Trends: Insight from 2022’s Top Cosmetics Brands & Companies

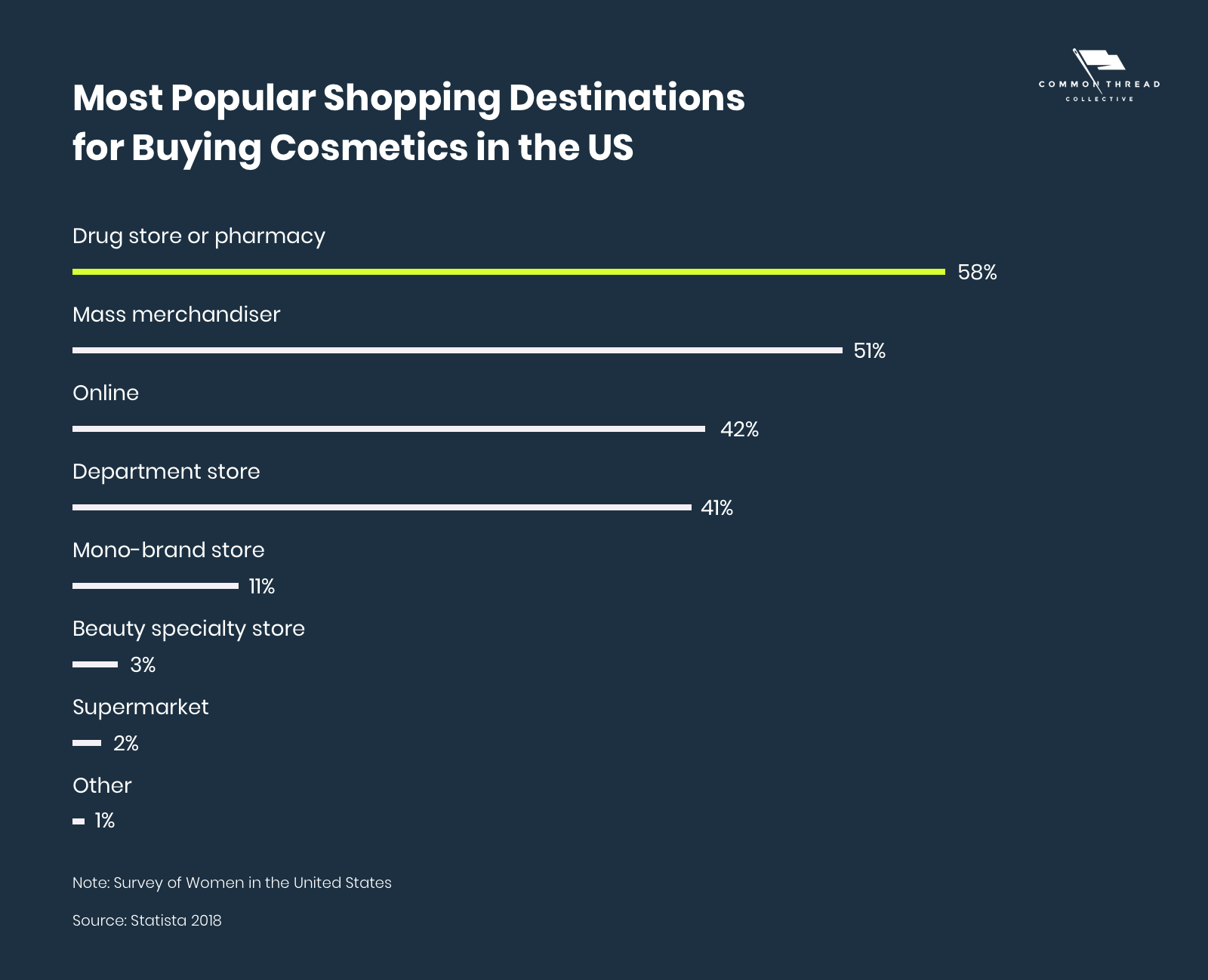

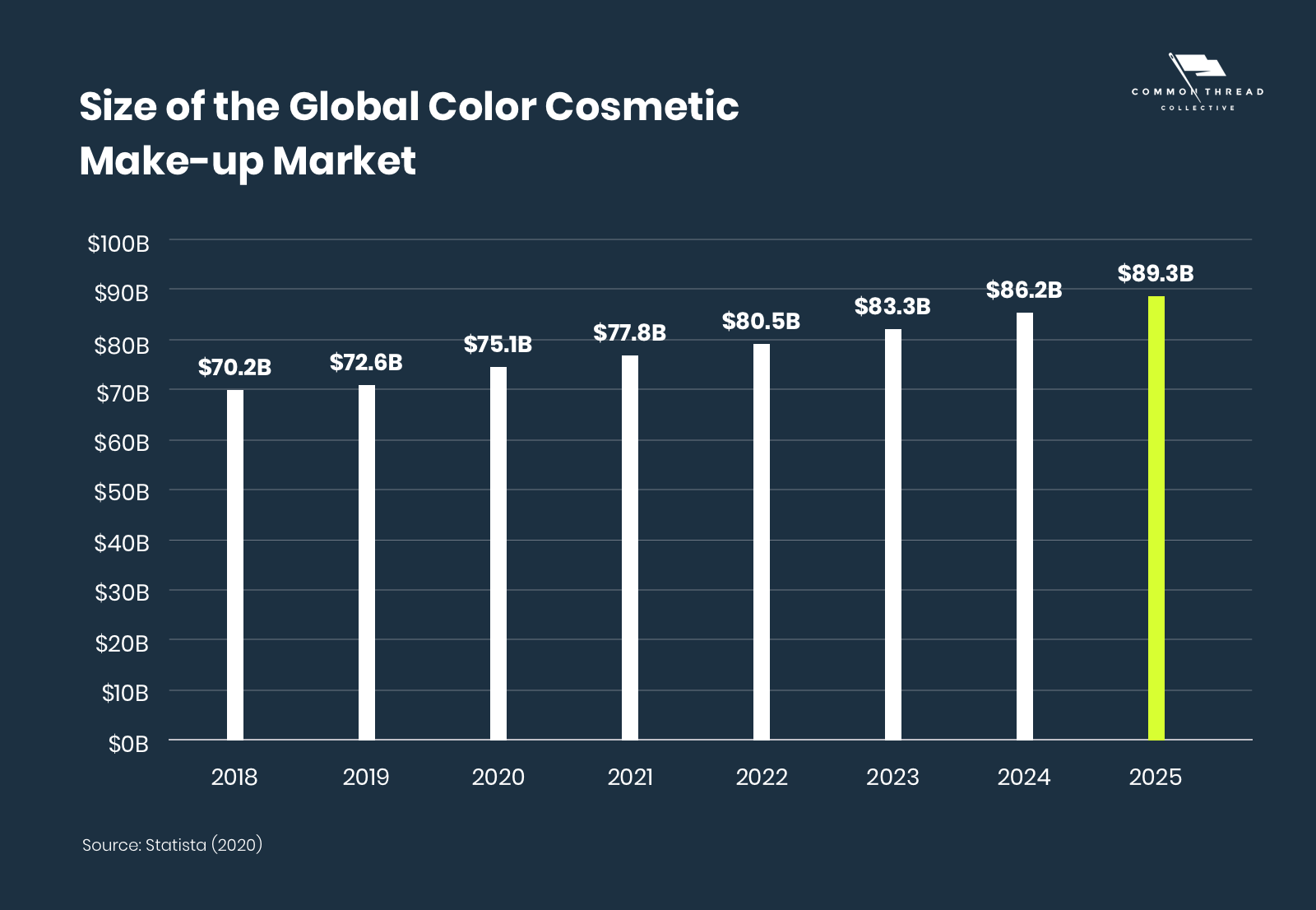

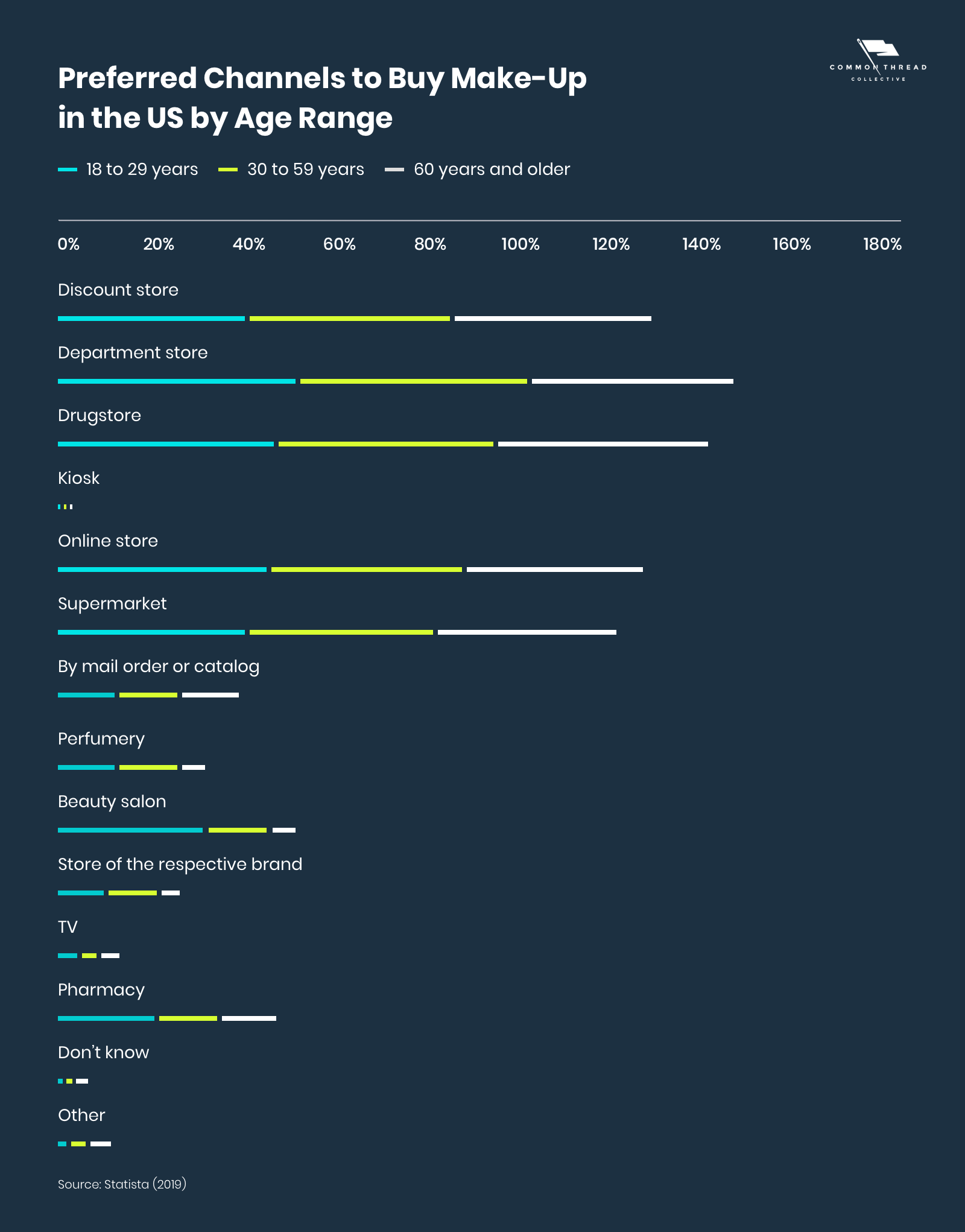

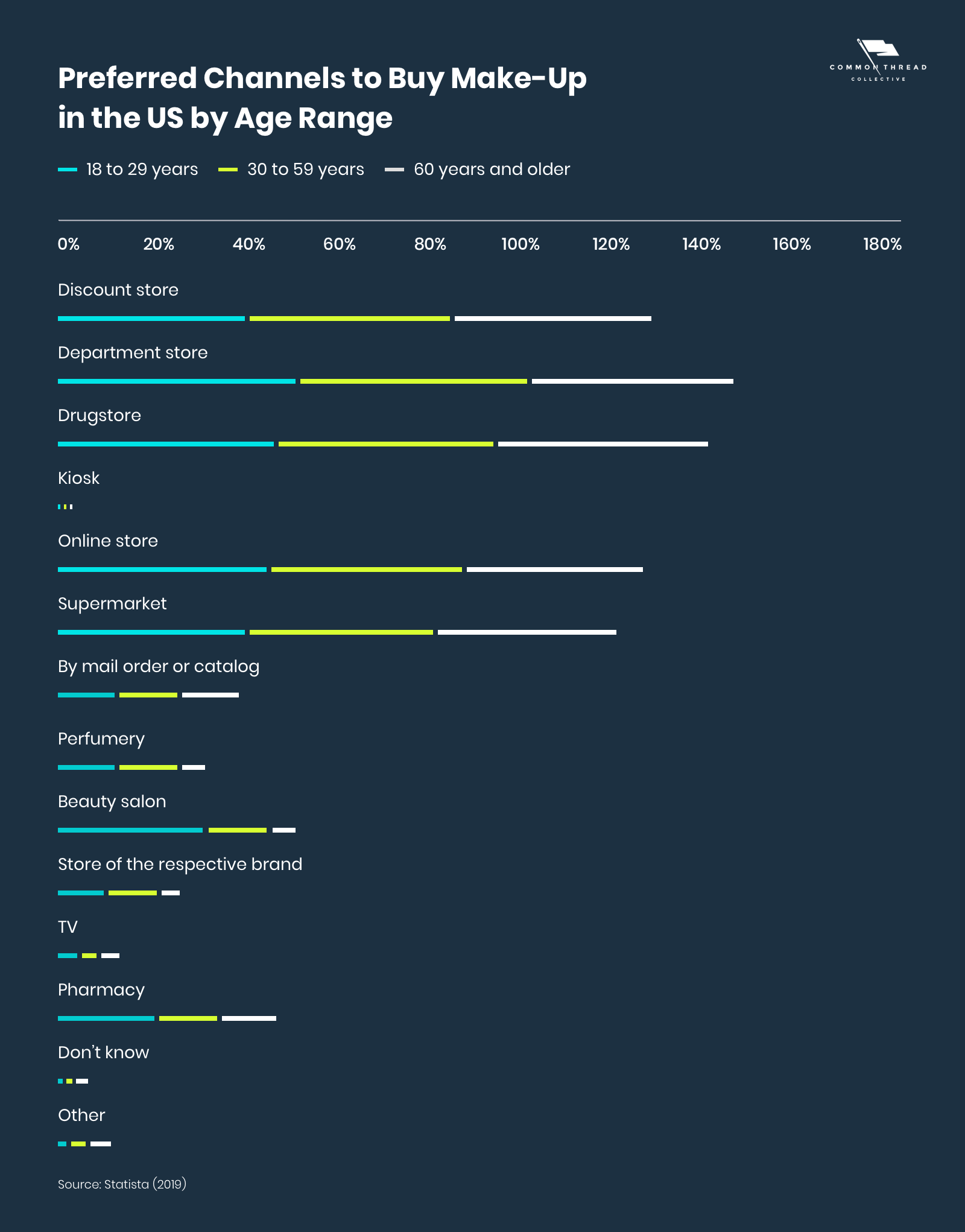

Each vertical can be differentiated further, both by distribution channel and brand. Color cosmetics occupy a unique segment as they’re available in a wide range of locations — from luxury spas, salons, and department stores to home-television shopping, drugstores, and airport vending machines.

According to a survey from Pymnts, the most important factor influencing consumer behavior — beyond price or location — were special sales, unique products, and rewards programs.

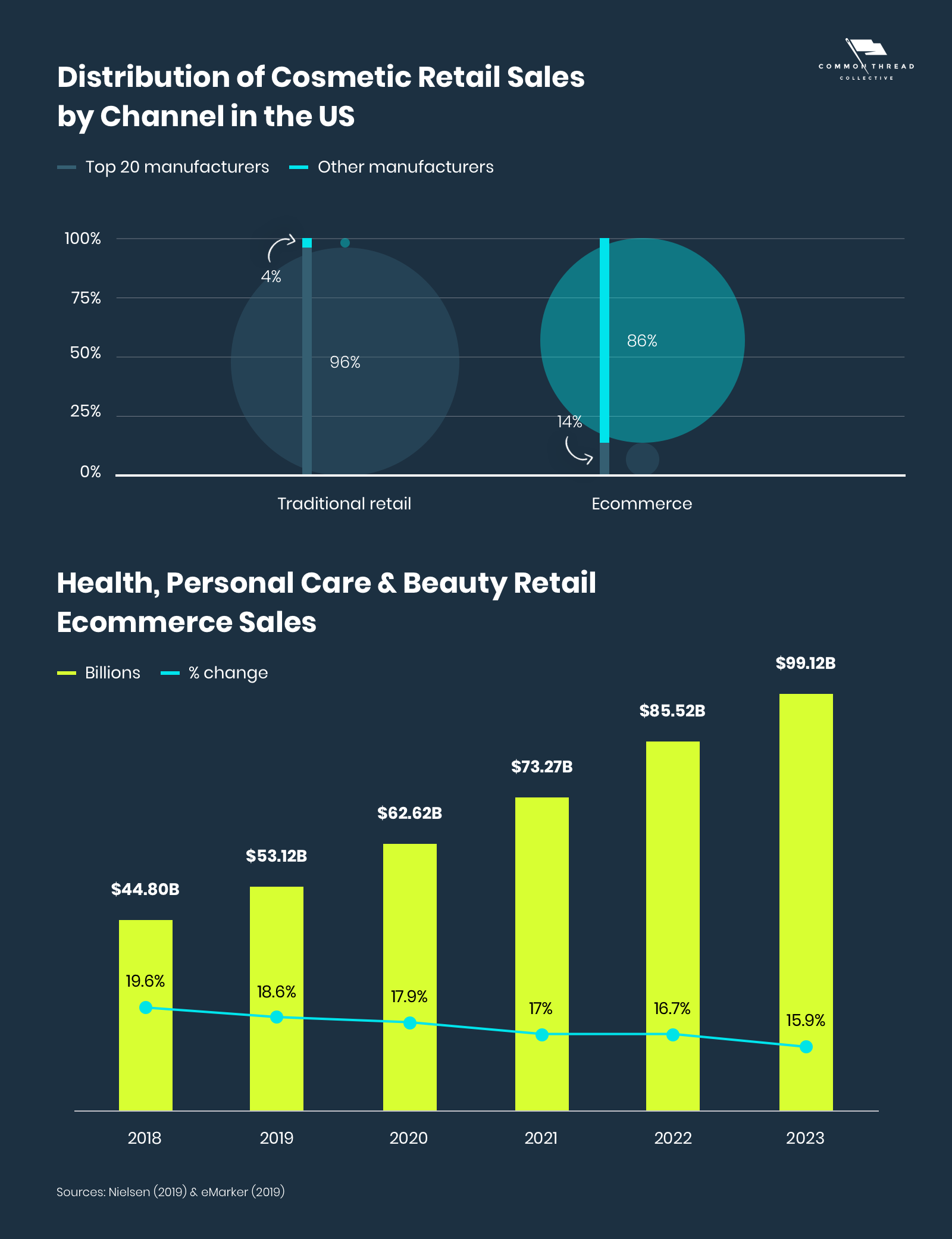

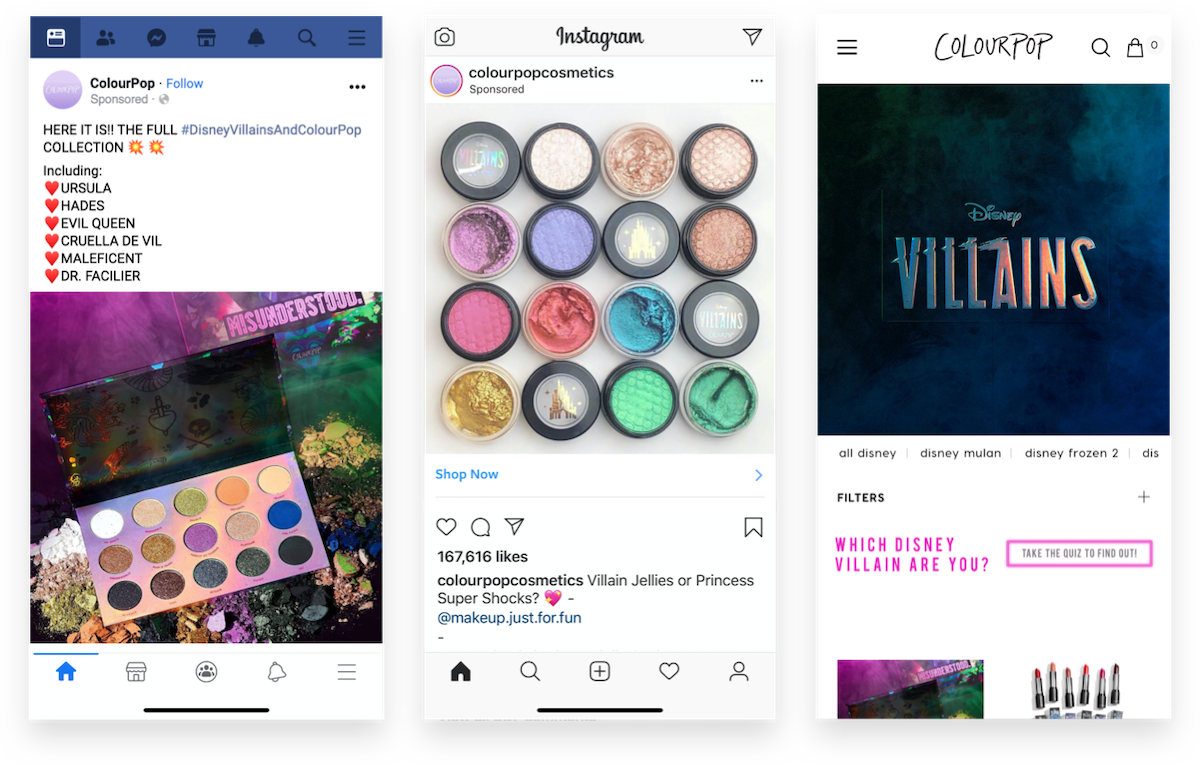

Much like ecommerce fashion and even the online pet industry, brands can lean into these digital marketing tactics with the exclusivity of the online shopping experience to challenge the upper-hand of in-store retailers.

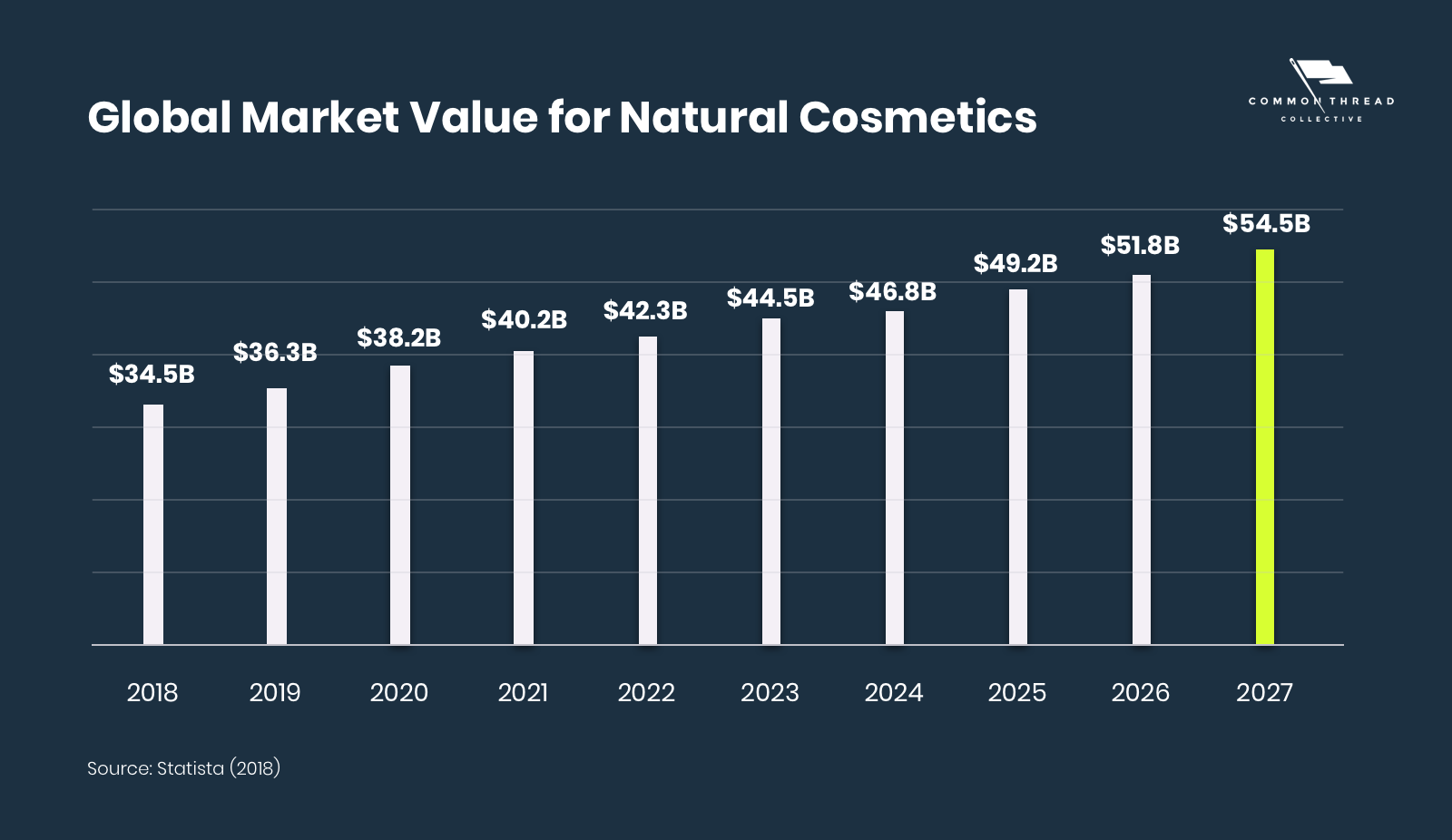

Beyond channels, there’s another divisive trend — natural and sustainable products versus discount and mass produced.

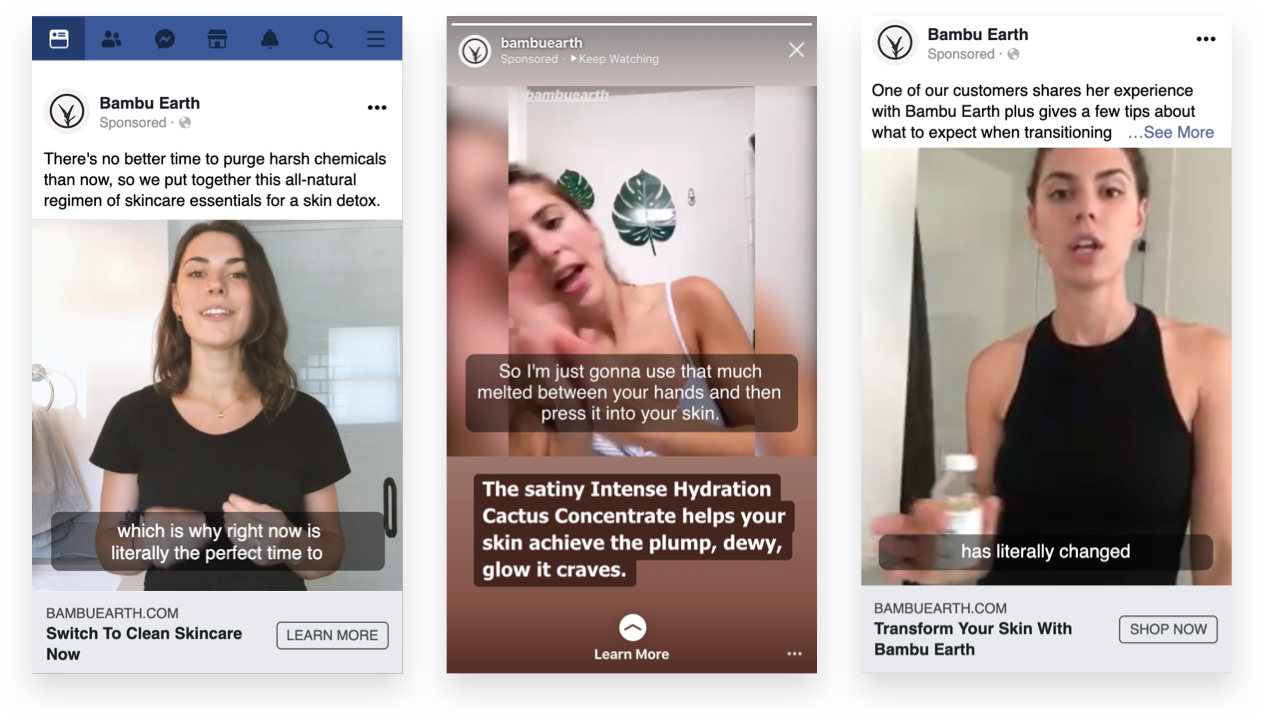

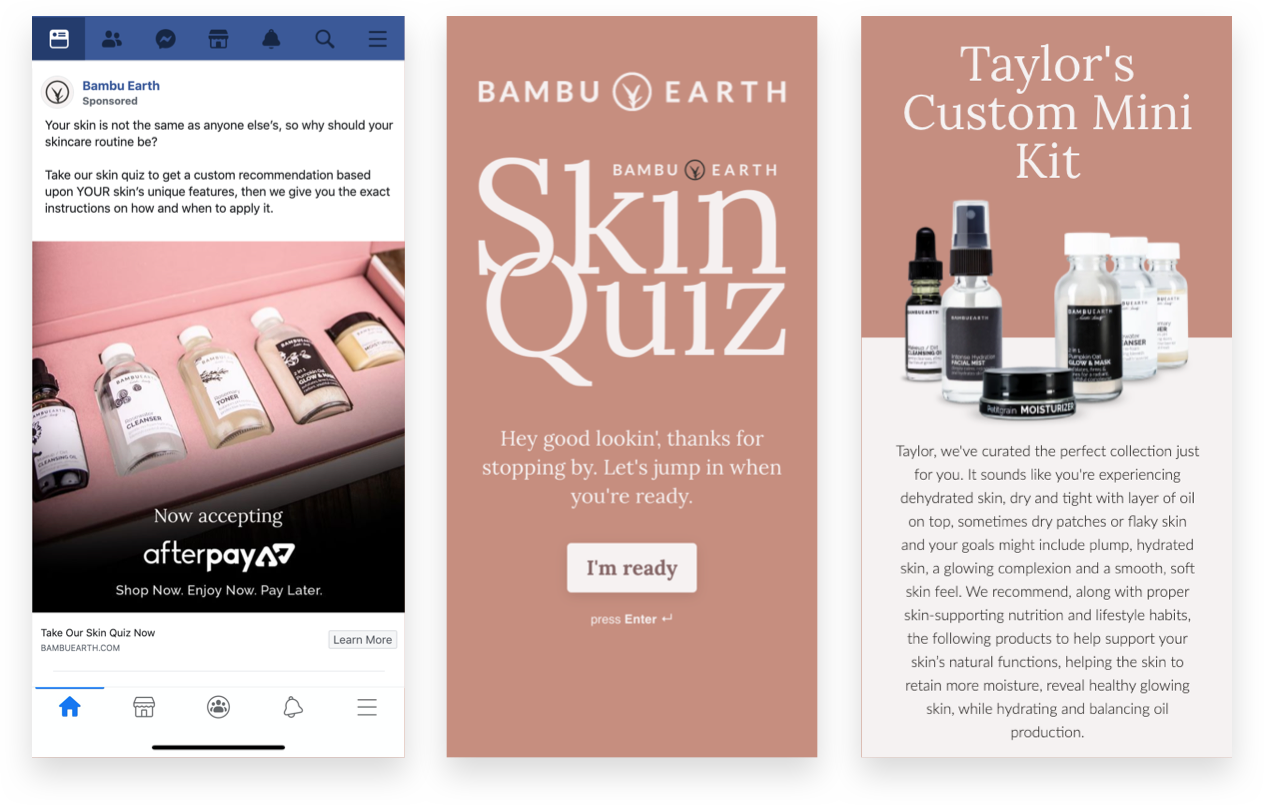

Because of rising incomes, consumers increasingly consider effectiveness and ingredients over price. As a result, positioning now focuses on demonstrating quality through customer reviews and UGC as well as sustainability through formulation.

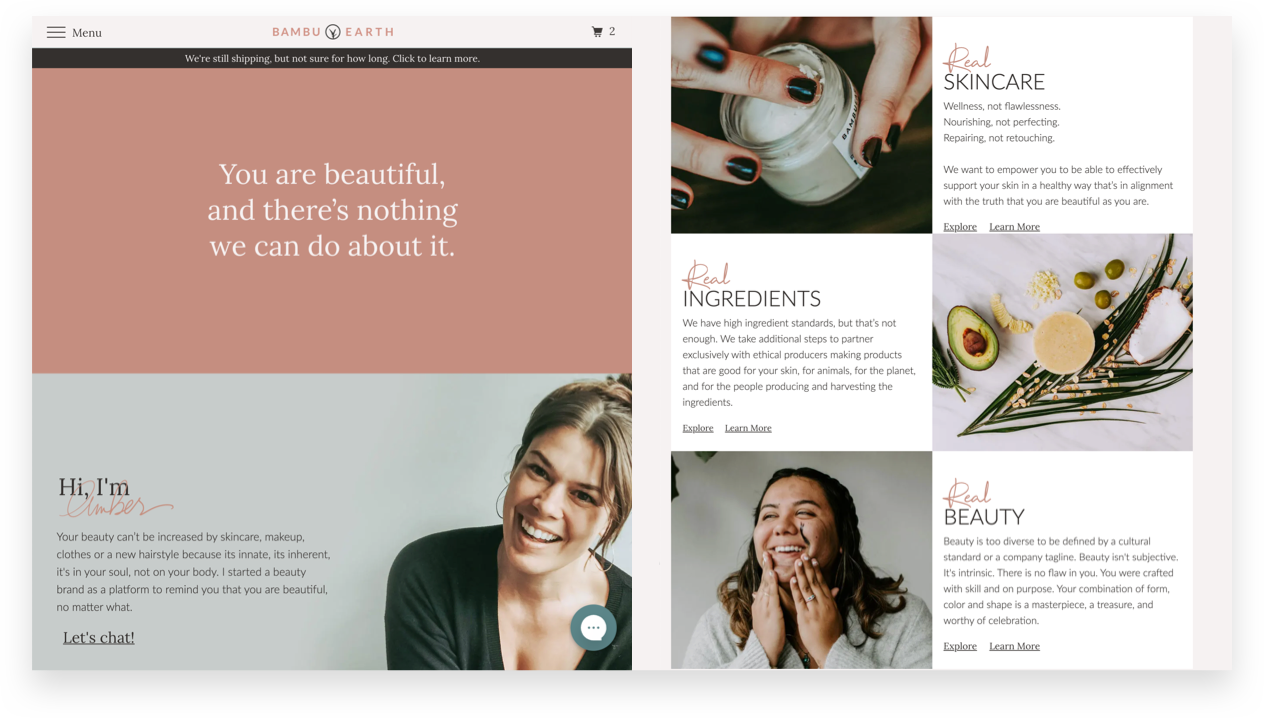

To win in the fight over product superiority comes from the marketing use of three little words: natural, organic, or clean.

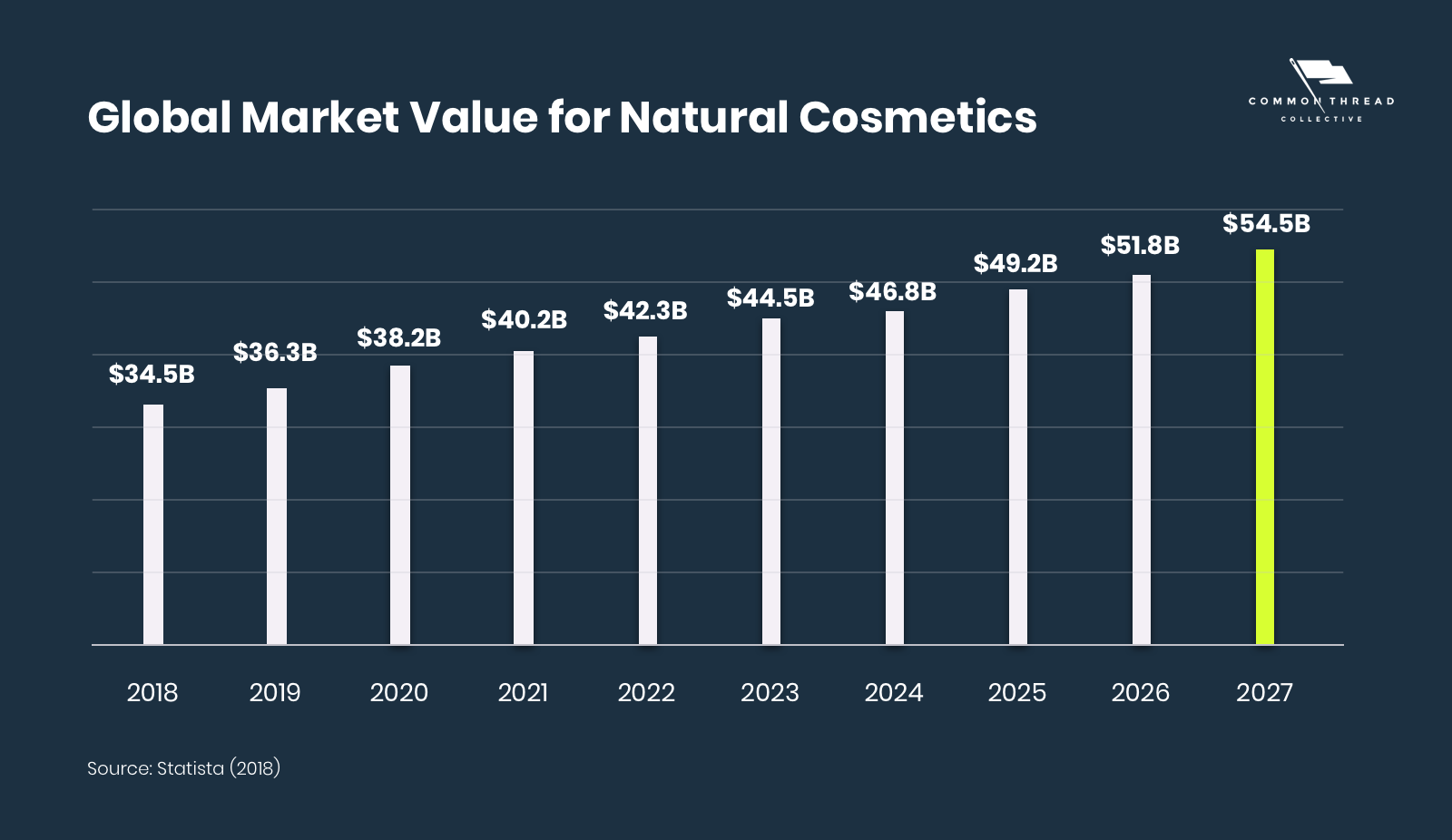

But, “clean beauty” and “organic makeup” are more than just buzzwords. The global value for natural cosmetics is expected to reach $54.5 billion by 2027.

The division lies within the definition. To be considered natural, the product must meet non-toxic standards for ingredients and processing.

Since there isn’t strict regulation, insecurity permeates over what actually constitutes “natural.”

Upstarts that want to dominate the competitive arena should look to build an authentic and sustainable model.

As consumers become increasingly wary of potential toxicity, safe and fragrance-free products made using natural ingredients and essential oils are likely to record strong growth in the future.

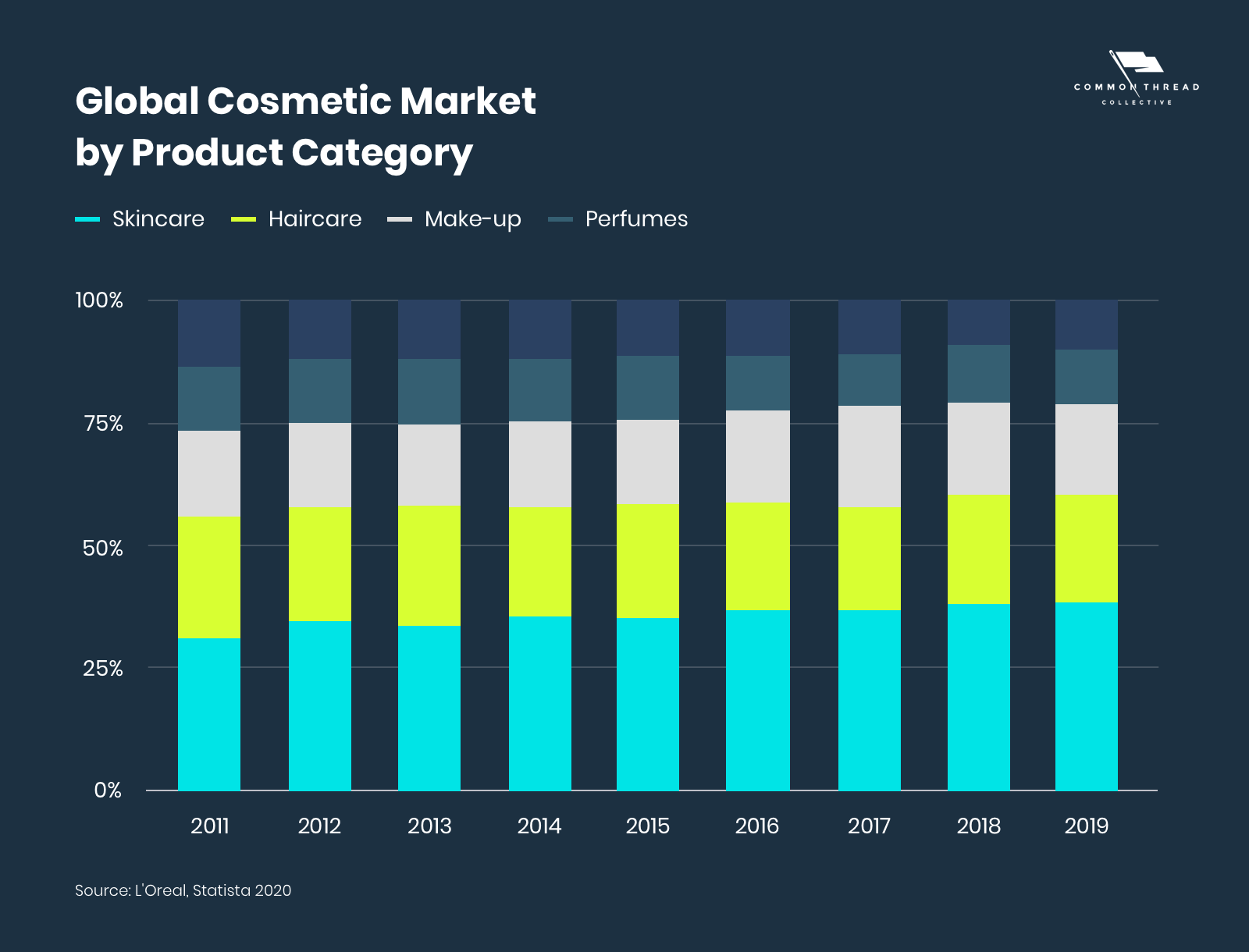

Beauty Products by Market Share and Growth: Skin Care, Hair Care, Make-Up & Perfumes

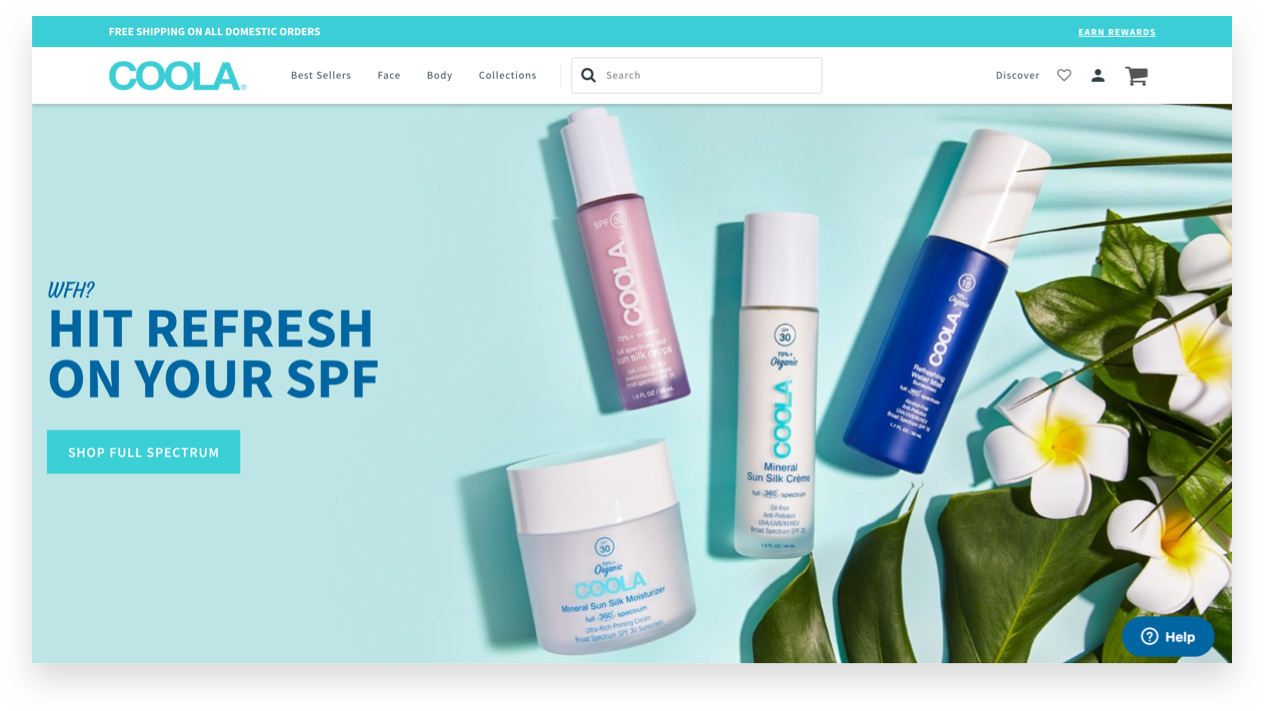

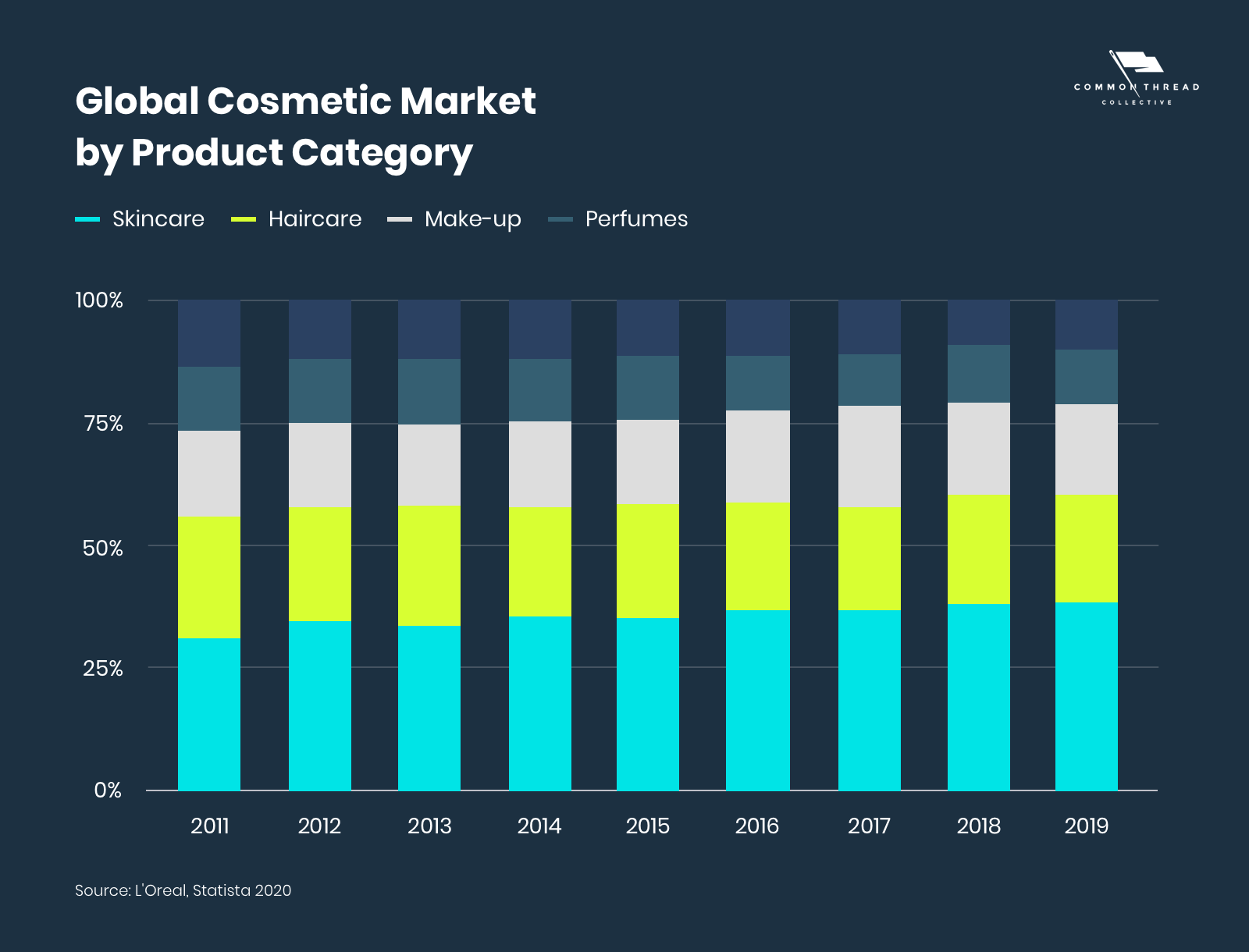

Across product categories, skincare made up 40% of the global cosmetic market in 2019.

It follows that this trend will continue as consumers become more educated about sun damage — indicating potential for growth within the subcategories of sun protection and anti-aging skincare products.

In the same vein, brands that meet consumer’s new demands and expectation levels of quality will experience growth.

Demographics & Customer Experience

As non-western countries climb in purchasing power, their influence on demographics follow. With ethnicity, culture, and rituals different from North America and Europe, diversity shapes the globe in its image.

Variety is now the norm.

“It’s not enough to make 50 shades of foundation and only sell the dark ones online,” said influencer Jackia Aina in an interview last year. “I’ve directly seen how the consumers have demanded better and fairer retail shopping experiences for everyone … we’ve seen a big rise in brands expanding on their products.”

Ethnicity isn’t the only driver, age plays a critical role in how consumers shop for personal care products.

As a result of entering the job market, Millennials and Gen Z have become the biggest drivers of new business. This is especially glaring in the US, where they have above-average expenditures on personal care products — an index of 122 on cosmetic products — compared to other shoppers.

Of the leading make-up purchase criteria according to women in the US — the importance of quality, value, and the brand remained relatively similar across all age-groups.

Among Millennials, in particular, were significant differences.

They more than doubled their baby boomer counterparts in regard to preference for organic or eco-friendliness.

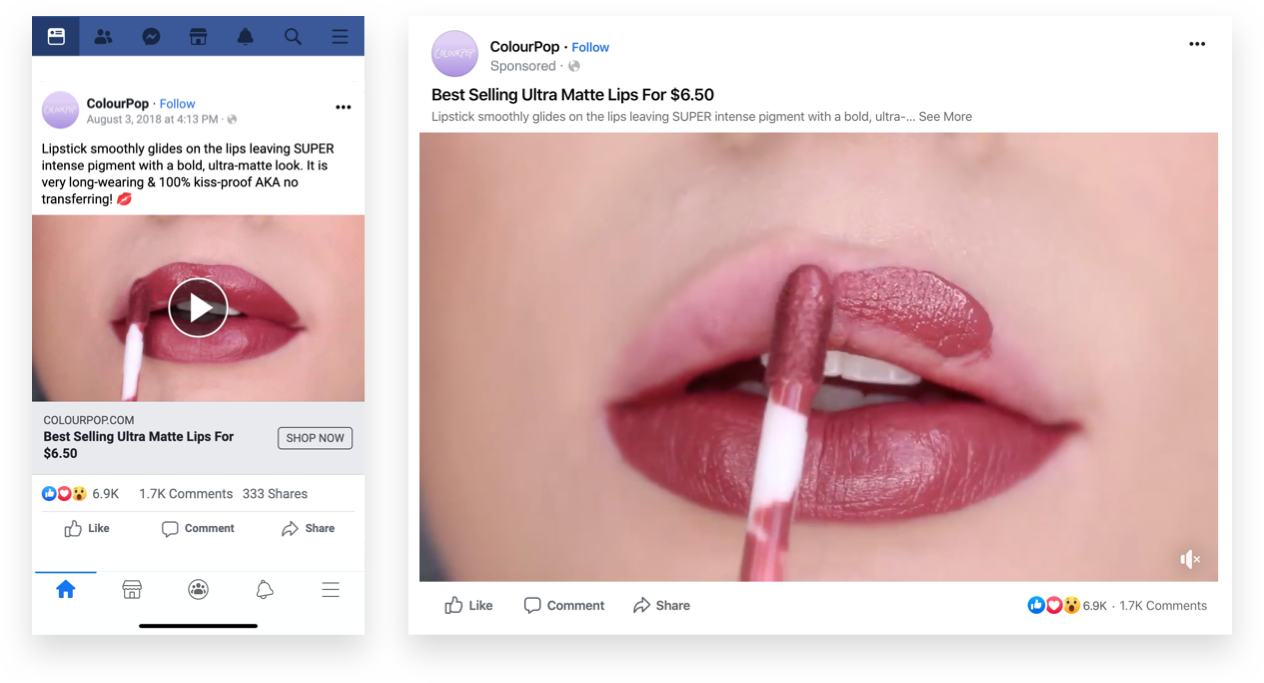

Even more striking, 29% of them make purchasing decisions based on media or online reviews — 3x greater than that of Gen X’ers and a whopping 6x more than Baby Boomers.

This sets the stage for social proof as the key to unlock Millennials’ loyalty and trust. To say nothing of the advantages NFTs create for online retailers.

Socially and digitally native brands are in a prime position to capture that demand.

Which, of course, brings us to …

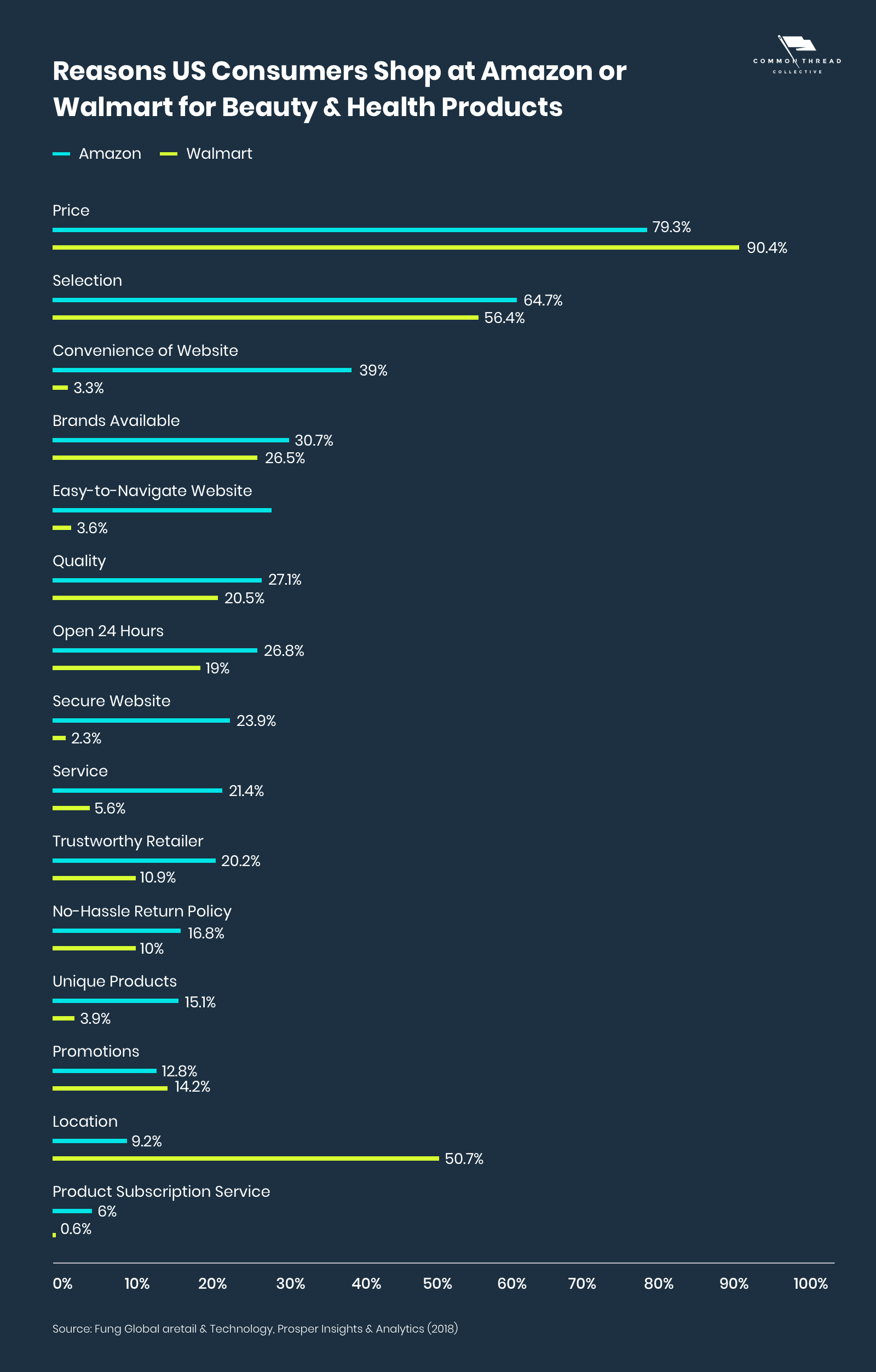

Amazon & Walmart

Amazon’s success in yet another CPG category is no surprise. According to Edison Trends data, health and beauty is the third-most-purchased category — accounting for 44.3% of total online sales in the US.

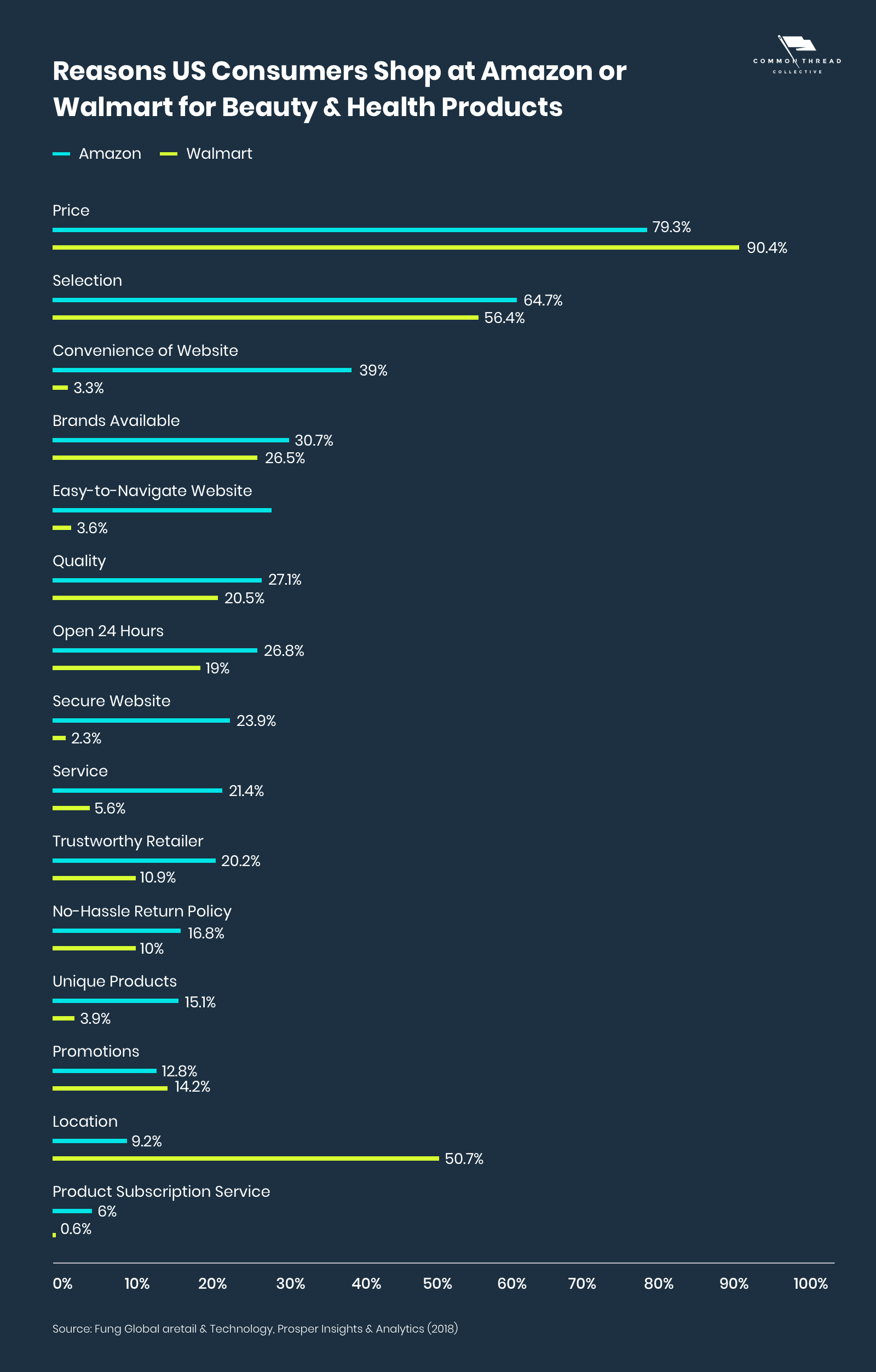

Consumers cite the convenience of Amazon’s website, easy navigation, and service as the main reasons they choose Amazon over Walmart.

This is also bolstered by its Prime membership program. According to eMarketer, 52.5% of Prime members bought beauty products in the past 12 months vs. 16.9% of nonmembers.

Although Amazon’s growing, shoppers still prefer other channels. Ulta has far higher ecommerce sales ($618.8 billion) and just 10.1% comes from digital channels.

It’s a glimmer of hope for beauty retailers not selling on the platform, that Amazon isn’t always the end-all-be-all.