Implement the Prophit System for Your Brand

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get Started

Welcome to another episode of Bridges, where we strive to forge connections between marketing and finance.

In today's journey, we embark on an expedition beyond the P&L, exploring the often-overlooked domains of the balance sheet and cash flow statement.

As we delve deeper into this financial landscape, I am reminded of a personal anecdote, one that resonates deeply with the challenges and opportunities presented by the intersection of marketing and finance. Allow me to share with you the story of Bambu Earth, a business I own and operate as a part of 4x400.

In recent years, Bambu Earth encountered significant hurdles in its quest for growth and liquidity. Two prospective transactions, poised to infuse the company with much-needed capital, collapsed at the eleventh hour, revealing the harsh realities of today's financial landscape.

In an era characterized by stringent capital constraints, even well-funded acquirers found themselves at the mercy of hesitant investors.

No one is investing in ecommerce right now.

That was really frustrating.

This sobering experience served as a wake-up call, propelling me to reevaluate our approach to value creation and liquidity. While Bambu Earth boasted commendable profitability on the P&L, translating these paper gains into tangible cash remained a challenge.

To truly thrive in today's economic climate, we needed to liberate ourselves from dependency on external sources of liquidity and chart our course toward self-sufficiency.

This realization forms the cornerstone of our exploration today - the journey from paper value to liquid assets, from theoretical profits to tangible cash.

In just 4 steps, you’ll learn how to transform your paper gains into liquid profit.

As marketers, we are tasked with transcending the confines of the profit and loss statement, venturing into the realms of the balance sheet and cash flow statement to orchestrate the transformation of value into wealth.

Here are the steps we used to generate cash at Bambu Earth, and an explanation of how you can do the same for your own business …

This blog post is another in our “Bridges” series, which aims to bridge the gap between marketing and finance.

In previous installments of this series, we’ve focused heavily on your business’ profit and loss statement (P&L), so for detailed recommendations to fix your P&L, check out episodes 1-4.

Understanding the financial components of a business has become vital for marketers, and we aim to bridge the gap between marketing and finance with this series.

Your business can be P&L profitable every month, much like Bambu Earth, without you actually having any money in your pocket.

To get there, you need to transfer out of the P&L and focus on cash flow inside the balance sheet. You need to focus on shareholder equity.

The balance sheet will provide you with a snapshot of your company’s financial position at a specific point in time. Its goal is to map out the relationship between your business’s assets and liabilities for a clear understanding of your company’s net worth.

The fundamental equation that governs the balance sheet:

In this equation lies the essence of value creation, where assets represent the resources at our disposal, liabilities denote our obligations, and shareholder equity embodies our stake in the enterprise.

Good marketers make their managers happy, but great marketers increase shareholder equity.

Within the realm of ecommerce, assets assume various forms - from liquid cash and accounts receivable to inventory, real estate, and intellectual property. These assets, when harnessed effectively, have the potential to bolster shareholder equity and drive long-term value creation.

Conversely, liabilities, encompassing debts and obligations, exert downward pressure on shareholder equity, underscoring the delicate balance between risk and reward in the financial ecosystem.

The balance sheet, unlike the P&L does not include profit.

While the profit and loss statement offers insights into our operational performance, it is the cash flow statement that unveils the true heartbeat of our business. Unlike the P&L, which operates on accrual accounting principles, the cash flow statement provides a transparent depiction of cash inflows and outflows, illuminating the path from revenue generation to cash realization.

As marketers, we stand at the nexus of value creation, poised to influence the trajectory of cash flows through strategic initiatives and innovative campaigns.

At the heart of understanding cash flow lies the ability to synchronize marketing activities with the ebb and flow of cash within the business.

By aligning marketing initiatives with cash flow cycles, we can mitigate seasonality risks and optimize revenue generation during peak periods.

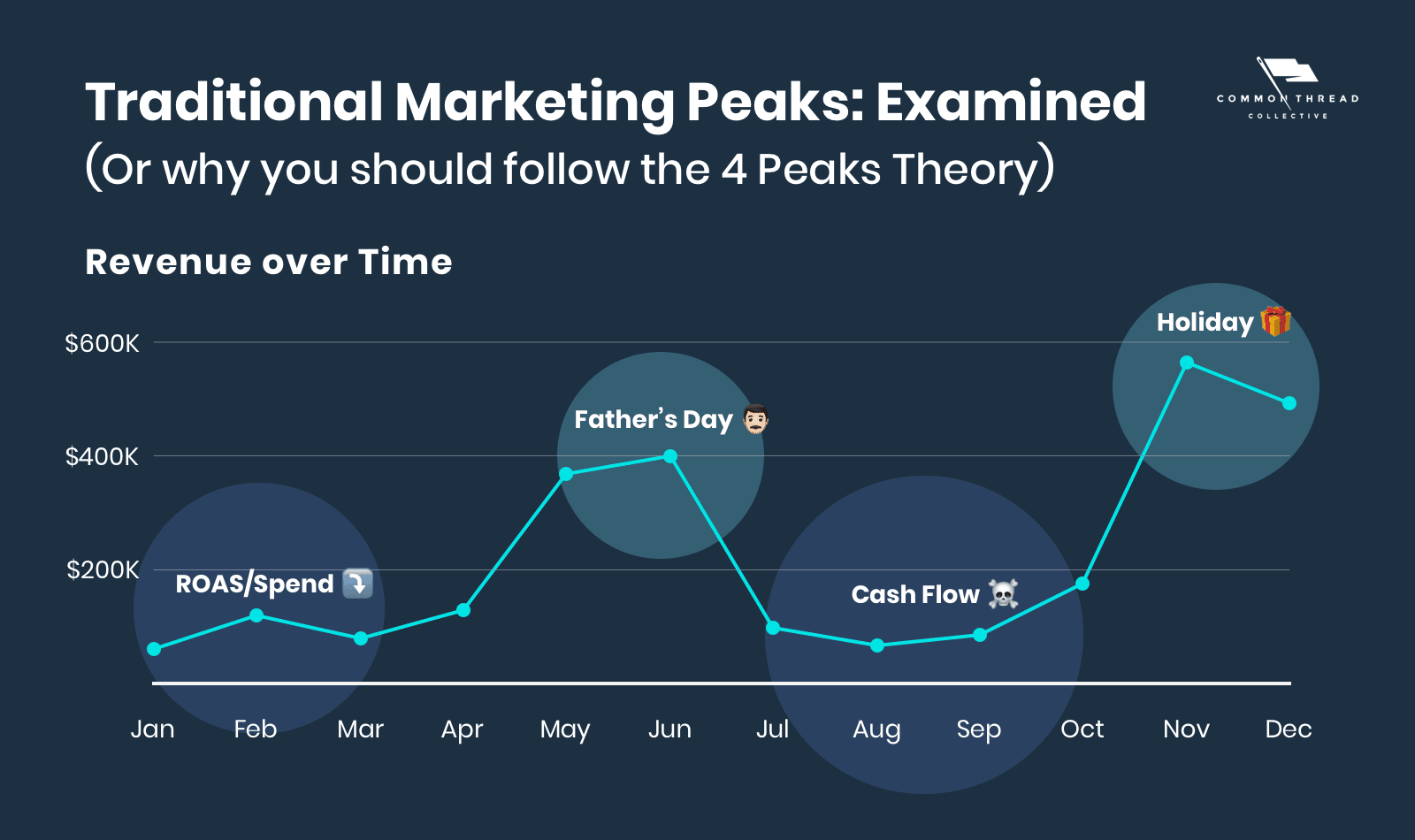

One of the biggest challenges that threatens the cash flow statement for many ecommerce brands is the seasonality of our industry.

Many ecommerce businesses see similar revenue flows throughout the year. Holiday (Cyber Monday, Black Friday) tends to create a big peak. In fact, for many ecommerce businesses holiday can represent upwards of 50-60% of the total revenue realization for the entire year.

Beyond holiday, most brands also have one more built-in moment in their marketing calendar. This may be a key gifting moment like Mother’s or Father’s day, New Year for many fitness brands, or Fourth of July for a swimwear brand.

Between BFCM and this additional peak moment, most ecommerce businesses see two points on their marketing calendar that create outsized demand. But what we’ve long-advocated for, is a calendar that creates four peak moments throughout the year.

Year-round growth comes from a calendar with at least four peaks.

With the Four-Peaks model, you take advantage of the traditional holiday season, major gifting celebrations, and cultural moments (i.e. Earth Day, April Fool’s Day, or International Coffee Day) as well as product events.

You get a calendar that drives performance through storytelling and imperative purchase opportunities.

When we consider the cash-flow of a business the issues behind a ‘traditional’ two-peak ecommerce calendar become more apparent. While holiday represents the largest revenue realization for most ecommerce businesses, it also represents the largest purchase order need.

Consider lead times for the manufacturing and delivery of your products. For many businesses this might be somewhere in the range of 8-16 weeks.

That means in July, August, September, you need to make one of the largest purchase orders of the year at a time when your revenue is often most depressed.

You need to shift from looking at a marketing calendar with stories naturally built into the year to finding or creating a story, cultural moment, campaign, promotion or product launch that can help create some cash realization when your business needs it most.

Think about the need of the business from a cash standpoint, and design your story against that. Think about the releases of your product calendar relative to those naturally built peaks?

Great marketing executives consider the flow of cash when designing the marketing calendar.

And the best way to do that is go back and look at the historical flow of funds. Find the low point, find the story associated with it and see if you can solve it in the future.

Creative operations and system design is vital to your ecommerce business. Part of that great system design is accounting for what you're selling and why. It's a merchandising consideration as a creative strategist that’s connected to the inventory position of your business.

Leveraging insights from the balance sheet, inventory will often be one of the biggest line items in any ecommerce balance sheet.

As a marketer, you need to be able to devise creative offers to liquidate excess inventory and bolster cash reserves. By aligning offer design with inventory dynamics, we can strike a delicate balance between margin optimization and cash realization.

This is even more true when you have a broader SKU assortment, variants, colors, sizes, etc.

Ideally, you have what's called “just in-time inventory,” which is the days of inventory remaining always stays somewhat related to the lead time to produce. So you're always receiving inventory just in time as you're expiring, and you're never holding tons of excess inventory.

That's the dream in ecommerce.

Once your business gets to a good place on their P&L and starts hitting monthly EBITDA goals, it’s time to start thinking about the future.

Winning too much in a short period of time is actually not the right action as a marketer.

If you’re surpassing your EBITDA goals for the month, it’s actually better to use that excess cash to secure the future. And while you have some options …

… that last one is our preferred way to set up the future success of the business..

Proactive engagement with vendors and strategic expense prepayment can enhance cash flow resilience and mitigate liquidity risks. By negotiating favorable payment terms and leveraging prepaid expenses, marketers can fortify the financial foundation of the enterprise.

Sustainable growth hinges upon efficient new customer acquisition, where the cost of acquisition aligns with the lifetime value of the customer. By optimizing marketing spend and prioritizing cash flow sustainability, marketers can safeguard the long-term viability of the business.

Understanding and implementing first-order profitability is crucial for the health and growth of any ecommerce business.

If your business has been spending at a net-negative new customer acquisition, it's not too late to course-correct.

Grow the overall margin of your business, not a false top-line revenue number.

Predictable, profitable growth might require a reset of top-line growth expectations for your ecommerce business. But a fake topline revenue number, propped up by non-profitable new customer contribution is not worth keeping around.

Eliminating it will create a much healthier scenario for your business.

The journey from paper to liquid requires an intimate understanding of the P&L, the balance sheet, and your business’ cash flow. It requires you as a marketer to partner with the finance team to deliver on the highest-value expectation.

The goal is not just to build value on paper, it’s to build value in liquidity and shareholder value.

By embracing these principles, we can bridge the divide between marketing and finance, charting a course toward sustainable growth.

If you found this journey insightful, I invite you to share it with your peers and begin your dialogue on the intersection of marketing and finance within your organization.

We’ll work with you to custom-build CTC’s predictable, profitable growth system for your ecommerce business.

Get StartedCommon Thread Collective is the leading source of strategy and insight serving DTC ecommerce businesses. From agency services to educational resources for eccomerce leaders and marketers, CTC is committed to helping you do your job better.

For more content like this, sign up for our newsletter, listen to our podcast, or follow us on YouTube or Twitter.