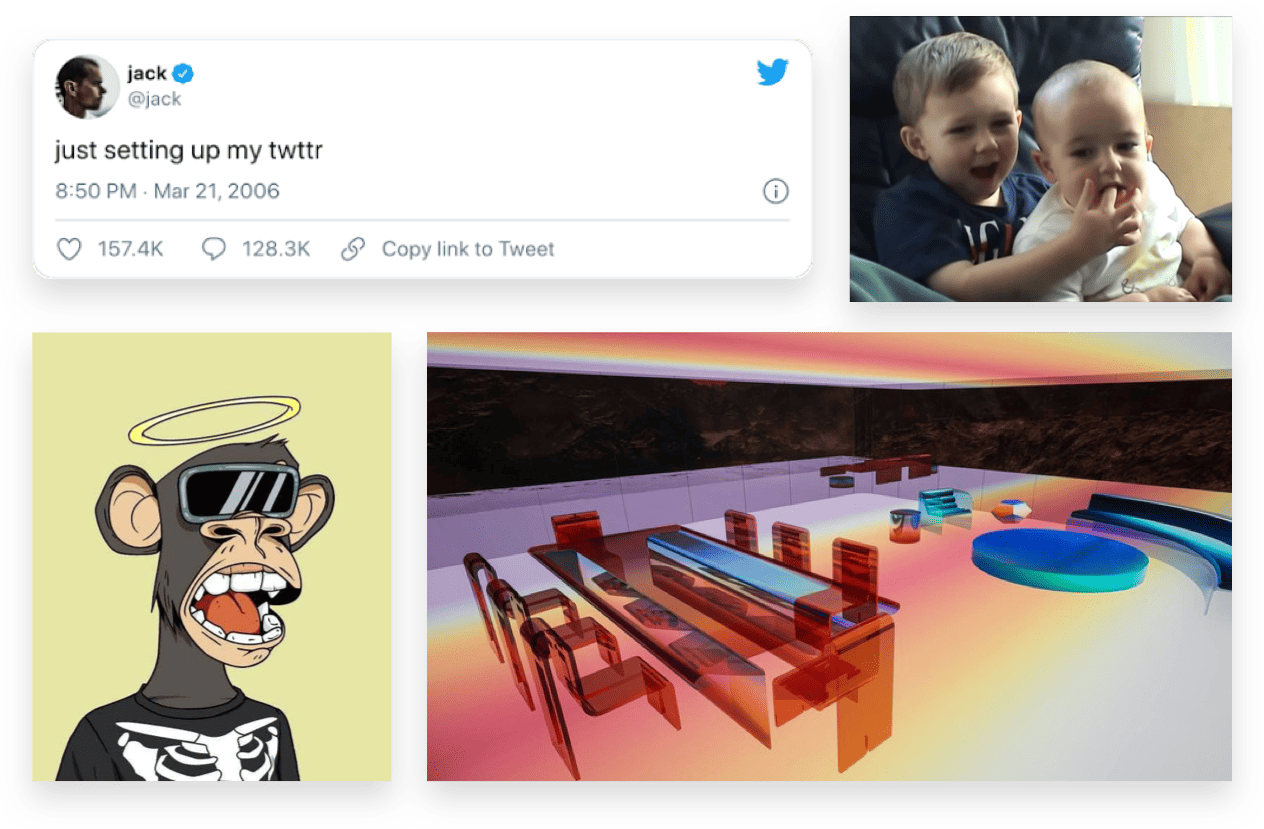

NFTs offer myriad options for making and trading assets — everything from digital artwork and collectibles; to images, videos, and gifs; to land and other elements in a game; to legal documents, proof of ownership, and smart contracts … even moments in time.

Things get really interesting when holding an NFT also gives the buyer utility: access to communities, events, physical goods, and people.

The true value of NFTs materializes only as we enter virtual worlds — bridges that move many of us closer to exploring realms to which we’ve only given credence in books and movies.

As we continue to spend more time in those worlds, NFTs allow us to shape our identities.

4. What Is the “Metaverse”?

The metaverse is an interactive digital experience spanning apps, games, and devices; its evolution promises persistent handles (avatars) and unrestricted interoperability.

Despite recent headlines, the metaverse defies simple definition.

For many, it first took shape in the context of online gaming where users could participate in world-building as well as purchase various upgrades to deck their avatar out with improved skills, equipment, and skins. These served as both aids in the game and status symbols.

Today, the average gamer spends about eight and a half hours a week playing. The industry continues to grow at an astonishing rate, expected to eclipse 4.8 billion users and $216 billion in the next five years.

However, most in-game purchases and achievements are limited to that world. What would happen if you could take them from game to game to other networks and platforms … to the real world?

That is the heart of the metaverse — interoperability between virtual and physical worlds, connecting the two in an almost inseparable way.

A prime example is Fortnite, whose player base of over 350 million represents nearly the same in-game population as the US. Further, 85% of those players purchase in-game upgrades, skins, and other downloadable content, contributing to $3.7 billion in annual sales.

And it doesn’t stop there. Mark Zuckerberg is betting Facebook’s future on the metaverse having brought together its family of apps and technologies under the parent company, Meta.

The number of people that will be onboarded to the metaverse in this transitional phase would eclipse the population of many continents. In total, 2.76 billion daily active people (DAPs) access Facebook-owned products — including Instagram, WhatsApp, and Messenger.

The metaverse is coming quickly and, in many ways, is already here.

5. What is Web3 versus Web2?

Unlike previous iterations, Web3 brings a fairer internet by enabling individual sovereignty; users can co-create — read, write, and execute — as well as share in the ownership and profits.

There have been three main phases of the web since its creation:

- Information: Read

- Platform: Read-write

- Token: Read-write and execute

In the first, creators were few and far between. Controlled by institutions and bound to desktops, Web1 was static — delivered through read-only, one-way communication. Users consumed information passively.

Phase two introduced web-based applications, allowing users to read and write on the frontend of social media and knowledge sites. Backend hosts also became available: e.g., WordPress for content hubs and Shopify for ecommerce storefronts.

Mobile devices propelled Web2 — democratizing, globalizing, and socializing it further. But expansion came at a cost. Constructed on centralized databases, Web2 businesses rely upon consumers to …

- Create fresh content, which increases existing users’ engagement and draws in new users

- Share personal data, which is then monetized through targeted advertising

Web2 users pay Web2 platforms with their time, talent, and customer data.

The key innovation of Web3 is made possible by blockchain technology: platforms, apps, games, services, etc. that no single entity controls … yet everyone can trust.

Open by default on the frontend and backend, Web3 users can own and be properly compensated for their time and data — eclipsing an exploitative and unjust web, where giant, centralized repositories own and profit from everything.

Who? 10 Ecommerce NFT Examples to Learn From

Enough explanation.

Who in the ecommerce world is proving the value of these burgeoning technologies? And what lessons can you take from them for your own business?

- The Hundreds

- BreakingT

- RTFKT

- Asics & Adidas

- Liquid Death

- MeUndies

- Gucci

- Dolce&Gabbana

- BIGFACE

- Crypto Packaged Goods

1. The Hundreds

Last year, The Hundreds — a community-based streetwear brand and media platform — became pioneers in the NFT space through the launch of their project Adam Bomb Squad (ABS).

The original drop sold out instantly and now trades on OpenSea — an NFT market — with a floor price of 0.38 ETH ($2k) and 21.0K ETH in total volume ($41.2M). In addition to artwork, ABS grants token holders a host of perks spanning the digi-physical divide.

Since then, ABS has spun out everything from media properties and new programming to IRL events and takeovers to collaborations with the likes of Bored Ape Yacht Club, Coinbase, Lee Jeans, and Gary Vaynerchuk.

2. BreakingT

BreakingT is an apparel brand that monitors social media data to identify the biggest moments in sports and immediately commemorate them with fan apparel. It launched a limited edition tee NFT collection in partnership with MLB player Harrison Bader.

Together they created three original and unique pieces of art that were made available for purchase in a limited drop spanning three days on OpenSea with a starting price of 0.02 ETH (about $800 at the time of publishing this article).

Buyers received a limited edition t-shirt featuring the specific NFT design they purchased and the opportunity to unlock an experiential benefit as well.

3. RTFKT

Born as a collaboration with FEWOCiOUS, an 18-year-old digital artist, RTFKT has quickly become a heavy-hitter in the NFT space.

Originally, three tiers of shoes were sold. Each came with a pair of physical sneakers — estimated to be delivered 14 weeks after the launch. To redeem them, users had to own the NFT six weeks post-drop.

The result? $3M sold in seven minutes.

But that was only the start. In Dec. of 2021 Nike acquired RTFKT, and in Jan. dropped MNLTH — a mysterious NFT that sent buyers on a three-month journey culminating in virtual sneakers named Nike Cryptokicks.

Today, RTFKT functions as Nike’s defacto virtual studio.

4. Asics & Adidas

Not to be outdone, both Asics and Adidas have entered the fray.

The former went to market with SUNRISE RED, a twenty-mint collection of nine limited-edition NFTs and one gold edition.

Although it didn’t include a physical component, Asics’ called the collection “a celebration of sport and a first step in building a future where digital goods inspire physical activity.”

Two of the more standout benefits included access to 3D model and texture files as well as gifting the highest bidder a future NFT from the Asics Digital Goods Artist-in-Residence program.

Adidas’ entry came to life under the name INTO THE METAVERSE.

Its differentiators? An “allow list” that granted access only to existing holders of gmoney, Bored Ape Yacht Club, Mutant Ape Yacht Club, and PUNKS Comic … then, lead directly to physical product claims also co-created with those communities:

What do you do when your launch misfires?

Not surprisingly, due to the newness of Web3 and NFTs, some kickoffs haven’t gone as planned. Adidas’ allow list, for instance, didn’t actually allow existing Mutant Ape Yacht Club holders in. After going live, the brand had to stop and restart the minting process for 24 hours.

That danger drives home just how critical having the right technical and marketing team on your side is. It’s one of the reasons why we’ve partnered with CPG Club … to help you avoid the same mistakes.

Our next two examples illustrate what to do and especially what not to do with misfires.

5. Liquid Death

Known for its strong commitment to environmentalism, Liquid Death’s NFT announcement — Murder Head Death Club — was initially greeted with strong suspicion from its audience.

Though minor points of the original announcement, Liquid Death began majoring on two commitments:

- Donating 10% of royalties to organizations helping “kill” plastic pollution

- Offsetting 110% of the mint’s highest calculated carbon emissions

In conjunction with Will Carsola (the Adult Swim artist behind the collection), a host of other influencers, and offset verification through Pachama, the project recovered quickly.

Fans flocked. Particularly to utilities like a private Discord, exclusive access to NFT-branded merchandise, early releases, and even a chance to be featured in Liquid Death television spots.

6. MeUndies

Unfortunately, the same outcome never materialized for MeUndies.

In Jan., the brand took to Twitter and shared it had purchased a Yuga Labs‘ Bored Ape Yacht Club — with the intention of licensing its print.

The backlash hit hard. In fact, the top comment even eclipsed engagement on MeUndies’ original tweet. Worse, the comment contained step-by-step cancellation instructions. Others took to social to share MeUndies alternatives.

A bevy of media pieces on the controversy followed.

After a knee-jerk response on Twitter — which was deleted along with the original tweet — the company posted a month and a half later to its Reddit account explaining it had canceled the collaboration and was selling the NFT:

“We’ve read every single customer comment regarding this and your feedback was critical in helping us make a better-informed decision.”

It’s a cautionary tale not so much against NFTs themselves but more the need to understand whether or not they’re congruent with audience expectations.

Though sometimes incongruency can be a blessing.

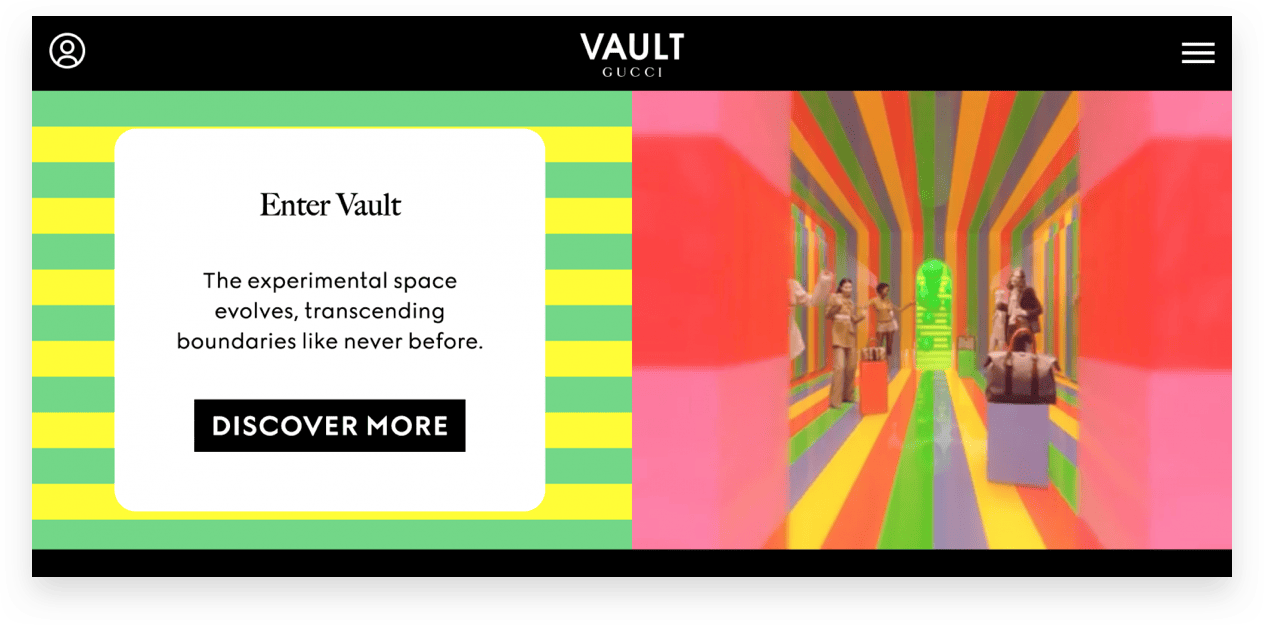

7. Gucci

Contrary to expectations, luxury brand Gucci entered the space with a product that costs less than $12.

It joined forces with Belarus-based fashion-tech company, Wanna, to release the shoe within their apps. The goal was to reach a broader audience range, targeting Gen Z customers who may not yet have the purchasing power to afford Gucci’s physical products.

In addition to the NFT, buying the “shoe” unlocked the ability to take virtual pictures or videos as well as “wear” it in Roblox — a platform with over 43 million daily active users across 180 countries at the forefront of building the metaverse.

Gucci’s metaverse focus has only intensified since then. In Feb., it became the first luxury brand to purchase virtual real estate within The Sandbox and set up a retail experience through VAULT.

8. Dolce&Gabbana

At the opposite end of the spectrum, fashion giant Dolce&Gabbana partnered with luxury marketplace UNXD for its “Collezione Genesi.”

“This 9-piece, one-of-a-kind collection was personally designed by Domenico Dolce and Stefano Gabbana exclusively for UNXD. It features entirely hand-made, museum-grade items across Alta Moda (women), Alta Sartoria (men), and Alta Gioielleria (high jewelry).

“In a historic moment for the NFT ecosystem, Collezione Genesi is the first luxury NFT collection that involves both digital assets and physical works, truly bridging the physical and the metaphysical.”

Winning bids on these pieces were anywhere between $383K to $1.67M and the owner was granted access to three benefits:

- Physical version of the product custom-fitted to the wearer along with the original signed sketch

- Digitally rendered animation and still recreations of the dress in one metaverse of the owner’s choosing

- Access to D&G events, private tours, and the choice to exhibit the product in D&G stores

Among other things, D&G understands that selling products with digital, physical, and customer-experience components will only become more of an expectation for consumers.

9. BIGFACE

All this focus on fashion brands begs the question: What about consumables, like cosmetics and beauty or food and beverage?

The former, we’ll cover next. The latter has illustrations in abundance: Starbucks, McDonald’s McRib, Flyfish Club, CHFTY Pizzas, and Taco Bell (to name only a few).

Alongside Liquid Death on the DTC front, Jimmy Butler’s Big Face COFFEE-001-NFTBOX stands out for its mix of 500 units containing four coffee varieties and BIGFACE non-fungible artwork.

At this point, there does not seem to be any digital access or experience components. Just very high-end specialty coffee and Big Face non-fungible artwork that sold out at $500 a pop.

It is notable that, according to Butler, this launch was also done in partnership with Shopify “so that he doesn’t have to split revenues from the coffee brand with the ecommerce platform.” In tandem, Big Face’s website also sold apparel, mugs, and coffee-making kits.

10. Crypto Packaged Goods

Our final example highlights a common thread running through many of the others.

Crypto Packaged Goods is an NFT project with a central focus on — as you might expect from the name — consumer package goods (CPG).

It first minted 250 digital collectibles, 100 of which were airdropped to a hand-selected group of 50 Club CPG mentors. Each mentor selected a peer or mentee to receive a Member Pass as well.

Additional Member Passes were then sold to the public on OpenSea, where the NFTs’ all-time-high floor prices hit 40 ETH ($50k).

Members gained access to a private Club CPG Telegram and Club CPG Events — networking, education, and community.

Within the first several months, this community at the intersection of crypto and consumer has grown into a valuable investing, hiring, and incubation ecosystem.

The Club CPG 🕳🐇 is full of legends across Coinbase, Shopify, the NFL, Ledger, consumer, web3, DeFi, VC & more

— cantino.eth (@chriscantino) October 21, 2021

Members are making investments in each other, hiring, and incubating projects together

Proud to report the community is producing a high output of value + alpha ❤️🔥👇 pic.twitter.com/zQhhKNbHYk

Why? The Benefits of Adding NFTs to Your Product + Marketing Mix

Now that we’ve walked through key explanations and explored real projects, let’s turn our attention to the benefits.

Namely, how Web3 and NFTs offer relief for margin-strapped ecommerce businesses.

- Increase Your Margins

- Invert Your Cash Conversion Cycle

- Build Community, Loyalty & Exclusivity

- Hype Product Releases & Drops

- Acquire ‘Real Estate’ & Customers

1. Increase Your Margins

Selling digital or experiential counterparts with your physical goods to increase the purchase value and margin of your product can allow you to sell your products for a much higher price point than you could if they were physical only.

As Bobby Hundreds put it, customers commit to brands because of “identity, community, and sense of ownership.”

What’s more, the COGS associated with NFTs are drastically lower than any material goods.

Soon, this will not just be a luxury. Owning a product in the physical world won’t be enough. Customers will expect digital extensions as we all continue to spend more and more time in the metaverse.

2. Invert Your Cash Conversion Cycle

The benefits of digital-first sales to then fund the operations and cost of their physical extension cannot be overstated.

Receiving income prior to purchasing inventory doesn’t necessarily extend lead times. It does, however, enable you to invert the typical cash conversion cycle.

Immunity to supply chain and logistical issues? No, but powerful insulation.

DTC ecommerce brands that can successfully use proceeds from the sale of digital products to fund operations will be able to reach new levels of unencumbered growth.

3. Build Community, Loyalty & Exclusivity

The combination of ownership and exclusivity achievable with NFTs can take loyalty programs to similar new levels. That incentive is one of the central reasons creating communities around your brand’s NFT holders is such a massive opportunity.

Subscribers become shareholders, individuals who are quite literally bought into your brand.

These customers will probably be the first to buy your new products, the first to tell their friends about your brand, and a rich source of customer research and user-generated content.

As you begin thinking through your brand’s NFT strategy, start crafting your community development roadmap and the unique access and benefits those customers will unlock.

4. Hype Product Releases & Drops

In most of the examples, physical products were on the roadmap from the beginning. RTFKT x Fewocious and BreakingT, in particular, show the marketing power of NFTs.

First, both brands created digital versions that gave a sneak preview of what the full product would entail.

BreakingT never featured a full image of the shirt, nor did they show customers what the logo would look like. RTFKT x Fewocious gave buyers a single image of the shoe that was digitally mocked up.

Second, both brands utilized external platforms — in addition to owned audiences — for limited-time releases.

BreakingT’s NFTs were minted on OpenSea and RTFKT x Fewocious on Nifty Gateway. Using NFT marketplaces in a limited timeframe or limited quantity drops can allow for additional reach and hype surrounding product releases.

5. Acquire ‘Real Estate’ & Customers

It’s one thing to sell in-game or in-platform “wearable” NFTs (apparel, accessories, etc.). It’s another thing to catch a vision for how users interact with in-game and in-platform environments.

For first-movers, advertising in those worlds has the potential to become a massive acquisition channel … specifically for brands aimed at the GenZ and millennial population who inhabit them.

Begin by identifying the virtual worlds where your customers spend time. Already, virtual land in places like Decentraland, The SandBox, Gala Games, and CryptoVoxels is available.

“All of this is on the precipice of scaling. When it does, be ready … I cannot overstate how massive this opportunity is. It is akin to buying parcels of Manhattan back in the early 1800’s – especially considering the interoperability that these games will have with each other.” — Chris Rempel, Creating the New Frontier

The Future of Ecommerce Businesses? Only ‘Marginally’

Will the future of DTC ecommerce be locked into the blockchain? Inescapably linked to the technologies stacked upon it?

If the digitization of commerce itself has taught us anything … yes.

But the future is only part of the point.

The real value of leveraging NFTs isn’t tied up in digital artwork selling for millions. Neither is it dependent on crypto-markets nor the adoption of Web3. While we firmly believe the metaverse is an inevitable gateway to such things, today’s urgency is driven by another, more pressing matter.

To turn Jeff Bezos’ infamous maxim on its head and make their margin your opportunity.

The good news we began with remains good. You’re not too late.

If you’re ready to simultaneously increase your margins and prepare your brand for a future that’s already arriving, then download the full guide and let’s get started together!

Unsubscribe from CTC or CPG at any time.

As the Director of Growth Strategy at Common Thread Collective, Luke Austin leads our team of Growth Strategists working with some of the most exciting $100M+ consumer ecommerce brands in the industry. Connect with him on Twitter.