As we look forward to the Fourth Peak of the year, BFCM/Holiday 2023, it’s tempting to think the work is almost done and you’ve almost reached the summit of this year’s journey.

While there is some truth to that, here’s what you need to understand to win Holiday 2023:

The Black Friday peak within the yearly marketing calendar is really better thought of as four separate mini-peaks.

Maximizing your Q4 outcome is contingent upon your ability to master each of the 4 mini-peaks within the 4th peak.

The Setup

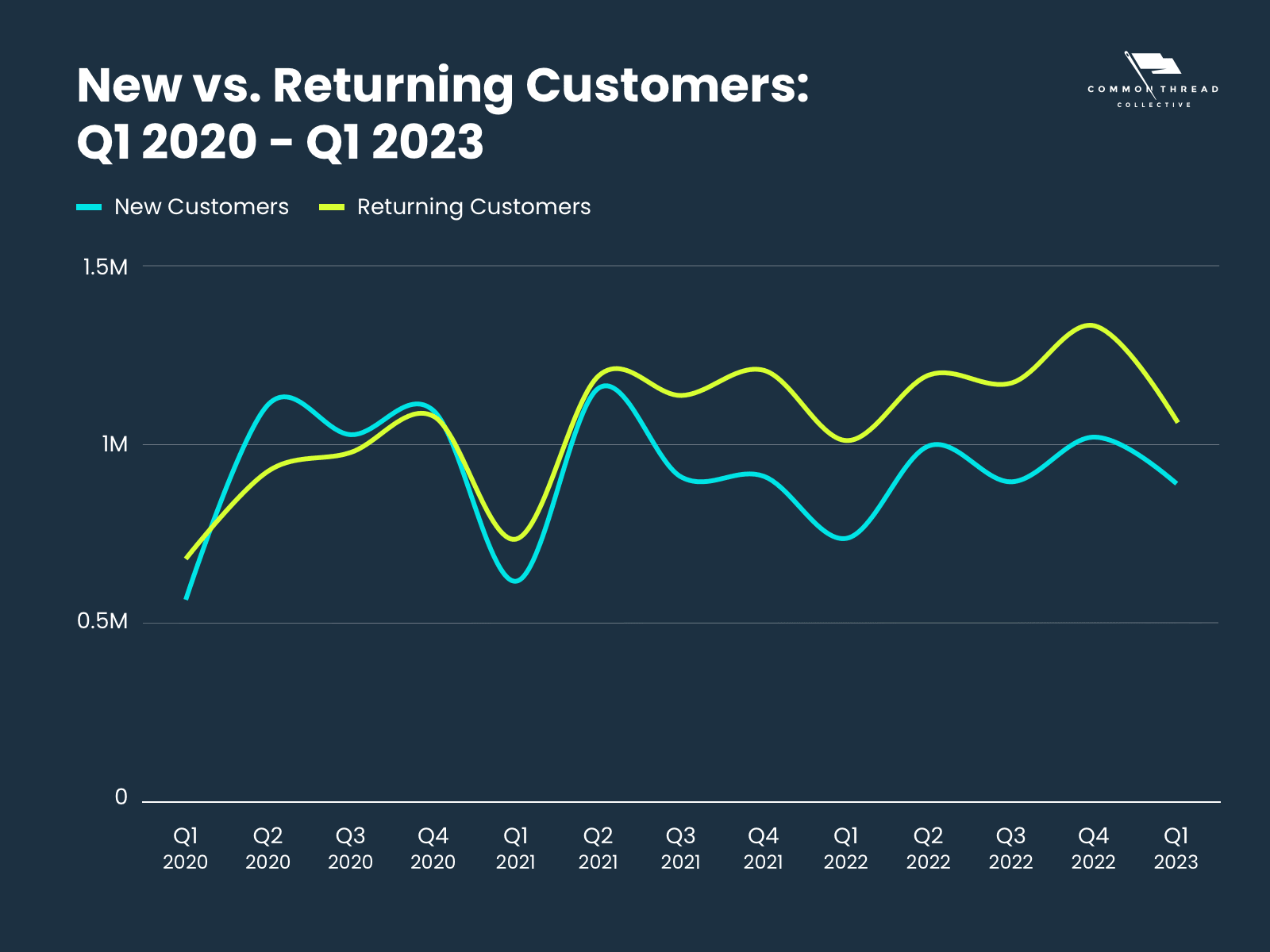

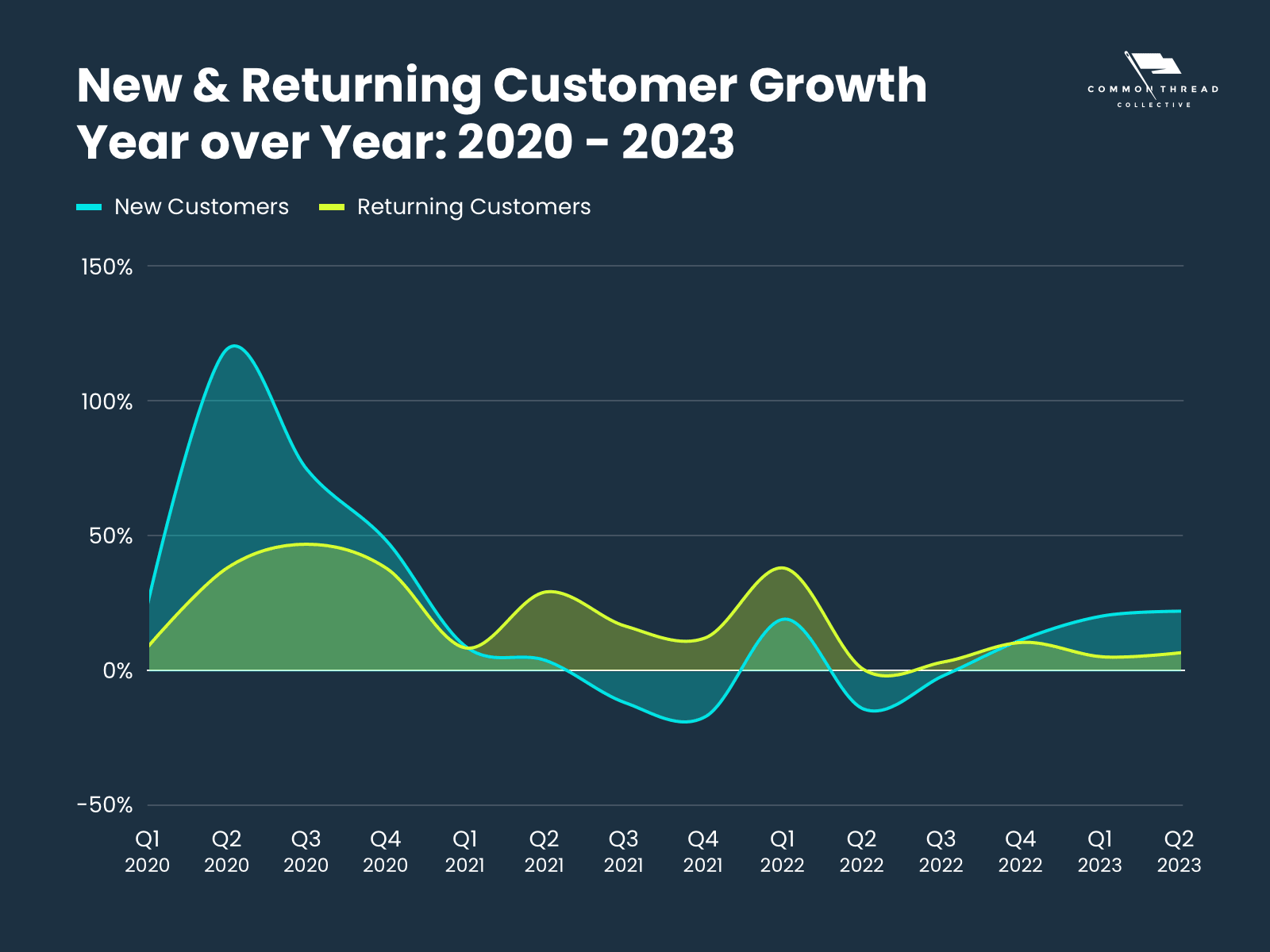

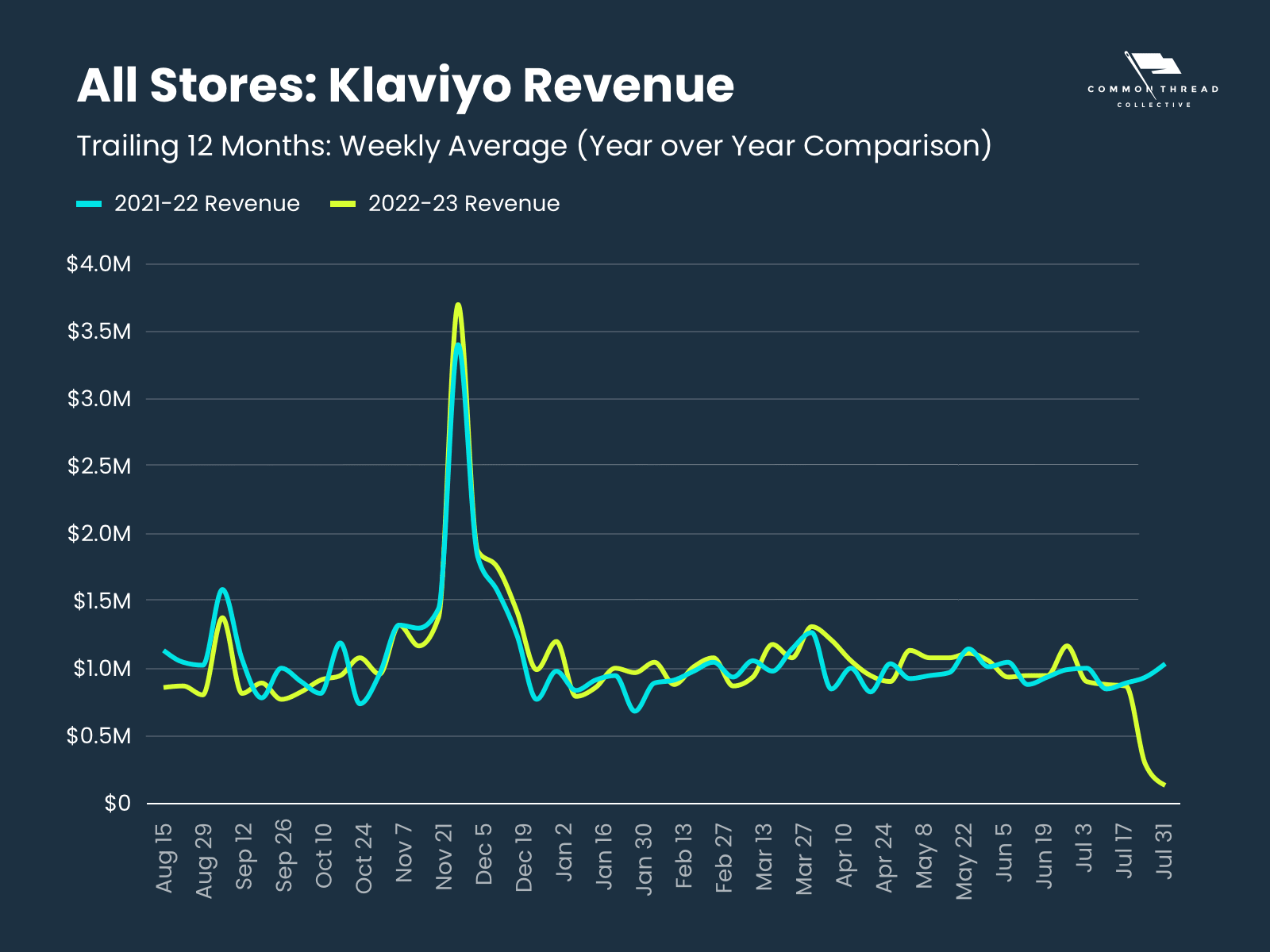

Over the course of this year, we’ve been closely tracking against one of the most important macro trends within our broader data set of DTC Ecommerce brands.

This is the most important story in DTC this year.

— Taylor Holiday (@TaylorHoliday) May 5, 2023

PLEASE READ. https://t.co/rA0PypQ1F5

The data indicates that brands realized the value from their 2020 new customer growth over the course of 2021-2022, with flat new customer growth during that time period.

Or, to say it another way, brands filled their sponge full of new customers during 2020, and then squeezed the sponge over the course of 2021-2022, meaning revenue over that period was heavily propped up by Returning Customers.

The big issue here:

In Q1 2023, we saw the lowest YoY Growth in Returning customers we’ve seen in the past 4 years.

Case in point, Q1 2023 is +5% YoY, while Q1 2022 was +38% YoY. Meaning brands’ Existing Customer Rev base has fallen off of a cliff.

And we saw this trend continue through Q2 as well. So if Returning Customers are flat, any growth brands want to realize must come from their New Customer acquisition efforts.

Fortunately, Q1 and Q2 of this year saw the strongest New Customer YoY growth quarters since 2020.

This is a good indication that brands are setting themselves up well for Q4 by re-filling their sponge, but what does the opportunity for Q4 of this year actually look like?

To answer this question, we looked through a few different lenses.

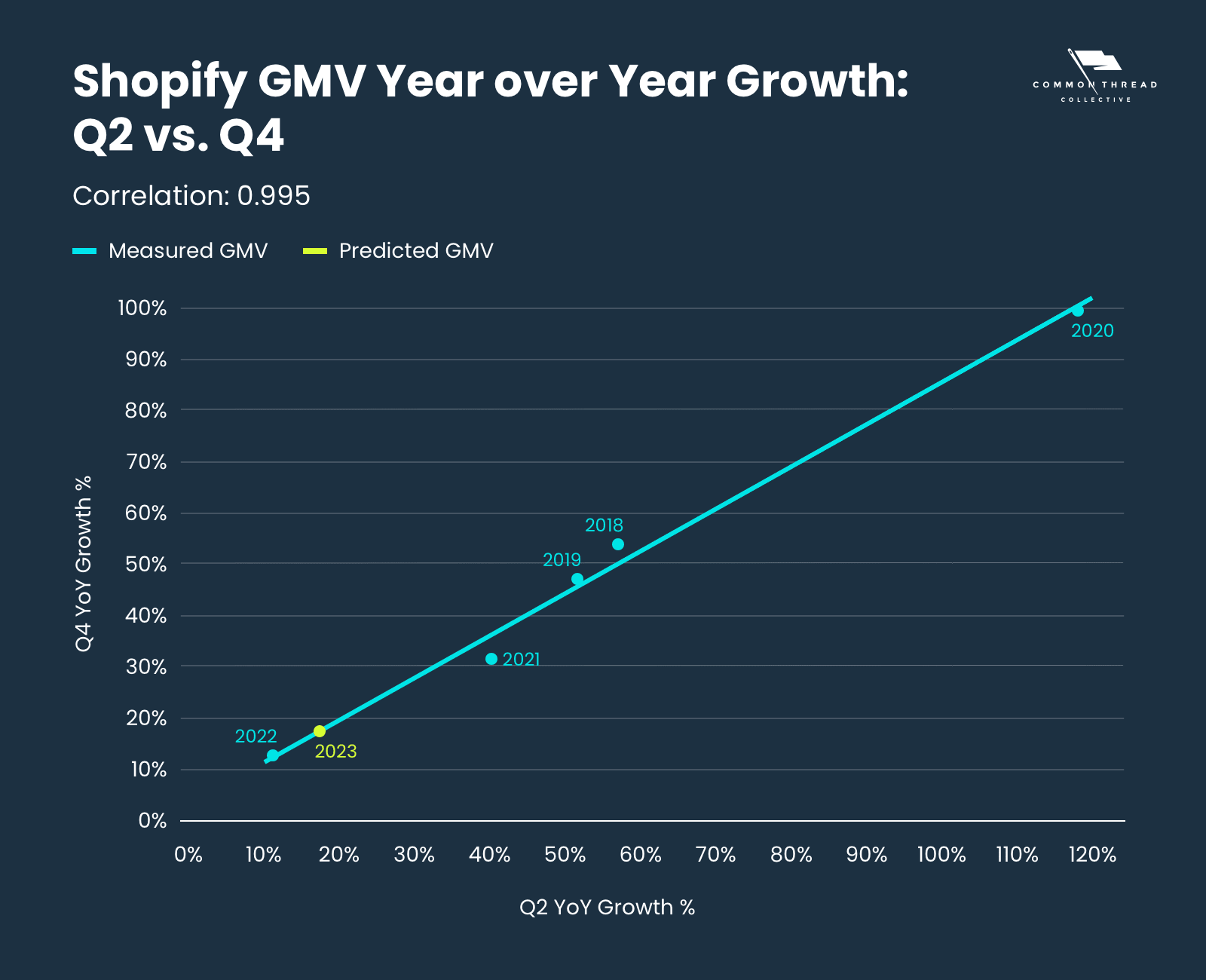

First, looking at Shopify GMV, we discovered a very strong correlation between Shopify GMV Q2 and Q4 YoY growth.

We’ve used this relationship, along with the Q2 ‘23 actual Shopify GMV, to estimate 17.45% YoY growth in Q4 ‘23 GMV (which would be higher than last year’s 12.75% Q4 YoY growth).

We also used major sale periods at other times of the year to estimate the outcome of the BFCM time period.

The outcome of the Memorial Day, 4th of July, and Labor Day sale periods has a strong relationship to the BFCM outcome in the same year.

Using each of those data points as factors, we’re able to model out BFCM 2023’s potential growth outcome as well.

Based on this model, we are projecting an average 14.5% YoY growth in ‘23 BFCM revenue.

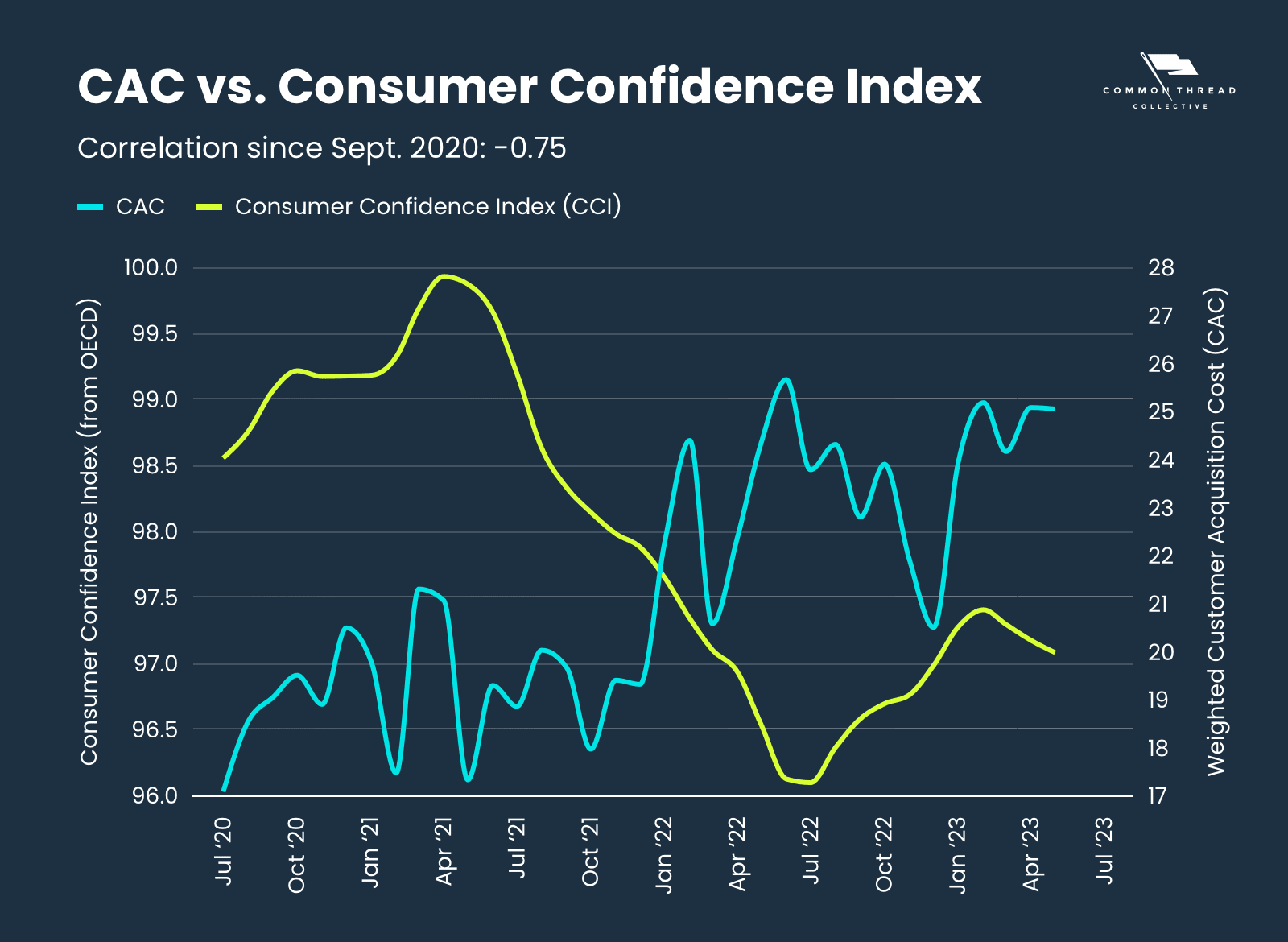

And, as of July, the Consumer Confidence Index is in a healthier spot compared to last year.

The data is all pointing to a big opportunity in Q4 of 2023, and, for brands who have stayed disciplined and committed to re-filling their sponge through Q1-Q3 of this year, Q4 is the time to realize the margin from all that effort.

The question then becomes:

How do you maximize your revenue and marginal outcome in this coming quarter?

Fortunately, we have the answer.

Get this level of strategic thinking for your own brand …

With BFCM around the corner, there’s never been a better time to sign up for CTC Services.

Plus, if you run an ecommerce brand between $10-$100M, and your Growth Quotient score is 130 or higher, we’re so confident we can win the holiday season for you that we’ll cover your first month free.

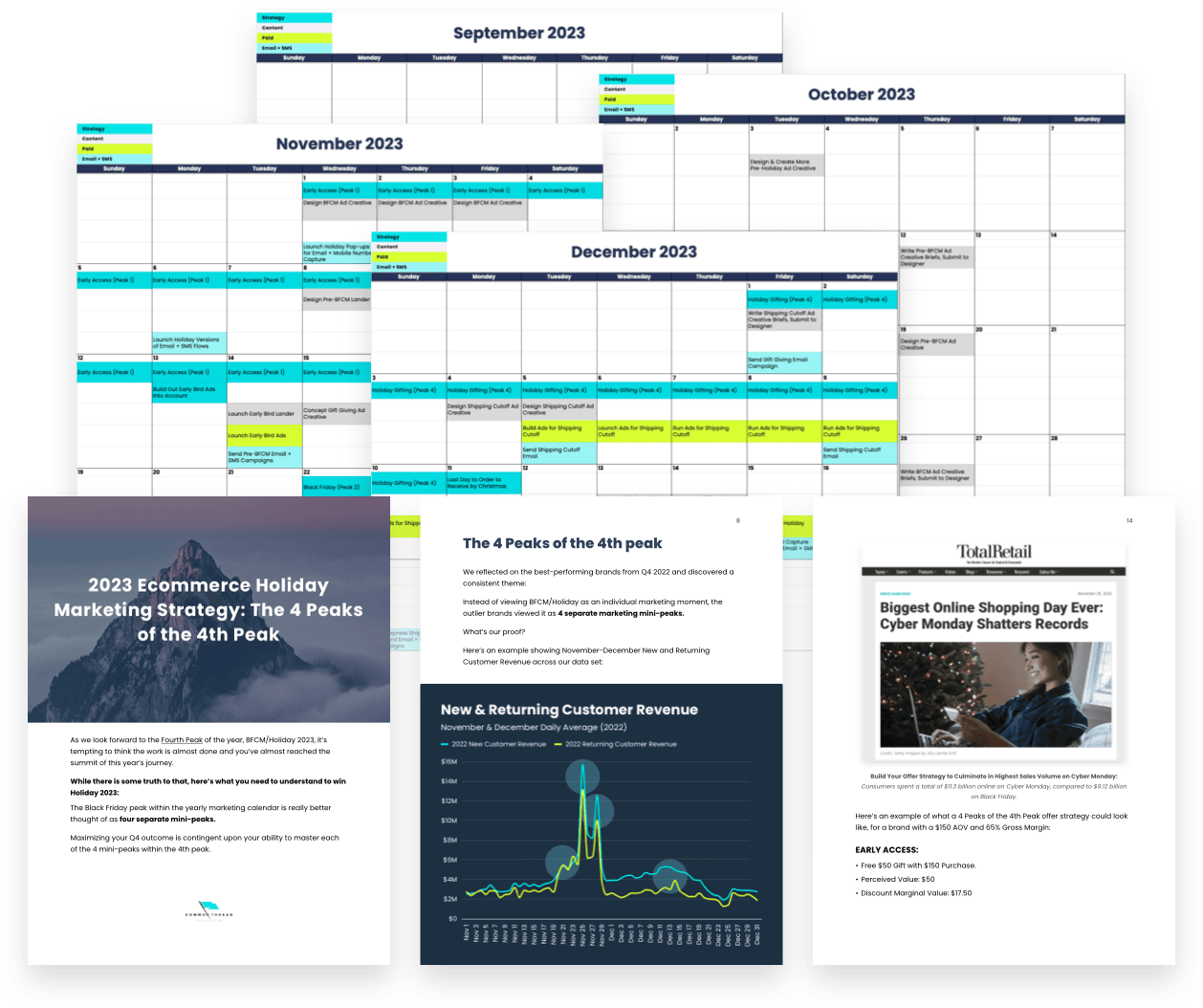

The 4 Peaks of the 4th peak

We reflected on the best-performing brands from Q4 2022 and discovered a consistent theme:

Instead of viewing BFCM/Holiday as an individual marketing moment, the outlier brands viewed it as 4 separate marketing mini-peaks.

What’s our proof?

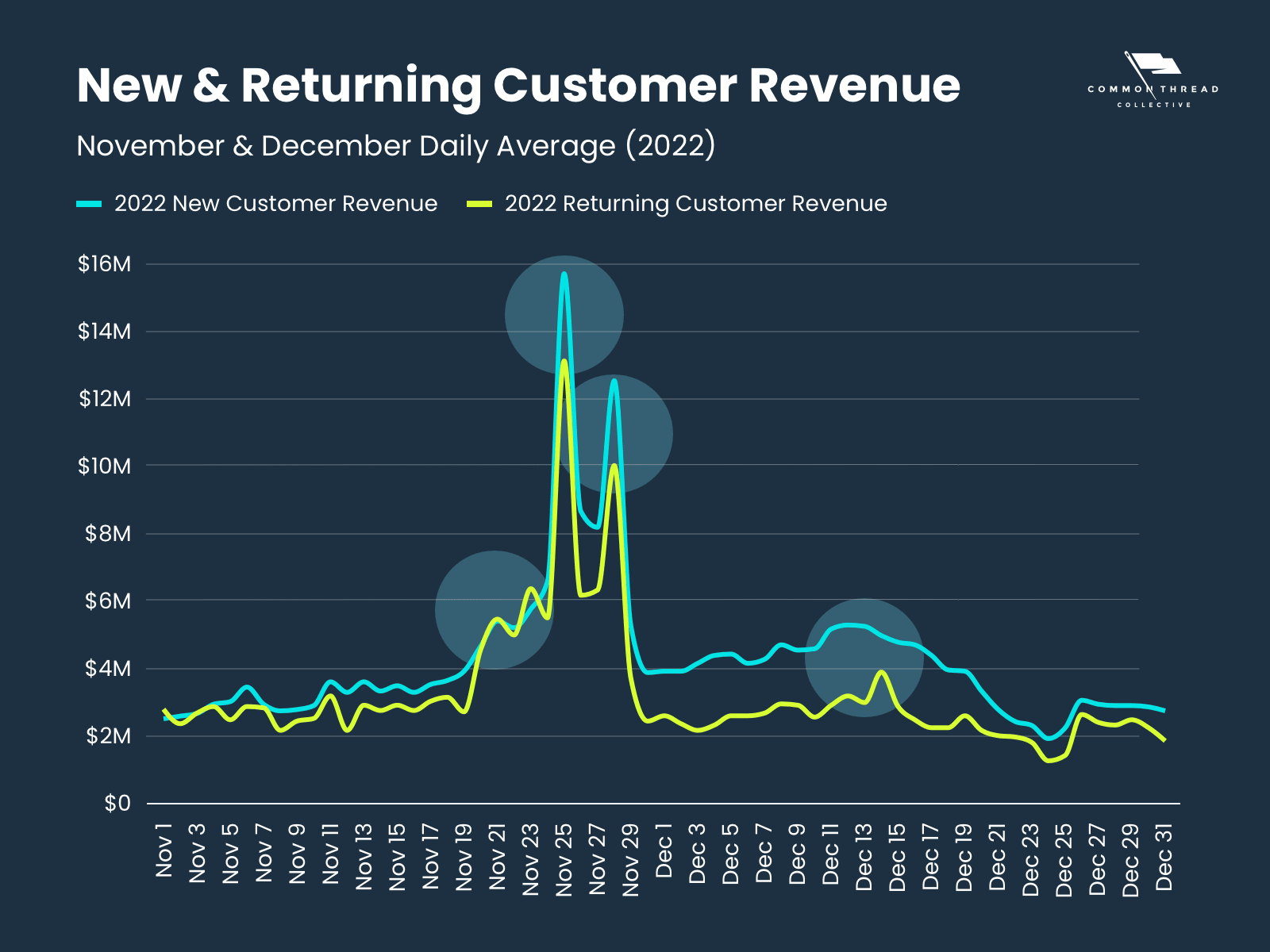

Here’s an example showing November-December New and Returning Customer Revenue across our data set:

The data reveals 4 distinct revenue realization moments:

- Within the first couple weeks of November

- On Black Friday itself

- On Cyber Monday

- Mid-December

We’ve given these mini-peaks the following names:

- Early Bird 🐦

- Black Friday 🎄

- Cyber Monday 🛒

- Holiday Gifting 🎁

These 4 moments become even more clear when we isolate some of the top-performing brands within our data set:

This trend is clear on the Revenue level, both across the broader data set and on an individual brand basis.

But when we dig a level deeper than Revenue, the “why” behind the existence of these 4 mini-peaks becomes even clearer:

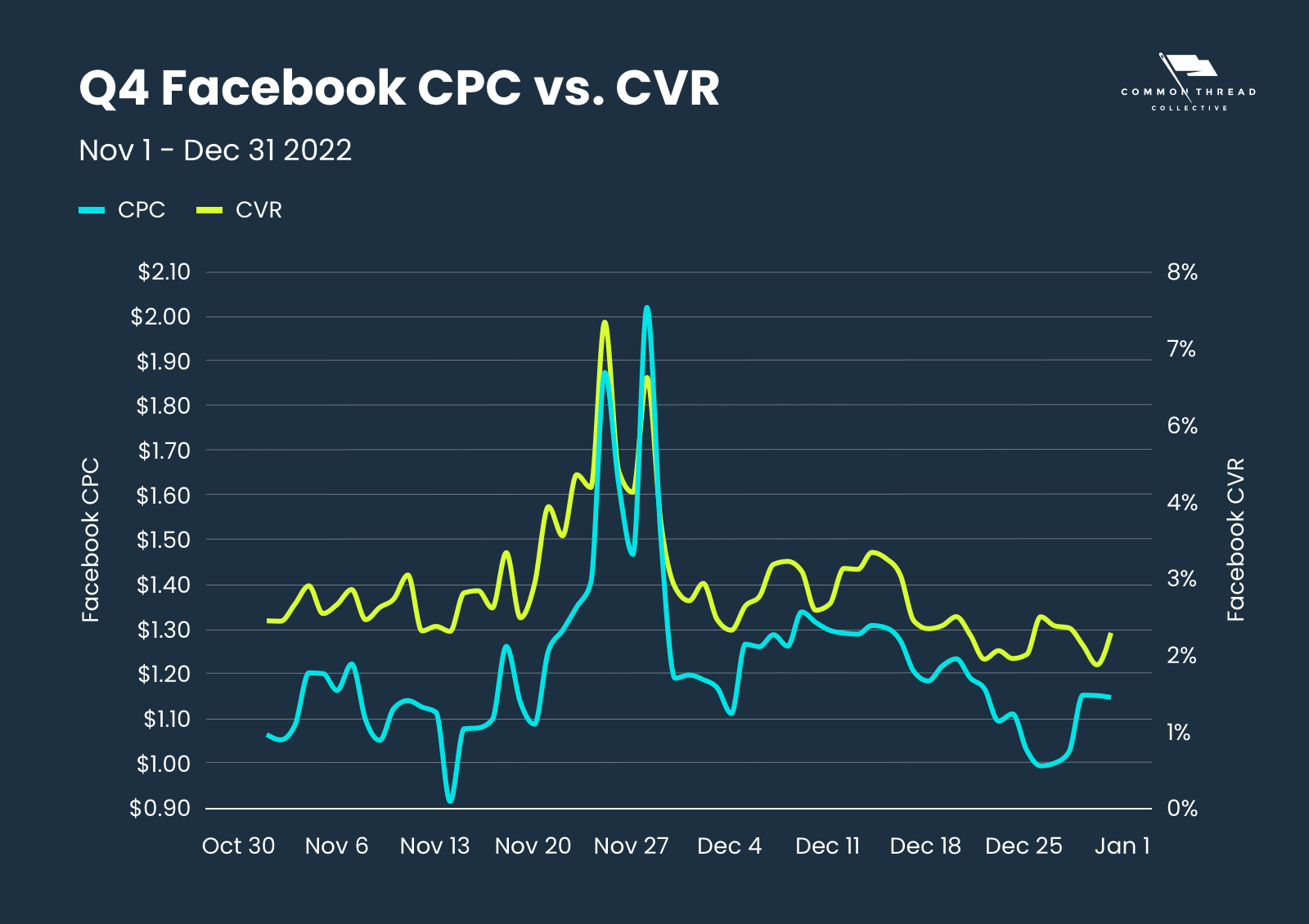

The opportunity for each of the Q4 mini-peaks lies in the arbitrage opportunity that sits at the intersection of CVR and CPC.

CVR on BF and CM is incredible, and will always be a moment to lean into. But we also see CVR increase in early November and post-BFCM, while CPCs are substantially lower. Those pockets of time represent opportunity as well.

The same opportunity is evident on Google: The CPC vs. CVR relationship reveals a higher than normal conversion demand pre- and post-BFCM, with substantially lower costs during those time periods as well.

Top-performing brands last year built a strategy that capitalizes on these pockets of performance: Both the moments that present the best Conversion Rates of the year, along with the moments that bring an opportunity to lean into much lower competition and costs.

By way of a reminder, the core question we are asking is:

How do you maximize your revenue and marginal outcome in this coming quarter?

The answer lies in building a strategy around the 4 Peaks of the 4th Peak:

- Early Bird 🐦

- Black Friday 🎄

- Cyber Monday 🛒

- Holiday Gifting 🎁

And for each of these mini-peak moments, there are 4 Core Strategies that need to be built:

Here’s how to do it.

1. Offer Strategy

The goal of your offer strategy is to maximize your Q4 margin outcome.

And the offer strategy that works best for this goal ladders up to your lowest margin, highest sales volume offer on Cyber Monday.

Here are the 4 mini-peaks of BFCM/Holiday and the role of each in the overall moment of Q4:

-

Early Access (Nov 1-15): allows consumers to buy before the craziness and ensure the availability of their desired styles, sizes, etc. are still in stock.

This discount/offer should be good relative to others throughout the year, but not as good a deal as BFCM.

-

Black Friday (Nov 22-26): Although you have three other marketing moments within this time period, BF accounts for a large portion of your sales during Q4.

Make sure you tailor this offer accordingly — make it more appealing than Early Bird, and applicable to the majority of your products. This is your highest order volume offer.

-

Cyber Monday: Your maximum discounted offer, with the goal of pushing the highest sales volume and AOV. Get people to buy a lot, for the best deal they’ll ever be able to get.

-

Holiday Gifting: The perfect time to move excess inventory or end of season/old collection SKUs. Create urgency with the shipping cutoff and offer a deal on expedited shipping.

Here’s an example of what a 4 Peaks of the 4th Peak offer strategy could look like, for a brand with a $150 AOV and 65% Gross Margin:

Early Access:

- Free $50 Gift with $150 Purchase.

- Perceived Value: $50

- Discount Marginal Value: $17.50

Black Friday:

- 30% off of $200+.

- Perceived value: $60

- Discount Marginal Value: $21

Cyber Monday:

- Buy 2, Get 1

- Perceived value: $100

- Discount Marginal Value: $35

Holiday Gifting:

- $200 Gift Bundle for $150

- Perceived value: $50

- Discount Marginal Value: $17.50

I wish we could give you a formula to use to back into your ideal Q4 offer strategy flow, but the reality is that there is too much business-specific context that needs to be taken into account, like inventory positions and the offers you run the rest of the year.

However, here are some key pillars to consider when crafting your offer strategy:

- Easy: Sitewide and no coupon codes

- Valuable: Less than 20% is not a discount

- Profitable: Stay ‘black’ all through q4

- Paired: Multiple products and free gifts

- Stacked: Boost AOV & margins via bundles or “tiers”

Your ideal Q4 offer structure comes from a deep understanding of your business …

For a customized offer strategy, get in touch with us today.

If you run an ecommerce brand between $10-$100M, and your Growth Quotient score is 130 or higher, we’re so confident we can win the holiday season for you that we’ll cover your first month free.

Now that you have your 4 Peaks of Q4 Offer Strategy dialed in, you're ready to begin crafting the Paid Media, Creative, and Email+SMS Strategies to pair with your irresistible offers.

And we’ll start with the most important of those 3 …

2. Email + SMS Strategy

Send More Emails:

The two highest impact levers you have to pull during BFCM/Holiday to impact your revenue outcome are:

- Having 4 “mini-peak” offers, and

- Sending more emails.

In that order. Period.

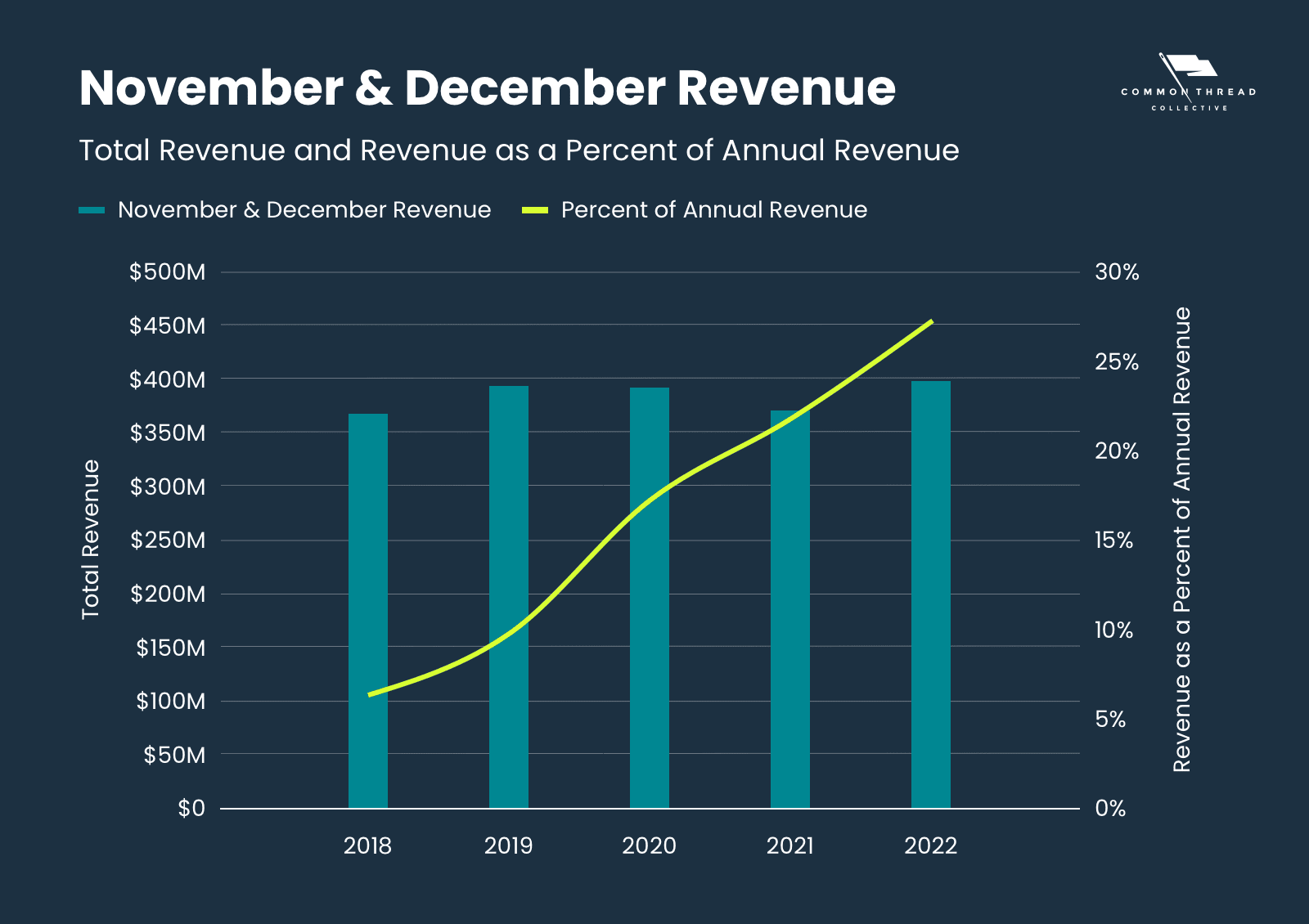

Across our data set, 23.81% of brands’ annual revenue is generated over the course of November + December. If nearly one quarter of your yearly revenue is being driven during this time period, you can’t afford to leave anything on the table.

If you’ve been diligent all year about acquiring customers, and you’re about to have the best roll-up of offers out of any time in the year, your customers need to hear about it.

And, in the midst of all the noise coming from other businesses during Q4, your customers could easily miss your offer if you only email them once or twice about it.

Based on what we see with those outlier brands, this is the minimum send cadence that we recommend you set up for Email + SMS during each of your 4 BFCM/Holiday offer moments (Early Access, BF, CM, Holiday Gifting):

- Day or evening prior to launch: 1 x VIP Email + SMS

-

Offer Launch day: 3x Emails and 2x SMS

- Email + SMS in the morning

- Email to non-openers of the first email around mid-day

- Email + SMS in the evening

- Every other day the offer is running: 1-2x Emails and 1x SMS

-

Final day of offer, with urgency/last chance messaging: 3x Emails and 2x SMS

- Same cadence as offer launch day

A common hesitancy here:

“Won’t sending more emails result in a higher unsubscribe rate?”

We’ve looked into this thoroughly — the revenue and margin increase from sending more emails substantially outweighs the impact of unsubscribe rates.

This is true all the time, and Q4 is the time to lean into this reality as hard as possible — email addresses become exponentially more valuable during Q4 than at any other time of year.

Case in point:

For ecommerce at large, 56% of email’s annual revenue is generated in November and December.

Why? Because 89% of BFCM purchases are made by customers who open an email before the holidays.

Q4 success starts in Q3 …

With BFCM around the corner, there’s never been a better time to sign up for CTC Services.

If you run an ecommerce brand between $10-$100M, and your Growth Quotient score is 130 or higher, we’re so confident we can win the holiday season for you that we’ll cover your first month free.

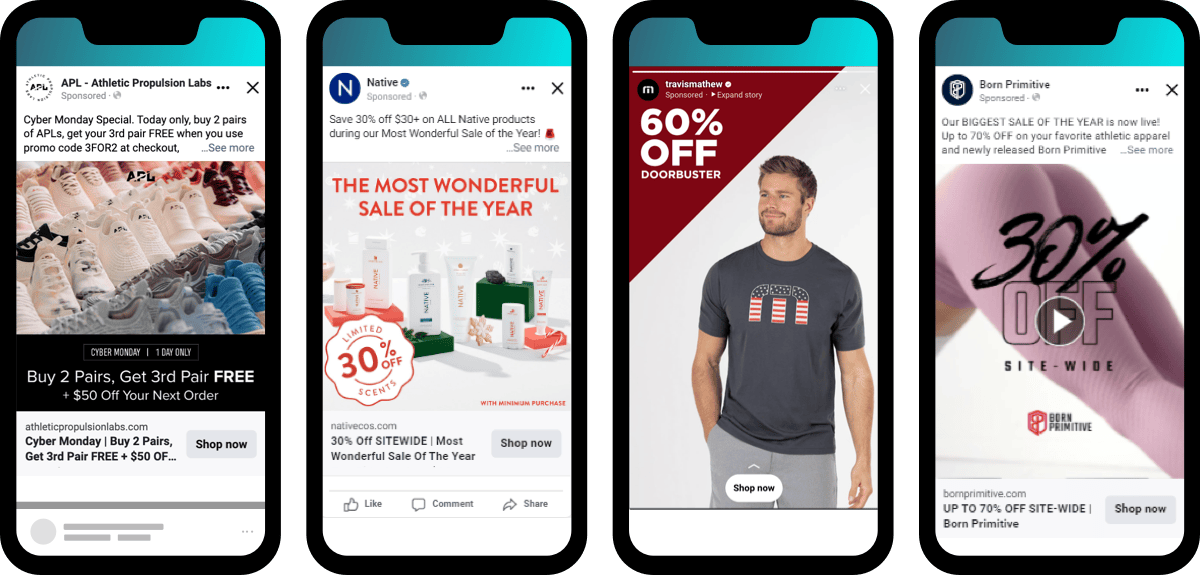

3. Creative Strategy

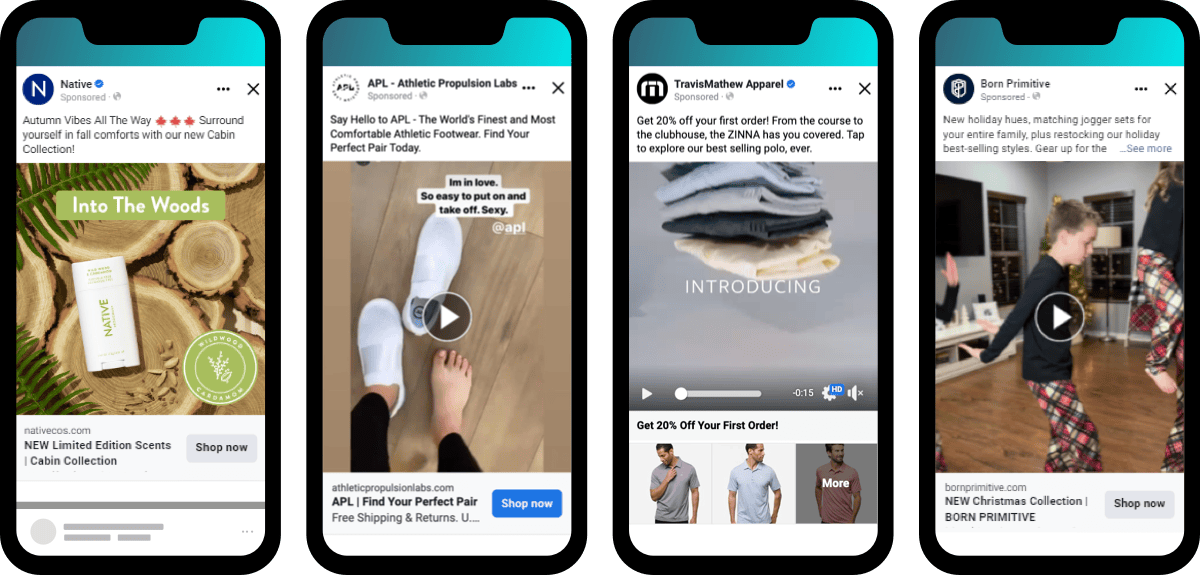

For the maximal Q4 outcome, your Q4 creative toolkit must include the following ad types …

- Evergreen ads

- Dynamic Ad Frames

- Graphic Ads

- Sale Ads

Here are some examples of each from top performing brands:

1. Evergreen Ads

Yes — you read that right.

Your evergreen, non-sale specific campaigns in your account will likely be your top performers.

In 2022, evergreen ads accounted for >50% of the account spend at higher efficiency than sale ads during the promo time periods.

2. Dynamic Ad Frames

Your dynamic product catalog campaigns always perform well during this time period, but you can take their delivery and performance to a whole new level by leveraging dynamic creative frame overlays on your dynamic carousels.

This ad type is crucial to getting the most efficiency out of DPA and DABA campaigns.

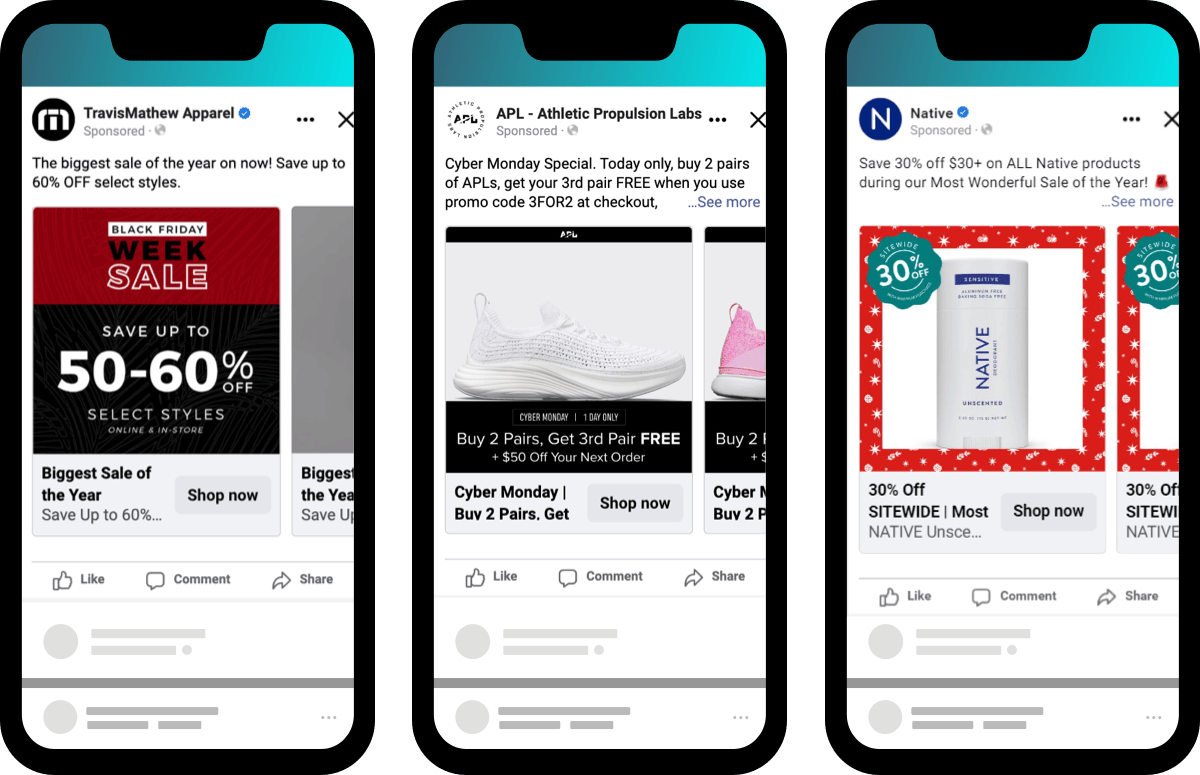

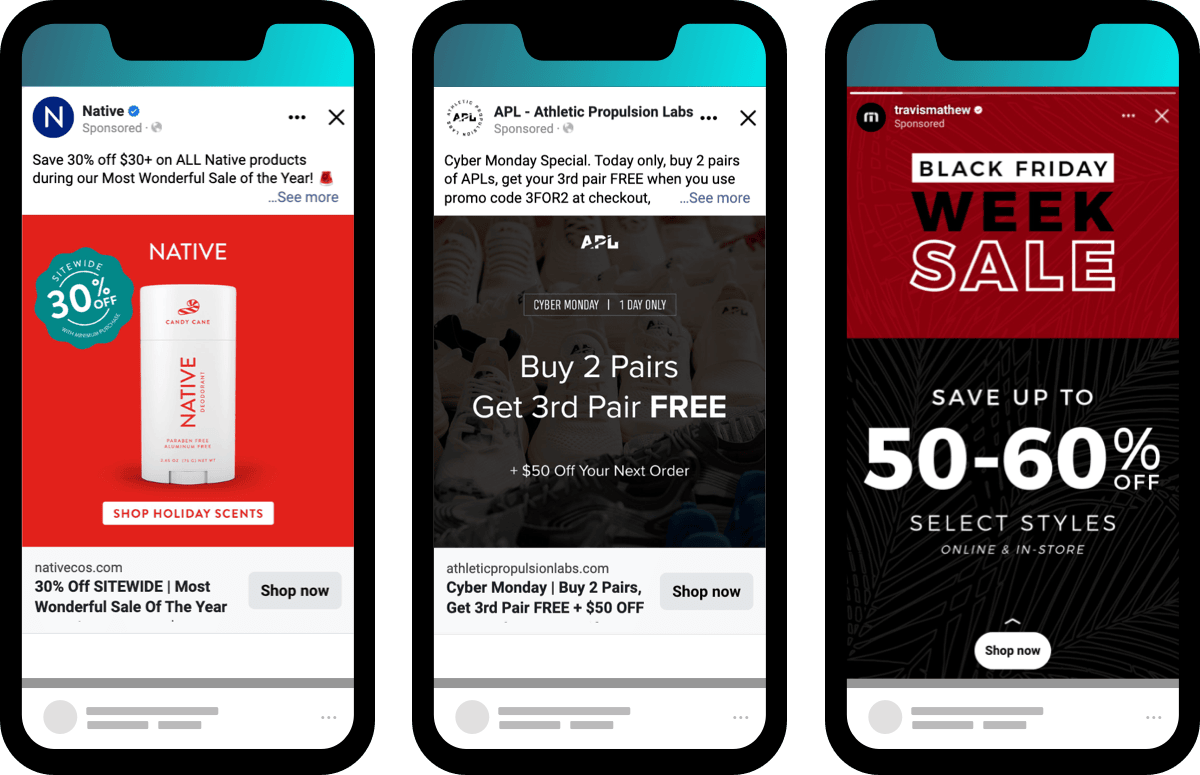

3. Graphic Ads

We cannot stress enough the centrality of your holiday offer and the creative that accompanies it.

Graphic, text-based ads keep the offer front and center — no need for other distracting elements. These will likely outperform lifestyle/product sale ads.

4. Gifting and “Gift Guide” Ads

The offer is still clear and attention is drawn to it, but now we’re supporting it with other product and lifestyle elements as well.

If you’re interested in this level of strategic thinking for your own brand, get in touch with us here — if you run an ecommerce brand between $10-$100M, and your Growth Quotient score is 130 or higher, we’re so confident we can win the holiday season for you that we’ll cover your first month free.

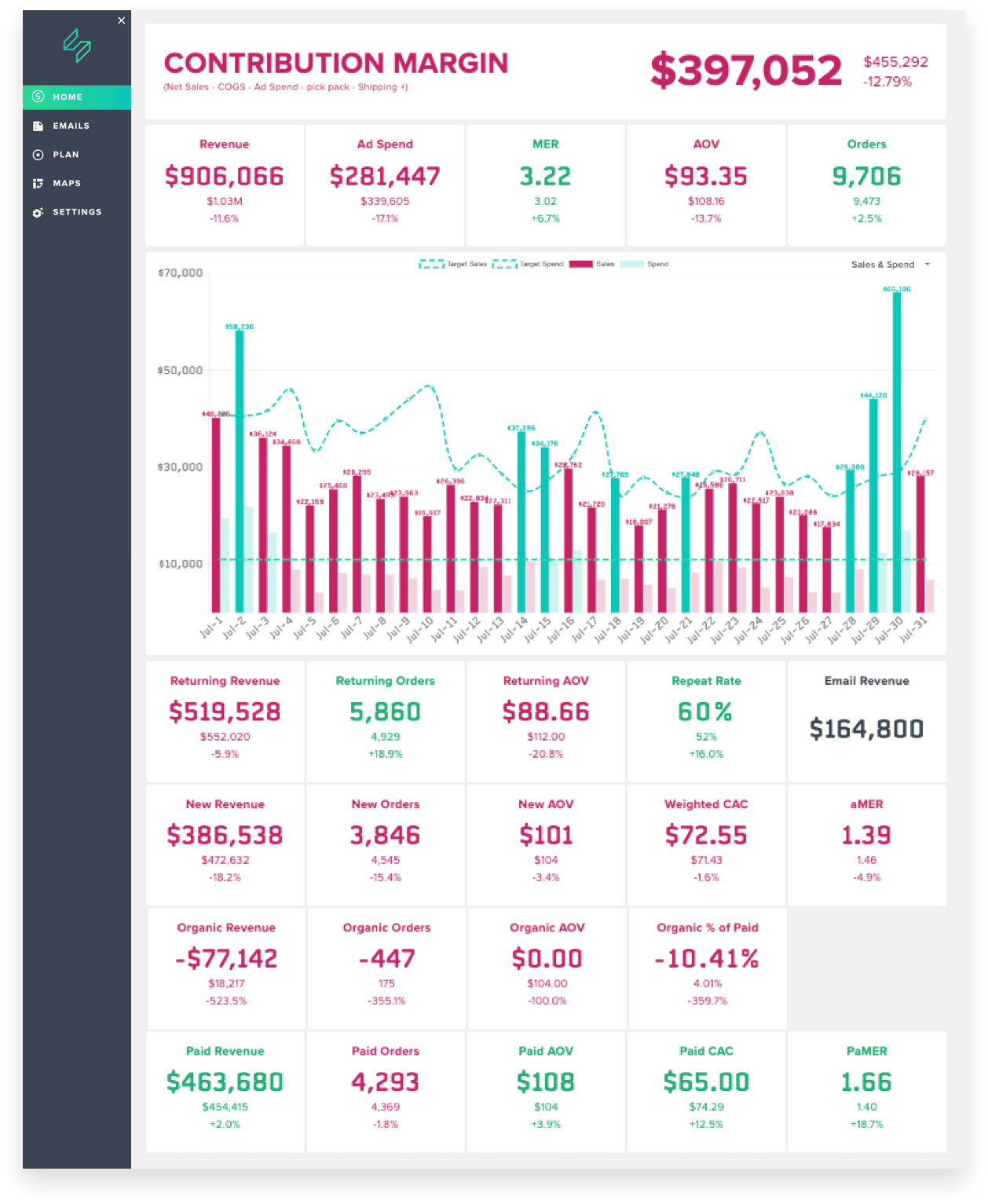

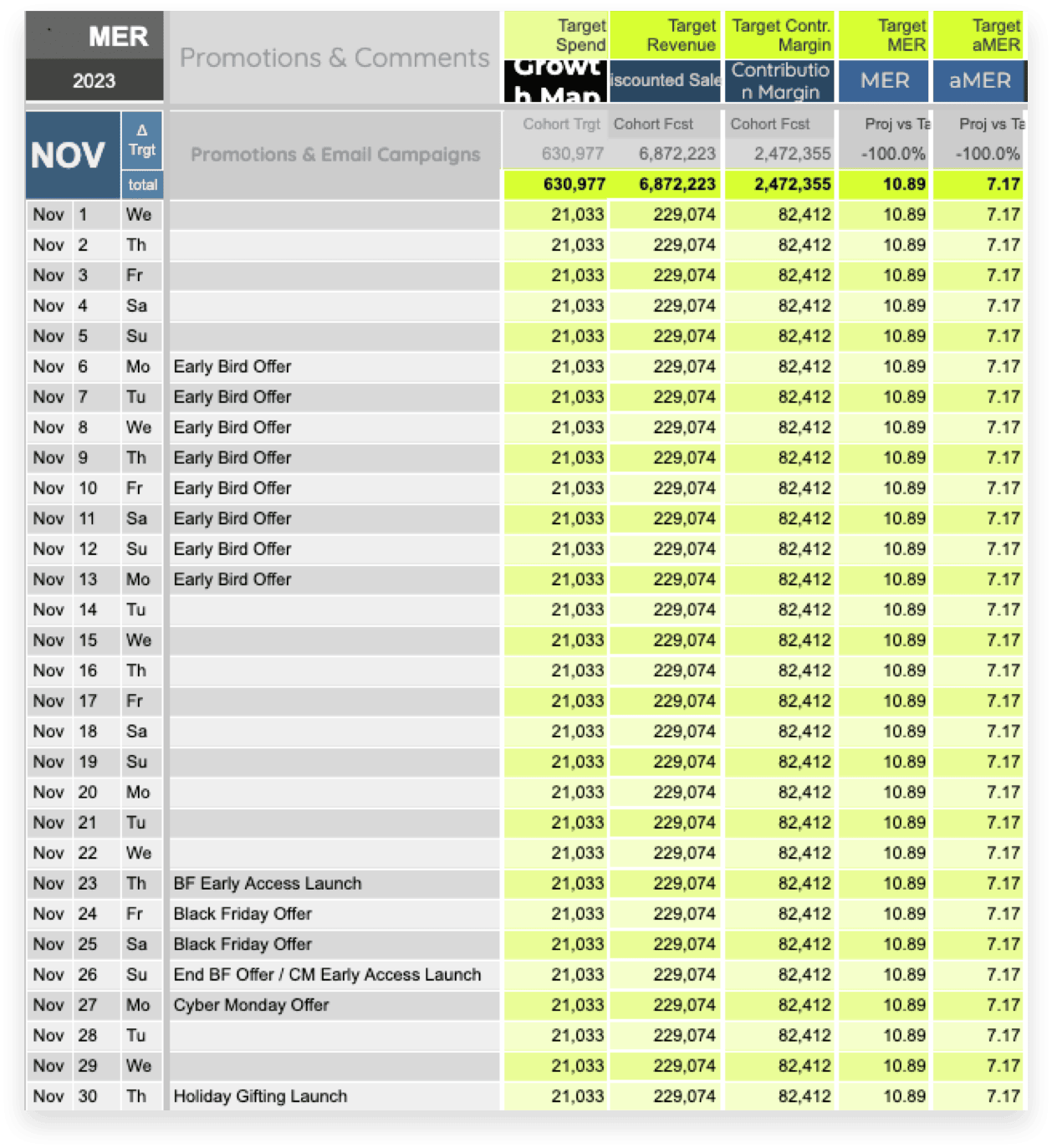

4. A Growth Map

Once you’ve dialed in Offer Strategy, Email + SMS Strategy, and Creative Strategy for Q4 2023, now you need a plan to execute against.

The tool we’ve developed for this, one that sits at the intersection of your Marketing Calendar and Media Plan, is the Growth Map.

Our process and methodology here is outlined in this video on Ecommerce forecasting, if you’re interested in more information.

We set Monthly Targets for every customer cohort (Returning Customers, Organic First Time Customers, and Paid First Time Customers), and then track against 27 metrics on both a monthly and daily basis.

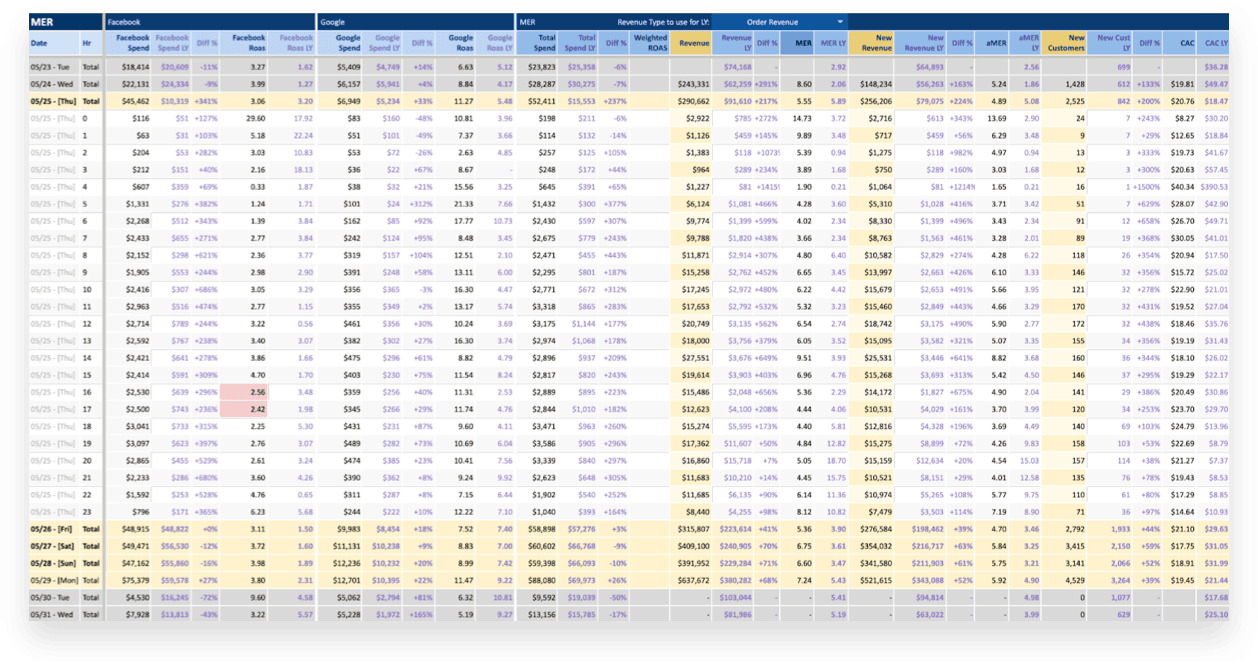

For Q4, we take it one step further: We track each Q4 mini-peak moment on an hourly basis as well.

Monthly Targets are broken down into daily targets …

Which are then tracked against on an hourly basis for each Mini-Peak:

This lets us see how we’re pacing against last year’s outcome, and where we’re over- or under-pacing against the target.

The BFCM 4-Mini Peak Hourly tracker sheet connects automatically through Statlas to import your historical data. If you’re interested in this, we will make the hourly tracker available to you if you sign up for Statlas.

One final piece of context that you should keep in mind when forecasting your Q4 2023 targets: remember what the broader data set and macro indicators are telling you.

The signals are pointing to a big opportunity in Q4 of this year, and a stronger outcome relative to what we saw in 2022.

But bullish aggregate models aren’t going to make that outcome happen for your brand by themselves. You have to step into the opportunities within Q4 in order to maximize your outcome this year.

All you have to do is remember the 4 Peaks of the 4th Peak:

- Early Bird 🐦

- Black Friday 🎄

- Cyber Monday 🛒

- Holiday Gifting 🎁

And to hone the following 4 strategies to maximize the impact of each of your mini-peak moments:

- ✅ Offer Strategy

- ✅ Retention Strategy

- ✅ Creative Strategy

- ✅ A Growth Map

We won’t send spam. Unsubscribe from Common Thread Collective at any time.

We won’t send spam. Unsubscribe from Common Thread Collective at any time.

Get a Free Month with CTC

If you’re a $10M - $100M ecommerce brand and your Growth Quotient (GQ) is 130 or greater, we’ll cover your first month of service. Apply below to get started.

Apply Now

As the Director of Growth Strategy at Common Thread Collective, Luke Austin leads our team of Growth Strategists working with some of the most exciting $100M+ consumer ecommerce brands in the industry. Connect with him on Twitter.