Close your eyes. Where were you one year ago? How did the future feel? Uncertain? Volatile? Terrifying?

The world was shutting down. Ecommerce, rising up.

After sitting in spreadsheets, pouring over databases, attempting to find a signal in the noise … I released an essay titled Dear Brand Owner, Swing.

It made the case to go all-in on the tidal wave of DTC adoption. Many of you plunged forward and experienced unimaginable growth. But what now? What happens to the spiked graphs — in particular, the year-over-year growth rates — in 2021 and beyond?

Amid COVID’s defeat and coffers of cash, I’m here to offer five reasons the next phase of ecommerce will be more tempest than tidal wave:

- Broken Compasses

- Sirens Calling

- Slacked Sails

- Giant Sea Monsters

- Hordes of Tiny Piranhas

An ‘antifragile’ update …

This essay was originally published in early 2021. Since then, our approach at Common Thread Collective to the mounting challenges online retailers face has culminated in what I’ve termed antifragile ecommerce.

You can read the full article by clicking the link above. Or, access the scorecard, guide, quiz, and accompany video here ⤵️

1. Broken Compasses: When Growth Isn’t Linear

Forecasting in COVID might as well have been the Riemann Hypothesis: an unsolvable riddle with no historical precedent.

In 2020, global ecommerce growth rates hit 27.6% — the largest single-year gain ever. Headlines, whitepapers, and social media proclaimed tsunami-level expansion:

When the dust settled over 2020, projections claiming “a decade of growth” in one quarter turned out to be closer to two-three years in total. While growth in 2021 will continue, the rate of expansion will likely be more modest.

Replicating or exceeding those numbers without the nation-wide lockdown will prove incredibly difficult.

Many brands still set their revenue and forecasting expectations on YoY growth. While less helpful than LTV forecasting, linear models worked because the industry itself followed that path.

However, the moment your algebraic growth rate goes parabolic, YoY forecasting might as well be throwing darts blindfolded. Why? Because …

2. Sirens Calling: When the ‘Real’ World Returns

What COVID took away was optionality. Retail shuttered, travel halted, and the online-commerce machine roared to fill the void.

With vaccine distribution underway, we’re finally imagining life outside again.

Admittedly, we’re in the early days of this return. Only 36% of Americans have resumed normal out-of-home activities.

Amazing news for us as human beings.

But also a major shift away from the objects of lockdown — online socializing, online meetings, online shopping — and back to the IRL experiences of pre-COVID life. The mall outings. The Disneyland vacations. The softball leagues.

“People will relentlessly seek out social interactions.”

— Dr. Nicholas Christakis, Epidemiologist looks to the past to predict second post-pandemic ‘roaring 20s’ (The Guardian)

During COVID, online commerce devoured an unrealistic share of consumers’ wallets. Digital spending increased in virtually every category.

It’s not just that the wind is shifting from online commerce.

The real problem is that whatever wind remains will not have the power it did before.

3. Slacked Sails: When Facebook Loses Its Edge

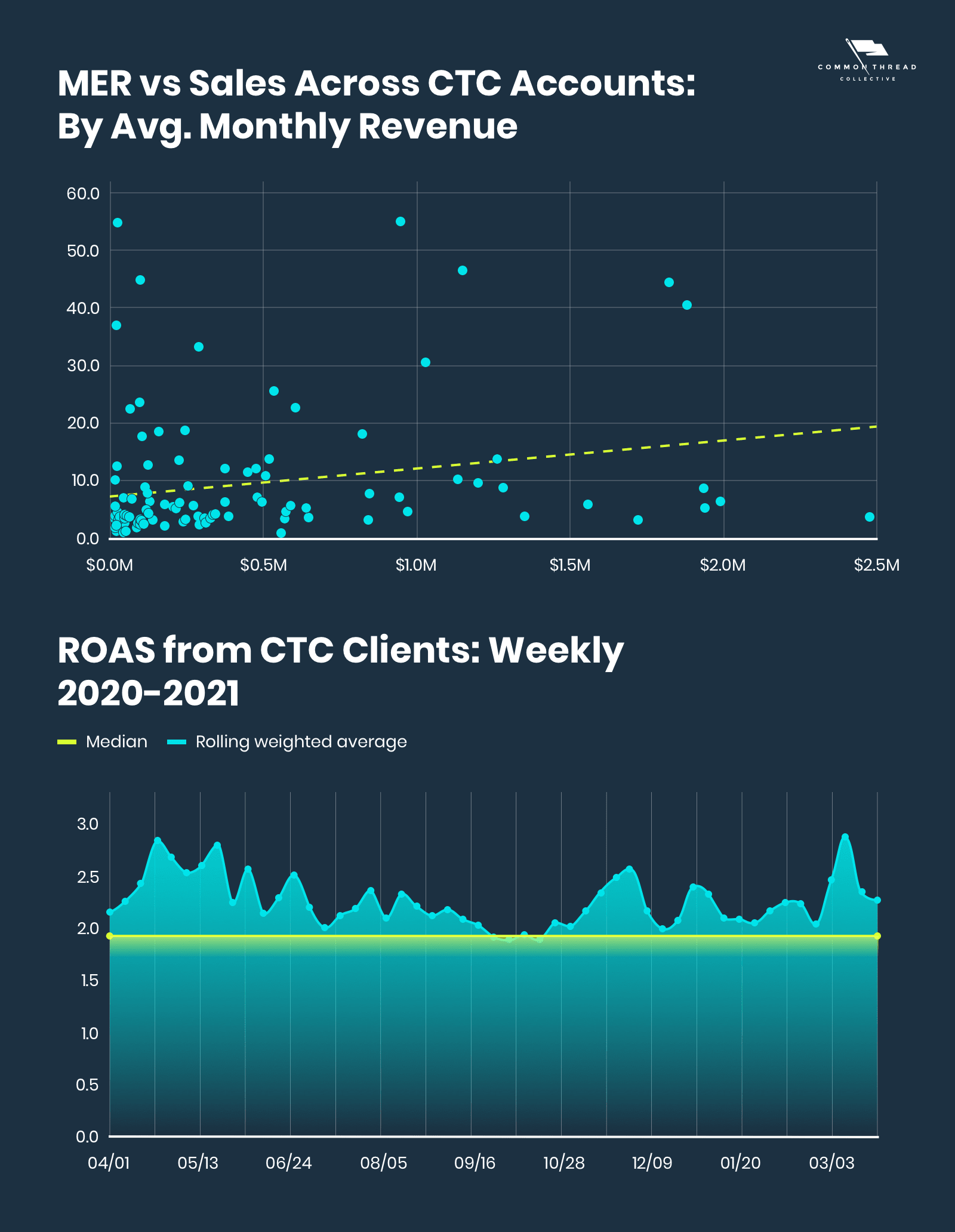

Across Common Thread Collective’s portfolio, last year’s marketing efficiency rating (MER) was 4.98.

MER is our North Star metric, sometimes called blended ROAS: total sales ÷ total ad spend. An MER of 4.98 means roughly 20% of revenue was spent on paid acquisition.

Of that 20% in ad spend, Facebook represented 67%. The median ROAS was 1.99 on 1-day click, 1-day view.

Because ~1% of Shopify’s gross merchandise value (GMV) flows through CTC’s clients, we can reasonably apply those figures to Shopify’s $120B in total sales.

Back-of-the-napkin math: Facebook represented an estimated $16B in spend and $32B in revenue.

In Apr.–May of 2020, +60% of our brands saw record-breaking revenue. The source? Facebook’s arbitrage — underpriced ad costs — and its data-fed, customer-hunting algorithm:

Today, Facebook’s wind is waning.

This sapped power comes in the form of restrictions to the data that’s fueled Facebook’s advertising algorithm for years. The two great innovations in Facebook’s ad product are the Pixel and optimizing for conversions.

Both of these features depend on access to an endless stream of purchase behavior and intent signals that allows Facebook to place ads in front of people at the perfect moment.

Suddenly, there are two legitimate attacks on that data warchest:

1. Apple’s iOS14

Once iOS14’s privacy measures go into effect, you will no longer be able to map certain users’ purchases to their in-app actions, like clicking on an ad.

You can dive deep into the technical and advertising effects here.

This has all sorts of implications for attribution modeling and reporting. Most importantly, it reduces the total data profile of each user — specifically around shopping behavior and internet browsing.

This will dramatically curtail Facebook’s ability to determine who to serve ads to and when.

2. Crumbling Cookies

It began with GDPR in Europe. It crossed the Atlantic with CCPA in California. The final nail in the coffin was hammered when Google Chrome announced the removal of all third-party cookies in Jan. of 2022.

This tech provided the backbone of FB’s ad algorithm. Core ad products like remarketing, Dynamic Product Ads, and more depend on cookies to serve you personalized ads.

Honest ignorance

Despite Facebook’s best PR attempts to scare consumers into Apple hate, no one really knows what the total impact will be on ad performance.

This uncertainty could be innovated away. A strong capitalist incentive exists to solve the crisis.

Nonetheless …

Anyone telling you they can solve the FB/iOS data restrictions with any of the following:

— Taylor Holiday (@TaylorHoliday) March 25, 2021

- Server to server integration

- AI

- Magic

Are lying.

4. Giant Sea Monsters: When Legacies Wake Up

In early 2020 I had a call with a major CPG brand about their DTC strategy. Its CMO described their interest as “strictly about data” and referred to the revenue potential as “inconsequential.”

Fast-forward one global pandemic and this is a mere sampling of DTC’s new landscape …

PepsiCo rolled out two websites. At Snacks.com, consumers can choose from over 100 Frito-Lay products. Over on PantryShop.com, they can buy everything from breakfast cereals to workout-recovery drinks.

Nike closed +15 of its major wholesale accounts including DSW, Urban Outfitters, Dillards, Zappos, Dunham’s Sports, Olympia Sports, and Big Five. And it’s committed to “doubling down on our approach with Nike Digital.”

Adidas unveiled a new five-year strategy that will shift the focus to a DTC-first model. Its plan? Double ecommerce sales by 2025.

In the health and wellness space, Ocean Spray launched Lighthouse Innovation Incubator; Clorox unveiled Objective Wellness; and Colgate, a new smart electric toothbrush.

Unilever opened an online store for Ben & Jerry’s fans to order their favorite ice cream and merchandise. Nestle launched an online shop called the KitKat Chocolatory, which allows customers to design their own premium chocolate bars.

COVID woke up a nest of sleeping sea monsters that are now lumbering within your pond.

With their shiny new websites and “strategies” also come hundreds of millions in ad dollars. Every one of them competing for social-media feeds, search-engine results, influencers, and wallets.

Oftentimes, ecommerce competition comes down to who can afford to spend the most to acquire a customer.

These monsters can measure payback periods in years, not days. Keep your head on a swivel, Perseus.

5. Hordes of Tiny Piranhas: When Death Comes by a Thousand Bites

Last, it’s not just attacks from monsters.

It’s also the horde of tiny competitors popping up every 28 seconds in every category that threaten death by small, painful nibbles.

Every 28 seconds a brand new entrepreneur gets their first sale on @Shopify. These entrepreneurs are the key to our post-pandemic world. I believe small and independent businesses will be the backbone of our economic recovery. pic.twitter.com/UHrOkv4nUi

— Harley Finkelstein (@harleyf) March 18, 2021

Beyond Shopify, in the last three months, there have been more small businesses started than any quarter in our nation’s history.

The result? Take this classic example …

When we started QALO, there were zero silicone wedding rings on Amazon. Today, the term yields +2,000 search results, many of which offer you 20 rings for the price of one QALO.

![]()

The rate of profit extraction for every opportunity is akin to the speed at which a piranha strips its prey’s muscle from the bone.

Moments of arbitrage emerge — facemasks, at-home gym equipment, etc. — and are met with drop-shippers, white-labellers, outright fraudulent websites, manufacturers with a “branding team,” incubators, on-demand makers, and more.

Survival in this world becomes costly. In a sea of sameness, winners will be defined by:

- Intellectual property

- Owned audiences

- Pricing power

- Brand affinity

Here’s the kind of soul-searching question you’ll have to ask yourself:

“Given a row of identical product photos … why would anyone choose mine?”

Golden Shores, Together

Let me be very clear: I am bullish on ecommerce.

The future of our industry has never been brighter; I’m committed to it with every fiber of my being. If you make your living selling things online, you are in the vanguard of one of the biggest opportunities in economic history.

Though the horizon is golden, reaching it won’t be easy. Not any more.

Showing up won’t suffice. Simplistic answers don’t exist. And, despite my predictions, there’s much we do not know.

In the coming storm, the only way to keep your bearings will be (1) to band together with co-journeyers and (2) to anchor yourself in data that’s deeper, wiser, and more-solid than YoY modeling.

In the words of Matshona Dhliwayo: “The storm only comes to teach you how to skillfully sail your ship.”

We’re stronger together than apart. We’re smarter. We’re more resourceful. We’re more resilient.

Join us in the journey.

We won't send spam. Unsubscribe at any time.